Weekly Effing Memo

ESOP's Fables: ELI5

The Memo:

To:

The Board

Re:

A Special Today in EFFing Time

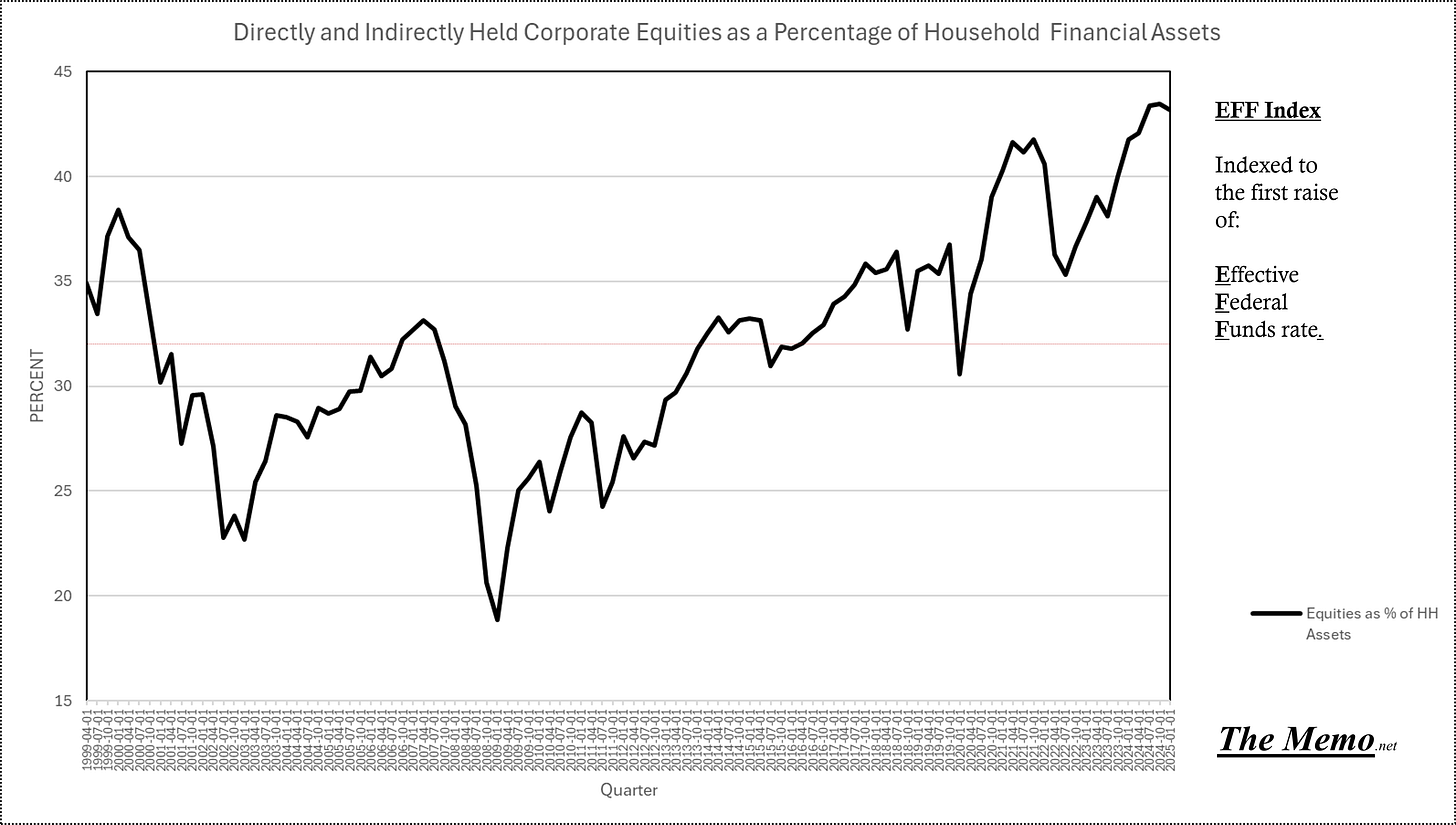

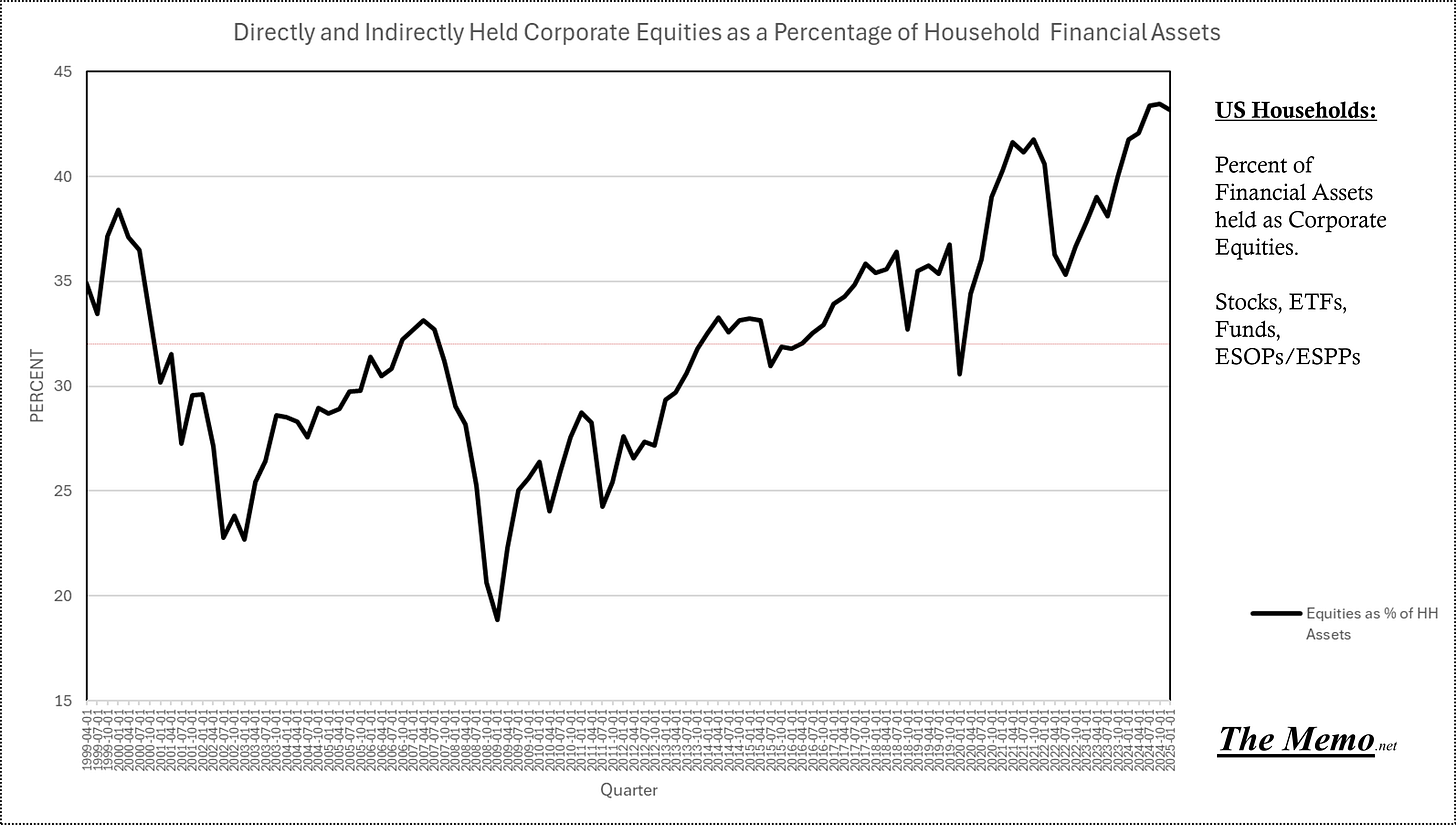

Equities: As a percent of Household Assets

GDP

Collateral Damage

Plight of homebuyers

Ancient Wisdom: 2,500 years later

Comments:

First, welcome to the new board members. I appreciate your time. Secondly, I realize it’s not Friday, but I needed some time for this one. Thirdly, I realize it’s Aesop’s Fables, not ESOP’s, but then again, this is my Memo, and my Report.

Normally, I combine a bit of Mad Magazine with my Macro research/commentary. Not today. Today I have some things that need to be said, some reminders of how stories end, and some information from the future that I see. This represents the next chapter in what was preceded by:

A reminder, as this represents Chapter 4 in the ongoing research, this the continuous study of the effects of Effective Federal Funds rate cycles on the economy at large and small. The EFF indices are economic data indexed to the first time Effective Federal Funds Rates elevated off of their trough. Which should not be confused with the first time the F.O.M.C. (Federal Open Market Committee) raised rates deliberately. Yes, there is a difference. But today is not that story.

Today in EFFing time is: the same day/week/month/quarter ending since Effective Federal Funds Rates began to rise. That is to say: Friday August 22nd was the 180th week ending of the 4th Rate Turning of the 21st century, and can be compared to the 180th week ending of any prior Effective Federal Funds cycle.

End Memo.

Belling the Cat

The Mice once called a meeting to decide on a plan to free themselves of their enemy, the Cat.

Many plans were discussed, but none of them was thought good enough. At last a very young Mouse got up and said:

"I have a plan that seems very simple, but I know it will be successful. All we have to do is to hang a bell about the Cat's neck. When we hear the bell ringing we will know immediately that our enemy is coming."

In the midst of the rejoicing over their good fortune, an old Mouse arose and said:

"I will say that the plan of the young Mouse is very good. But let me ask one question: Who will bell the Cat?"

-Aesop; Which is a much longer way to say:

None of this is investment or monetary advice. This is for research and entertainment purposes only.

The Report

Equities and ESOP

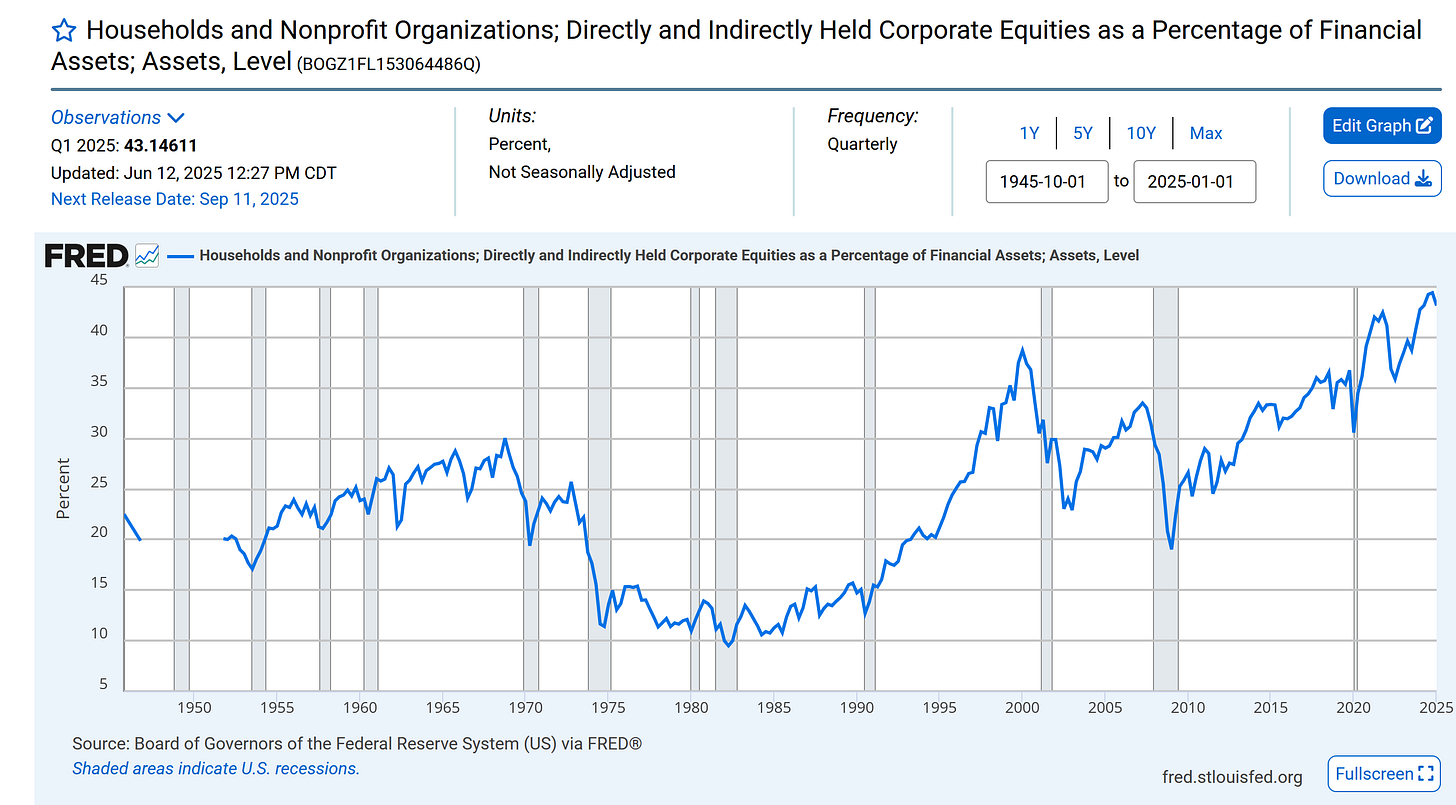

Today, actually as of Q1 because we collect and publish government data in reverse, (which is unnecessary now but was necessary in olden times) we are just under all time highs in allocation of household’s financial assets into Corporate Equities. Also commonly referred to as Stonks Stocks. We have never sustainably held above 35% allocation. Ever.

To expand the horizon beyond the turn of the century, let’s use a government chart:

To further understand this, there was a reason why this data set troughed and rebounded in the early 80’s, and why it launched to new paradigms (until it fell back to earth) in the 90’s.

One of those reasons are: ESOPs (Employee Stock Ownership Plan). More Commonly and of late referred to as ESPPs. (Employee Stock Purchase Plans).

Employee ownership is nothing new, in fact it’s as old as Aesop’s Fables. But in 1974, Le Congress passed ERISA, aka: The Employee Retirement Income Security Act of 1974. Further legislation in:

1975

The Tax Reduction Act created a tax credit specifically for ESOPs.

1978:

The Revenue Act of 1978 added new formalities to ESOPs, including the creation of IRC § 409A.

1984:

The Deficit Reduction Act of 1984 (DEFRA) introduced major tax incentives, making it even more attractive for businesses to establish ESOPs.

1986:

The Tax Reform Act of 1986 continued the trend of providing incentives and refining ESOP law.

All boosted the deferred cash payments of salary/wages to employees through stock ownership participation. This has prevented the much discussed, rarely seen “wage price spiral” that economists like to reference, amongst other things they don’t actually understand, from ever happening.

The ESOP eventually transitioned to the Employee Stock Purchase Plan, or ESPP, which is more commonly associated with publicly traded companies.

During the 1990’s, this became a prevalent payment method for employers to attract talent. See Federal Reserve Bank of New York paper below:

They have become so prevalent, that employers now have to fight employee indifference to them. As JP Morgan so handily points out here in a “content” post titled “Every employee on board”:

The concept is simple:

Offer stock in lieu of actual wages paid. Promote the benefits, downplay the risks, make everyone understand the “goal” and sing “Kumbuya Jambalay Crawfish Pie Me Oh My Oh” when the stock hits “internal targets”. All while the company controls more share volume through employees passive purchase options upon each paycheck, as a percent of their wages. A percent of their wages which then becomes a percent of their Household Assets.

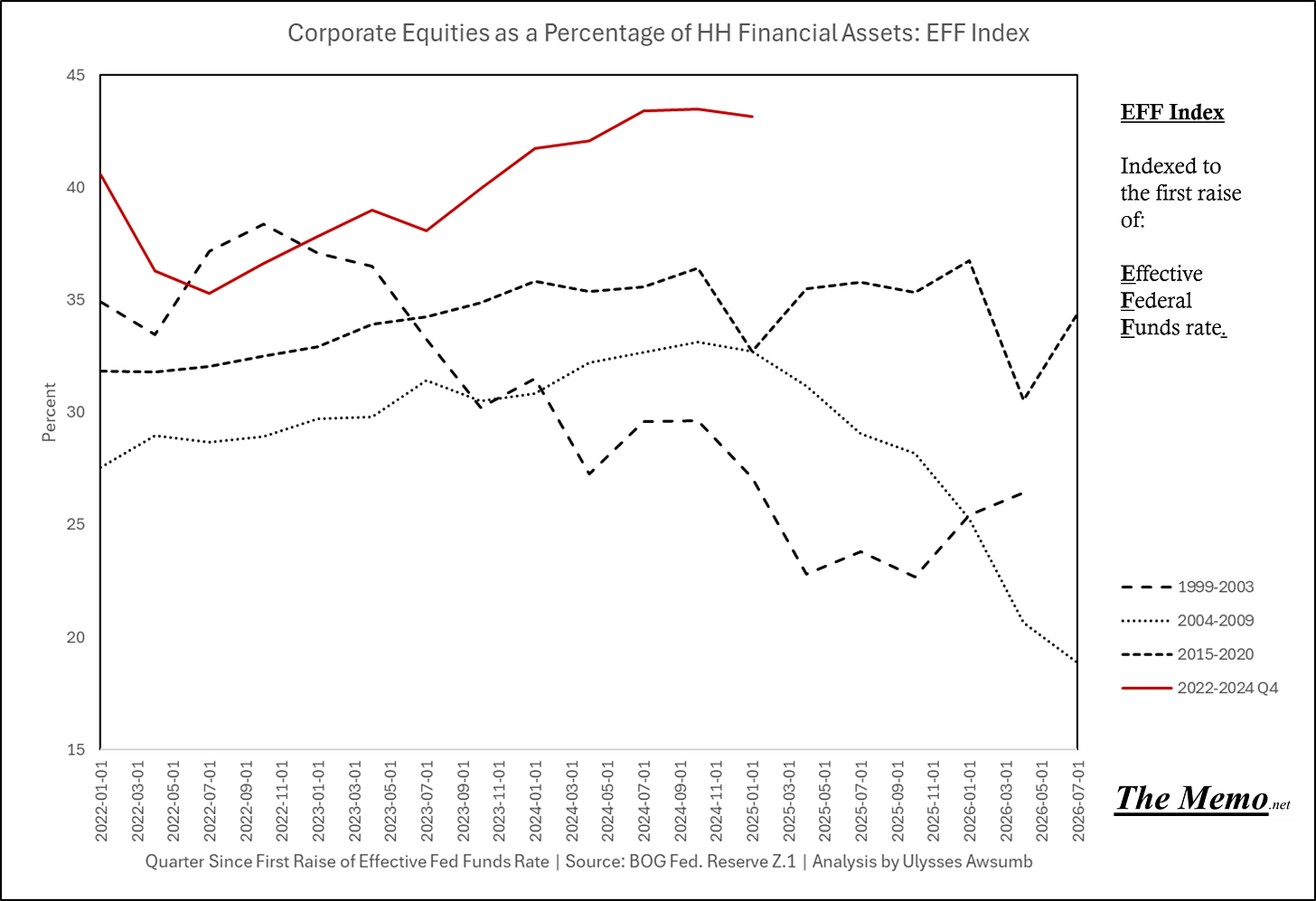

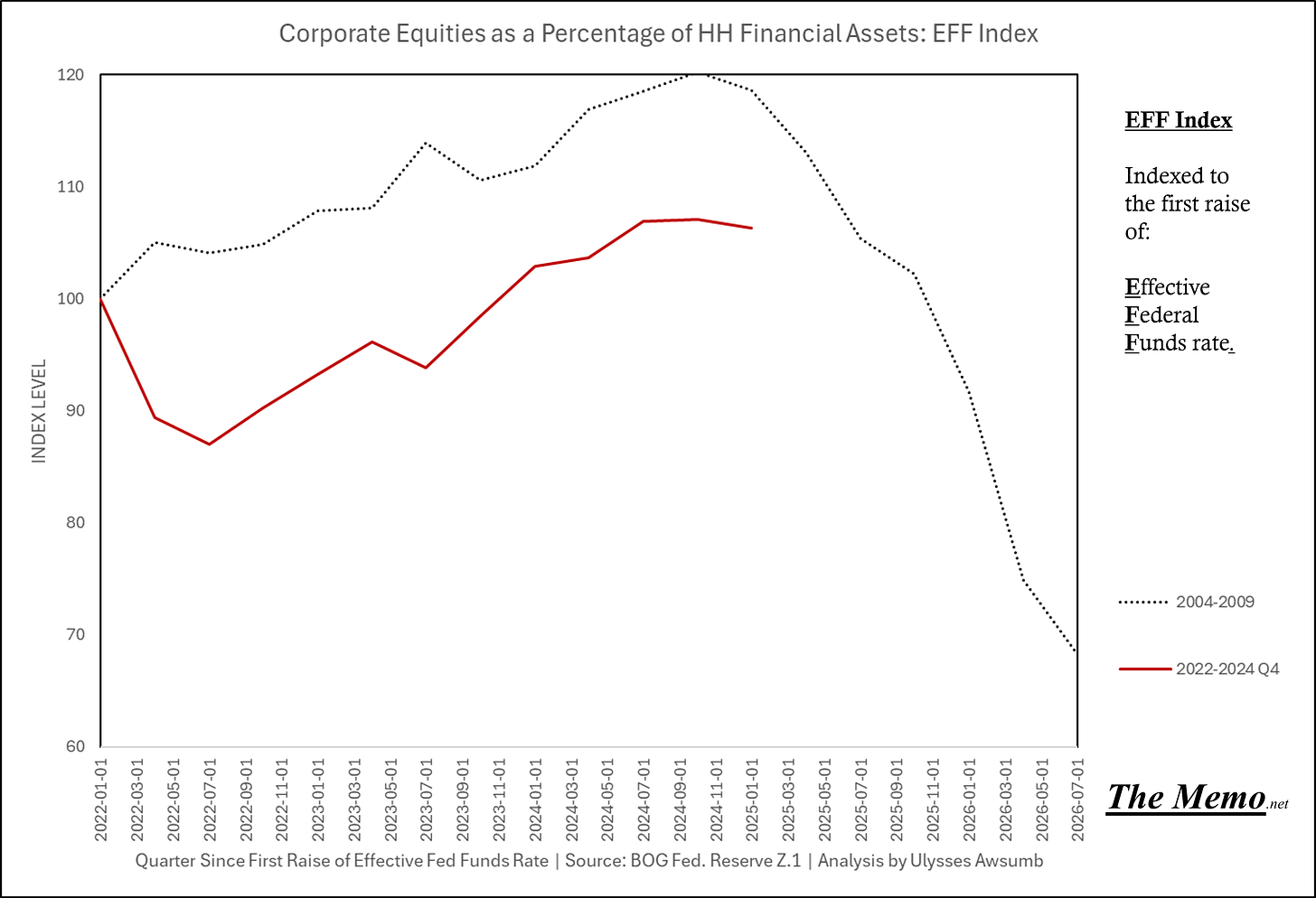

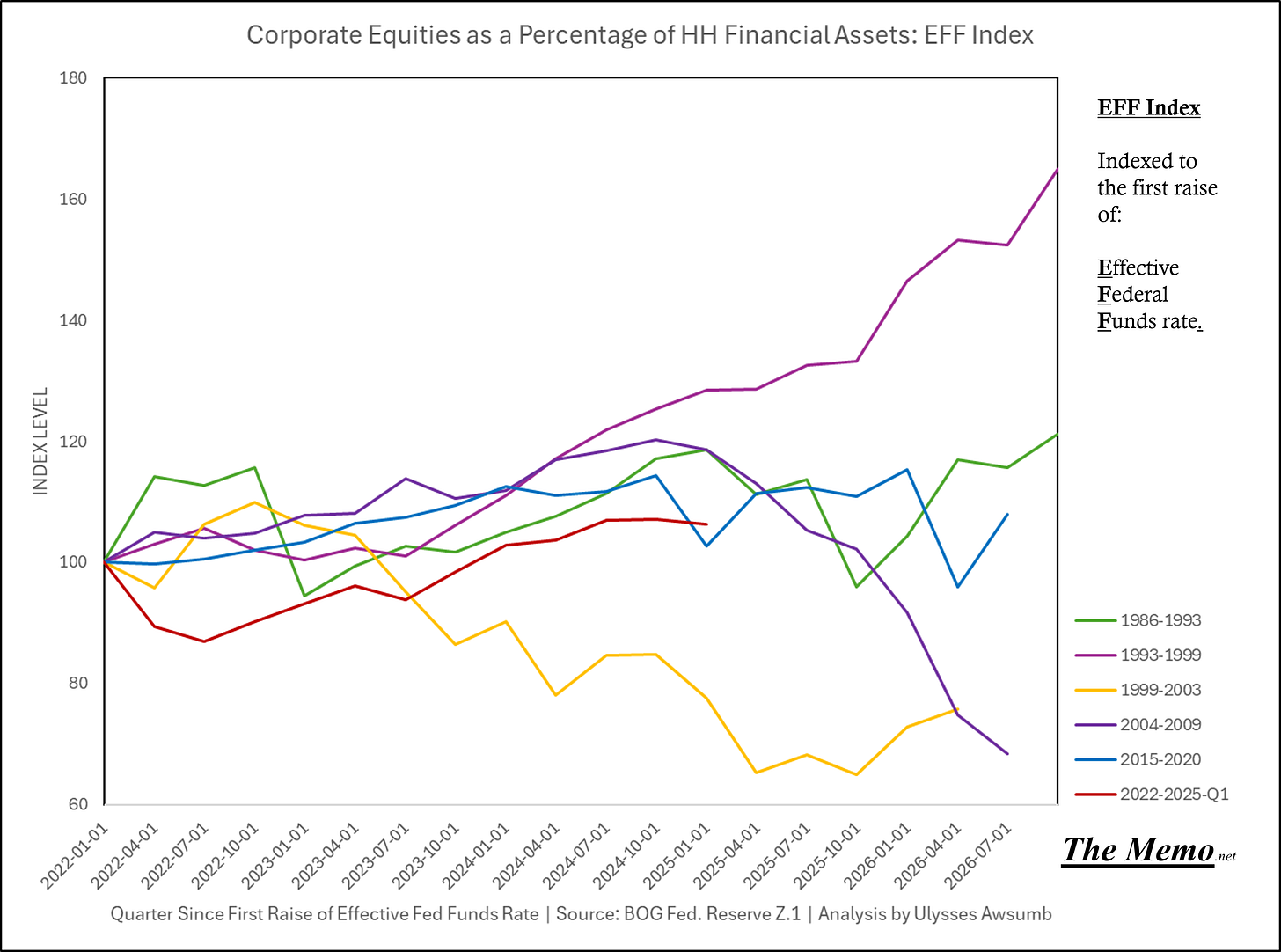

Which is at all time highs, as a percent of Household Assets. Now, same chart, but in EFF format, which measures change since effective federal funds rate trough:

Which shows, less raise from trough, despite the all time highs. So which cycle is most similar?

Oh, the 2004-2009 cycle. Fun. Compare this with the next 3 weeks of projected NASDAQ further below.

Here’s the past 6 cycles going back to 1986.

None of this should be misconstrued with criticism of taking on equity or success pay in companies or people you believe in, nor in taking on stock compensation.

In fact, Aesop has a Fable about that too.

The Tortoise and the Hare:

No Warren Buffet (and Charlie Munger) wasn’t an employee buying into company stock, but he did believe in the concept of: Buy into companies that are well run, have a future, and are focused on returning money to their investors/employees future, wait, profit.

The flip side is also true, especially for those who care not about their employee’s well being, those who seek to sign up participants just to shirk payments in wage and make a bonus on stock sales participation.

Perhaps one of Aesop’s most misunderstood and forgotten morals of a story:

The Wolf in Sheeps Clothing.

A certain Wolf could not get enough to eat because of the watchfulness of the Shepherds. But one night he found a sheep skin that had been cast aside and forgotten. The next day, dressed in the skin, the Wolf strolled into the pasture with the Sheep. Soon a little Lamb was following him about and was quickly led away to slaughter.

That evening the Wolf entered the fold with the flock. But it happened that the Shepherd took a fancy for mutton broth that very evening, and, picking up a knife, went to the fold. There the first he laid hands on and killed was the Wolf.

-Aesop

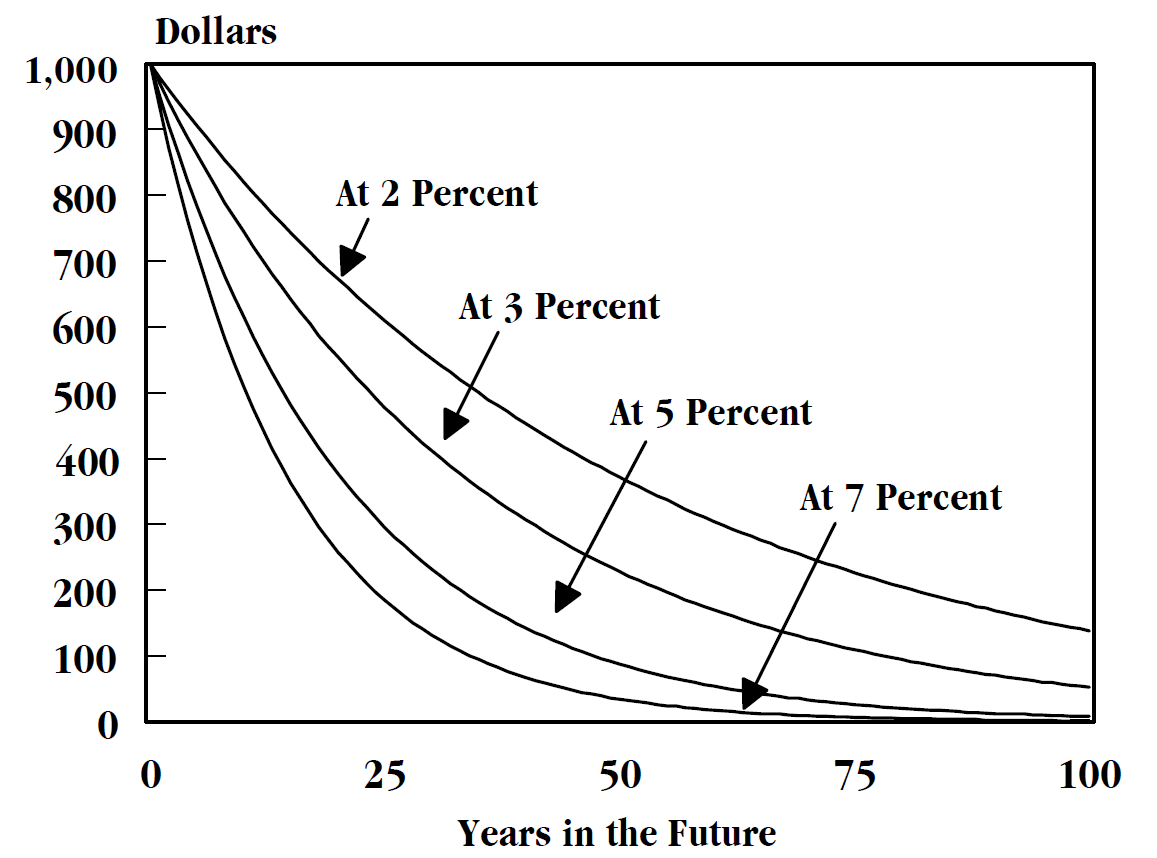

You can’t eat stonks, and a dollar today is always worth more than a dollar tomorrow, an economic reality expressed as the Time Value of Money.

Something J. Wellington Wimpy is known for expressing in another fabled form:

(C) E.C. Segar via Popeye

Adding insult to injury, there’s plenty of folks still in the workforce, who worked at pre dot com blowup companies that were investing into their ESPPs/ESOPs where the per share price of what they were purchased at, are worth the same or less than they were 30 years ago. Case in point:

After Uncle Sam took his cut of the company, but not before he takes his cut on selling those shares at 1996 prices.

By the way, U.S. Challenger Job Cuts have reached their highest level since 2020. Which I heard was a fun year for everyone on Earth. +75% YOY. I’m sure the highest salaries won’t be on the chopping block. Right?

And don’t get mad at the Wolf either. Wolves gotta eat too, same as ants and grasshoppers. Plus everyone has to answer to the Shepherd (Uncle Sam or The CEO/Board) when they fancy their favorite Mutton Tax/Cost Savings dish.

Which brings me to the next of Aesop’s Fables. The Ant and the Grasshopper.

I’ll segue using the same timeframe, because there’s a colossal economic misunderstanding about the “Boomer” population in the country, or just the older demographic in general. These are the first generation of Americans to require their 401k’s to fully function because of those previously mentioned legslative acts that helped U.S. Conglomerates kill pensions.

Existing Home Sales

Equities aren’t the only source of Household Assets being discussed and heralded by Wolves with something to sell. The National Association of Realtors, Zillow, Redfin, and everyone else who requires sell side research tools love to discuss the “record” equity in housing today, as a bolster to the narrative that all is well and Boomers are all loaded, hoarding wealth and immune to the fiscal and monetary policies set forth by Uncle Sam.

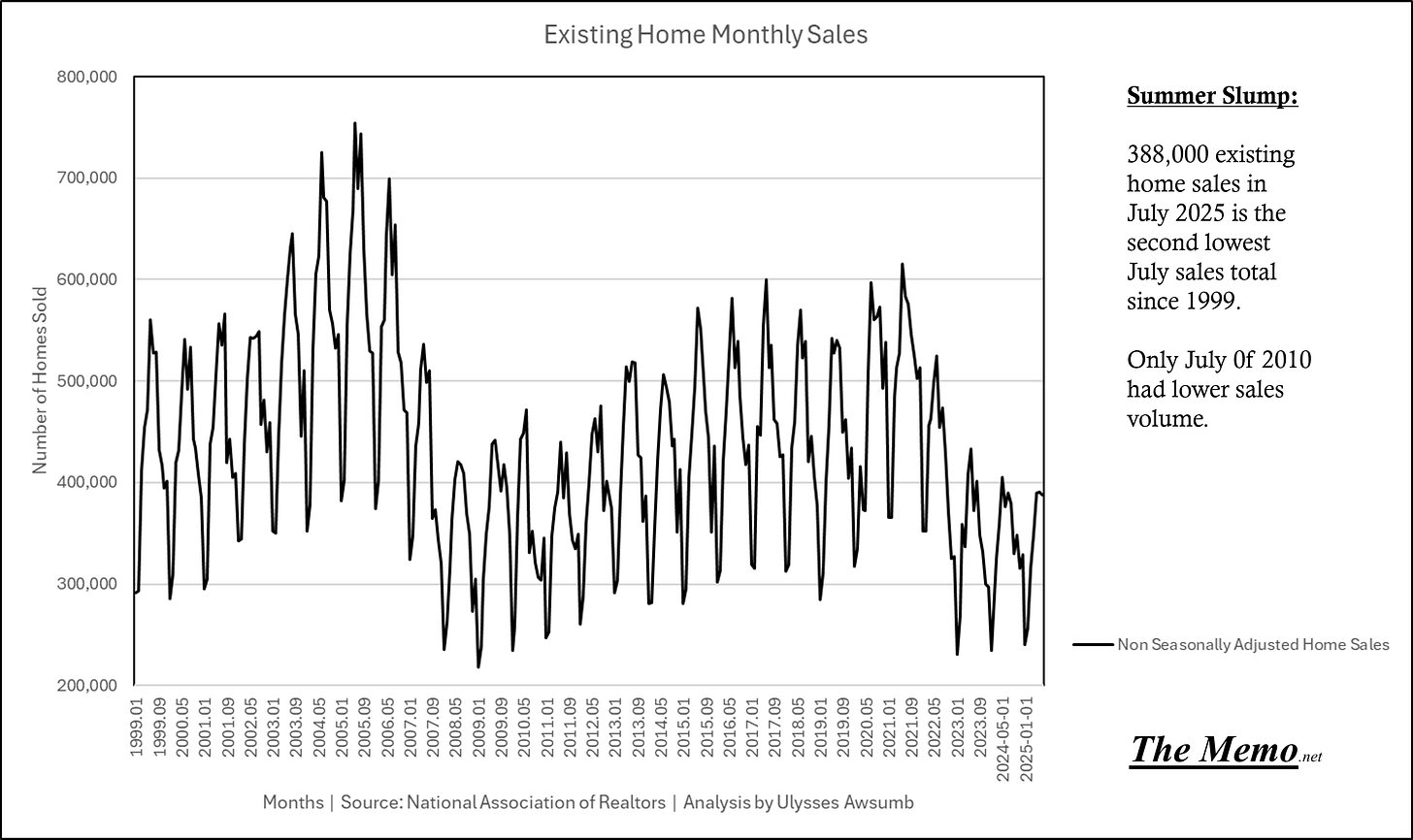

Using the National Association of Realtor’s home sales data, published this week, we just clocked the second lowest sales total on record for the month of July.

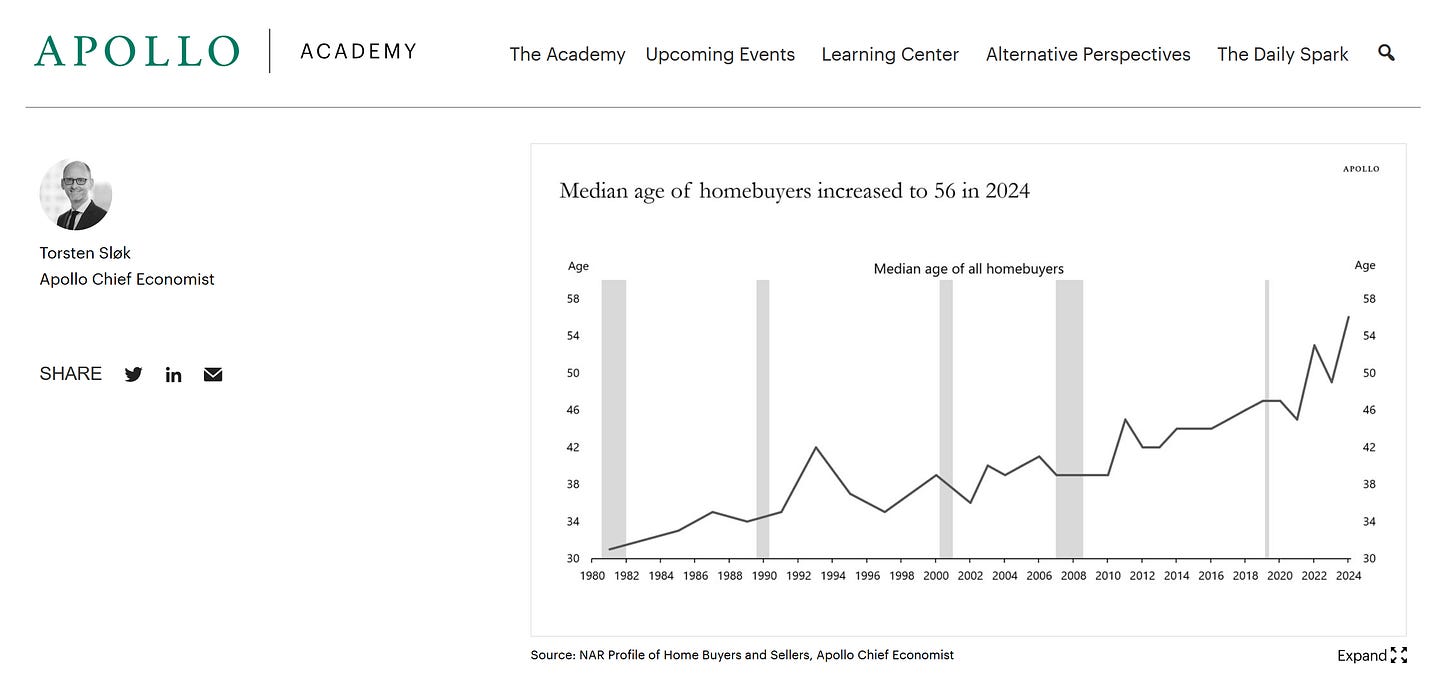

The combination of the existing home Median Sale price (July’s figure of $422,400) and current interest rates combined are clearly impacting sales transactions. One figure that continues to get tossed about is the Median Age of homebuyers right now, which is 56 years old. Back in 1995, the Median age of buyers was 34.

But let’s look at the reality, of the 56+ age set, and transacting to buy a home in the current market.

To illustrate, we’ll use the following example:

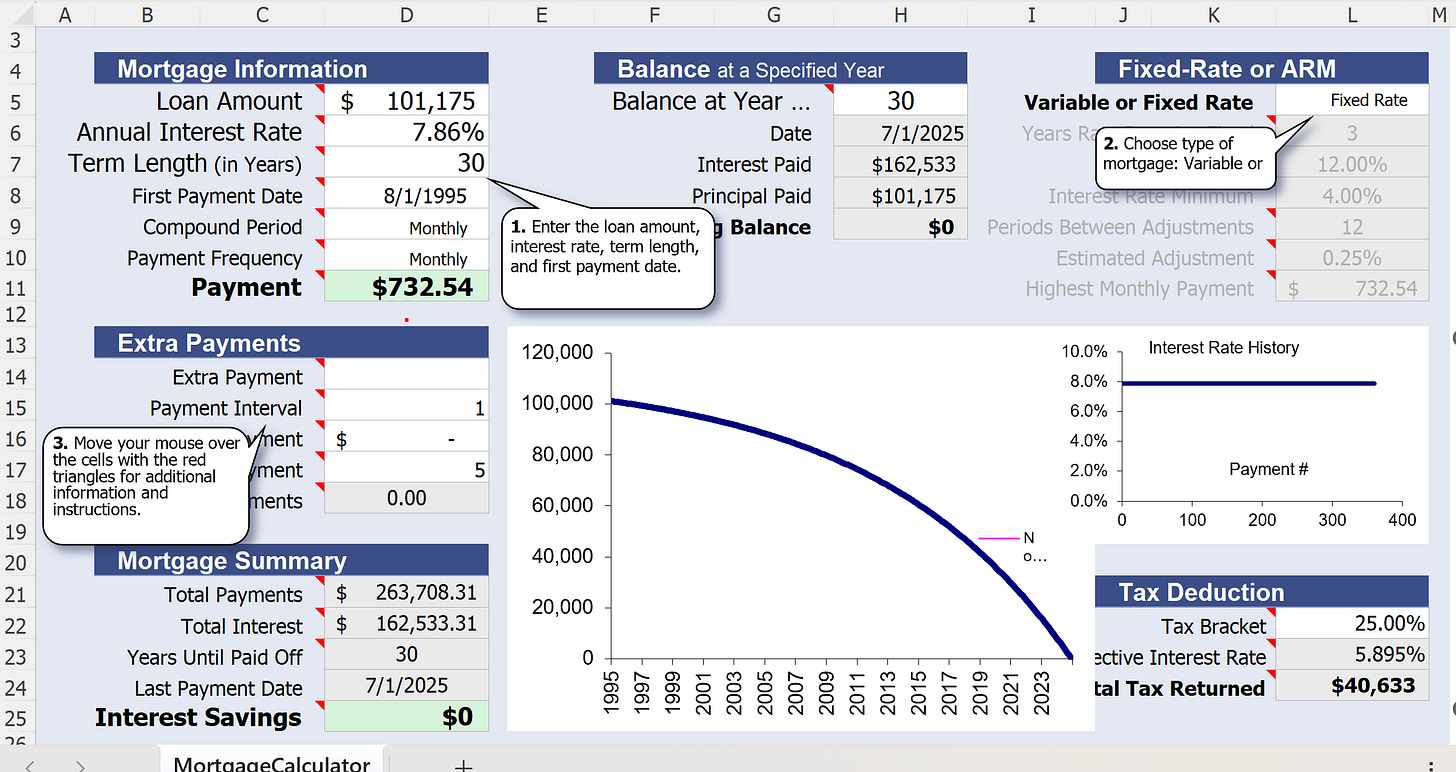

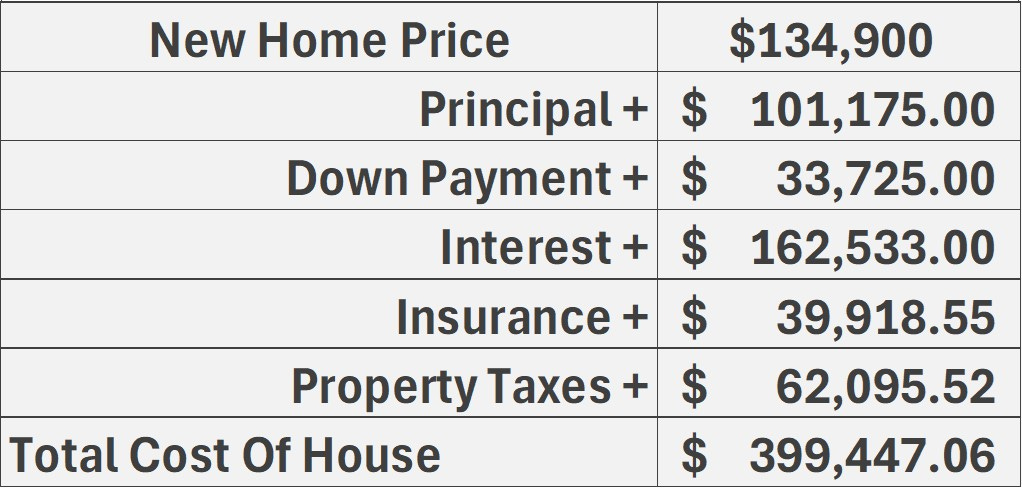

In August of 1995, a 30 year old couple decided to purchase a brand new home. They found a great neighborhood and bought the Median Priced ($134,900 on 8/1/1995) new home from LEN 0.00%↑ Lennar. They put 25% down because they had saved money since graduating college, both worked and wanted to start a family.

Fast forward to today. They just paid their last mortgage payment, and want to net that sweet difference between $134,900 and the $422,400 they’ll get right now. Nice profit eh? “Record Equity”. Ant saving away innit.

Ahem, aren’t we forgetting something?

Right, interest.

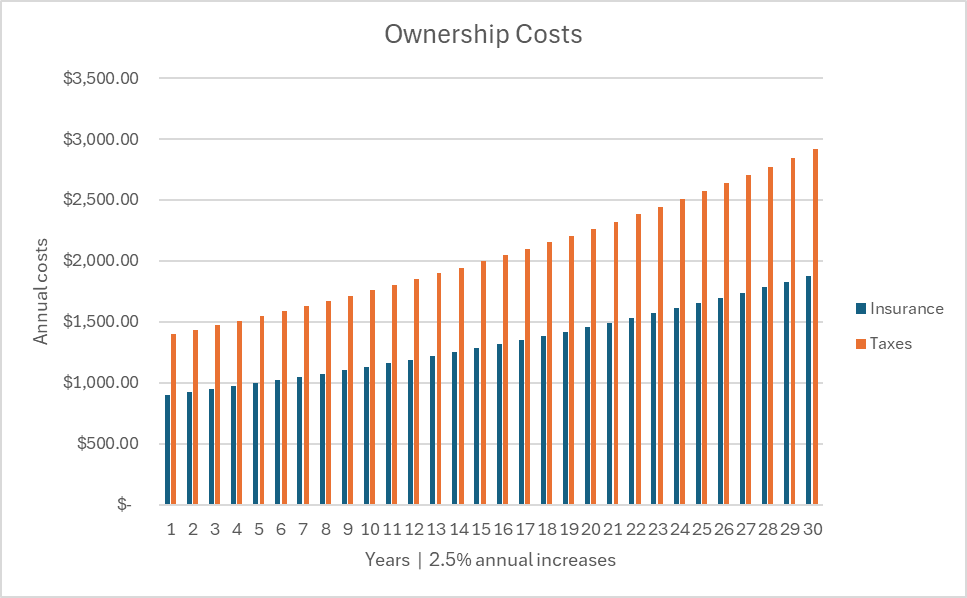

But they also paid for homeowner insurance (PMI wasn’t required). And of course, property taxes. Let’s also figure, that they each increased on average 2.5% per year. Since the Fed is terrible at that 2% target.

Lets add it all up:

OK, so they still made money, right? Hold on. Let’s sell it for $422,400 first. Because they had a top notch broker who understood their market, and double ended the deal, they only paid 3% brokerage fee, or $12,672 in extra cost to take off the top.

The Profit:

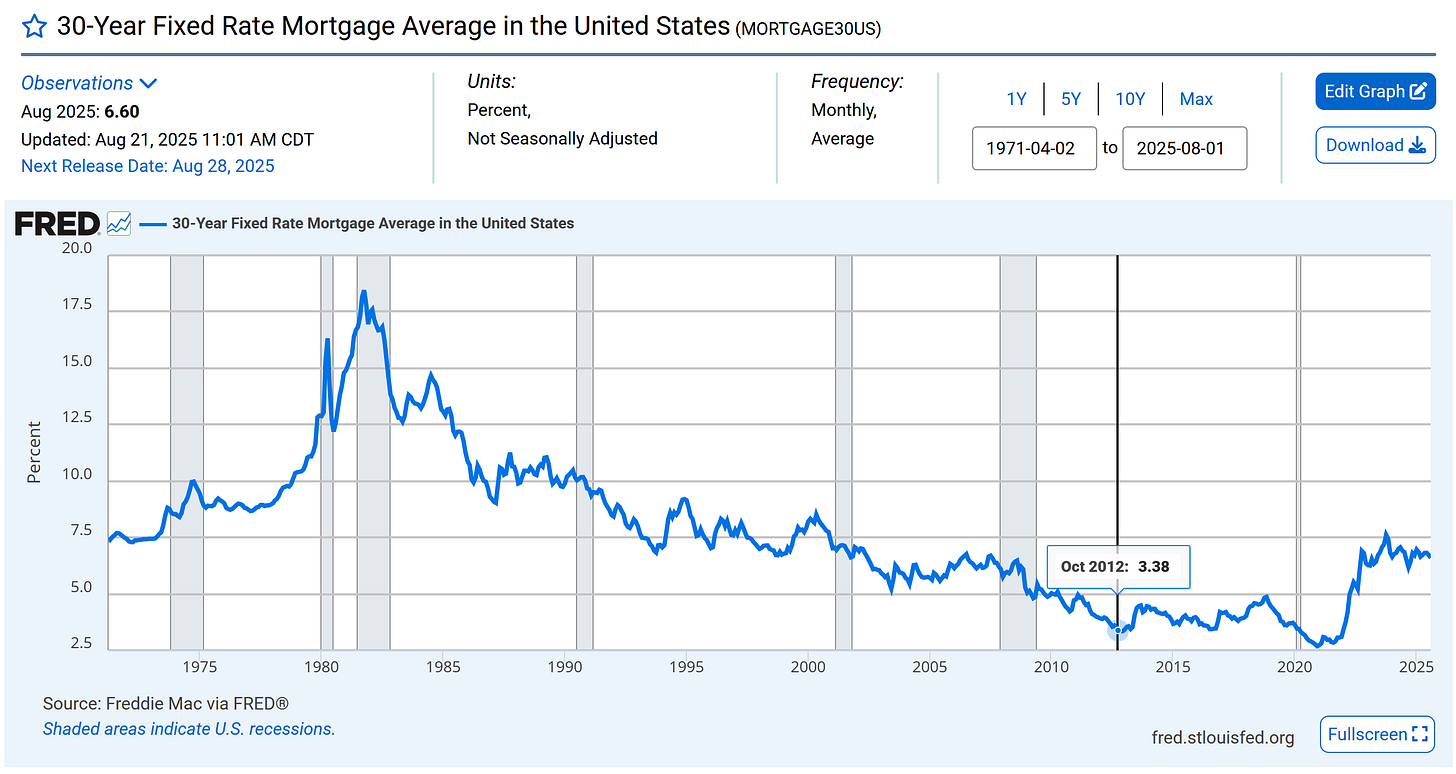

“But they would have refinanced at a lower rate at some point!”. Glad you also thought of that. If they refinanced at the first rate trough in October 2012, they could have cut their mortgage interest rate in half.

They would be refinancing $70,647. However, that would have only decreased their total interest paid to today by $14,348, going from $162,533 to $148,184 YTD and they’d still have 17 years left to pay principal and interest if they stayed. However, if they sold in July this year, they’d have to credit their lender $48,620. in remaining principal owed upon sale, wiping out all that profit. Of course, that’s if they never used a HELOC/Cash Out Refi.

Even if they had gone with a 15 year mortgage at the same 2012 rate, it would increase the interest paid to $199,408 YTD, eliminating all “profit” at sale, and at best 3 more years to go before being free of making payments if they stayed.

Keep in mind, the “profit” as pointed out, includes zero maintenance or repair cost. So either the lawn is in absolutely wild shape, and it’s in need of a lot of repairs including a roof, mechanical upgrades etc., or the real profit is actually, a loss.

Do they have the $409,728 cash in hand after the sale though? Yes, they do. And now, at 60, with the kids out of the house, they have to decide what to buy below median price to have no mortgage, or how much of that to put down on another house, to make payments on until they’re 90, along with the taxes and insurance at higher price basis.

As Aesop’s Ant and the Grasshopper shows us, saving is good.

But it should never be confused with profit. Such is the time value of money.

If equity is used, does it still exist? If a tree falls in the woods, does it make a sound?

NASDAQ

The Leap At Rhodes:

I called the drawdown earlier this year, the bottom, and now I’m calling it again. Because regardless of what I did then, that’s Rhodes, and this is here.

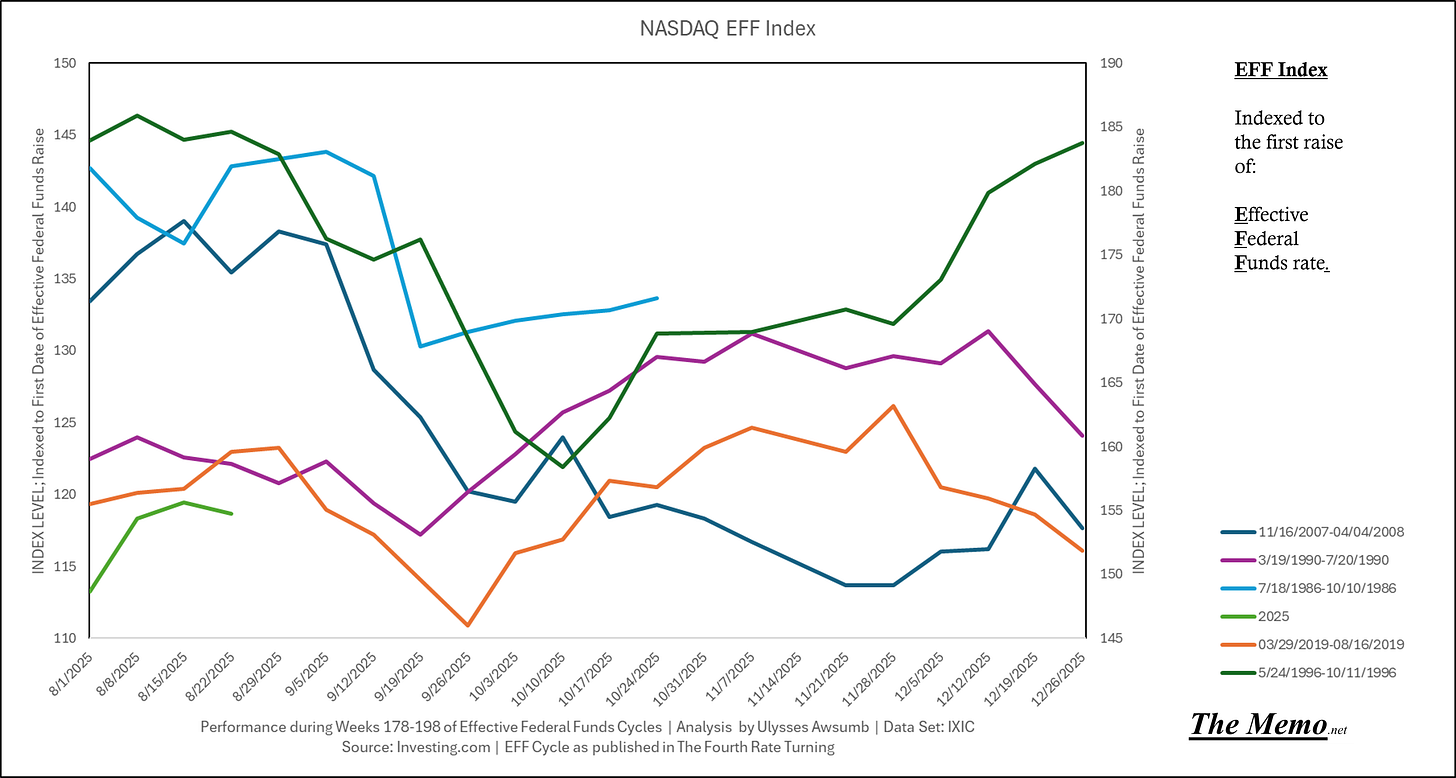

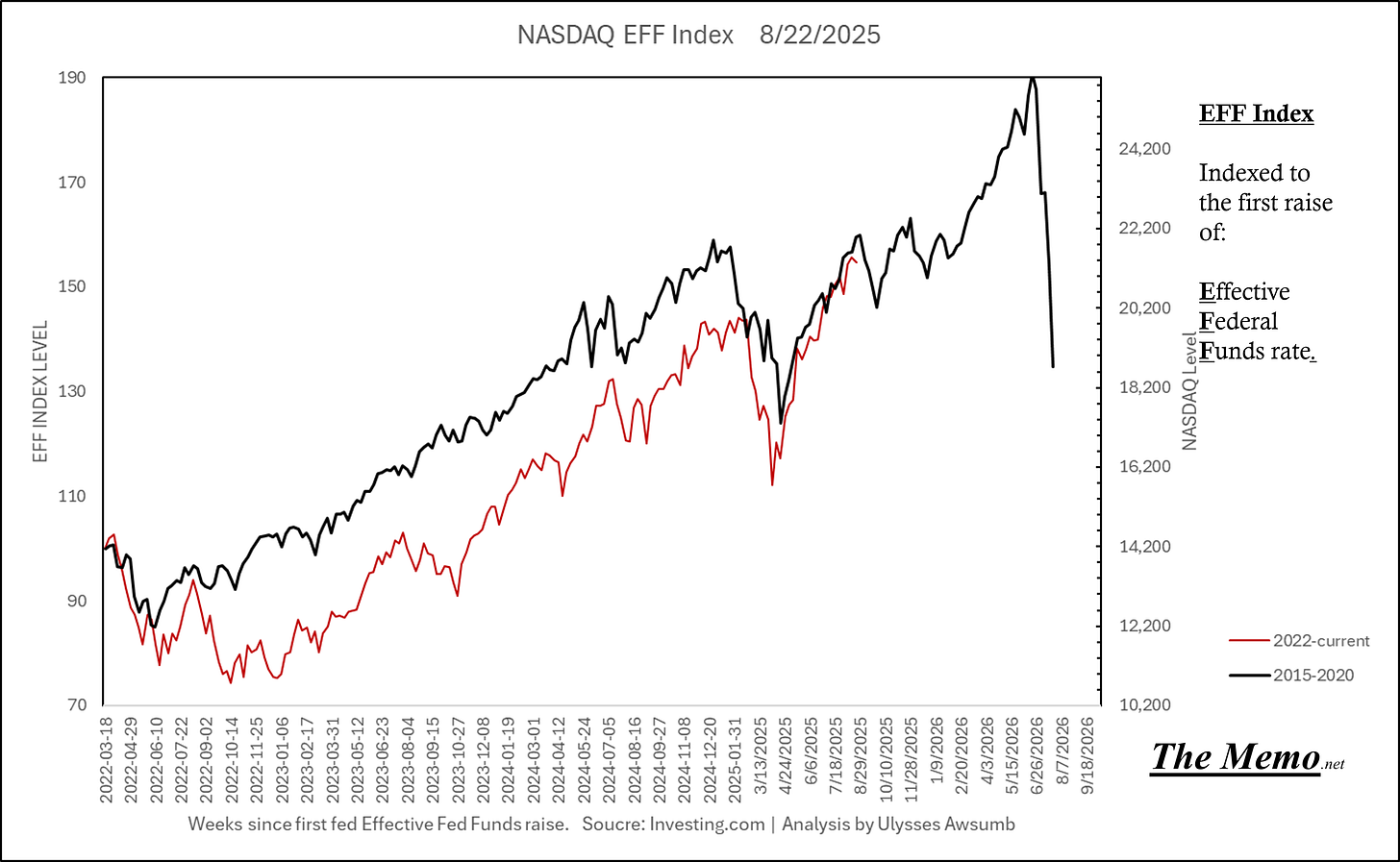

The next drawdown appears to have begun, right on scheduled time. This will mark the second drawdown of the year the EFF indices have shown coming, and their timeline. We will see between -3-9% (we alredy hit -3% this week before Friday’s up day). Because this is the story of how people react to the cost of money, and when they react, regardless of the newfangled things of our time.

This from last week, updated.

And each of the prior EFF cycles back to 1986.

So while we’re currently trending closest to the 2015-2020 cycle:

That does not preclude a repeat of the aforementioned closest cycle of 2004-2009

The difference will be how we rebound at the end of September. Beware the next 4 weeks of markets the way one would have been cautious of the Ides of March in ancient times. Caveat Emptor.

The Leap at Rhodes

A certain man who visited foreign lands could talk of little when he returned to his home except the wonderful adventures he had met with and the great deeds he had done abroad.

One of the feats he told about was a leap he had made in a city Called Rhodes. That leap was so great, he said, that no other man could leap anywhere near the distance. A great many persons in Rhodes had seen him do it and would prove that what he told was true.

"No need of witnesses," said one of the hearers. "Suppose this city is Rhodes. Now show us how far you can jump."

-Aesop

Gross Domestic Product

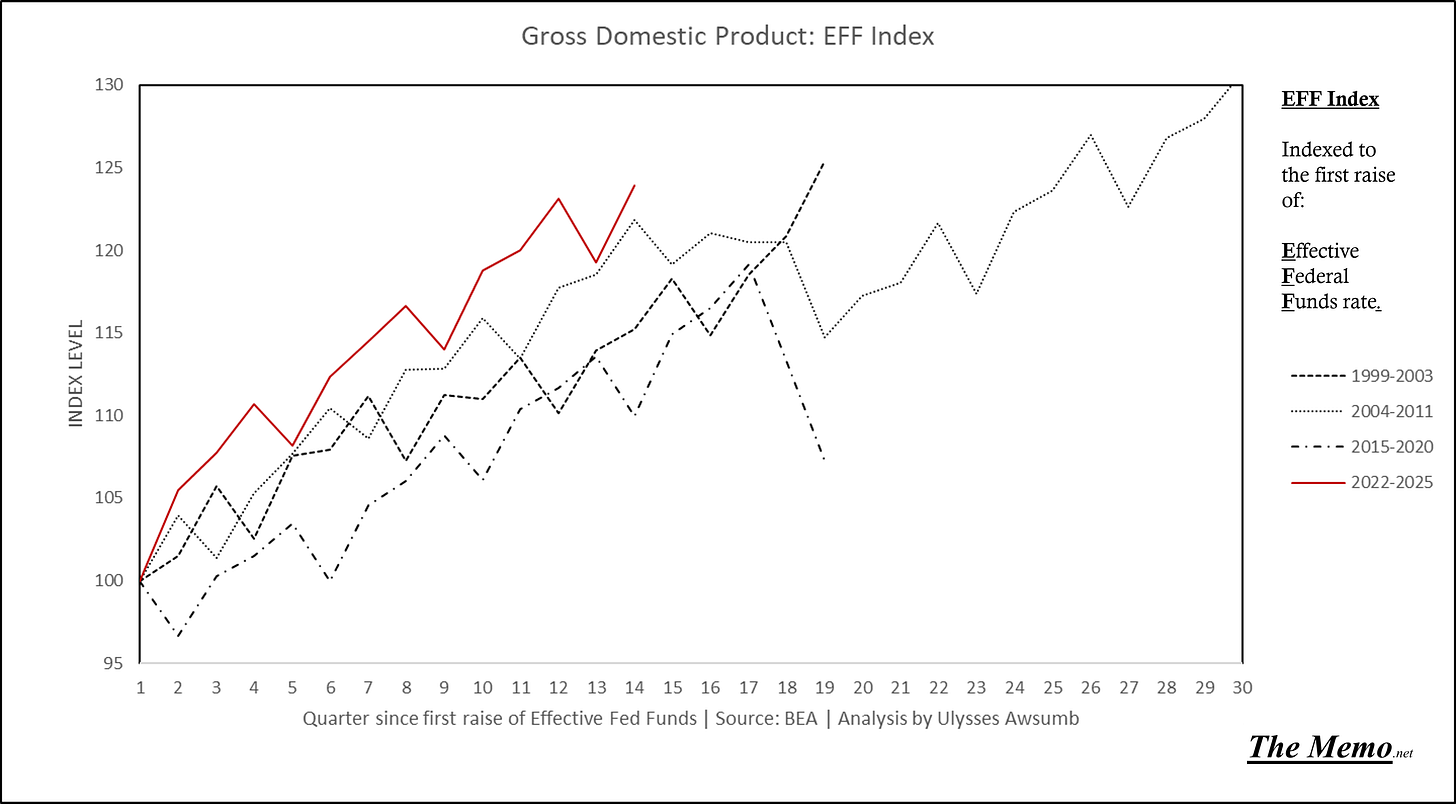

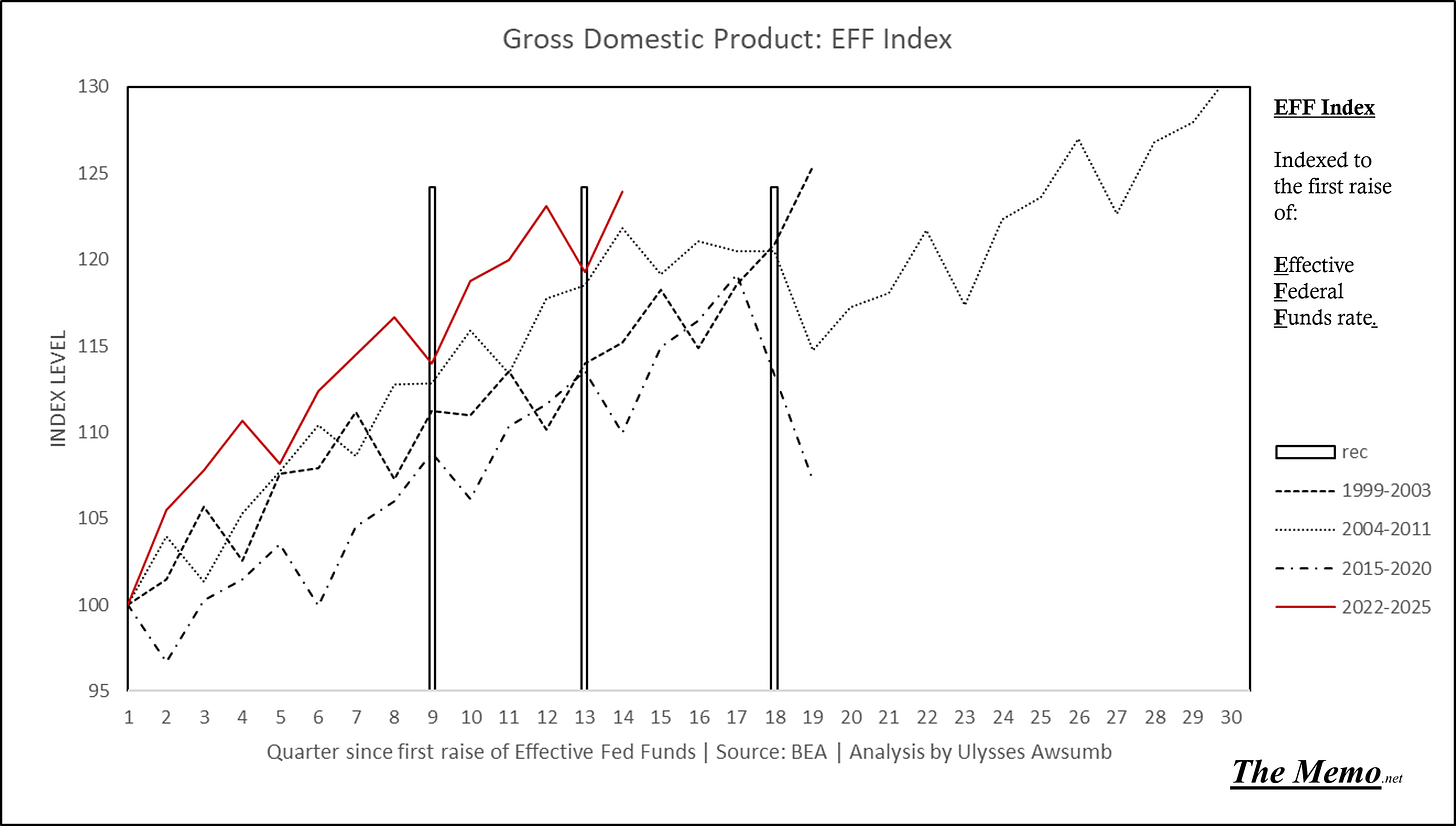

GDP for Q2 came in positive, after a negative Q1 print. Here it is in EFFing time.

That does not preclude the situation from being “all Clear”. In fact, in the same chart below, I’ve added three storypoles (vertical markers). The first on the Left represents the 2001 Recession. The Second represents the 2007-2009 Recession. The Third the 2020 recession. Or the 3 cycles of the 21st century. Having regained the growth post loss does not make a positive growth story. It makes for a flat note.

Which happens to most closely resemble of the prior 3, the 2004-2009 cycle.

Collateral Damage

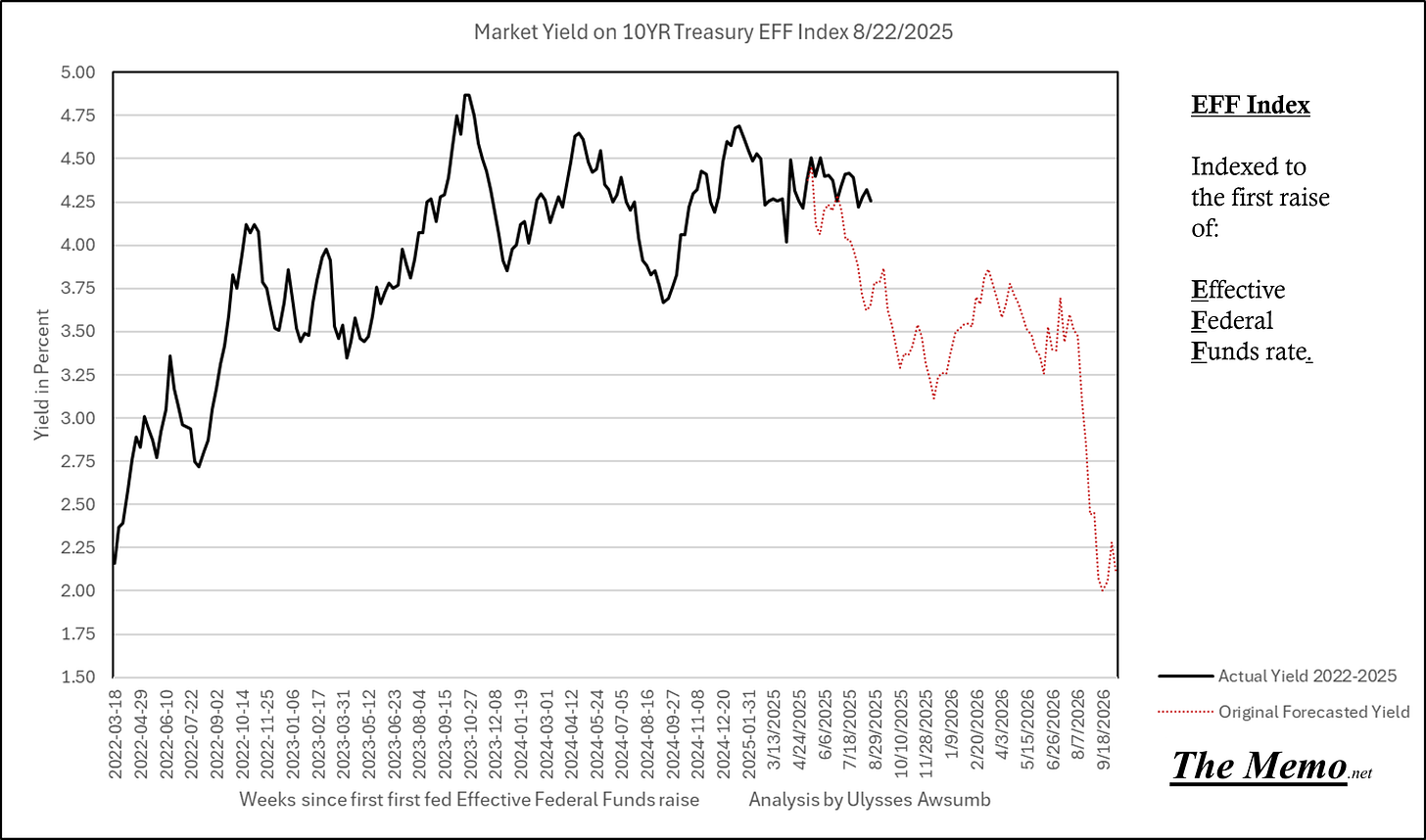

I have no desire to see this yield drop for anyone on Earth. Especially given the rampant spending this country is embarking upon.

Unfortunately, If I were to buy these notes in any quantity, it would pale in comparison to those who have obligations to provide liquidity (read cash dollars) to investors and depositors upon demand. Should the need arise to have collateral to pledge overnight, this yield stands to lower further. Which is sadly by design, despite its negative affect on the elderly, the savers, and those who expect and demand responsible behavior of their, by their and for their elected representatives.

The North Wind and the Sun dispute this injustice, but replace cloak with “your tax dollars”

The North Wind and the Sun had a quarrel about which of them was the stronger. While they were disputing with much heat and bluster, a Traveler passed along the road wrapped in a cloak.

"Let us agree," said the Sun, "that he is the stronger who can strip that Traveler of his cloak."

"Very well," growled the North Wind, and at once sent a cold, howling blast against the Traveler.

With the first gust of wind the ends of the cloak whipped about the Traveler's body. But he immediately wrapped it closely around him, and the harder the Wind blew, the tighter he held it to him. The North Wind tore angrily at the cloak, but all his efforts were in vain.

Then the Sun began to shine. At first his beams were gentle, and in the pleasant warmth after the bitter cold of the North Wind, the Traveler unfastened his cloak and let it hang loosely from his shoulders. The Sun's rays grew warmer and warmer. The man took off his cap and mopped his brow. At last he became so heated that he pulled off his cloak, and, to escape the blazing sunshine, threw himself down in the welcome shade of a tree by the roadside.

-Aesop

To add further complication to this matter, Lighthouse Macro wrote an interesting note this past week about collateral fragility and the changing market for government debt instruments. Its worth the read:

Those comments I made about bonds aren’t sour grapes mind you. Just like accepting the wolf is a wolf, we must accept that which is out of our control, and for the things that are within, focus on those.

The Fox and the Grapes:

A Fox one day spied a beautiful bunch of ripe grapes hanging from a vine trained along the branches of a tree. The grapes seemed ready to burst with juice, and the Fox's mouth watered as he gazed longingly at them.

The bunch hung from a high branch, and the Fox had to jump for it. The first time he jumped he missed it by a long way. So he walked off a short distance and took a running leap at it, only to fall short once more. Again and again he tried, but in vain.

Now he sat down and looked at the grapes in disgust.

"What a fool I am," he said. "Here I am wearing myself out to get a bunch of sour grapes that are not worth gaping for."

And off he walked very, very scornfully.

-Aesop

Inflation is a feature, not a bug. One should invest and act accordingly. It’s never too late to make the next effort, the first effort, or the best effort. But there’s no sense in throwing away the effort for a taste of something better in life just because it isn’t easy.

Today in EFFing time:

The purpose of this segment, or “moral of the story”, is to show that we’ve been here before, and that which is proclaimed to be a new threat, a new reason to fear, is nothing new at all, and we have the roadmap to thrive regardless of the claims to the contrary. To that end, here are a select group of news/articles/highlights of the past todays, and links to read more for those who wish to do so. Also if you thought today was the first time we’re facing a conductor/chip trade battle, see below: 1986

Today in EFFing time it is:

4/12/2019

11/30/2007

9/20/2002

6/07/1996

Yay soft landing for US. Ever heard of the Asian Tiger Crisis, the end of US balanced budgets, LTCM and Dot Com bubble? I remember.

3/16/1990

8/1/1986

7/27/1979

7/11/1975

4/2/1971

9/4/1964

4/18/1958

11/12/1954

6/4/1948

I think I made my point.

The Bundle of Sticks

A certain Father had a family of Sons, who were forever quarreling among themselves. No words he could say did the least good, so he cast about in his mind for some very striking example that should make them see that discord would lead them to misfortune.

One day when the quarreling had been much more violent than usual and each of the Sons was moping in a surly manner, he asked one of them to bring him a bundle of sticks. Then handing the bundle to each of his Sons in turn he told them to try to break it. But although each one tried his best, none was able to do so.

The Father then untied the bundle and gave the sticks to his Sons to break one by one. This they did very easily.

"My Sons," said the Father, "do you not see how certain it is that if you agree with each other and help each other, it will be impossible for your enemies to injure you? But if you are divided among yourselves, you will be no stronger than a single stick in that bundle."

-Aesop

Aesop: 620-564 B.C.

It was my pleasure. Thank you for sharing your analysis with us all.

Thank you for the mention! Very much appreciated