Friday EFFing Memo

No Clucks Left to Give. Where we're going, we don't need roads.

The Memo:

To:

Everyone

Re:

The Fourth Rate Turning is Here. The EFF cycles for:

Equities

Commodities

Eggs

Story Poles

Tariffs

From:

Mr. Awsumb

Comments:

“Good evening. I'm Doctor Emmett Brown and I'm standing here in the parking lot at Twin Pines Mall. It is Saturday morning, October 26, 1985, 1:18 A.M. and this is temporal experiment number one. Please note that Einstein's clock is in precise synchronization with my control watch.

If my calculations are correct, when this baby hits eighty-eight miles per hour, you're gonna see some serious sh**.”

- Emmet Brown, Back to The Future ©Universal Studios

I’ve added another important feature to the EFF Indices. You’ll understand momentarily the reference. Also welcome to all the new colleagues. We do mean business around here but we also have some fun.

I know this is early for Friday but I wanted to catch you before the end of the day. This one might take time to digest.

Also I'll be joining the MacroEdge Radio team at 3pm Central today for a chat about commercial real estate with the good folks from TreppWire.

You're invited:

https://x.com/i/spaces/1djGXrWjoEdxZ

Please CC your colleagues. I’m sure I’ve forgotten to copy someone. Just don’t hit “reply all”. And Ted, don’t forget to wind your watch!

End Memo.

The Report:

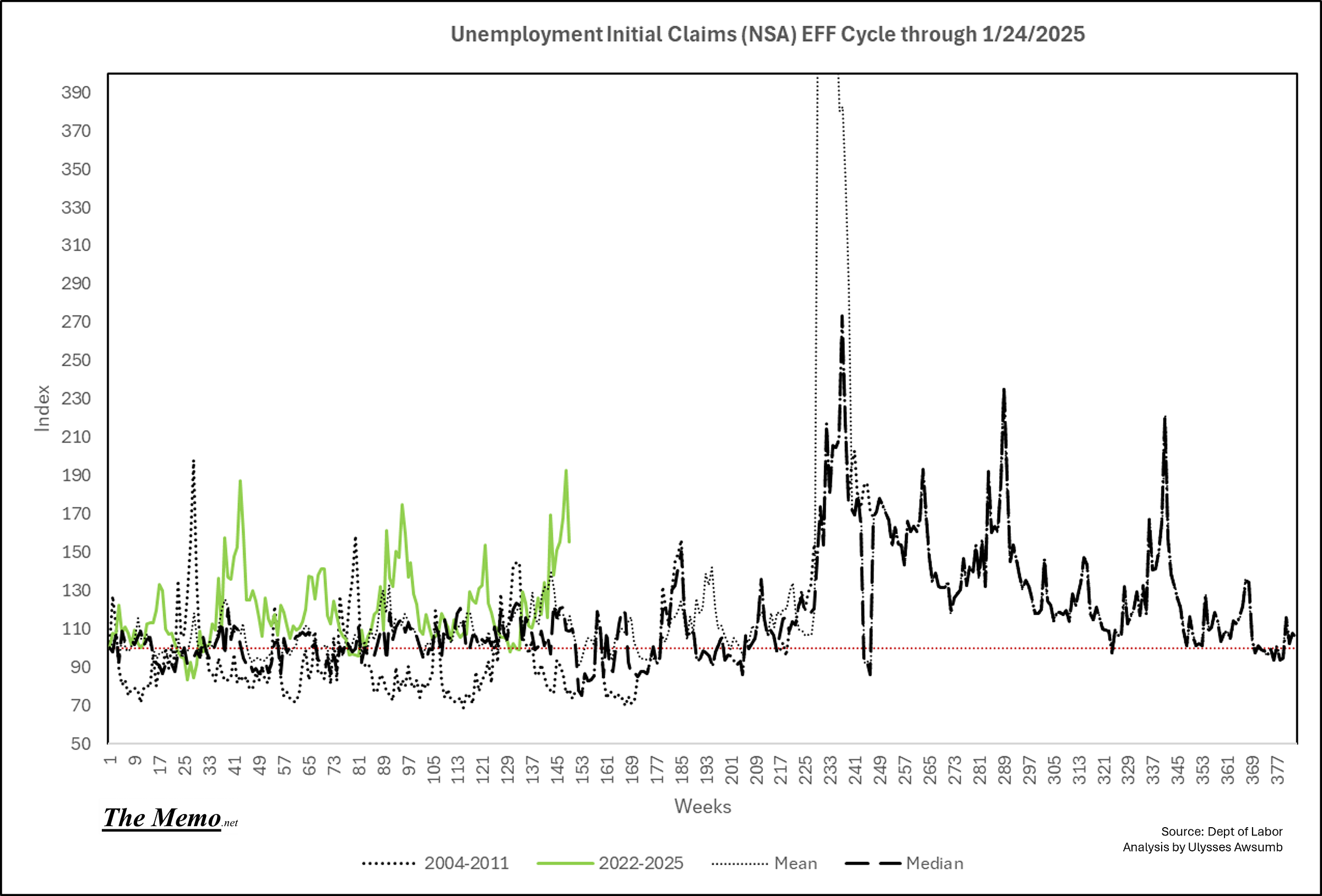

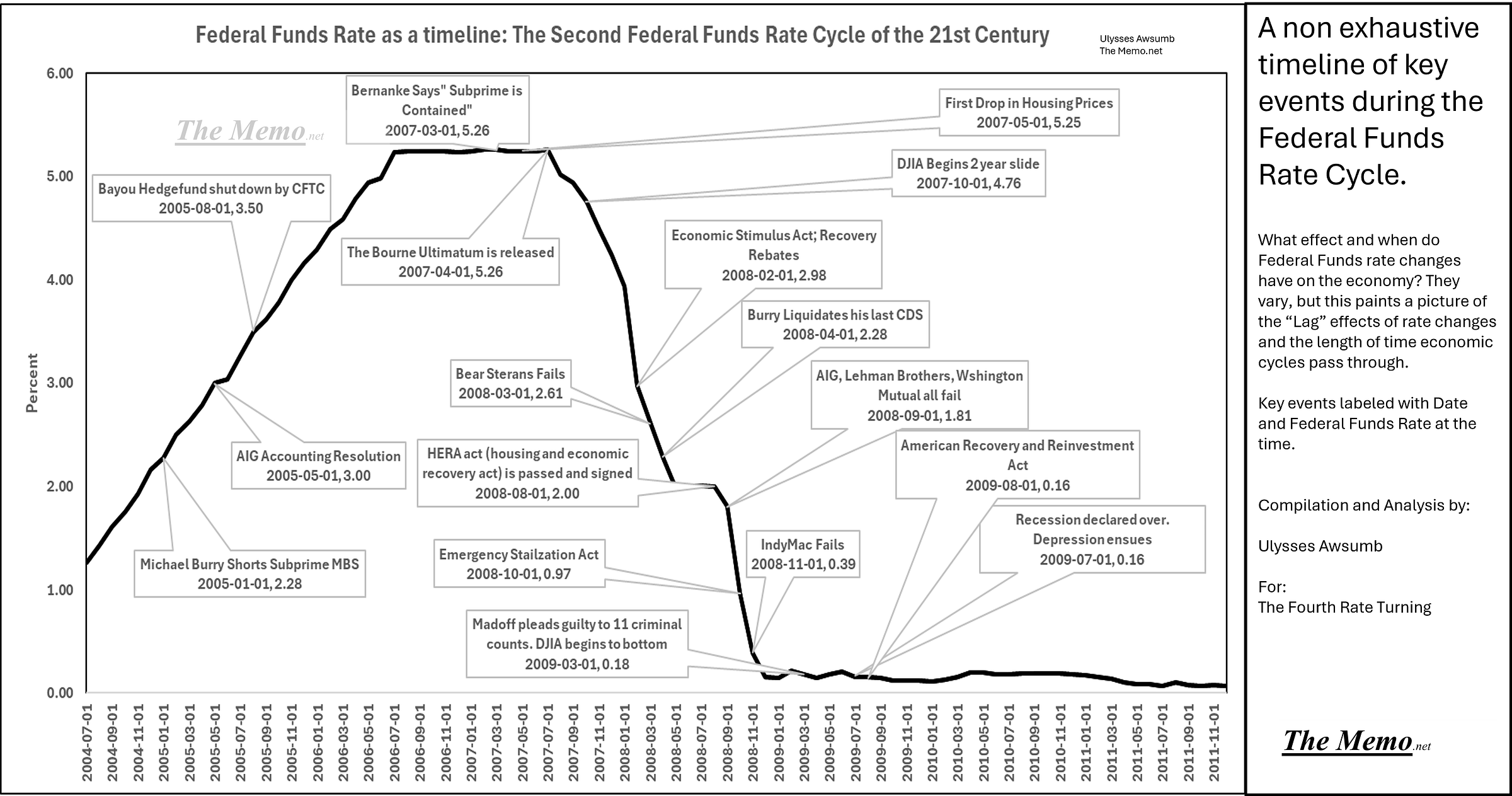

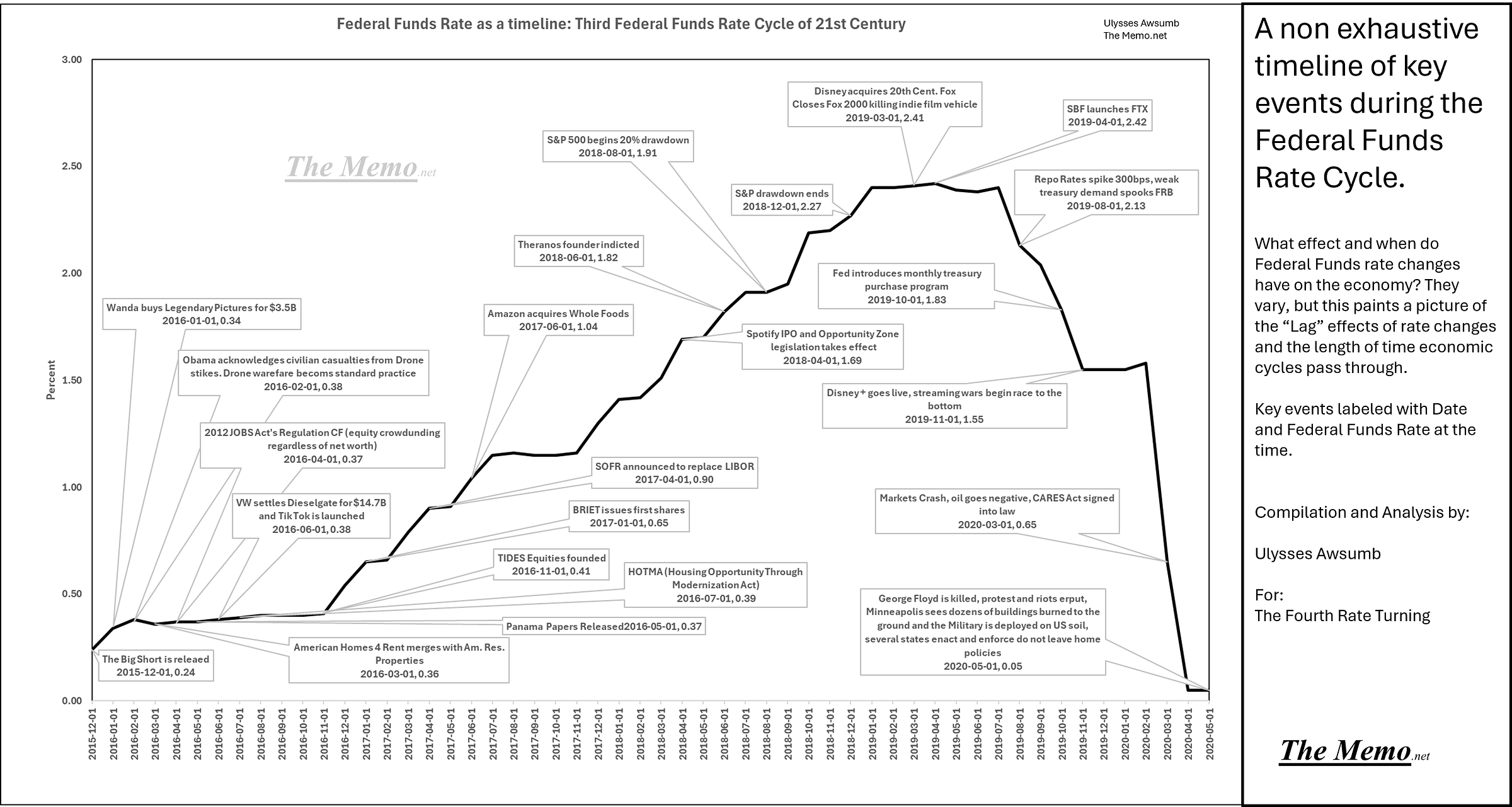

Agent Smith His Chairmanship Powell had to make a call this week. Hold, Cut or Raise. While inflationary numbers have hit headlines, take a look at the second part of the “dual mandate” of “Stable Prices/Full Employment” from where it stands in EFFing time:

What an absolutely terrible job, I’m not sure there’s a way you could ever convince me to take it. This is the stable employment compared to the mean and median of the cycles. Up and to the right it is. And we’re above both mean and median.

Letting the days go by, let the water hold me down

Letting the days go by, water flowing underground

Into the blue again, after the money's gone

Once in a lifetime, water flowing underground

Same as it ever was, same as it ever was

Same as it ever was, same as it ever was

Equities

“Hello San Dimas High! - Our First Speaker was born in the year 470 B.C.”

“A time, where much of the world looked like the cover of the Led Zeppelin album “Houses of the Holy”.

-Bill S Preston Equire and Ted Theodore Logan- Bill And Ted’s Excellent Adventure. © MGM

The NASDAQ

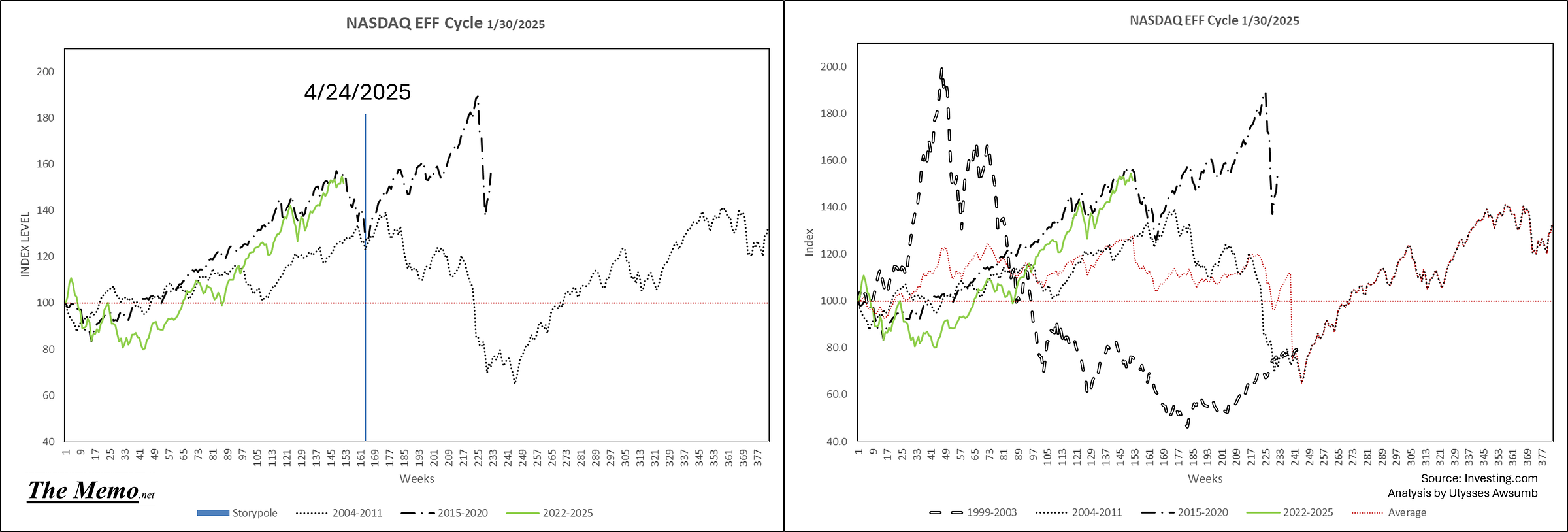

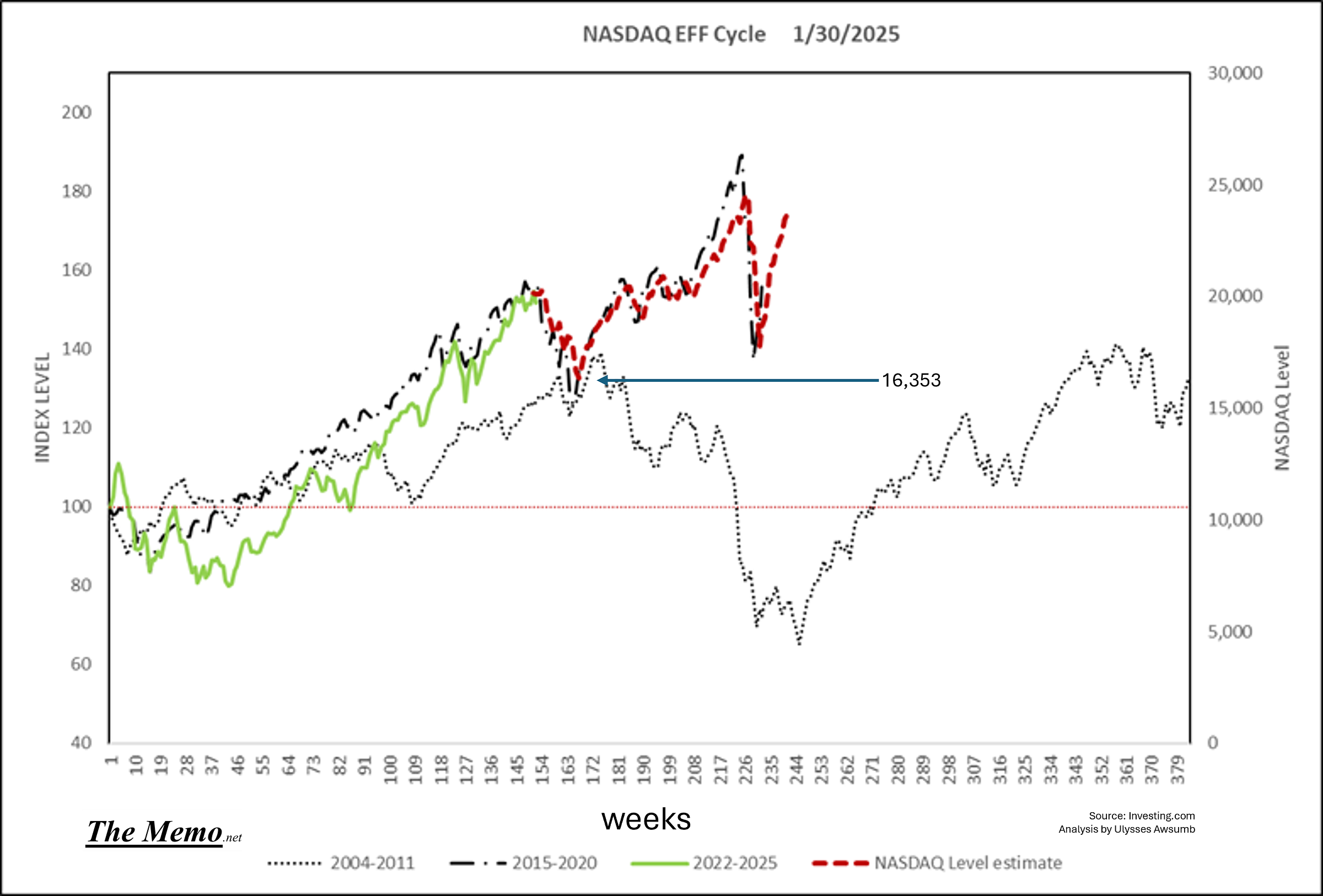

Here’s your EFF Cycle Index for the NASDAQ. Wait, why is there a date in the future on this chart?

Because:

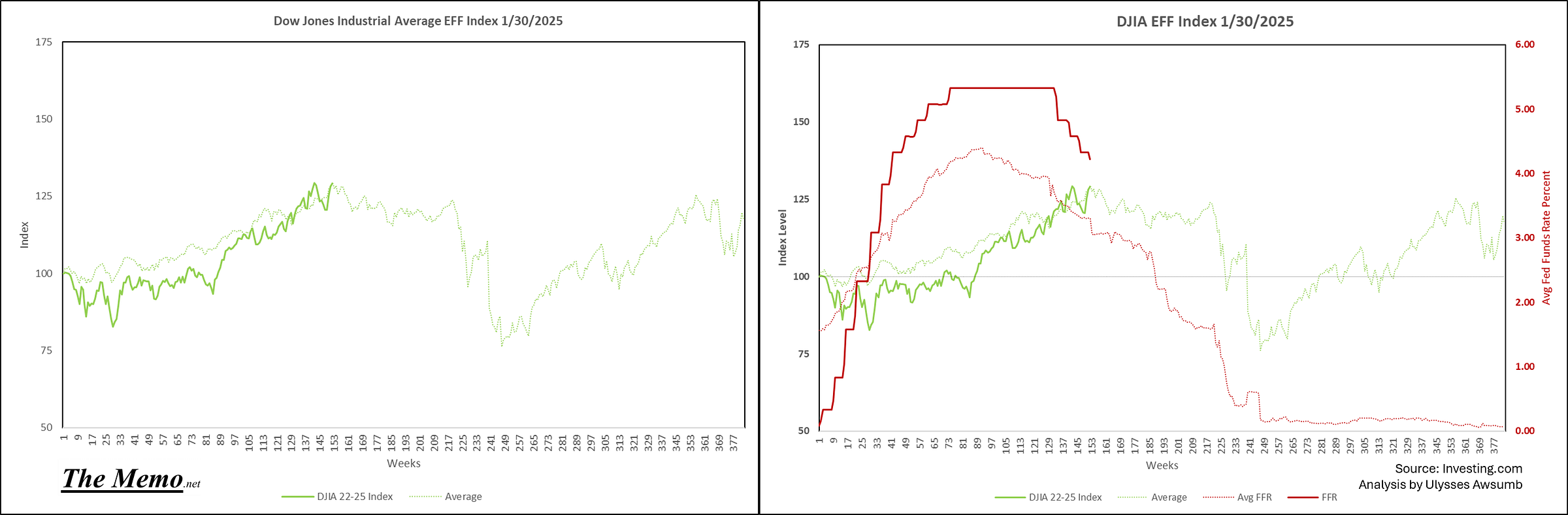

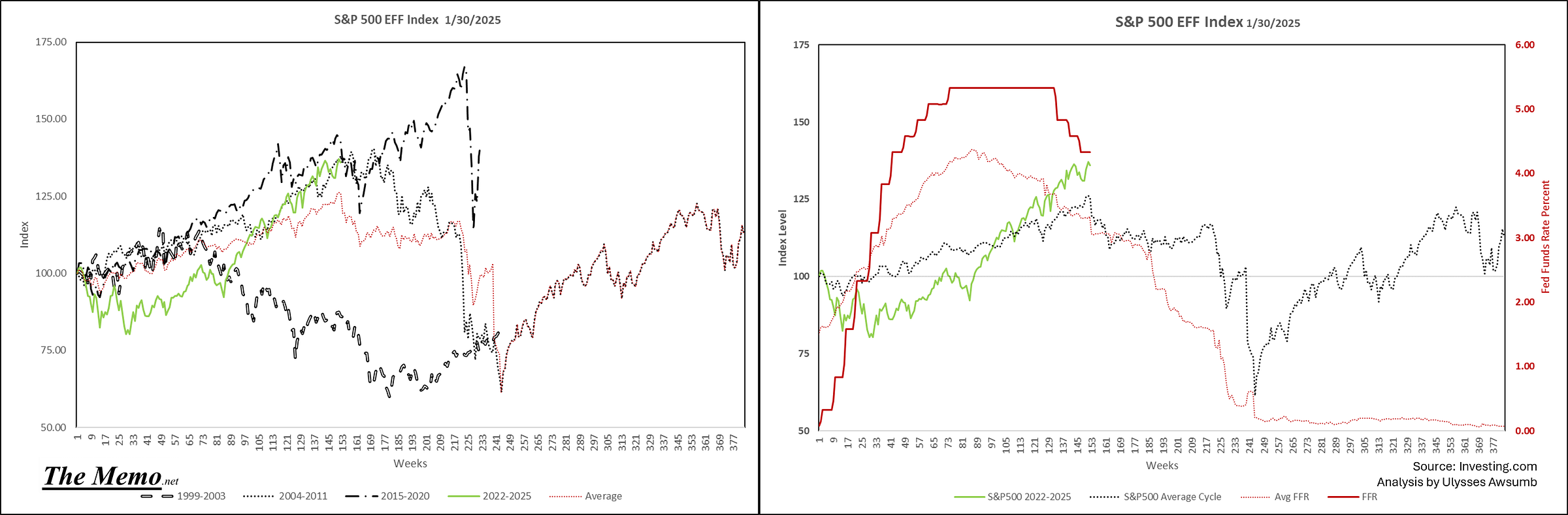

I ran a set of calculations using the current proximity to the 3rd cycle (2015-2020: 3rd rate cycle of this century, for the new colleagues) and projected a potential future path of the NASDAQ following that proximity. 4 weeks in it’s holding.

So what’s with the Storypole? For those of us who were carpenters before the turn of the century (I just made myself feel ancient, like “Rigg’s, I’m getting too old for this sh**…. Danny Glover was only 41 when he uttered that phrase) before the turn of the century, a story pole was a stick you made and pre marked all the dimensions of important things you were building with. That way you could walk around and put the stick up to say cabinet backing, a stair step, an electrical outlet, and the measurement lined up or it didn’t’. It told the “story” of what you were building. And it goes back to ancient times. In fact:

-Raiders of the Lost Ark © Disney

The Staff of Ra was a storypole. Just a different take, but the practice goes back that far. So a storypole just tells the tale of how a thing is built or “tale of the tape” so to speak. In fact, an Architect is “master builder”, derived from Archetype and Tekton, from ancient Greek. Archetype being recurring trait or the master of a thing, and Tekton being a builder. There are 12 Archetypes (allegedly) and thus everyone is a permutation of those 12 recurring traits.

Now I added storypoles to the EFF indices.

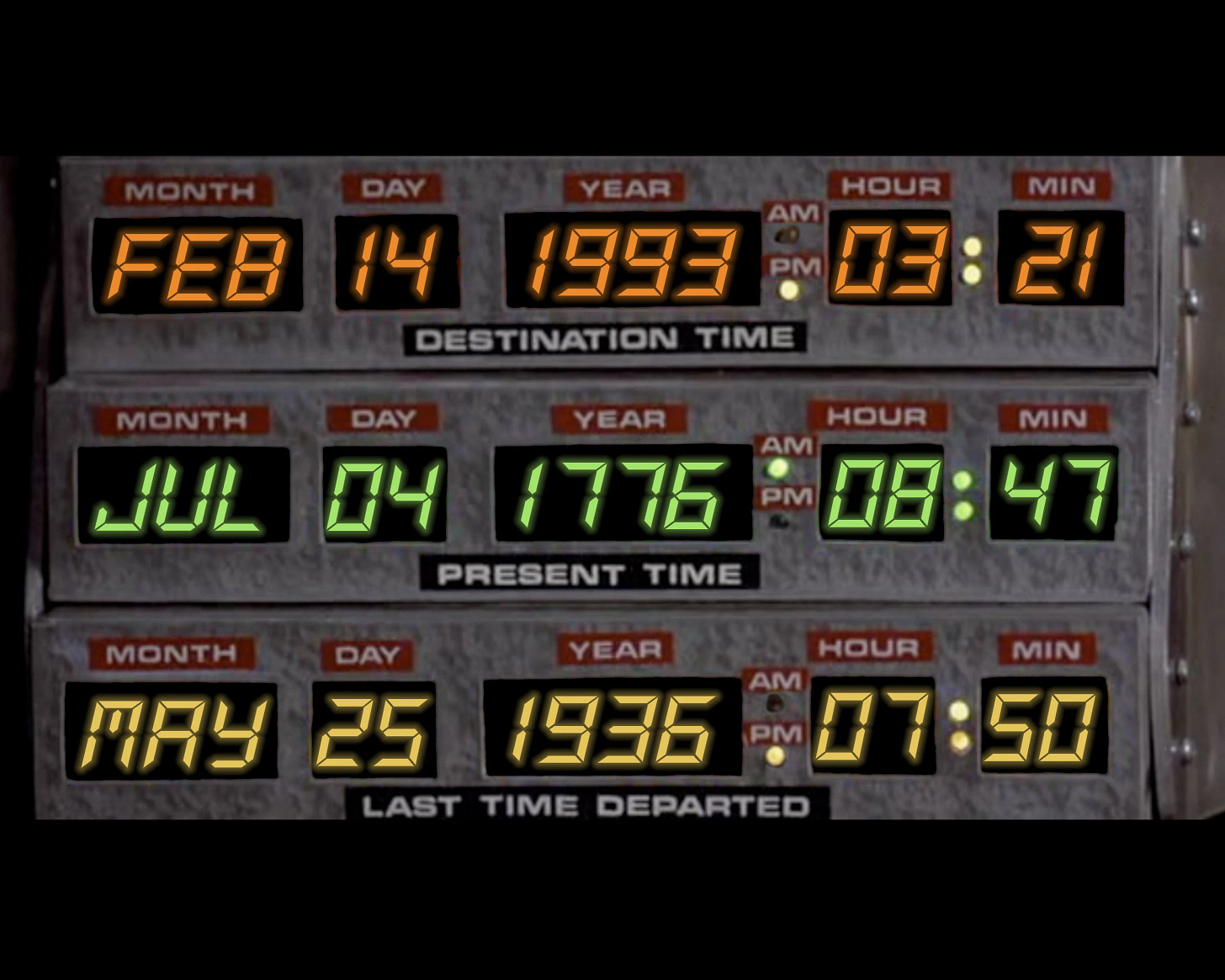

As I’ve said, look where we are in EFFing time. EFFing time as in, today is yesterday at some point, and tomorrow is today, and yesterday is tomorrow.

Ok let’s pause. I’m not suggesting there’s a mathematical formula for predicting any of this. What I am saying is that human behavior is what it is, and we tend to repeat those behaviors over and over. Archetypes. In Fact, if you use today as the measure of past EFF index cycles, we’re at the week ending of: Sept. 28th 2018, May 25th 2007 and March 15th 2002 respectively. As in, the week endings since each set of Fed Rate Raises began (current century). I debated including some fun links, but instead, go google those dates. From confirmation hearings to Gaza/Israel, time is a flat circle as far as human behavior.

“It's like in this universe we process time linearly forward. But outside of our space time from what would be a fourth dimensional perspective time wouldn't exist. And from that vantage could we attain it? We see our space time would look flattened. Like a single sculpture of matter and super-position of every place it ever occupied. Our sentience is just cycling through our lives like carts on a track. See everything outside our dimension that's eternity. Eternity looking down on us. Now to us its a sphere but to them its a circle.” -Rhust Cole, True Detective © HBO

Sometimes to achieve our best, we have to go outside of ourselves, detach and look at the situation from above, or outside our normal perspective.

If that’s not enough:

I need to update this one above. As the (not kids) say, this is late cycle behavior.

© Columbia Pictures

Dow Jones Industrial Average

“Junior! Indiana, Indiana, let it go.” - Henry Jones Sr. to Henry Jr (aka Indiana Jones).

S&P500

Standard and Poorer Poors x 500

Commodities

Best 2 out of 3 we end below where we started. Not inflationary. You have sunk my battleship.

-Bill and Ted’s Excellent Adventure © Orion Pictures

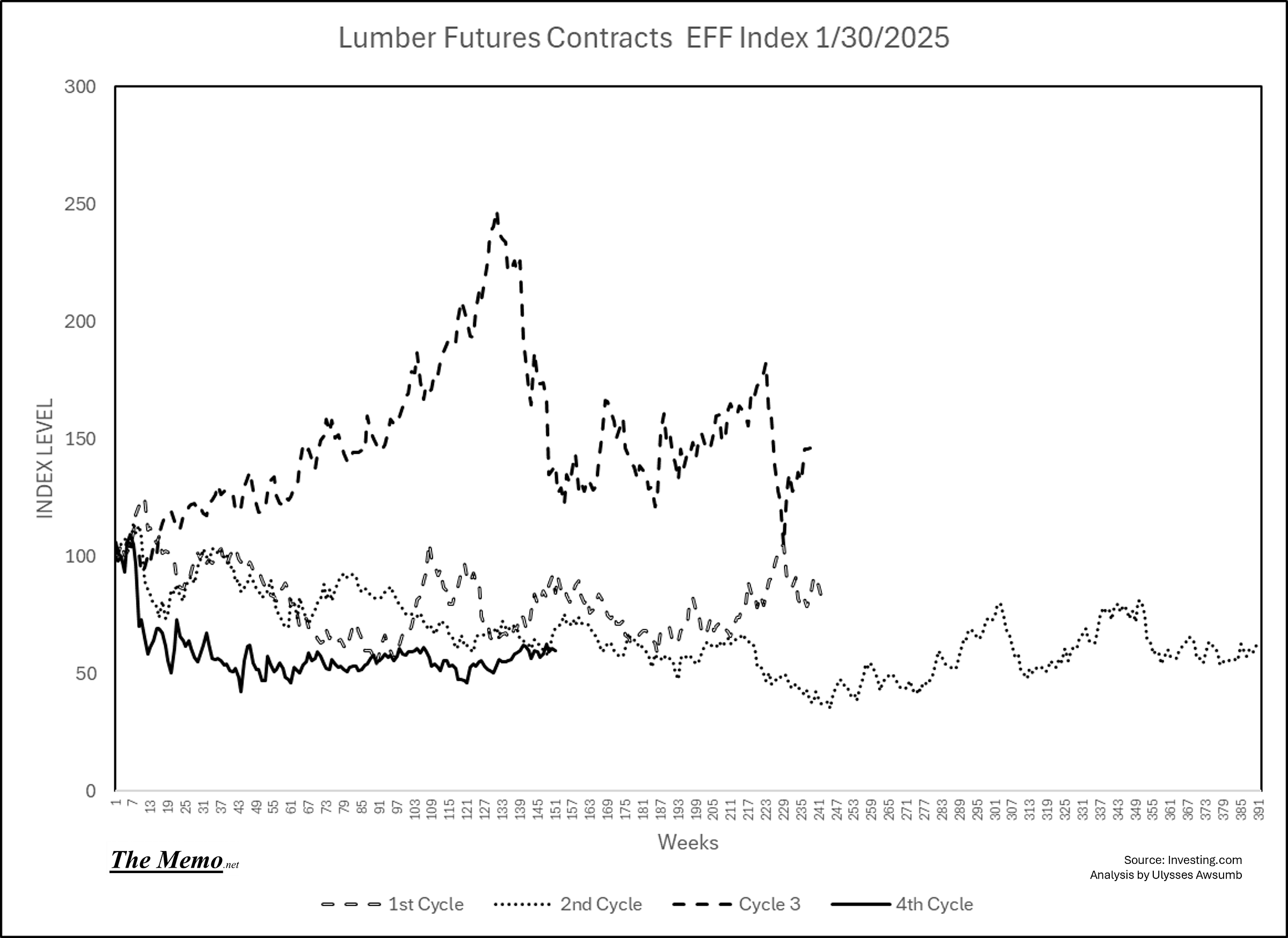

A note on that and the talk of tariffs, we’ve been declining in the number of units under construction for two years, constantly. If we were adding and on the upswing, that would be an inflationary pressure. If your project doesn’t pencil now, it won’t with 25% tariffs on Canadian lumber, and it’ll just lead to less units under construction. Which will lead to less jobs in the space, which further reduces the other potential inflationary pressure floating around about “migrant labor”. Less jobs less need for labor. All not inflationary, WITH the surrounding circumstances.

Oil. Texas Tea that is. Black Gold

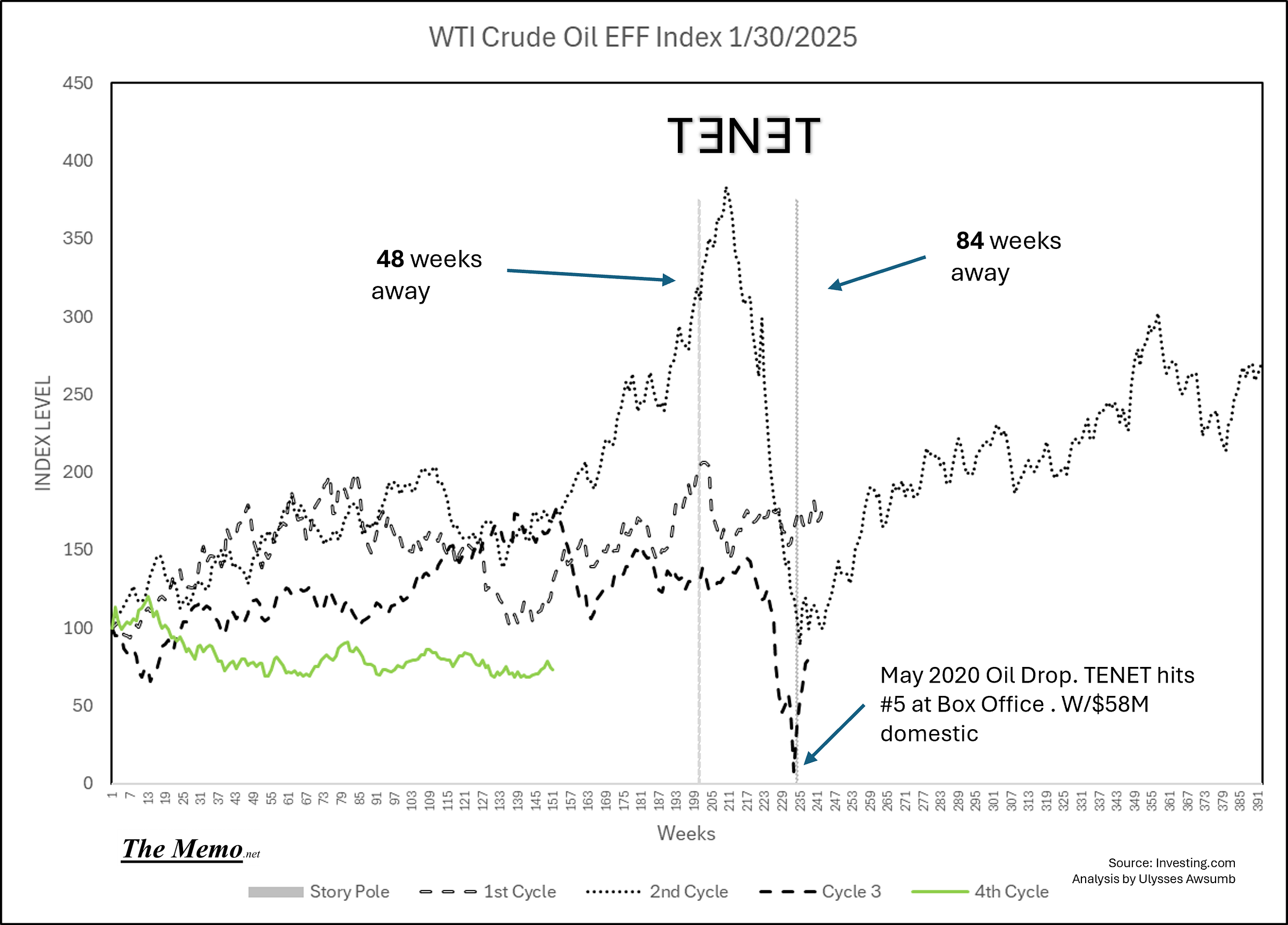

Picture for a moment if you will, an American Energy Boom. With mass production of oil and hydrocarbon energy. If supply floods the market, does the price go up or down? We’re at a cyclical point to see this price rise, but over time, mass production reduces the commodity price. There might be a boom in the production sector, and company’s jobs that support the industry, but the underlying commodity has headwinds, including less demand as and if unemployment increase. But a bump coming either way.

Here’s the story pole. Within 48 weeks we should see a rise and within 84 weeks a decline.

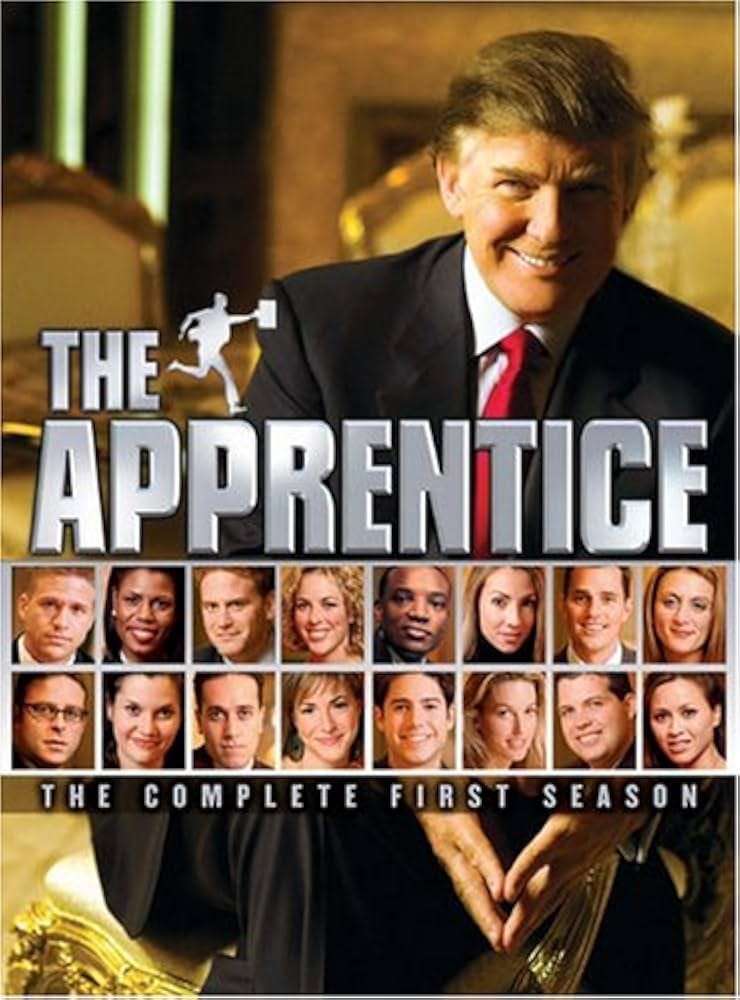

So tell me future boy, in the future present past of yours, who’s the President?

© NBC

Wheee Doggie

The Ecstasy of Gold

With yesterday’s “NEW ALL TIME HIGH” in Gold futures pricing, let’s look at tomorrow from yesterday (the other yesterday):

The Ecstasy of Gold is a score from The Good, The Bad and The Ugly, starring Clint Eastwood, Eli Wallach, and Lee Van Cleef, scored by Ennio Morricone. You might know offshoring today as Chinese Mfg of goods, but back then, 12 cycle’s ago, Sergio Leonne offshored Hollywood itself, to Italy in order to produce the Spaghetti Western. A staple of Leonne and “Americana Icon” Clint Eastwood. Made in not the USA.

A Fistful of Dollars For A Few Dollars More.

And compared to the 21st century cycles. Here’s all 4.

It’s been 84…..65 years. Look at the ridiculous pursuit of “neutral” rates. Wonder why they use this. Almost like human behavior doesn’t change. Same as it ever was.

And a Christmas Candy. Compared to EFFing rates.

My new favorite, the Storypole chart. “The lady in that car over there said that Marco Polo was in the year 1285”

Police Psychiatrist: I wanna know why you claim to be Sigmund Freud.

Sigmund Freud: Why do you claim I'm not Sigmund Freud?

Police Psychiatrist: Why do you keep asking me these questions?

Sigmund Freud: Tell me about your mother.

-Bill And Ted’s Excellent Adventure

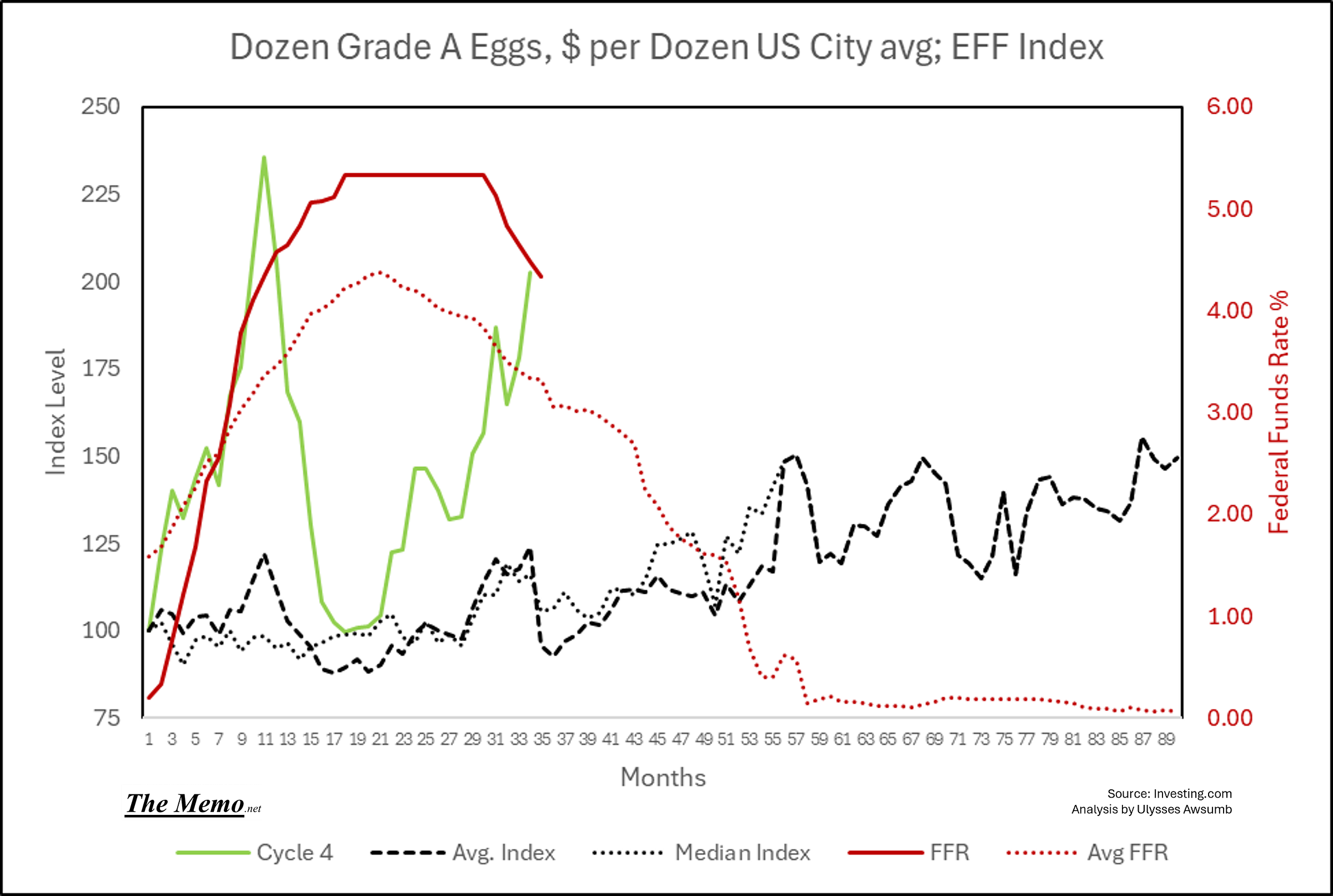

No Clucks Left To Give

Amazing what skating to where the puck is at, instead of where it’s going gets a person. A buck won’t get you a single cluck these days. Whoops. Guess killing the 100m geese laying golden eggs has added consequences. So which came first, the chicken or the egg?

Bill: So-Crates - "The only true wisdom consists in knowing that you know nothing".

Ted: That's us, dude.

Gentlemen (and Ladies). We’re history.