The Fourth Rate Turning

Federal Funds Rates vs The Economy in the 21st Century

The Memo:

Re: The fourth rate turning is here

From: Ulysses Awsumb (@MrAwsumb)

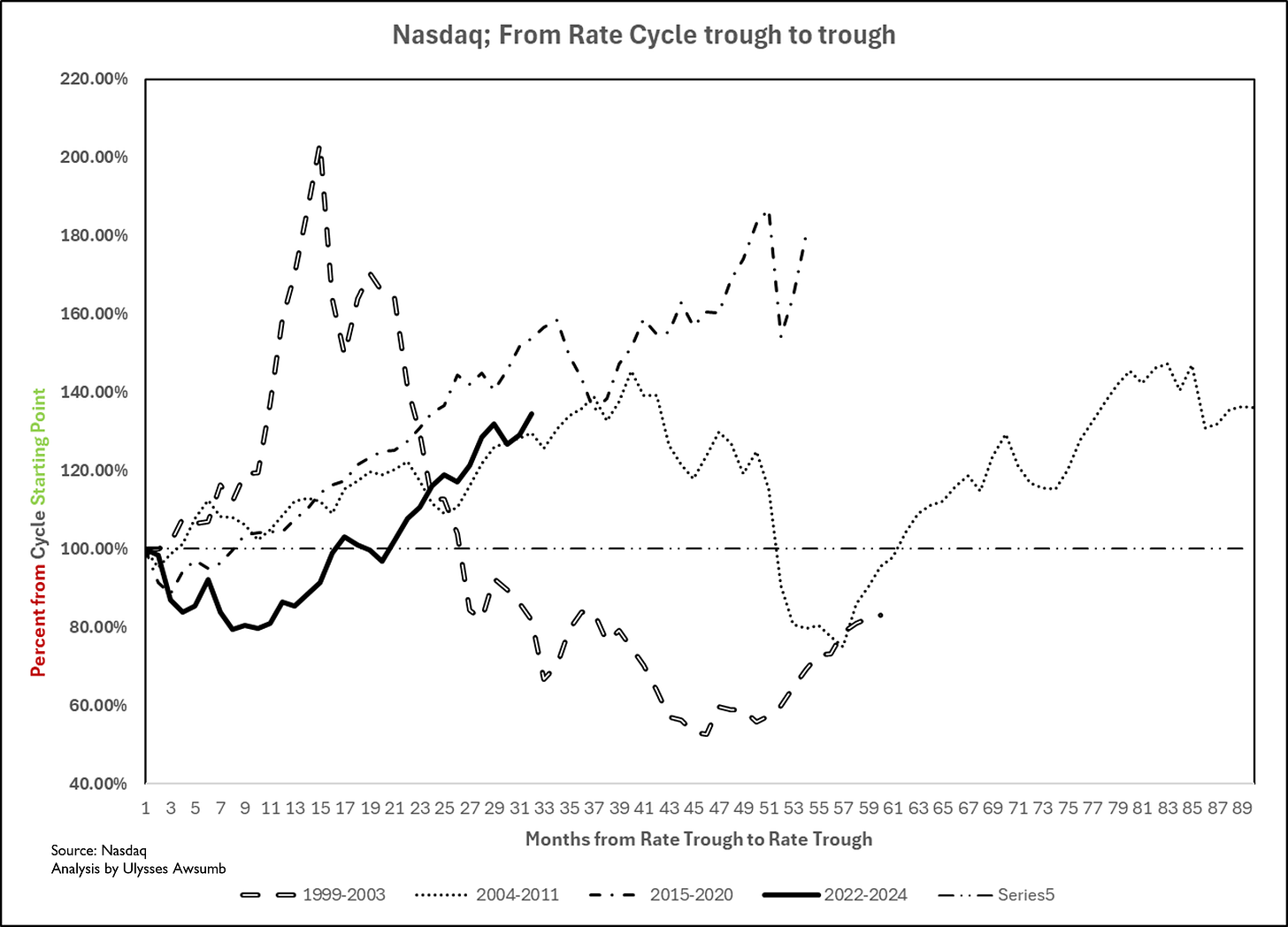

Comments: I broke down the economic cycles into four defined time periods across the 21st century, from Federal Funds Rate trough through raise and back to trough, then compared performance of stocks, stock markets, hard and soft commodities, currencies, rate yields, treasuries, energy and real estate sales/price performance. I call these indices EFF Cycle Indexes. (EFF For Effective Federal Funds Rate Cycles.)

The results show that we’re trending inline with past performances and several trends are remarkably similar across these cycles, the next twelve months represent relative to past cycles, is the time frame for market drawdowns and economic weakness;

Market Indices: could see large drawdowns inline with 2008/2018

New Home Sales: continuation of the trend of challenged sales and price impairments

Existing Homes: Could see negative pricing through spring. If they don’t, appreciation will be extremely minimal.

Precious Metals: May have room to run still

Energy: has underperformed all previous cycles, if it has room to increase, it’ll likely bet later than the next twelve months.

Sales: Ecommerce, retail, mfg and auto sales have room to fall further.

I’ve prepared a detailed report on each cycle that you can read as a primer, or you can jump through the 50 pages of charts showing the current performance relative to the cycles and where they may perform until the Federal Reserve has finished its “Fourth Rate Turning” and rates bottom. I’ve even included a forecast of S&P 500 and S&P Case Shiller Home Price Index.

I’ll be updating these through the coming cycle.

Happy New Year!

-MrAwsumb

Introduction

RATE

1: a quantity, amount, or degree of something measured per unit of something else

CYCLE

1 : an interval of time during which a sequence of a recurring succession of events or phenomena is completed

a 4-year cycle of growth and development

2 : a course or series of events or operations that recur regularly and usually lead back to the starting point

… the common cycle of birth, growth, senescence, and death. —

b : one complete performance of a vibration, electric oscillation, current alternation, or other periodic process

c : a permutation of a set of ordered elements in which each element takes the place of the next and the last becomes first

In the year 1999, the US economy was said to be barreling full steam ahead, in the midst of a reported “new paradigm” and dawn of a new era that would forever change the world.

In conjunction with this “new paradigm”, there was also a reported Doomsday narrative on the calendar. Y2K that is.

As the internet progressed, it became apparent that computer programmers had long decided to only use 2 digits for the YY in the MM/DD/YY format, and upon the stroke of midnight on December 31st 1999, the computer world would reset to Jan 1st of the year 00, setting about total disaster for computer controlled programs, ending business operations and creating general calamity, rather than turning the date to say “2000-00, party over

Oops, out of time”

This “fear” led to hiring in the computer industry alongside the boom in “dot com mania”. Coincidentally Y2K did bring about destruction. But not the type that most people had predicted. The digital clocks struck midnight, and rolled over to 01/01/2000, his Purpleness reverted back to his name, and by 03/11/2000 the NASDAQ began collapsing, taking with it a slew of company’s stock valuations that had been promised to never go down, and even more business disappearing as it was discovered, it still took actual work to sell something, even if it was on the internet. AOL, Ask Jeeves, Hotmail and several other “guaranteed” winners would soon disappear, while a pair of allegedly obscure yet to make profit companies, who were often mocked for “all it does is tell you what’s on the internet” and “they just sell books” would eventually become the behemoths known as Google and Amazon.

The Y2K “New Paradigm” and “Doomsday”, as presented in two charts:

Let’s take a step back. In April of 1999, The Matrix starring Keanu Reaves would open to gross more than $100 million at the box office for the month. This was back when that was still blockbuster territory to even reach $100 million. But there was something else that happened that same April.

Deep beneath the earth in The Eccles building, Agent Smith His Chairmanship Alan Greenspan would actually begin the dawn of a new era, ushering in the 1st Rate Cycle of the 21st Century and creating “a glitch in the Matrix” of Rate policy, known as “ZIRP” (Zero Interest Rate Policy) creating Asset Price Bubbles that were most definitely not “regional”, introduce the world to new financial derivatives made of bad coding and eventually land taxpayers on the hook to bailout Wall St™ . But not before raising rates right into blowing up the US Stock Market in 2000, after having lent a helping hand to LTCM.

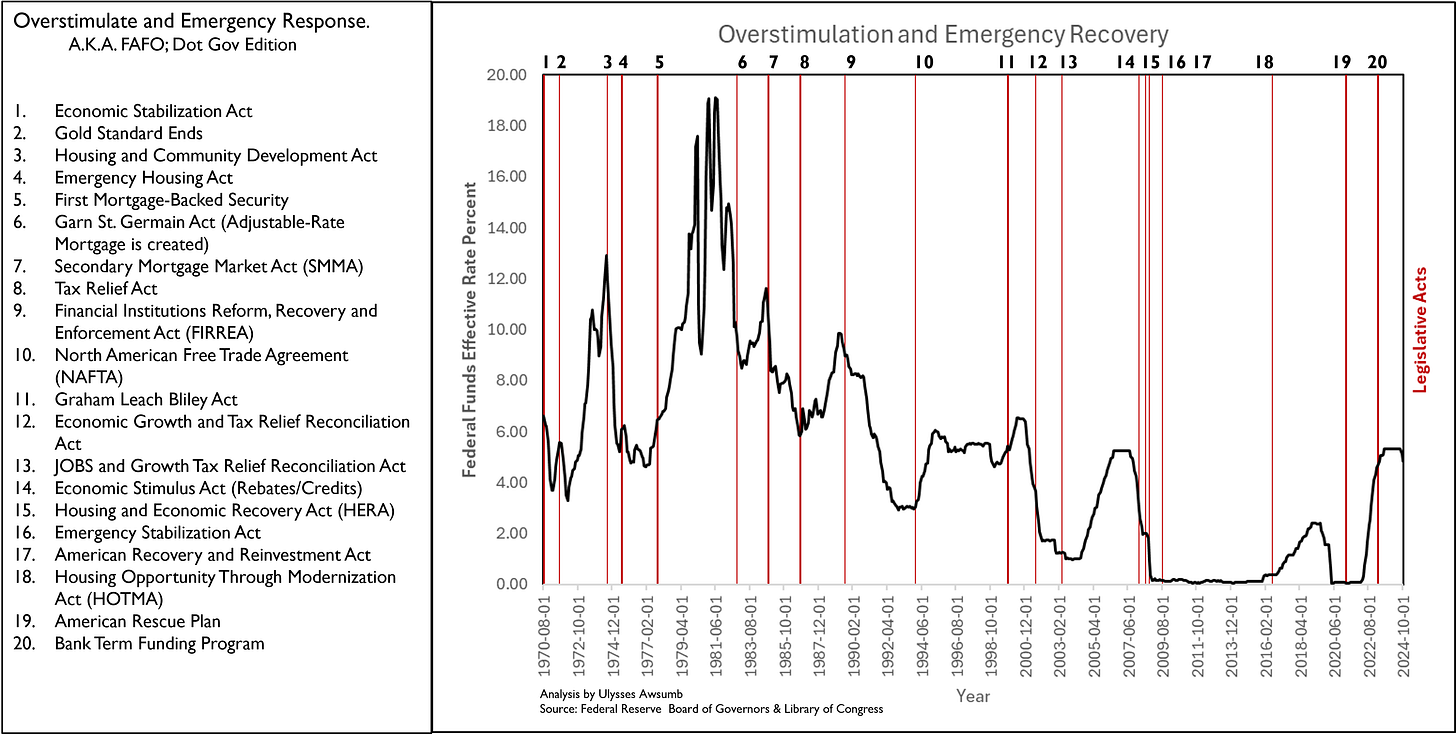

The litany of actions taken to pump the US Economy full of Uppers and Downers in an attempt to balance the effects into some form of permanently expanding ever performing mutant has been going on so long, by Congress and The Federal Reserve, that I’ve decided to put them into a pair of neat charts as shown below.

Here’s an in-exhaustive look at the required fiscal and legislative responses to Rates being Raised and Lowered:

Legislation

As the kids say these days, “FAFO”. Only prior to the start of this rate cycle, there was a popular phrase that applied, from the 1994 film Forest Gump; Stupid is as Stupid Does.

That saying about the definition of insanity comes to mind no? But rather than simply mock the notion, it’s relatively easy to tie together the stimulative and responding recovery legislative behavior that comes along with the Federal Funds Effective Rate changes, let’s look at this in the context of; if we keep repeating the same behavior, the outcomes should be expected.

As in,

A Rate Cylce

RATE

1: a quantity, amount, or degree of something measured per unit of something else

CYCLE

1 : an interval of time during which a sequence of a recurring succession of events or phenomena is completed

Or better yet, A Federal Funds Rate Cycle, from trough through peak to trough. In that framework, we can measure the degree of “something” through an “interval of time during which a sequence of recurring succession of events” is completed. Here are the 4 Cycles of the 21st century;

These are periods categorized as: 1999-2003 | 2004-2011 | 2015-2020 | 2022 to Current. With periods in between as a sort of no-mans land where rates didn’t move at all, as if they were Cthulhu resting on the ocean floor, waiting to be released, yet again becoming the fabric of anxiety to mankind.

With these cycles in mind, it’s worth noting that we’ve entered the Fourth Rate Turning. That is, the lowering of the Fourth Rate Cycle of the 21st century. I note this because the entire purpose is to examine different components of the economy through this particular “interval of time during which a sequence of a recurring succession of events happens as measured by a quantity, amount, or degree of something per unit of something else”

We’ll examine stocks, indices, hard and soft commodities, real estate, rates and yields as well as employment in the perspective of Rate Cycles to see if we can estimate where they’ll go from here with the remaining rate cuts to their trough. As an indexed method for evaluation, I’m calling these: EFF Cycle Indexes. EFF For Effective Federal Funds.

Cycle 1; 1999-2003

“This is your last chance. After this, there is no turning back. You take the blue pill - the story ends, you wake up in your bed and believe whatever you want to believe. You take the red pill - you stay in Wonderland and I show you how deep the rabbit hole goes”

-Morpheus; The Matrix

Coming off of a 6 year expansion of the business cycle, in which the fabled 1995 soft landing was achieved, this period lasted from April 1999 to December of 2003. Rampant speculation in the stock market and the booming internet was underpinned by the expanding housing market, having recovered from a near disaster by builders in 1995, due in part to expanding demographics and rising wages.

After the Dot Com bust, the ensuing recession saw the first drop to near zero rates of the new century by the Federal Reserve. Followed by the legislative and fiscal spending in response to the recession & 9/11. The Government passed the Patriot Act, creating Job Factories known as Transportation Security Administration (TSA) and The Dept. of Homeland Security, respectively. They launched a full-scale war in Afghanistan/Iraq both and spent a fortune on rebranding “America/Freedom” at every sporting venue in the country. The destruction and new paradigms both of Y2k were real, but not the way they had been sold. “You believe it's the year 1999 when in fact it's closer to 2199. I can't tell you exactly what year it is because we honestly don't know. There's nothing I can say that will explain it for you, Neo”

The 21st Century was born with millions losing their retirement savings, the unemployment rate increasing into 2003 and Big Government™ was now in Business.

Key events included;

· Graham Leach Bliley act allowing for “Super Banks” to be created, putting insurance, investment and S&L banks under one umbrella.

· Dot Com bubble burst

· “Bush Tax Cuts” and restructuring tax rebates

· 9/11 and Invasion of Iraq

· JOBS and Growth act of 2003, creating economic incentives for reinvestments/businesses

· The Patriot Act

· Afghanistan/Iraq Invasion

· Invention of Job Machine: TSA™ (Transportation Security Agency) and Dept. of Homeland Security

· The Recession was Backdated

· The Matrix was released in April of 1999

Cycle 2; 2004-2011

“Extreme ways are back again

Extreme places I didn't know

I broke everything new again

Everything that I'd owned

I threw it out the windows, came along

Extreme ways I know move apart

The colors of my sea

Perfect color me”

-Extreme Ways; Moby

The second cycle of the 21st century brought about extremes in both directions. Moby, having recently found commercial success in 2000 after 20 years of playing music, would see his song Extreme Ways rise to notoriety through licensing to The Bourne film franchise. From the obvious extremes in lending both prime and subprime, to extremes in the “Police State”. With the US Military Industrial Complex and the National Security Industry being handed nearly unlimited dollars at home and abroad. The Bourne Franchise hit at a critical time as well as being a fresh storyline about the rising Natsec industry.

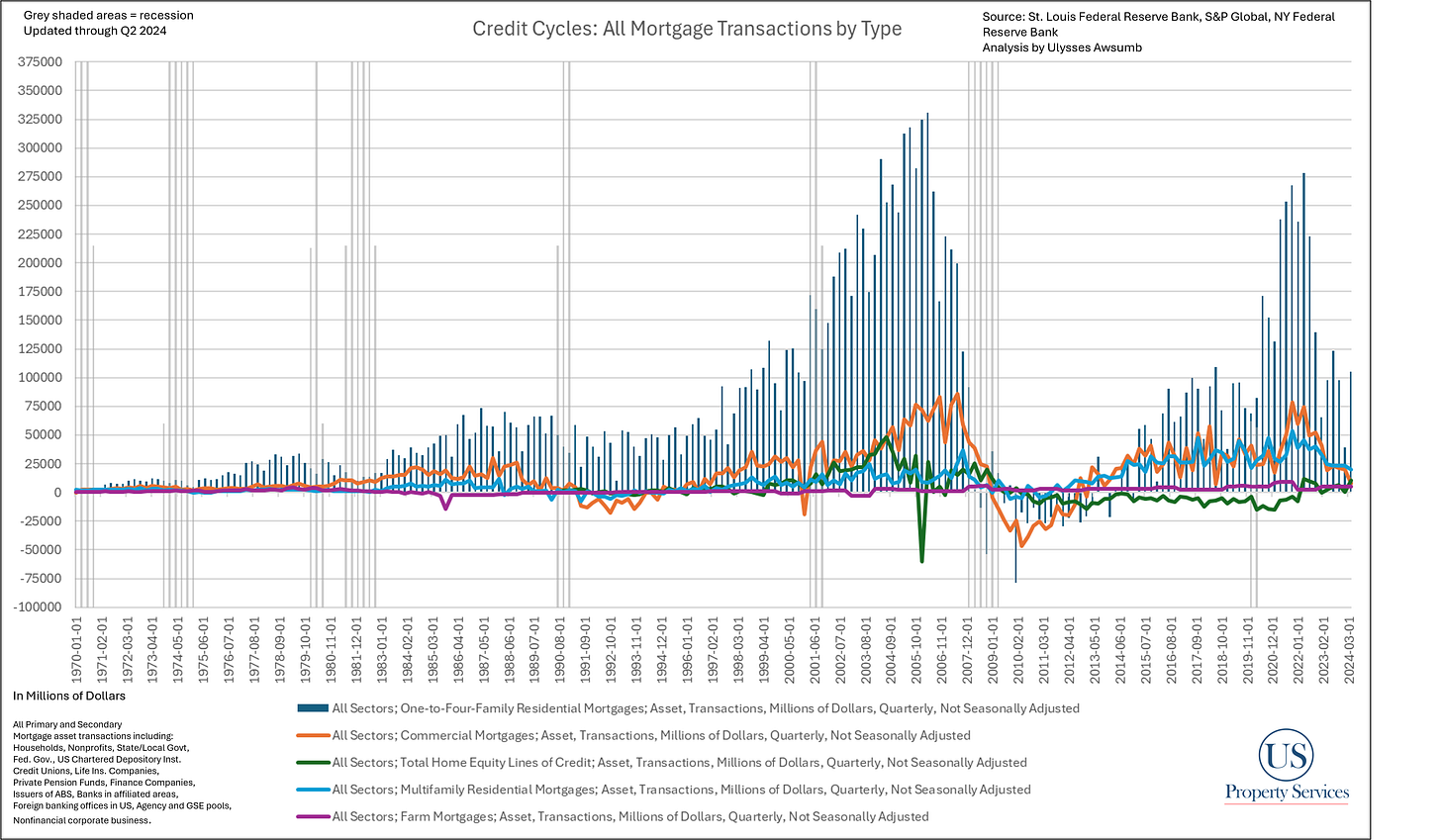

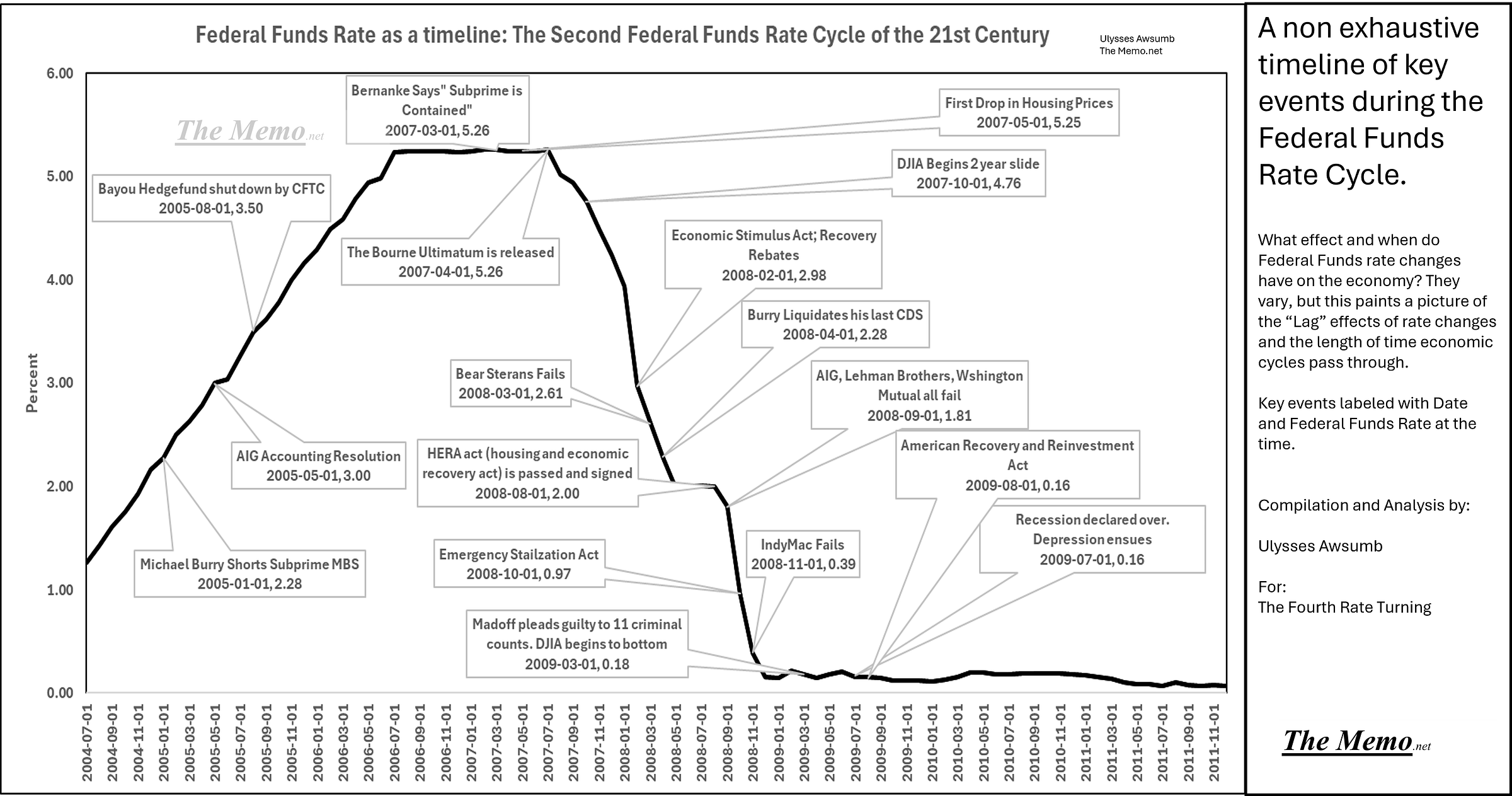

Off the bottom ranges of ZIRP round 1, the housing market saw a meteoric sales pace, and subsequent run up in home prices. It also saw lenders (including the freshly minted banking conglomerates from the Graham Leach Bliley Act lending to anyone willing to borrow, which spurred a frenzy in lending elsewhere, by any means necessary including the now famous MBS that would soon become villainized. Stock markets began to tank well after the housing market had entered its downturn, this time responding to the underpinning of the housing cycle rather than being the lead. Some of those Super Banks failed outright, while others were handed taxpayer dollars, all while 3.8 million homeowners lost their homes from 2007-2010. The worst year for American Casualties in Iraq and Afghanistan were in 2008 and 2009, swept aside by the financial carnage stateside. Gone, but not forgotten.

Among those industries damaged by the fallout was the auto industry. One way the government bailed them out was the “Cash for Clunkers” program (aka CARS Act; Car Allowance Rebate System), whereby the Government handed out $3,000,000,000 to destroy 700,000 vehicles, through rebates for buying new cars where the trade in was destroyed.

The patient wasn’t responding, and the Government prescribed more stimulants. By measure of how our money supply expands, 2008-2012 was by all accounts, an actual economic depression (as the chart below will show). But that isn’t catchy to say, so instead it was rebranded “The Great Financial Crisis” and as history goes, would soon be rewritten to be about A Guy™, shorting “housing” through credit default swaps. “Extreme Ways are back again, Extreme places I didn’t know, I broke everything new again. Oh baby, oh baby, Then it fell apart, it fell apart, Oh baby, oh baby, Like it always does, always does”

Key events:

· Economic Stimulus Act

· CARS Act

· HERA Act

· Emergency Stabilization Act

· TARP

· American Recovery and Reinvestment Act

· The Bourne Ultimatum was released in 2007 (then capping off the series)

· Economic Depression

· The Recession was Backdated

Cycle 3; 2015-2020

“My friend, Jefferson's an American saint because he wrote the words, "All men are created equal." Words he clearly didn't believe, since he allowed his own children to live in slavery. He was a rich wine snob who was sick of paying taxes to the Brits. So yeah, he wrote some lovely words and aroused the rabble, and they went out and died for those words, while he sat back and drank his wine and f***** his slave girl. This guy wants to tell me we're living in a community. Don't make me laugh. I'm living in America, and in America, you're on your own. America's not a country. It's just a business. Now fucking pay me.” -Jackie Cogan; Killing Them Softly

Oscar Wilde once said, “Life imitates art, far more than art imitates life”. But then again, actions have consequences. 2012’s Noir film Killing Them Softly, takes place set in 2008, amidst the Presidential Election and economic fallout happening across the country. The story loosely revolves around 3 criminals who decide to rob a mobster poker game, creating an economic crisis amongst the criminal underworld, and the Hit Man sent to clean up the situation. If that isn’t a portrait of art imitating life, or at least being shaded by it, then the quote from the cleanup/hit man Jackie Cogan (Brad Pitt’s character) above should. This period marked an ideological shift in our national timeline. And it wasn’t hope and change. It was cynicism and apathy. Stages of “grief”. The next iteration of the economy bore these stages before being forgotten.

From 2008-2012 jobs were hard to come by. As things kicked along, those with money had watched their yield on savings disappear as noted in this chart:

It’s worth mentioning, given that “Housing is the economy” and how the next iteration came to be. In those early years, there were both large and small investors buying foreclosed properties. They found a way to attract investors by offering a higher yield than they could get through traditional means, through bonds, stocks or savings yields.

A lot of these operators were real estate newcomers, who had no “risk” mitigation experience. A 6-7% rate of return was huge given the alternative options early on. This would continue to grow, and as the stock market continued recovering, the Opportunity Zone legislation was introduced as well as the Housing Opportunity Through Modernization Act. Both of these helped spur additional investment into the space, and the housing recovery would soon be running on jet fuel. As Federal Funds rates turned yet again, liquidity issues reared their head in September of 2019. All signs pointed to incoming economic contraction.

During that whole episode, banks took a while to recover from their post “GFC” losses. Private Credit (Private Equity) firms stepped in to fill the void, and Non Bank Lending became a systemic part of the housing market. While Airbnb, Uber/Lyft, Bitcoin, Fivr, Streaming platforms and more helped to normalize the further financialization to consumers, degrading value by adding additional middlemen to the costs and fractionalized ownership became seen as normal.

Enter a global health pandemic and the most severe reaction by the US Government on record, shuttering businesses, printing money directly into bank accounts and creating new legislative programs to provide financial support furthering “Big Government”. Or as Cogan stated; It’s just a business, now f****** pay me.

Key events:

· HOTMA legislation

· September 2019 liquidity crises

· Rise of the GP

· Federal Reserve’s implementation of SOFR

· Federal Reserve purchasing MBS

· Federal Reserve paced treasury purchase program

· Covid 19

· Declining birth rates

· Private Credit Lending replaces traditional Bank Lending

· Fractional Ownership and the rise of App Middlemen

· History was rewritten from being a story of negative equity, speculative frenzy and government encroachment to one of “irresponsible subprime borrowers” and wall street savvy via “The Big Short” released in December of 2015.

· Oil futures went negative in April of 2020

Cycle 4; 2022-Current 2024

“Go home, get ahead, light-speed internet

I don't wanna talk about the way that it was

Leave America, two kids follow her

I don't wanna talk about who's doin' it first

As it was

You know it's not the same as it was

As it was, as it was”

-Harry Styles

If it isn’t yet apparent, I’ve chosen each of these entries for a reason. They embody the Zeitgeist of the era in question. Each Rate Cycle.

Coming off the global economic shutdown and stay at home Era of 2020, armed with PPP/ERC/Pandemic Stimmies™ and working from home, consumers (read every us citizen) started spending all the fresh monetary supply (I don’t want to talk about who was doing it first). This sudden demand across all industries decimated supply chains that were already short staffed from inequal “Back to work” freedoms. While some worked “remote” others were deemed “Essential Workers” and never left. Either way, demand soared, sales skyrocketed, people were handing out millions for .gifs renamed NFTs, buying property in online worlds, Home Prices and Stocks had “Mooned”, and the nation divided along race, party, creed, color, religion and sex. But not before the eventual pendulum swing; the city of Minneapolis saw dozens of buildings burned to the ground amid riots over police treatment of first George Floyd and subsequently protesters outside the eventually burned out police station. All the military gear from the prior two decades of war had been sold to police departments and combined with the national guard, eventually deployed on US Soil, patrolling streets and enforcing curfews.

Between May 2020 and March 2022, the Fiscal and Monetary Policies of the US and Federal Reserve created the largest wave of inflation in the US to date. Then Cthulhu was freed again. (The Federal Reserve began the fastest hiking cycle to date). Stock markets saw a drawdown, and homebuilding sales fell flat. By March of 2023, banks began to feel the squeeze, culminating in the Bank Term Funding Program, a stopgap measure that issued (loans not QE) to banks. This subsided market discomfort and the market indices and homebuilders continued at their previous pace. While the US has seen an enormous increase in immigration during this period, there was a shift of younger folks to Leave America, emigrating to other nations amid the rampant inflation and them having lost hope for opportunity. You know it’s not the same as it was, as it was, as it was.

We’re in the 31st month of the cycle, at the ¼ Century mark, and the Fourth Rate Cycle Turning is now upon us as the Fed has dropped rates by 75bps. The next 12 months will be telling in how markets respond in similar patterns to these previous cycles post turn.

Key events:

· American Rescue Plan

· CARES Act

· Bank Term Funding Program

· Largest annual increase in Home Prices

· Second largest New Home Median Price Correction on record

· Longest duration ever, inversion of 10Yr minus 3Mo Treasuries

· Massive Pharmaceutical Subsidies

· PPP

· ERC

· Pandemic Stimmies

· Drawdown of 2022

· Film Industry self destructs, killing day and date releases, shutting down production and losing money hand over fist on streaming deals.

· Harry Styles releases As it Was, the video would receive 790,000,000 views on YouTube

· Guy Ritchie’s The Covenant is released in 2023, a gripping reflection on the 21st century’s battle with war and the effects on it’s participants, as well as a memory of those forgotten.

And now, for the EFF Cycle Indices:

Dow Jones Industrial Average

The current cycle of the DJIA, despite starting out weaker, is tracking withing 99.97% correlation to the 2004-2011 cycle, through 31 months. Throughout the prior 3 cycles, the DJIA has shown weakness in the same cycle points. Months 39, and have all seen their biggest weakness/drawdowns months 43-51

NASDAQ

Months 39 to 51 again represent the biggest drawdowns, while the current similarity is closet to the 04-11 cycle, the rate of increase is similar to the 2015-2020 range. Despite the 99-03 Cycle having peaked earlier and drawn down faster, it ended month 57 at the same level that the 04-11 Cycle was at.

S&P 500

The similarities in index performance continues across cycles. If history does provide guidance, then even if the index does climb higher, it eventually faces a tailing drop, before rebounding again.

NYSE

By month 53, all 3 prior cycles saw the NYSE negative from it’s starting point in the cycle. Directional trending in similar fashion to each one of the prior cycles, having started closer to the 1st cycle (99-01) and now rising while being below the gains posted from either the 2nd or 3rd Cycle. The NYSE may be leading in the correction trend, if it follows rates of change from cycles 1 & 3, whereas cycle 2 could provide unseeingly high valuations prior to a larger drawback as cycle 2 did.

Forecasting

By comparing the current cycle to the rate of change to past cycles, I’ve run the 3 month moving average of this cycle compared to “future” months of the closes past cycles. The black split bars representing the average of the prior 3 cycles future, and the red being the target range of the closest correlated cycle (2nd).

If the market continues to move higher past December 2024, the next few months could see S&P 500 as high s 6500, followed by a long decline similar to the 2nd rate cycle drawdown into 2009.

Individual Stock and ETFs

Currencies and Money Supply:

Real Estate:

Existing Homes;

New Homes:

Loan Performance:

Commodities

Energy

Economic Indicators

Sales

Yields

The Four Prior Rate Cycles

So this is certainly super interesting, and well written. I guess I would say that you've limited it to the last 24 years, where's expanding it to include more history might be more enlightening.

I don't know if you're aware of the Foundation for Cycles Research - but would strongly recommend checking them out.

Generally the idea:

- there's an ~18 year real estate cycle (goes back several hundred years), and we are rapidly approaching that

- there's some very long cycles in interest rates of 40-60 years, with the general idea that we're entering a secular bear market for bonds

- a 3.5 year cycle for risk markets

Plenty of others. But you're definitely onto something here.

I'd challenge the idea that energy can't perform - because I think that's rooted in the environment we've been in since the end of the last commodities super cycle. Put differently, I see strong analogies to today being equivalent to January 1973 - in which case it could be energy and bonds that push us over the edge to the next down cycle.

Thank you very much!

I'll check out The Foundation of Cycles research, haven't seen it yet.

Also, I agree energy can perform, or better than it is. To what degree is measurable to any other was my point. My latest EFFing memo covers the updated weekly natural gas cycle as well.

Thank you for the conversation and suggestions.