Friday EFFing Memo

The Boss has questions

The Memo:

To:

The Team

Re:

The State of Homebuilding

EFF Indices Updates across sectors

Who, what, when, where, why and how?

Comments:

Welcome to all the new team members. Thanks for joining us. As far as I know, there isn’t another outfit measuring things the way we do here. If there is, it’s news to me. It dawned on me one day, that we just might have the most perfect control group to study economics ever. That being said:

I’ve got a lot of questions for everyone today. And the only answers I’m giving are the charts.

Regards,

Please CC your department members. And remember to ask them:

© Legendary Pictures and Warner Bros

End Memo

The Report

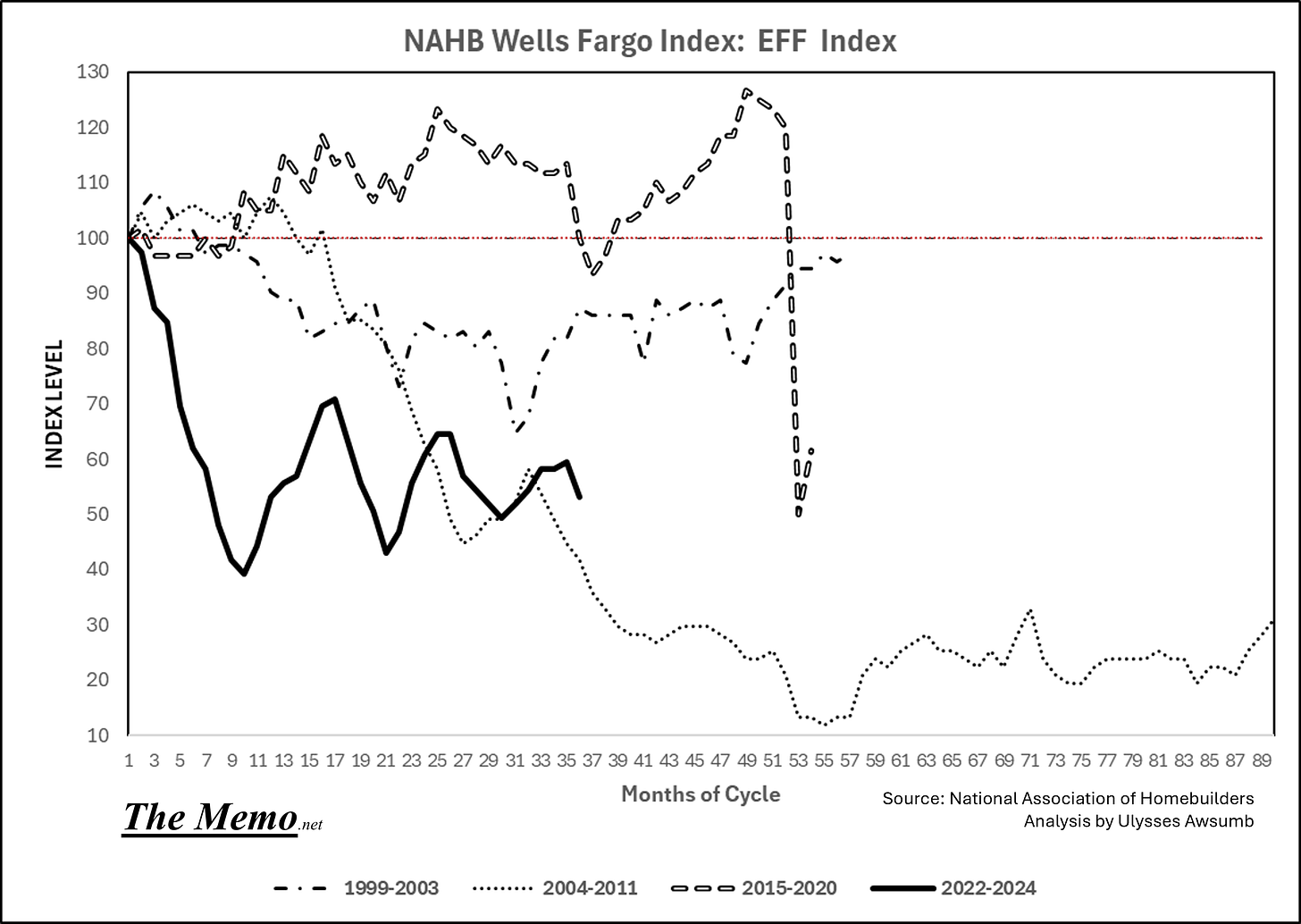

Since I last wrote, the National Association of Homebuilders released their NAHB “Wells Fargo” Index, which measures “sentiment”. Sentiment wasn’t very chipper. Notably outlook for the next 6 months dropped several points.

I have little interest in market sentiment indices, usually because I don’t find the questions being asked useful, and because they’re being asked of people. And the response is words. Actions speak louder than words.

Another reason: What perspective am I getting from the “sentiment check”? To that end, are they ever useful?

Take for instance this “housing market” index:

As compared to how I measure it (Where in EFFing time):

Which begs the question: If sentiment isn’t optimistic for the next six months, which past cycle of actions is most likely to reoccur?

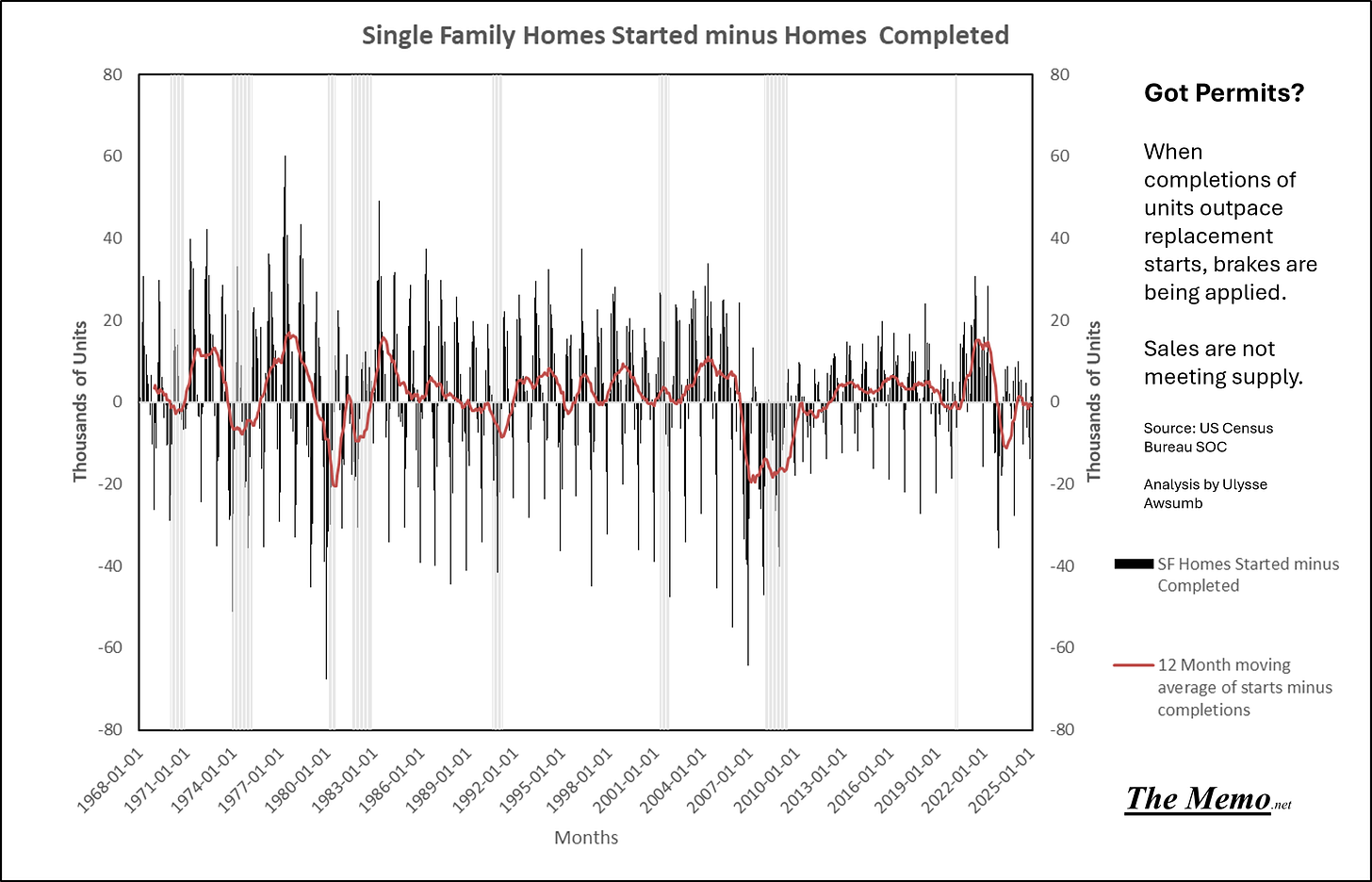

How many Permits got approved last month? Is that number the seasonally seasoned (my term) annualized rate to describe the reality of “today” despite the data being "actually last month” and that SAAR (seasonally adjusted and multiplied by 12) is something that doesn’t ever actually exist? I ask you: If I told you how many permits were approved last month, how many would respond with: Is that a lot or no?

Does it even matter? Permits can take months to be approved. MY question is: How many replacement units are being STARTED in excess of completed units?

While the monthly data can appear “noisy” using the moving average of the past 12 months CAN be helpful to see the pattern taking shape.

If that number isn’t above zero, are actions being taken to slow the replacement (Read backlog) supply as sales aren’t meeting supply output?

“Outlook for the next six months of sales dropped”:

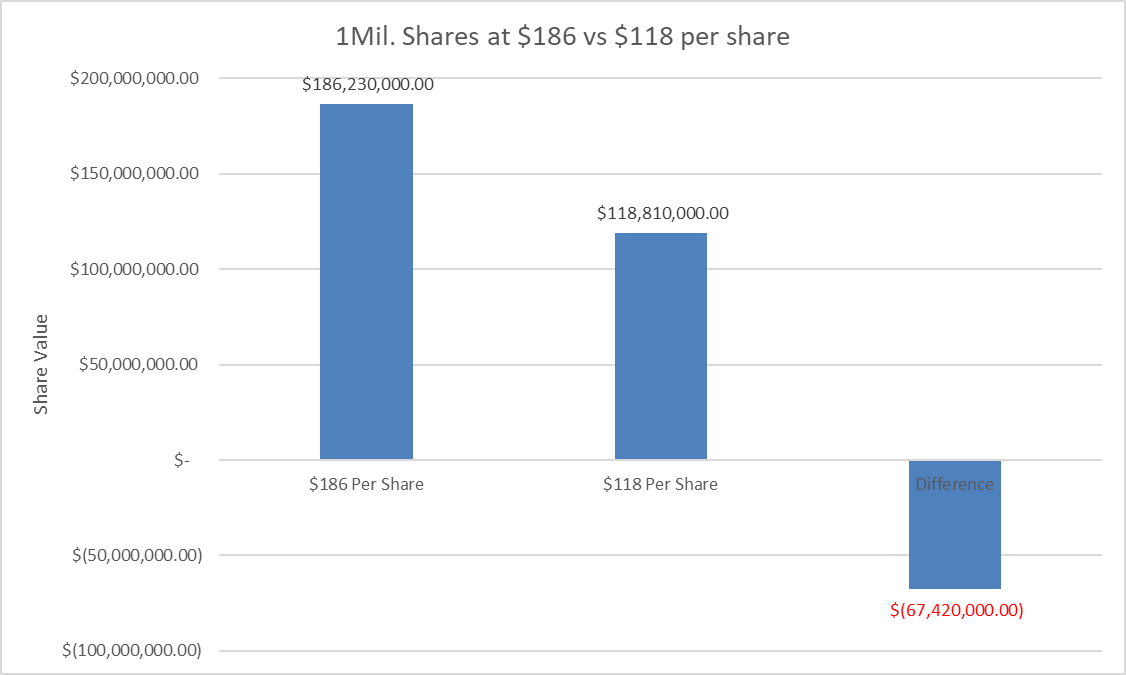

If the next six months of sales follow sentiment, what happens to builder share prices?

The “Big 3” Public Builders have all seen their share prices drop by 30%+ in the last 4 months.

Lennar's share price has dropped 37%

Have we been here before?

Let’s look at that 37% share change:

If sales get worse over the next six months, does that affect ability to raise capital, via offerings, considering the value loss?

Does 1 million shares do anything anyway? Lennar has Homebuilding operating expenses annually of $ 28,809,464,000.00 (28 Billion dollars). Do operating expenses go away if sales slow down?

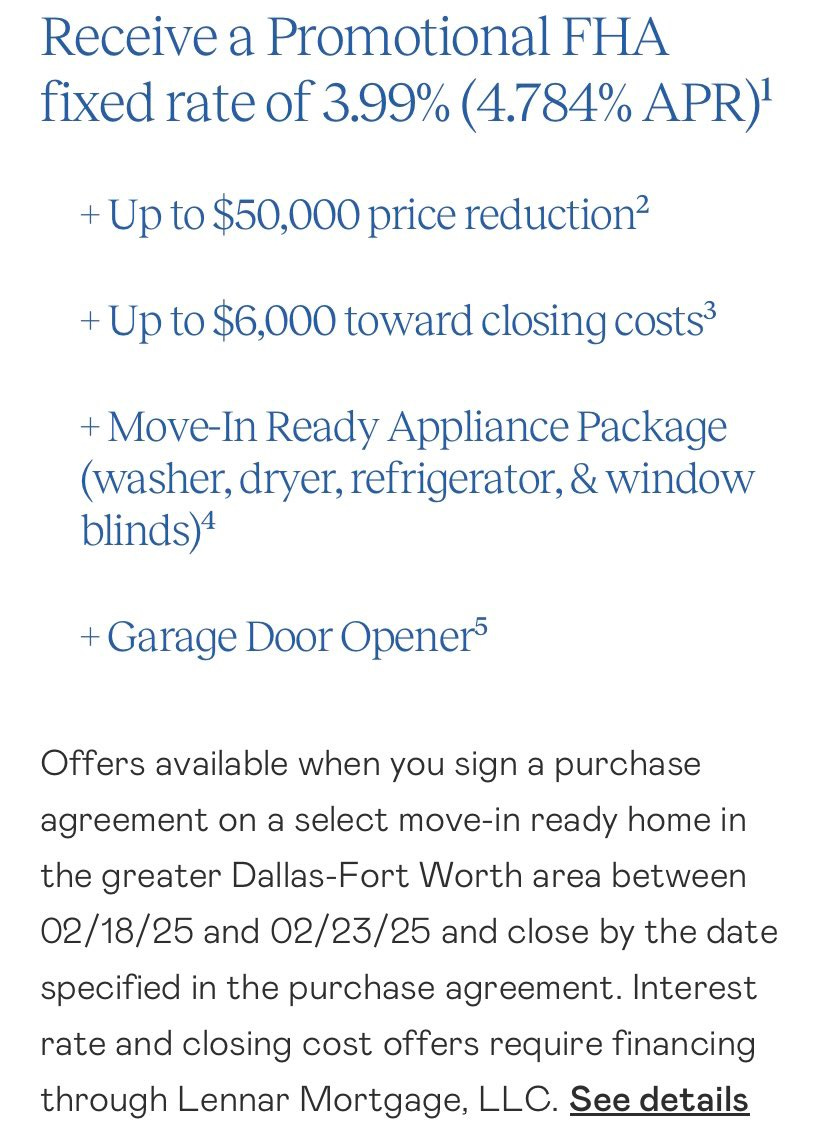

Is this pricing power?

Is this pricing impairment?

Even Pulte who has been outperforming is under fire:

If sales drop, and backlog replacement drops, where does that lead Lumber and when, in approximate exact EFFing time?

When Sentiment is on the floor, the Situation will be improving. Just like after surgery, the pain is real, the recovery is too no?

An' now that you've been broken down

Got your head out of the clouds, back down on the ground

An' you don't talk so loud an' you don't walk so proud

Anymore and what for?-Guns N Roses “Estranged”

For Home Builders anyway. New NAR numbers dropped today. Literally.

Total sales dropped to 240,00 homes, and the median sale price dropped to $396,900

The Apartment Construction numbers:

Riddle Me This

Who’s sentiment, What is their sentiment regarding, When are they framing it in time, Where are they in position, perspective, time and obligation, and Why, are we listening to them. And if we are: HOW are we going to interpret it?

Good leaders know sentiment by paying attention and staying connected. And it’s always worth checking in on those you care about to see how they’re doing, because you can. That sentiment has real value.

Ladies and Gentlemen: Your Friday EFFing Indices are here.

Equities

(all numbers; as of yesterday’s market close 2/20/2025)

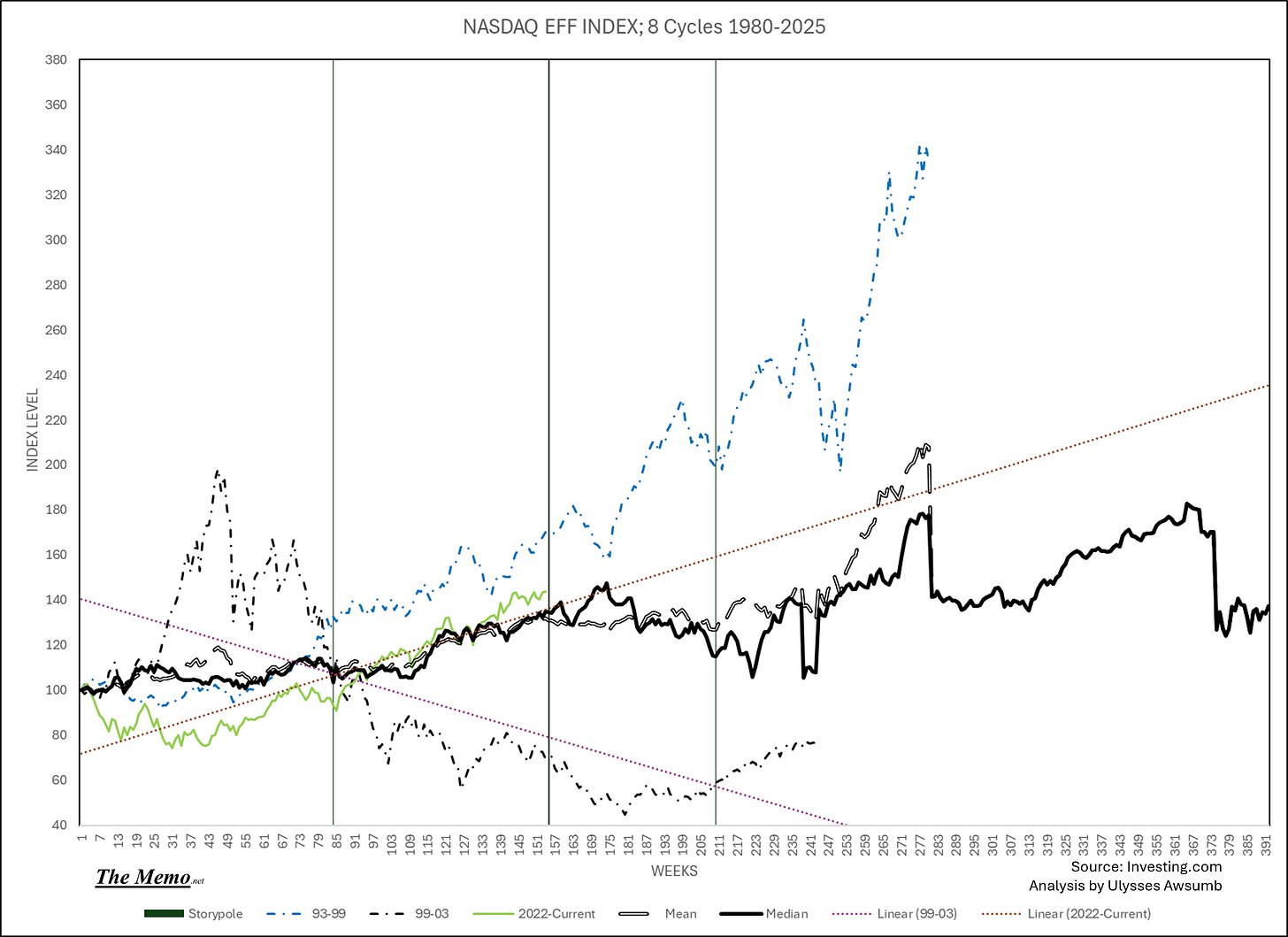

NASDAQ

T Minus 7 days to the potential first squishy part and the changing of the season.

Houston, this is Apollo, do you copy?

Ground Control to Major Tom

Ground Control to Major Tom

Take your protein pills and put your helmet onGround Control to Major Tom

Commencing countdown, engines on

Check ignition and may God's love be with you

Does violently sideways keep up with inflation?

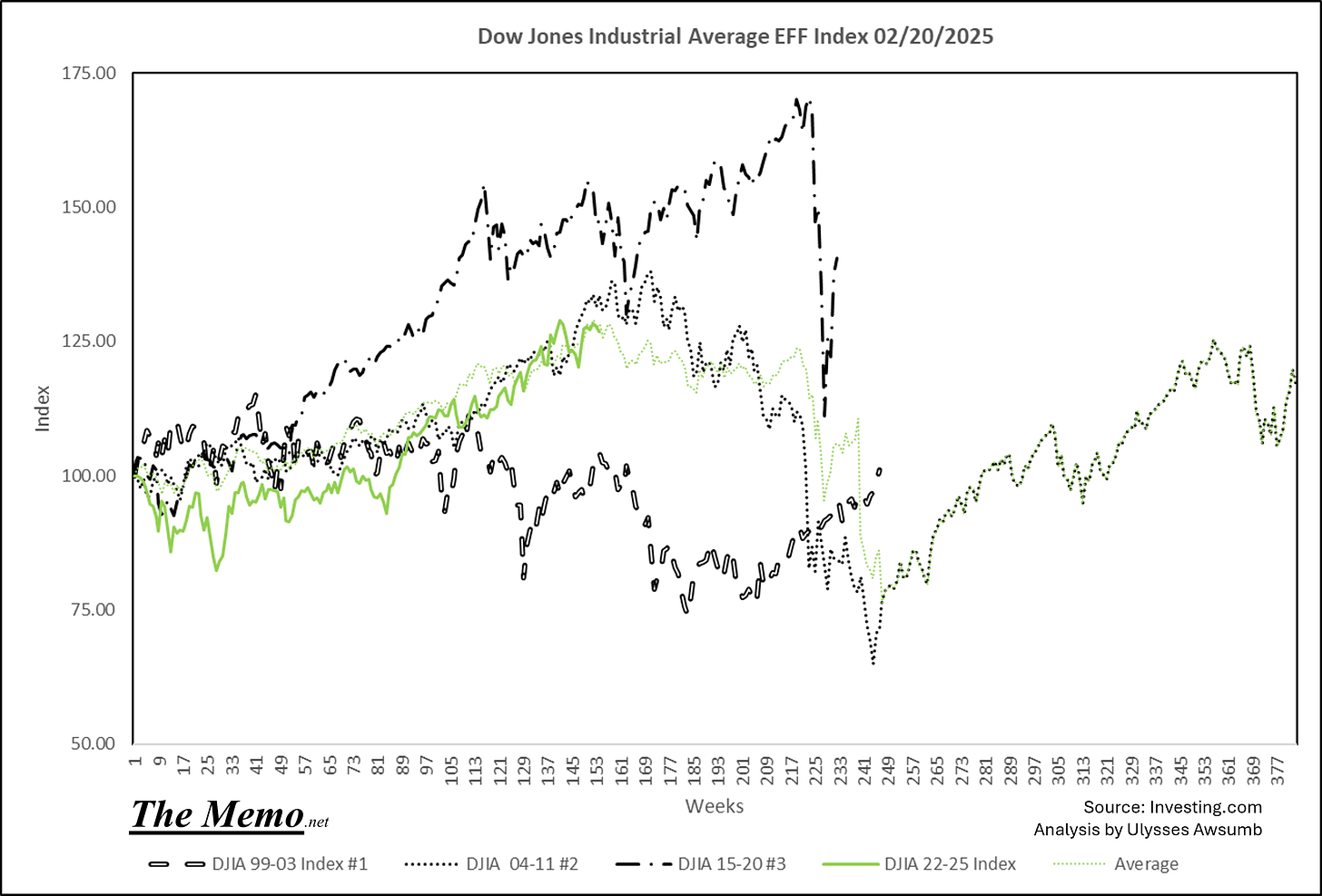

DJIA

Dow(n) Jones Industrial Mean is almost here. Lagging the spectacle of NASDAQ. But only slightly.

S&P 500

Daytona Standard and Poor’s 500

Bad joke, sorry. I just found out that NASCAR doesn’t even have a title sponsor anymore.

Hard to believe it’s been 4 cycle’s since NASCAR went by Winston Cup.

Ok, maybe it was too easy to sell cigarettes.

NYSE

Le New York Stock Exchange composite. Type A. Most people I know just want a Royale with cheese over caring about this Index these days.

I'll gladly pay you Tuesday for a Royale with cheese today.

Spider Sector Select choice of the week.

How is the Financial Sector doing?

Wen Texas Stock Exchange?

The Ecstasy of Gold

There's a lady who's sure all that glitters is gold

And she's buying a stairway to Heaven

Your head is humming, and it won't go, in case you don't know

The piper's calling you to join himDear lady, can you hear the wind blow? And did you know

Your stairway lies on the whispering wind?And as we wind on down the road

Our shadows taller than our soul

There walks a lady we all know

Who shines white light and wants to show

How everything still turns to gold

And if you listen very hard

The tune will come to you at last

When all are one, and one is all

To be a rock and not to rollAnd she's buying a stairway to Heaven

-Led Zeppelin “Stairway to Heaven”

Currencies

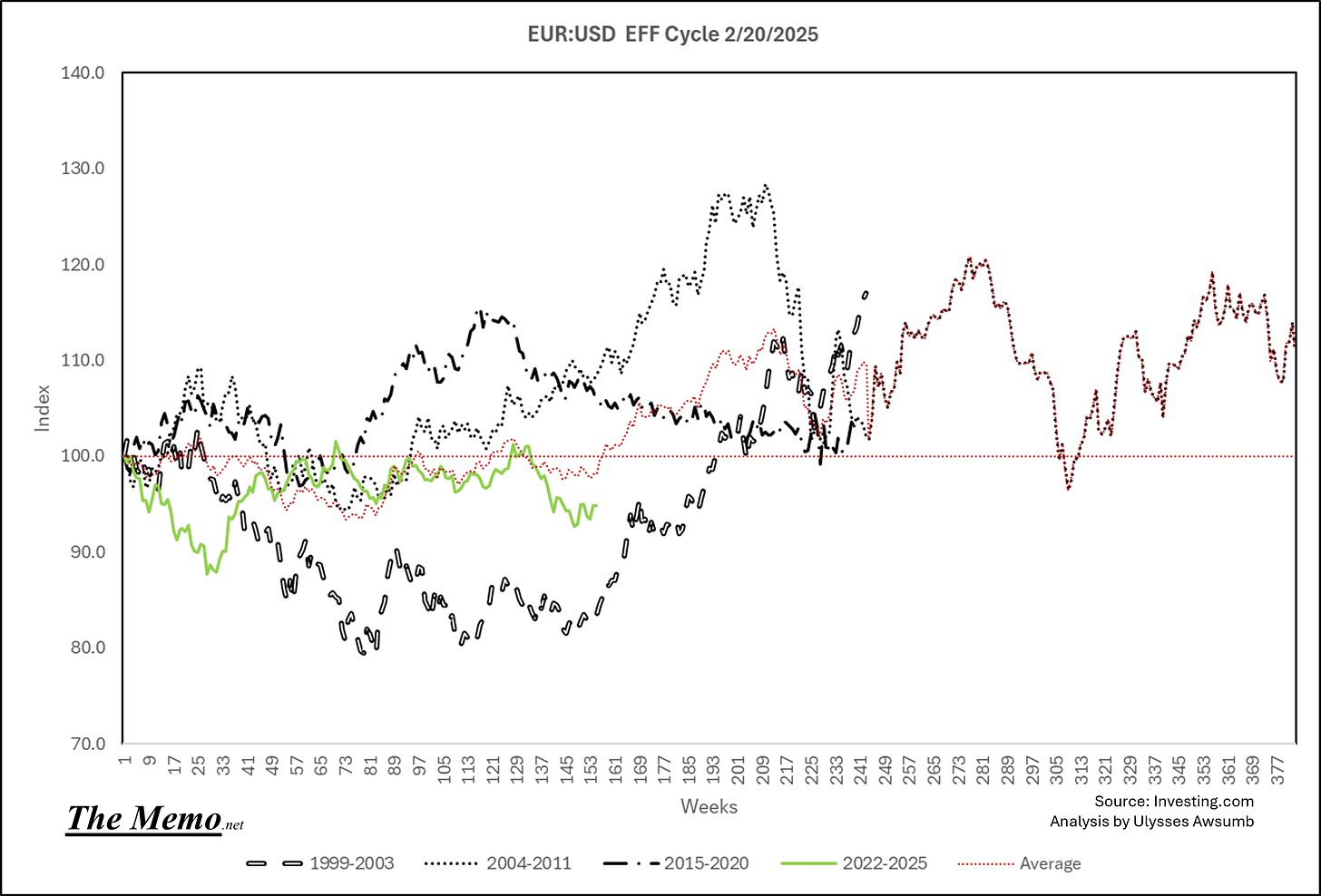

We're going to be forced to hear about “the carry trade” again aren't we?

How's Europe doing? Really?

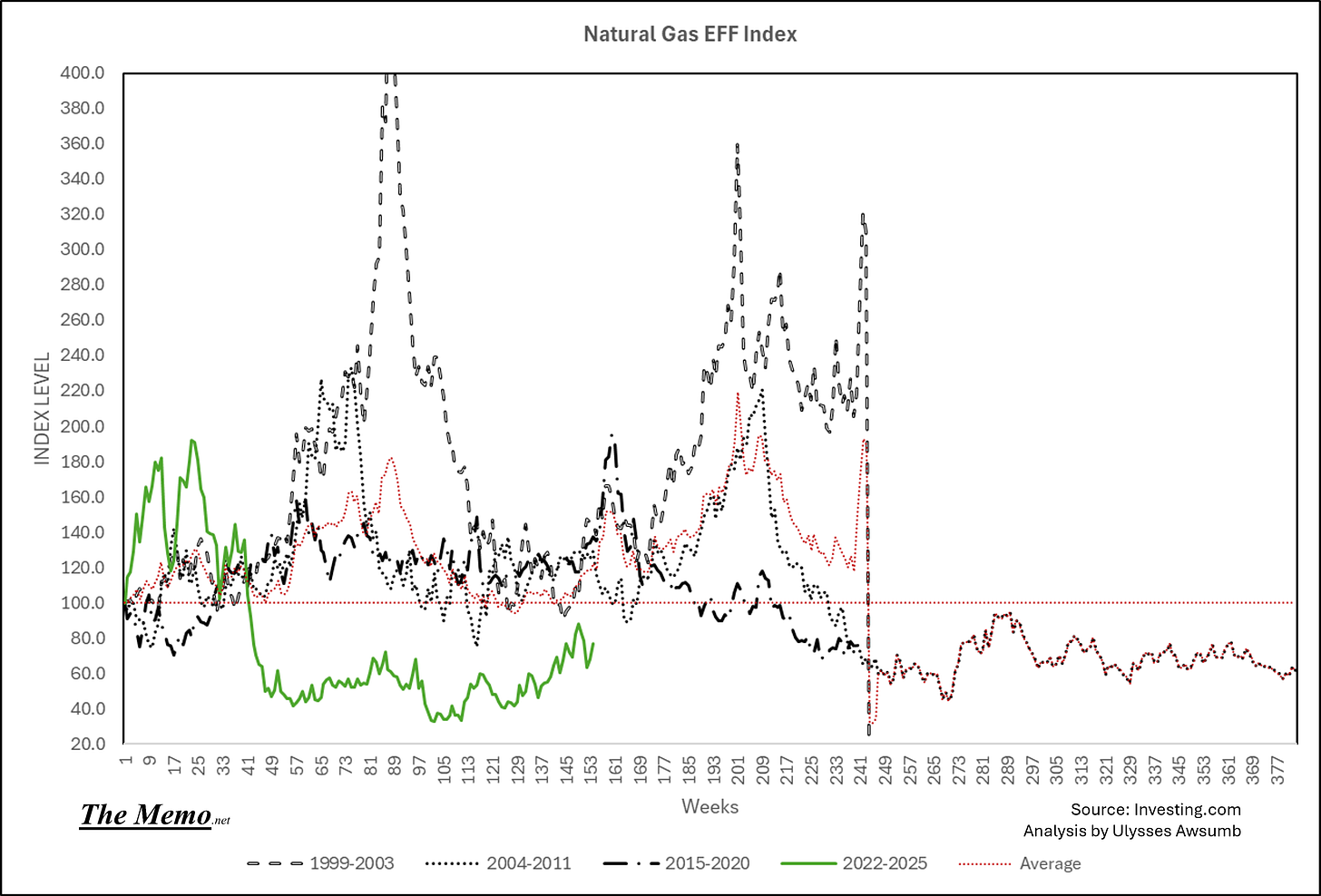

Energy

What’s a Kilo of coelectricity worth these days?

Is there any industry more reactionary than this?

Shutting down all the rigs might be a temporary solution. Does the film title spell the same thing backwards and forwards though?

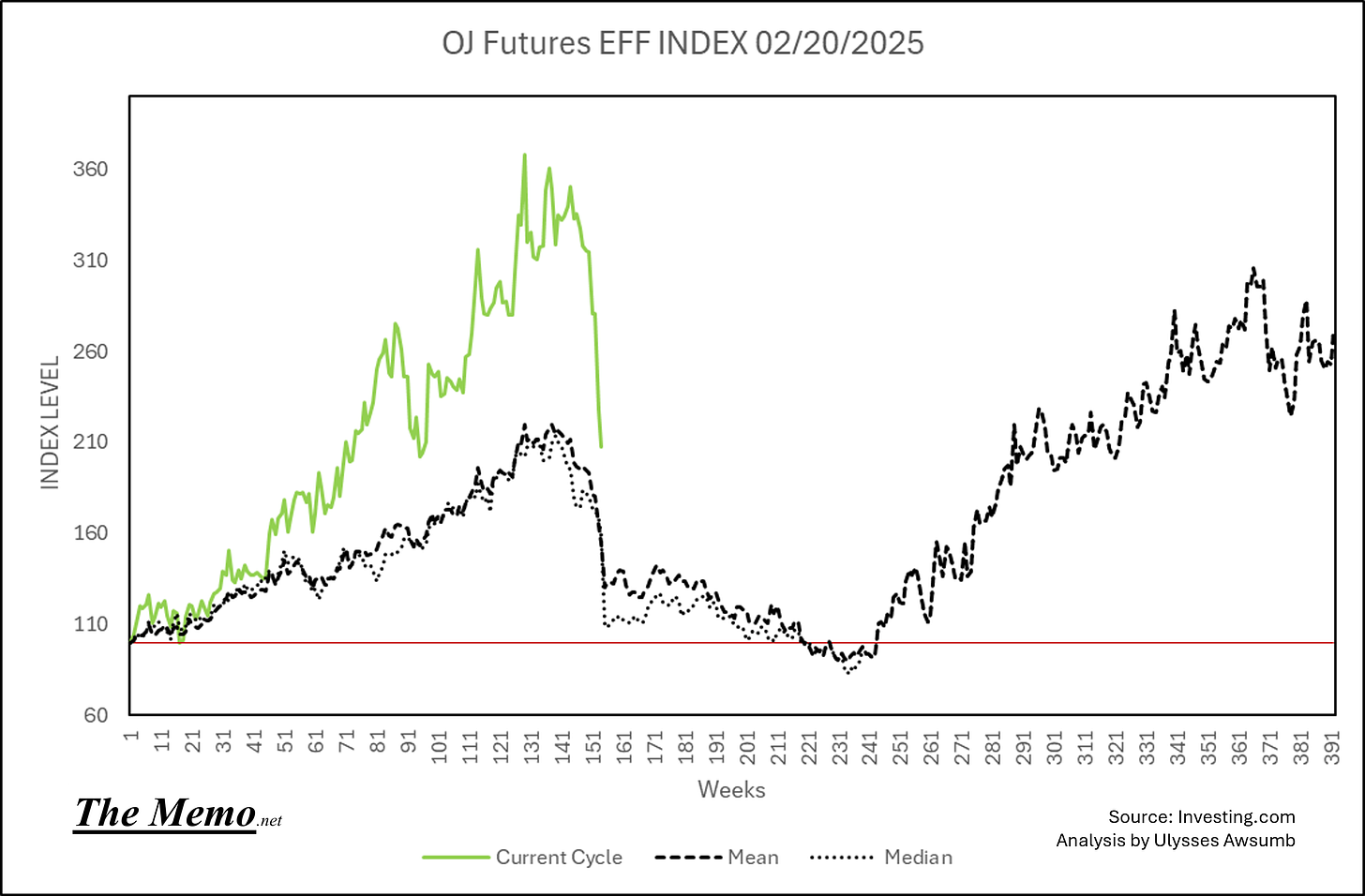

Soft Commodities

“We’re Ruined, this is an outrage. Turn those machines back on!” - Mortimer Duke

Is this A Clockwork Orange? -Me

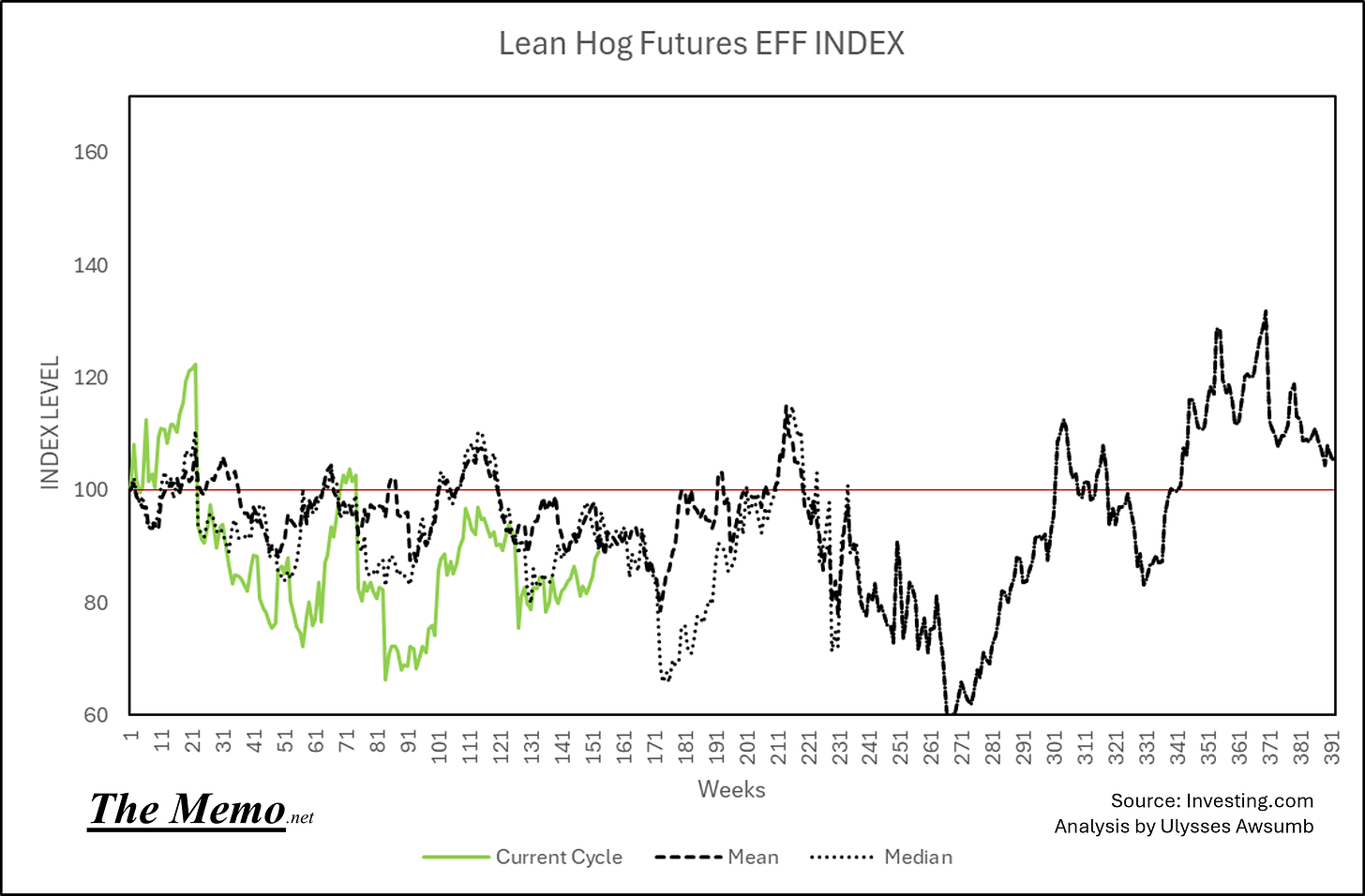

All pork no beans.

Breakfast in America: Bacon, Eggs and Toast. Pick your coffee. For now.

I prefer mine black, espresso. Hoping to get a cup at Grod’s L’Americano in the future while seeing the sights of Couer d’Alene. Idaho isn’t just potatoes. Allegedly.

Today in EFFing time it is:

Winter

Today

November 23rd 2018

June 8th 2007

May 12th 2002

Fall

December 22nd 1995

September 1st 1989

January 10th 1986

The 1980 Cycle was over

Summer

February 9th 1979

January 24th 1975

October 16th 1970

March 20th 1964

Spring

The 1958 Cycle was over

November 1st 1957

May 28th 1954

December 19th 1947

See you next week. Same Bat Time. Same Bat Channel.

Remember, ask questions first and later.