Friday EFFing Memo

MAYDAY, MAYDAY: Lies, Damned Lies and Statistics

The Memo:

To:

Everyone

Re:

Statistics and Tales

Comments:

A Refresher: EFF indexing:

Simply put, the day the Federal Reserve Starts raising rates, is equal to day/week/month/quarter 1, of the timeline. What dataset gets measured, is then indexed to its value at that exact moment in time. So 100 equals the starting point. From there, we can track any data set, in a controlled timeline fashion with the same parameters to view its (and thus human) behavior.

I.E. The Federal Reserve began raising rates in March of 2022, therefore for instance, the Median Sale price of a new home in March of 2022 = 100. Each cycle is one full Effective Federal Funds (EFF) rate cycle, from trough to trough.

There have been 16 (including this current) cycles since Bretton Woods/WWII.

When combined with Neil Howe and William Strauss’ The Fourth Turning framework, we can then break these cycles into the same seasons: Spring, Summer, Winter, Fall. There have been 3 (U.S)Turnings: The US Revolution, The Civil War, WWII, and soon to be the fourth turning.

We are in the final Autumn of the Third Cycle. Winter is coming. What lies beyond that is potentially a new world, new monetary regime, or new chapter if you will.

Using this Indexing and Timeline format we can also measure not just statistics, but world events, and human behavior, using the changing cost of money as our guide to meausure current events to events of the past.

End Memo

The Report

If the Trade Wars™ or geopolitical tension seem like new territory, let me remind you, first of all that we’ve been here before, 15 times to be precise.

Today is also January 25th 2019 in EFFing time, and the Trade Wars™ were in basically the same spot we are now:

Here’s nice ordinary timeline of it:

https://www.reuters.com/article/business/timeline-key-dates-in-the-us-china-trade-war-idUSKBN1ZE1AA/

If you need a refresher of how that ended, look up Covid 19. Which was absolutely part of the 2015-2020 EFF Cycle.

Today is also November 3rd 1989. In the world of Geopolitics and changing of the seasons, the Autumn Revolution was in full swing in the U.S.S.R. (Union of Soviet Socialist Repulics, for those of you who aren’t as old or into history)

Poland having just conducted elections months before, with Georgia and multiple former Soviet states having left the Socialist Republic. Not so coincidentally, we are one week from the fall of the Berlin Wall. In EFFing time.

The U.S.S.R. wouldn’t make it until the end of the 1986-1993 EFF cycle, with the the Union dissolving entirely in December of 1991. Ukraine, then the largest former Soviet bloc nation, had also gained freedom from the Communist/Socialist Iron Grip. In exchange for United States defense assitance guarantees, Ukraine returned to then/now Russia, and or destroyed their remaining (and then largest by volume) nuclear aresnal. I’m sure this would be the end of that story.

If that’s not fresh enough, in June of 1989, China committed the now infamous Tiananmen Square Massacre, effectively ending the Liberation Movement. Within the next 6 month, the U.S. Under Bush Sr. would embargo and place further sanctions on China (again, or did you think this was also the first time?) Strange things happen during recessions though:

Mark that as one Winter and One Spring. Where one Communist state collapsed, a new verison of Chinese state arose.

In Japan, 1989 saw the changing of the Emperor, the spectacular rise of the Nikkei, peaking in just one month from Today in 1989 (December 29th), followed by its infamous collapse, and subsequent “Lost Decade”, where the population shrank, real estate prices collapsed (for two consectuive decades) and eventually lead to the Bank of Japan’s negative interest rate policies. Winter meet spring: III Nations facing reset.

In the U.S.A, in November of 1989 I was eagerly anticipating Back to the Future II’s release on November 22nd (The Cubs finally won, where’s my hoverboard and flying car?) and would begin to get my first informal education in real estate and business at a very young age, glomming any bit of information I could from my Father, as he embarked on completing a CBD (Central Business District) project that would leave a lifetime of memories for me. Including the first indoor mini golf course I had ever seen or heard of.

I loved Baseball at the time, and from that experience and my love of the game, would learn to trade and sell baseball cards with kids at school and around the neighborhood, to make a little money. Mostly to buy more cards or candy at the local convenience store. But notheless, an early education.

While those “other” Nation’s were undergoing seismic changes, the US was in the midst of it’s own crisis while I was busy playing baseball and looking forward to the next chance to go see what my father had been up to at work. That crisis: The Savings and Loan thrift collapse, the Resolution Trust Corporation’s enactment to dispose of the assets of 4k+ failed banks (a lot of Houston apartment buildings that just went bust again) and the tailing off of the Farm Crisis that has largely been forgotten.

Another throwback to today’s headlines of freight disruption, this all had quite the effect on US’ domestic freight. My colleague over at https://johngaltfla.com/ occasionally brings back great coverage of it.

From 1983 to 1990, $47 Billion dollars (non inflation adjusted) in Farm mortgage assets, and countless more dollars in value to non bond holders (Read farmers/vendors) were destroyed.

Farmers had ammassed record debt up to 1983, and the subsequent implosion of commodity prices caused mass bankruptcies. Some of which I’ve discussed here. (Can you guess which other countries were involved in that early disruption?)

Another 1989 Film would become perhaps the only (or maybe just most widely) popularized depiction of the farm bust. Field of Dreams, released in April of 1989. I was dissapointed then, and even more so years later.

While the entire plot revolves around Ray Kinsella, facing foreclosure of his farm in Iowa, this film somehow completely misses the real plight American farmers faced, and in the end, the film’s message accidentally or misguidedly turned out to be:

Baseball fields were a more productive use of farmland than farming.

Consider that an indictment if you wish. It wouldn’t be until 1995 before farmland prices stopped falling though.

The only thing I enjoyed about that movie was the late James Earl Jones’ performance, although Ray Liotta was solid as Shoeless Joe Jackson looking back. I digress.

Now that the stage is set, the actors lineup has been identified, let us turn our attention to today. The 164th week of the Current EFFing Cycle that began in March of 2022.

Mayday

Gross Domestic product just went negative in Q1. Here is the EFF index of GDP in Billions of Dollars, compared to the previous 3 cycles.

I’ve read some remarkable commentary in news pitching this as good. Let’s just clarify where we are. Here is the same chart, with the quarter recession hit in the prior 3 cycles (I told you Covid happened during Cycle 3)

1 Quarter away from “GFC” recession. Today is also August 19th 2007. August saw the collapse of the I35W bridge in Minneapolis, MN, The Federal Reserve Cuts rates for the first time in the cycle, Russia/China and 4 other nations begin what would become routine military cooperation drills.

Let’s dig into some items that contribute to GDP Shall we?

Residential Housing Construction and Sales

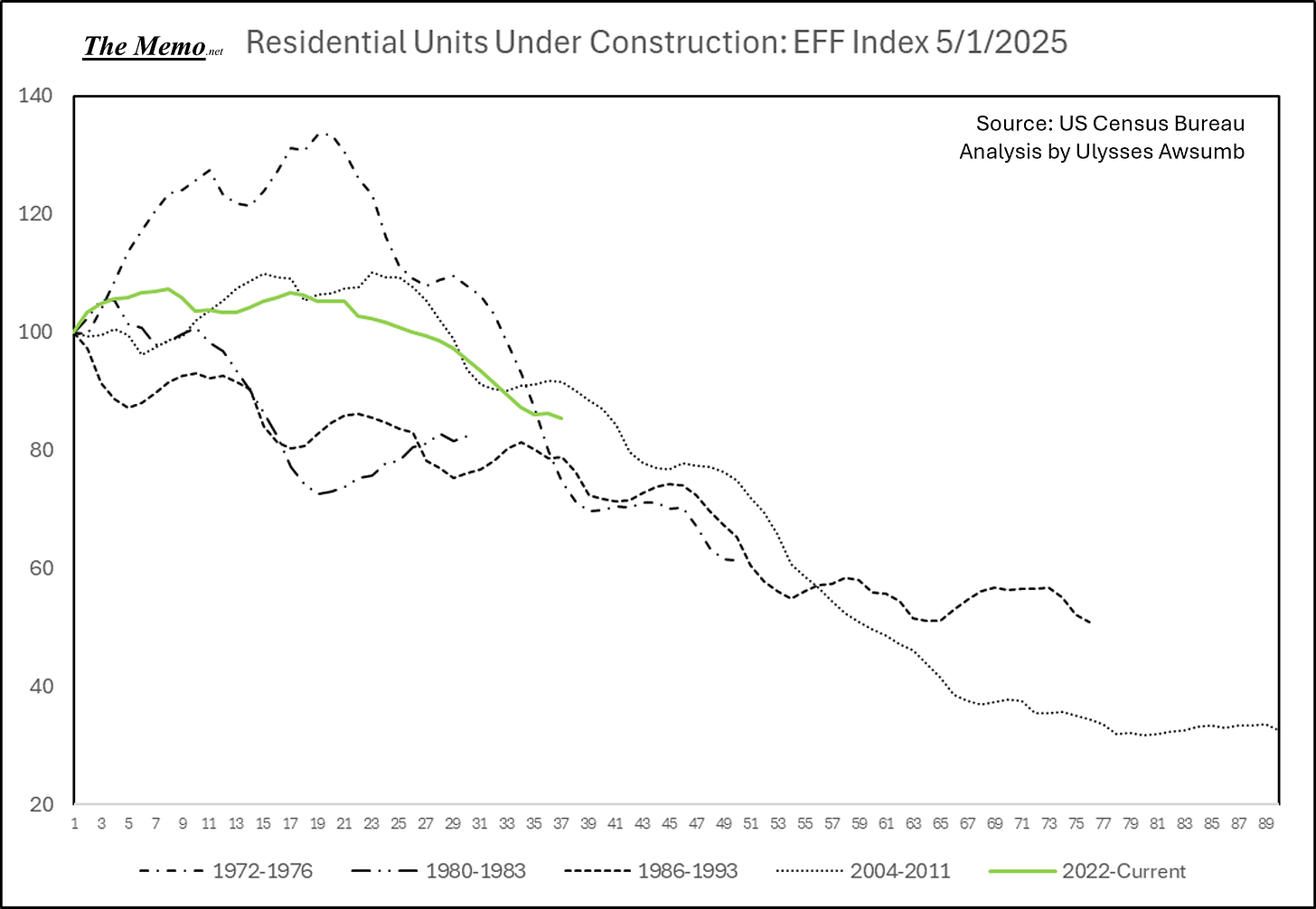

With the latest realease of sales and permit data, the contraction in construction of housing units continues totally unabated. 2 years of consecutive declines. In comparison to past cycles, we are smack dab in between the 1990/2008 contraction levels. These are the two longest contractions on record.

In what I can only describe as: Interesting

New home sales in March, somehow matched the exact percentage from cycle start at the exact same month in time as the two prior cycles it was least tracking. Sales had been underfperorming the 2004-2011 cycle and directionally identical, until March’s survey of construction publication, which also delivered 5 months of data revisions.

Meanwhile the median sales price for new homes continues its contraction, far underporming the 2004-2011 cycle.

Just for those still doubting, here’s the same chart in standard format.

Given the reduction in pricing and and increased use of incentives, one could concievably believe sales increased. However, with builders now facing reduced net income year over year, the focus will turn to selling inventory on the books rather than replacing it.

None of which will be a positive contribution to future GDP.

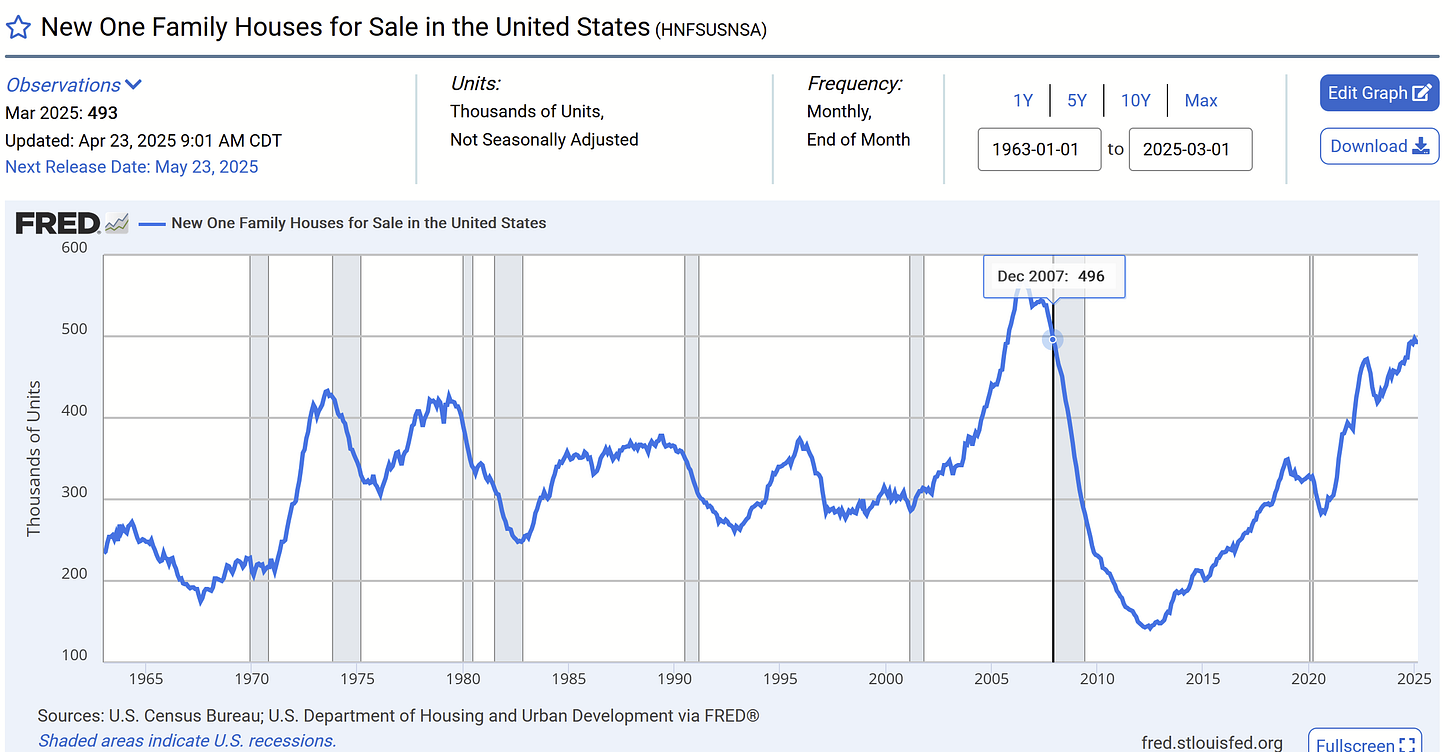

And to put that inventory into context, it’s the most since December 2007. Which was the offical recession start of the aforementioned.

Paring compressed margins and reduced income, or rather compounding the situation for existing builders is their continued slide in share price. Lennar has seen 48% of their share value evporate since October 2024. and not so concidentally, tracking performance during the contractions of 1990/2007-8 as well.

DR Horton is right behind them. DHI went public post 1990.

With all that in mind, is it any wonder that construction job openings are collapsing?

And with collapsing openings, reduced income, and shrinking desire to build more, less hires also makes perfect sense.

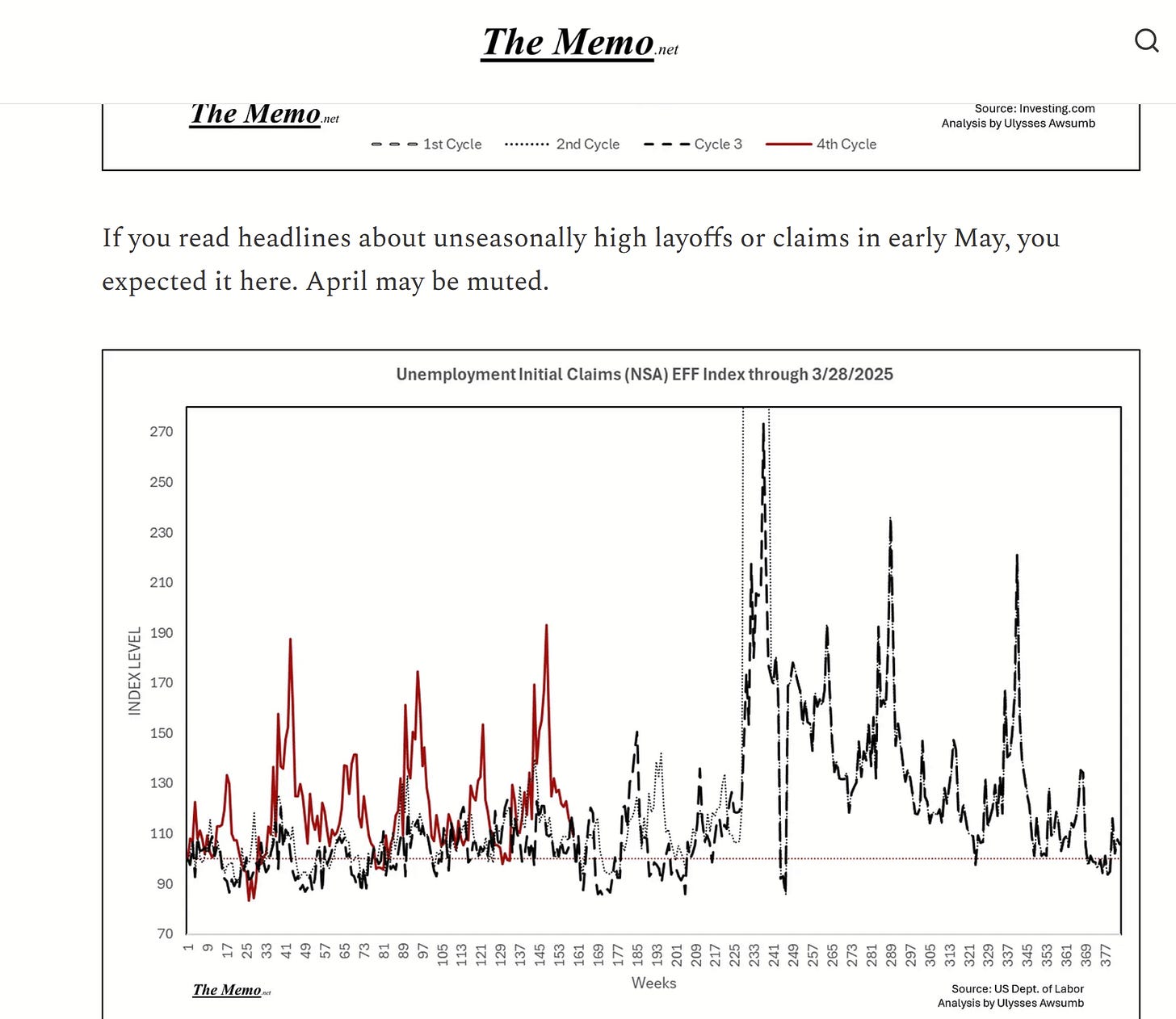

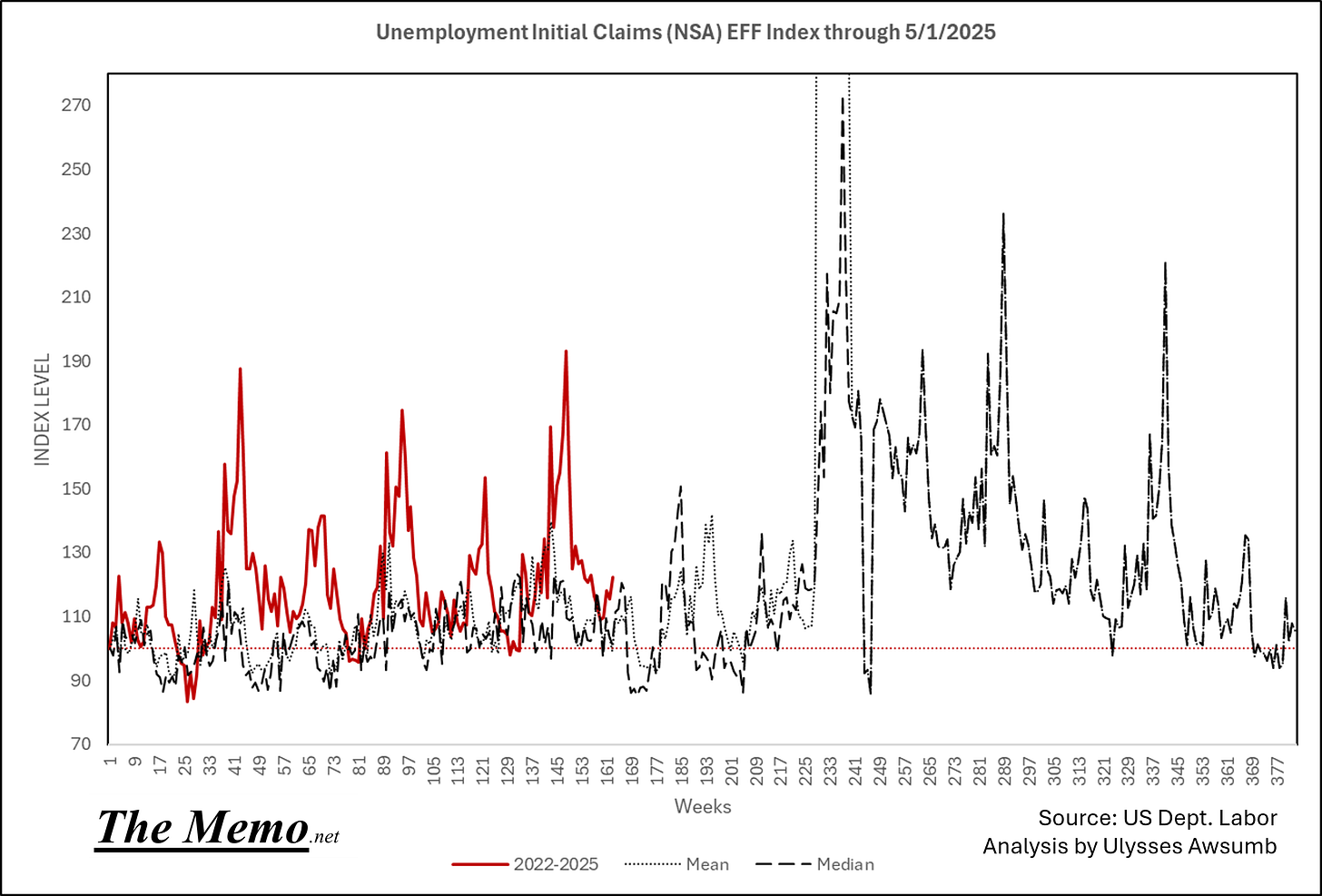

Which leads us to unemployment. If you recall, in the March 28th EFFing Memo, I suggested to expect to read headlines about unseasonally high unemployment claims.

Well Mayday didn’t dissappoint.

We stand to see 1-2 more slightly elevated weeks of claims, before the subject is dropped. Which will be the wrong time to drop it. Following the Mean and Median of past cycles, even with all the work by app, and 1099 online positions available, I fully expect we follow the same path as always. Up and to the Right from here. By the time you’re reading the news of high unemployment, it’ll be too late.

Other headlines du jour showed the unemployment rate decreased. Meanwhile:

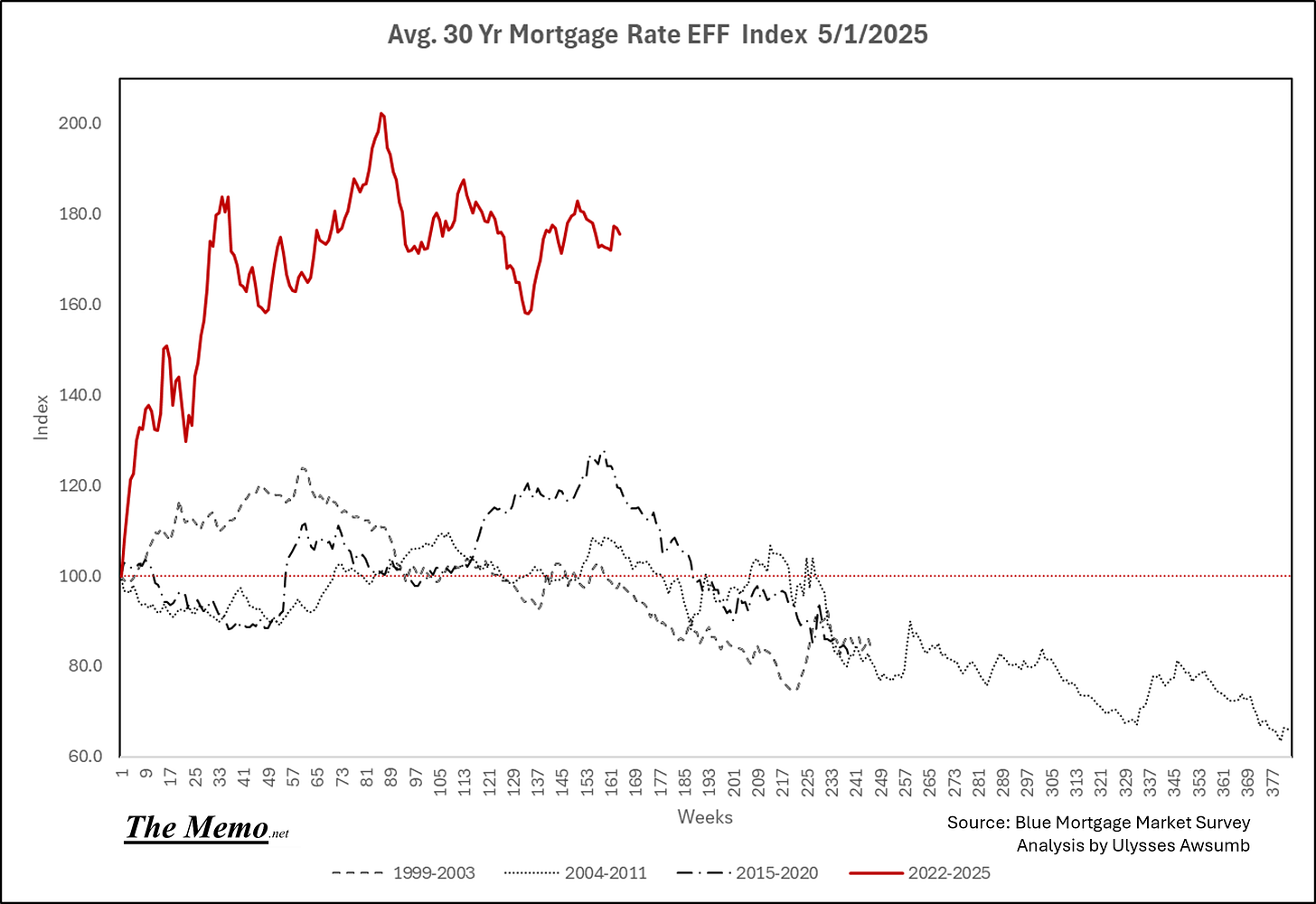

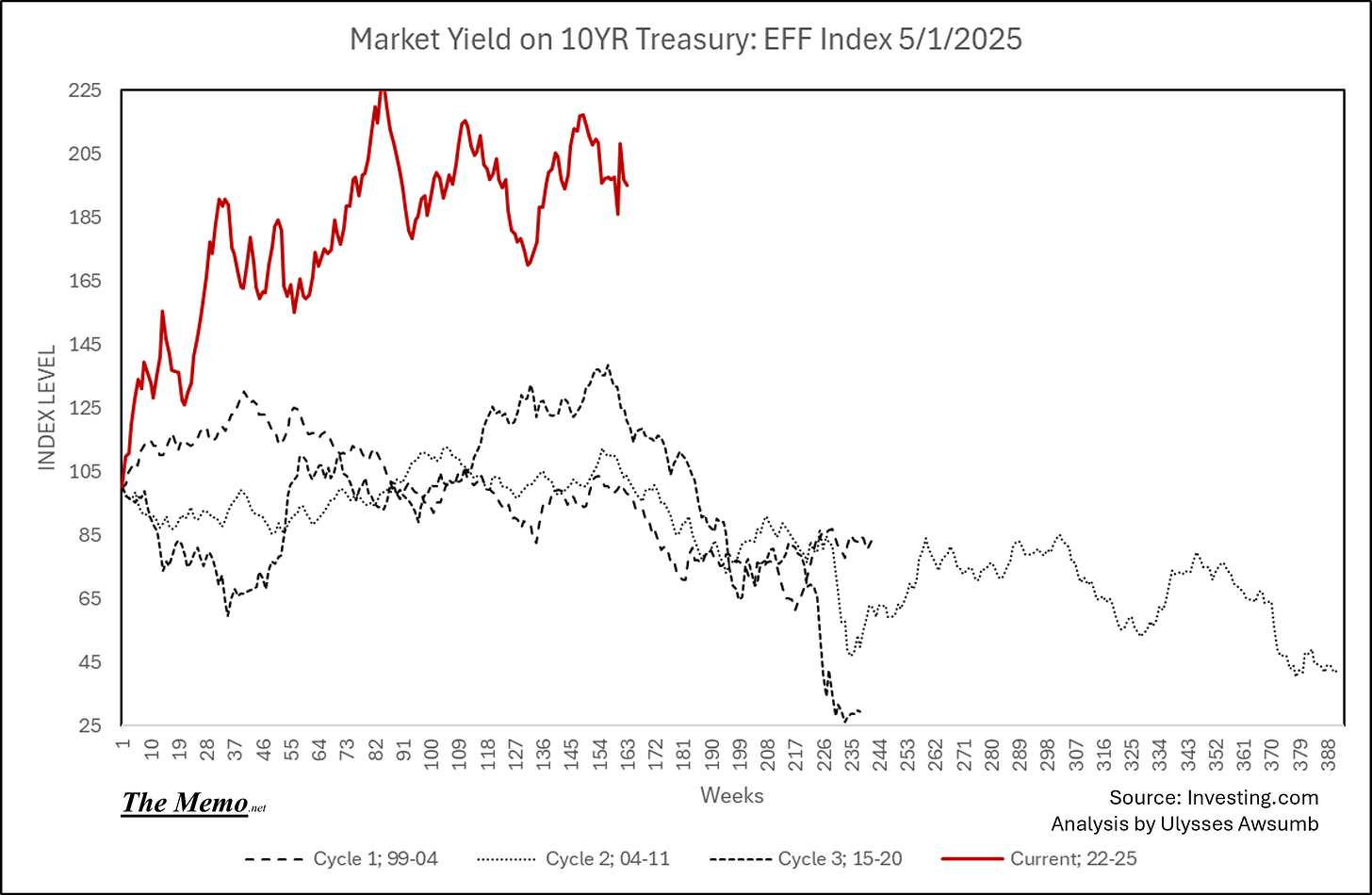

The cost of purchase money is stubbornly high.

Coupled with high prices and the rising employment instability, it’s a small wonder that home sales remain depressed even through a traditionally strong sales month.

Meanwhile the existing home median sales price ($403,700), remains on perfect trajectory to collide with month 39 of the 2004-2011 cycle. This after having set that target 4 months ago.

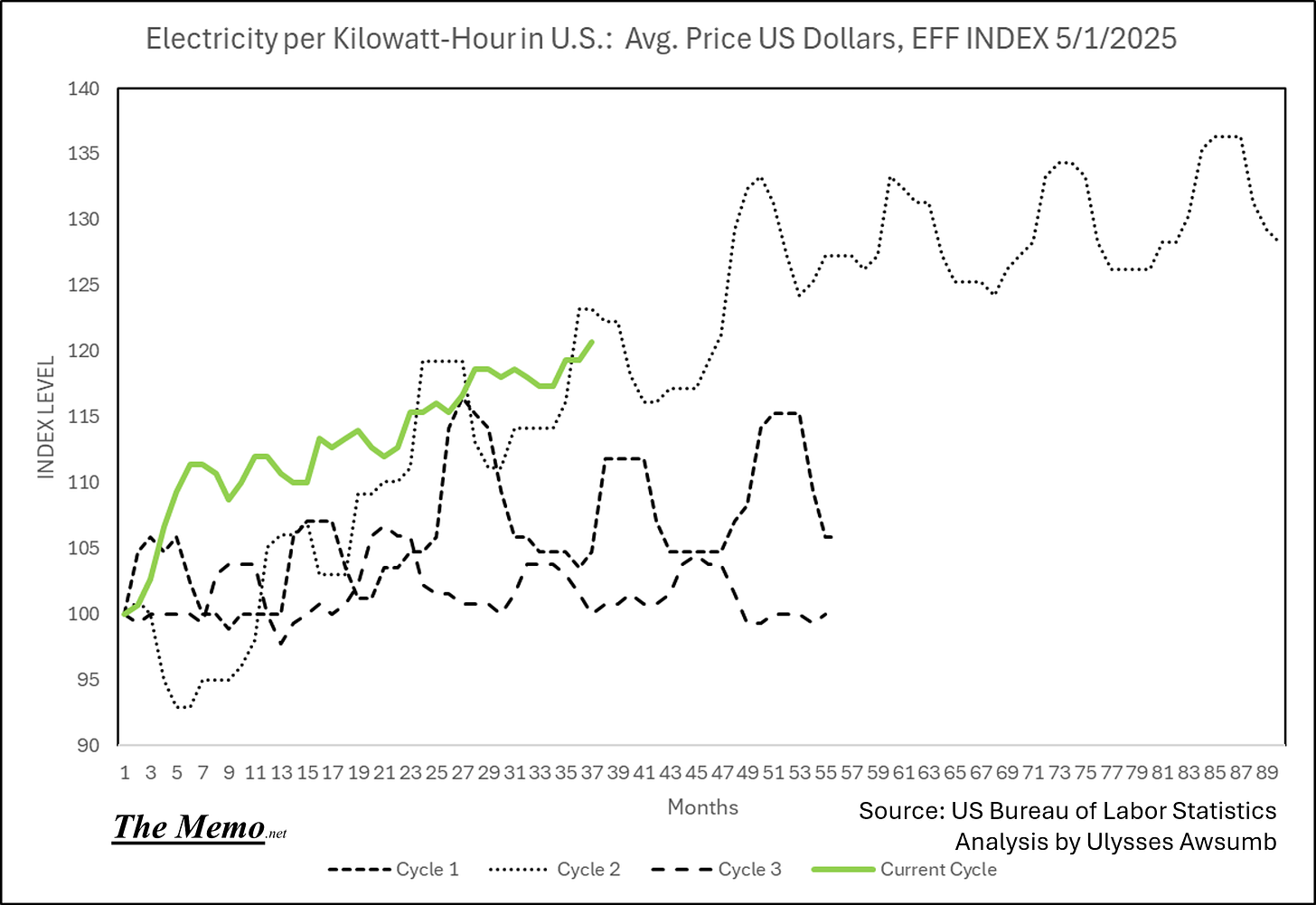

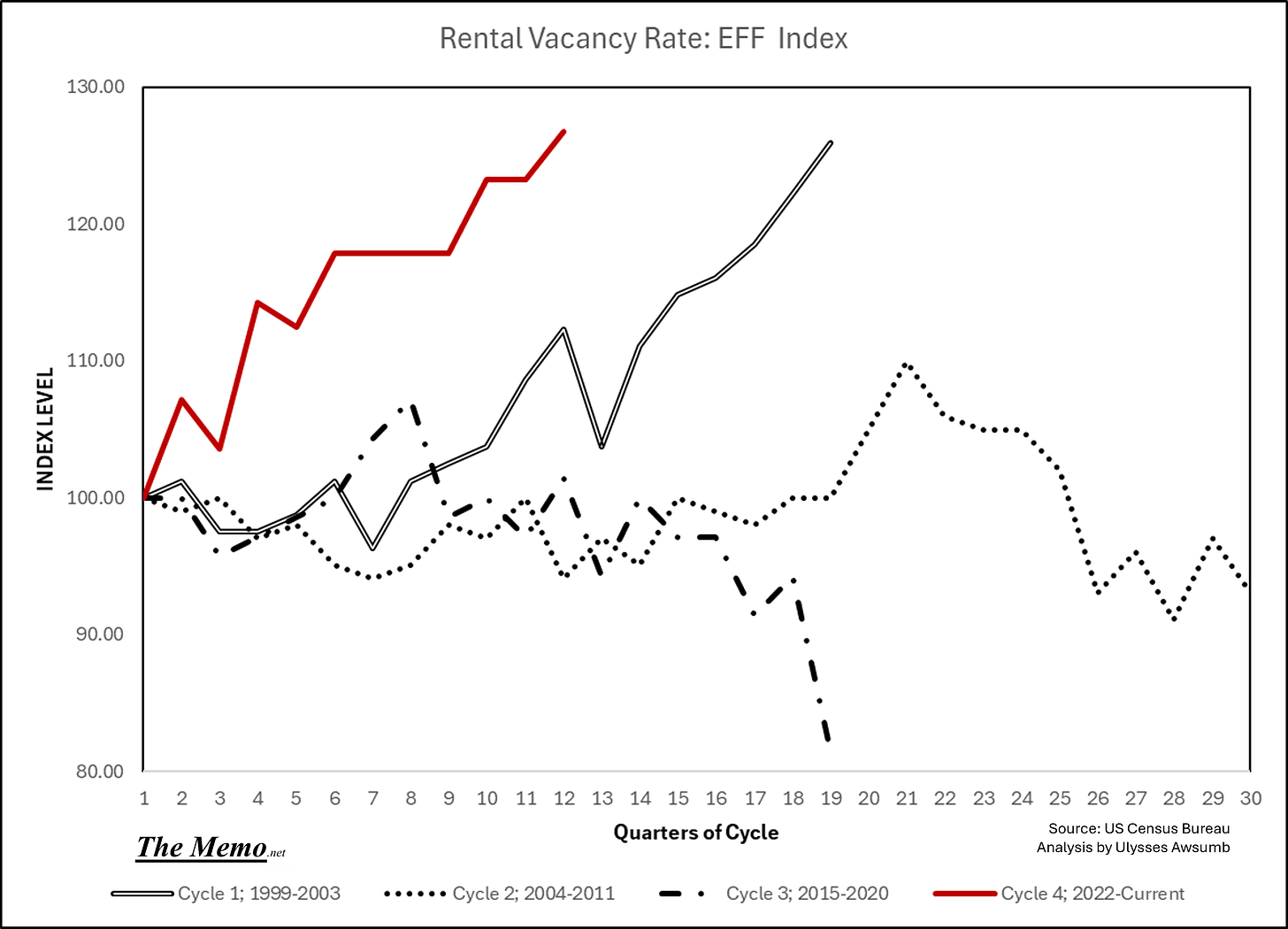

With rising insurance, mortgage payments and electricity costs:

And increased rental vacancy, potential home buyers have what I call:

ALTERNATIVES.

It will take a large rise in incomes (less likely with less employment), a large decrease in interest rates (be careful what you wish for) or a large contraction in prices before any credit expansion via mortgages is readily available, or associated economic activity contributes meanignfully to GDP.

Breakfast

Leaving aside the anti American sentiment abroad, let’s look at home. At home home.

How’s breakfast pricing going for the modest and moderate income households of the United States?

$4.51 gets you:

2 slices of white toast

2 eggs

1/4lb of bacon

6 oz of coffee

6 oz of frozen concentrate Orange Juice

Look what they’ve done to breakfast. Stable pricing you have there, would be a pity if something happened to it.

So if $4.69 for a breakfast sammy at McDonald’s is pushing it, I’m going to guess $4.51 for breakfast at home is hurting folks as well.

Like homebuilders have left margin reduction conversations and entered income reduction, how long before others follow suit? Will reducing income contribute positively to future GDP?

Equity?

When (not if) this market gets the picture, and takes it’s winter fall (companies are already removing forward guidance) as incomes become reduced, employment weakens, then, maybe Uncle Sam will get his wish.

To borrow more of your money at a lower interest rate that is.

That is if our friends don’t share the Anti American sentiment and sell their holdings.

In the year 2025, shiny rocks are still reliable and remember the springs and winters of nations past. While meme coins, new paradigms and currencies wage war against one another.

Someone on the Tele told me gold was falling. I told em I wasn’t interested.

Because we’ve seen this movie 15 times before.

End Scene.

Excellent piece. I love all of the historical contextualization. I was in Minneapolis during the bridge collapse. I would have been on it had we not been required to stay late at work due to all of the turmoil and writedowns we were doing.

Thank you Melody! Very much! That is incredible you were delayed from crossing it. I had a similar experience, I took the bridge daily but was working late also. Missed it by 2 hours. I remember driving on it thinking it was a bad idea to stack equipment the way they did on one side before all of it.