Friday EFFing Memo

The Wizard of Oz

The Memo:

To:

Everyone

Re:

Today in EFFing Time.

Comments:

This week had plenty of headlines. From markets dropping to rallying, presidential tweets and bond yields.

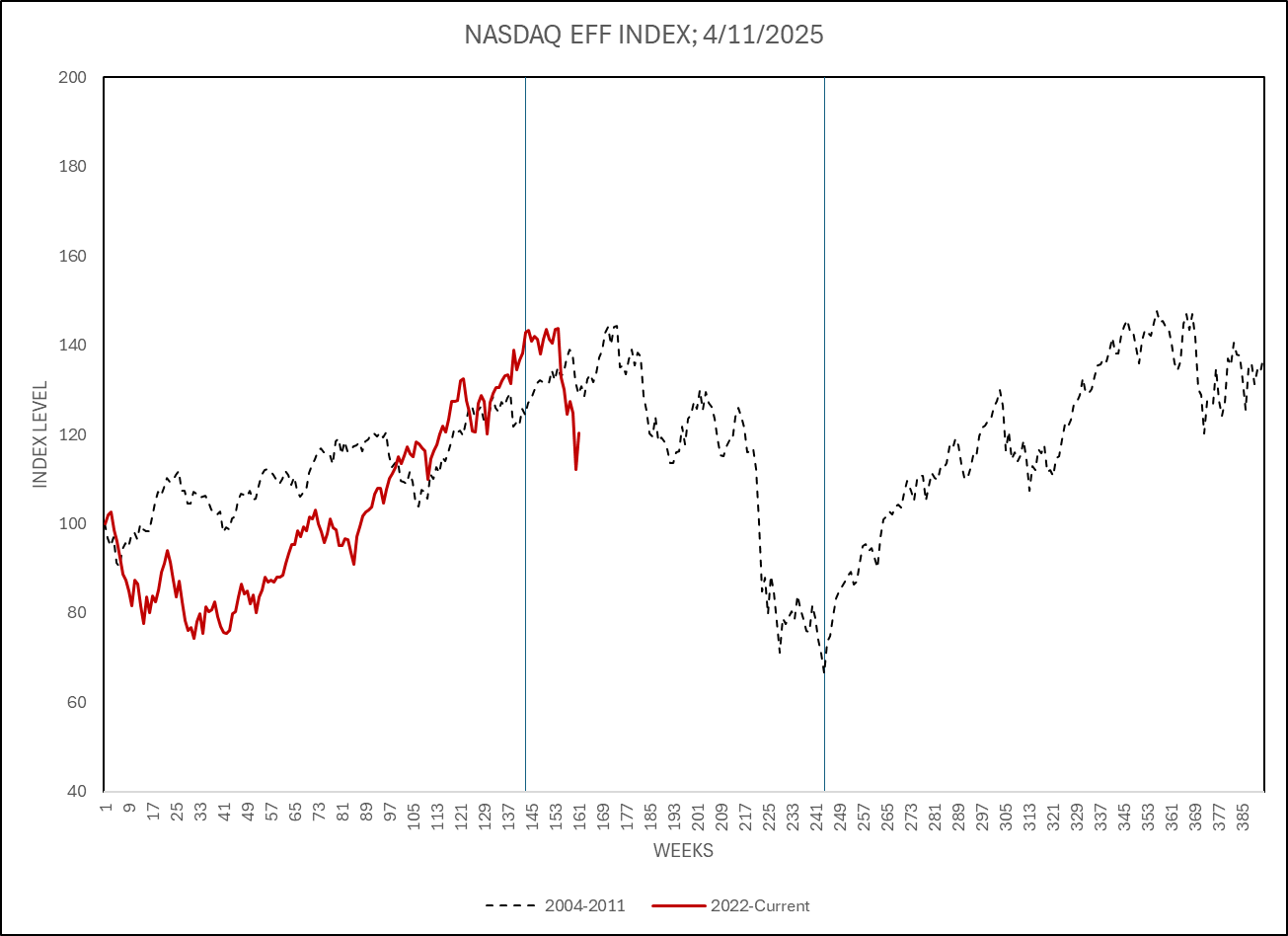

This week is further evidence, that the EFFing Cycle as published here is a timely way to gauge the stress of the cost of money across economic sectors. Instead of the usual format, we’re covering today in yesterday, with charts.

How do you break a cycle?

End Memo.

Today in time it is:

The Week ending April 11th 2025

The Week ending January 4th 2019

The Week ending July 27th 2007

The Week ending May 24th 2022

Let’s walk our way back in time slowly.

This week saw major market moves. So lets check in on January 2019 comparatively:

And the EFFing market Comparsions:

“No one could have seen it coming”

How about unemployment?

In case you all forgot: 2020 was part of the EFFing Cycle. Including the response to Covid. In January 2019, we were fighing in Yemen, Syria, threatening Tariffs on Mexico, Canada, China and more. By 2020 we would see mass lockdowns, 25M unemployed Americans, and the largest protests and police state responses in Modern history. From multiple fronts from Floyd riots to later J6.

And just to solify it further:

Ok, you’re saying that’s part of the President’s agenda. So let’s go back to the previous Cycle. 2004-2011. But before we do, how were bonds and banks doing?

The Fed had to intervene in bond market operations to stem overnight spikes in SOFR due to collateral constraints.

2004-2011

Everyone remember Hank Paulson?

But it’s not just markets:

Timing even down to when the economic slowdowns potentially cause stress, exhaustion, and anxiety amongst us all. And whether it’s the cause or symptom of the situation, even when tragedy can strike. Week 161 of the 04-11 cycle:

Week 161 of the 2022-Current Cycle.

May the departed be remembered, and their loved ones find peace.

Back to the markets, here’s the going adrift mentioned in the first article.:

And comparison.

And Employment:

We were fully engaged in War in Afghanistan and Iraq, the NatSec machine was in full swing, the Flag was being flown at every sporting event,

No one needs my commentary on banking here right?

1999-2002

Surely, it’s not all the same right?

Even down to talk of NATO:

But Dot Com bust was in 2000 right?

Yes. But that wasn’t the end of the story. The market continued to drift lower, and tanked at week 161 of the EFFing cycle. We had gone to war in the middle east, Bush Jr. was talking to “this Putin fellow”, and we were still talking about drug cartels and NatSec.

For Comparison:

And employment claims:

That’s a cover for this century. What about last?

Today is also October 27th 1989 in EFFing time.

Let’s start with, we had to creat the Resolution Trust Corporation, to help deal with failing banks.

But markets also saw the same action:

Even written about later:

And in even more timely:

Charted:

We had just witnessed Kuwait claiming Iraq was drilling cross border, and would soon invade Iraq in Operation Dessert Storm. By the time the cycle was done, over 4,000 banks/Savings and Loan Institutions failed, $180,000,000,000+ in non inflation adjusted dollars worth of commercial mortgage securities would be destroyed.

Other EFFing Indices

Other people’s money:

But don’t take my word for it:

Mr. Buffet Agrees

Buying income in Yen or going to Margarittavile?

US Sovereign Debt Cost

On the other hand, the US Treasury Dept. should probably avoid Magarittavile for quite some time.

There’s no place like home. Maybe someday the streets will be paved of gold, and the Emerald city will be recognized for the man behind the curtain.

Until then, hit play on the Lion’s 3rd roar and:

Breathe, Breathe in the Air.