Friday EFFing Memo

Friday Night Lights

The Memo:

To:

Everyone

Re:

EFF Cycle Updates

Reviewing wins

Deja View

Real Estate Market Segment turning point?

Comments:

Someone I once worked for had a saying: “Review your wins often”. I had no idea where he got it from, but he had a lot of wins, the saying, and practice has stuck with me since.

I’ve had some really good market timing analysis the last few months, if I say so myself.

Regular readers have seen the US Homebuilding Situation, and it’s bottom in Q4 2024, as a LEADING indicator.

I was on Making Money with Charles Payne talking about FHA’s issues before it became accepted that it’s got major issues. (Thanks Don, Six et al!)

Back in October, for MacroEdge, I called the drop in homebuilder stocks here.

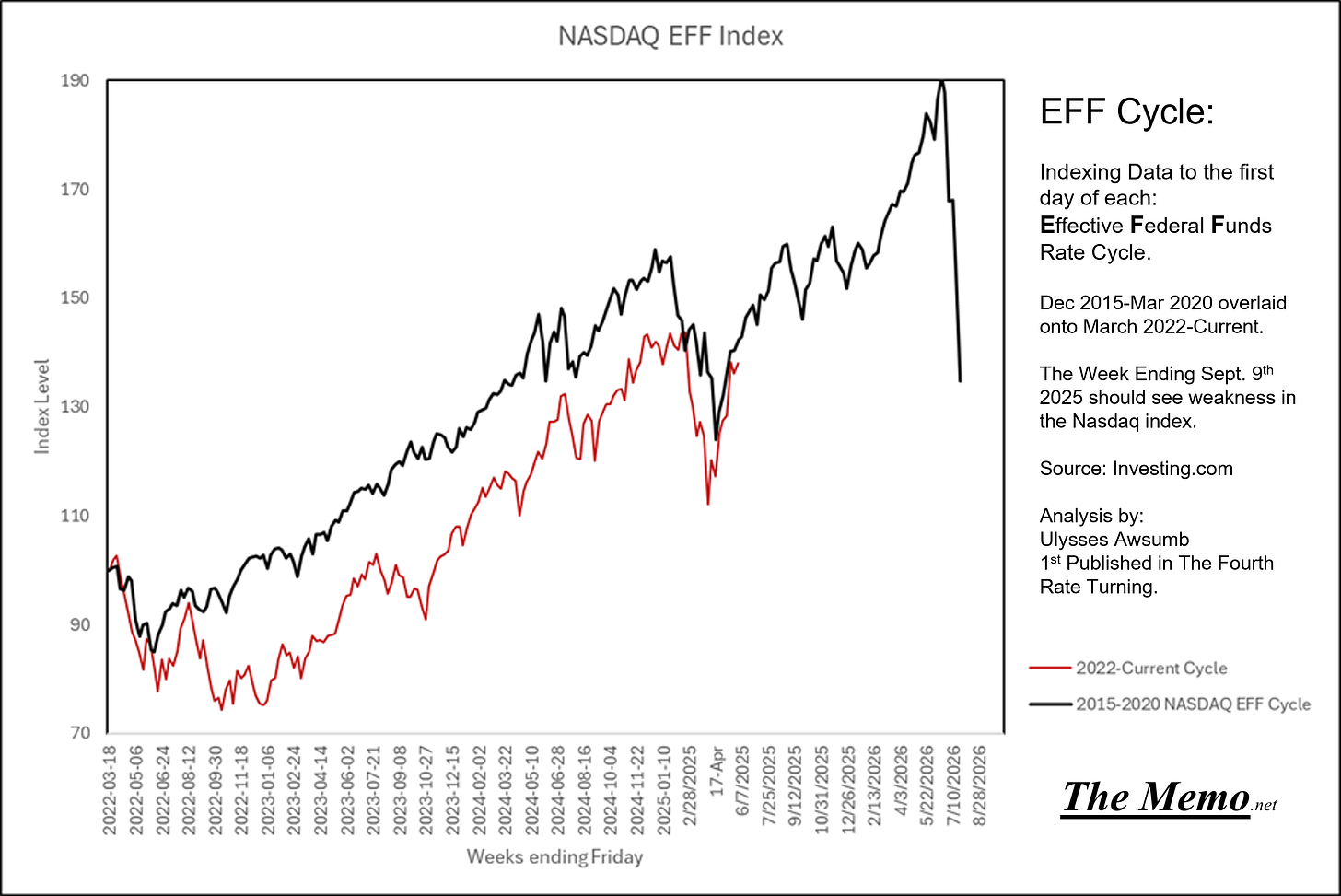

Right here within a Memo I called the week the NASDAQ dropped. Here:

One of the things about reviewing wins though, is it’s an opportunity to reflect on what worked and what can be improved.

Antoine de Saint-Exupéry is attributed with the phrase:

Perfection is when achieved when there is nothing left to take away.

Now I’m as far from perfect as anyone. But I still find truth in that quote. And as such, I’ve been working to improve my EFF cycle analysis, as well as other works. I had the priviledge of having a long sit down chat with a former investment manager at a big firm. I’m fortunate to be able to call this person a friend and for his similar to Antoine’s advice in taking away the unecessary. To that end, The EFF Indicies are undergoing some maintenance updates, I’m dropping a sneak peak at the new look in the report below.

Plus I’m actually including some real estate info from a different persepective.

Have a great weekend!

End Memo.

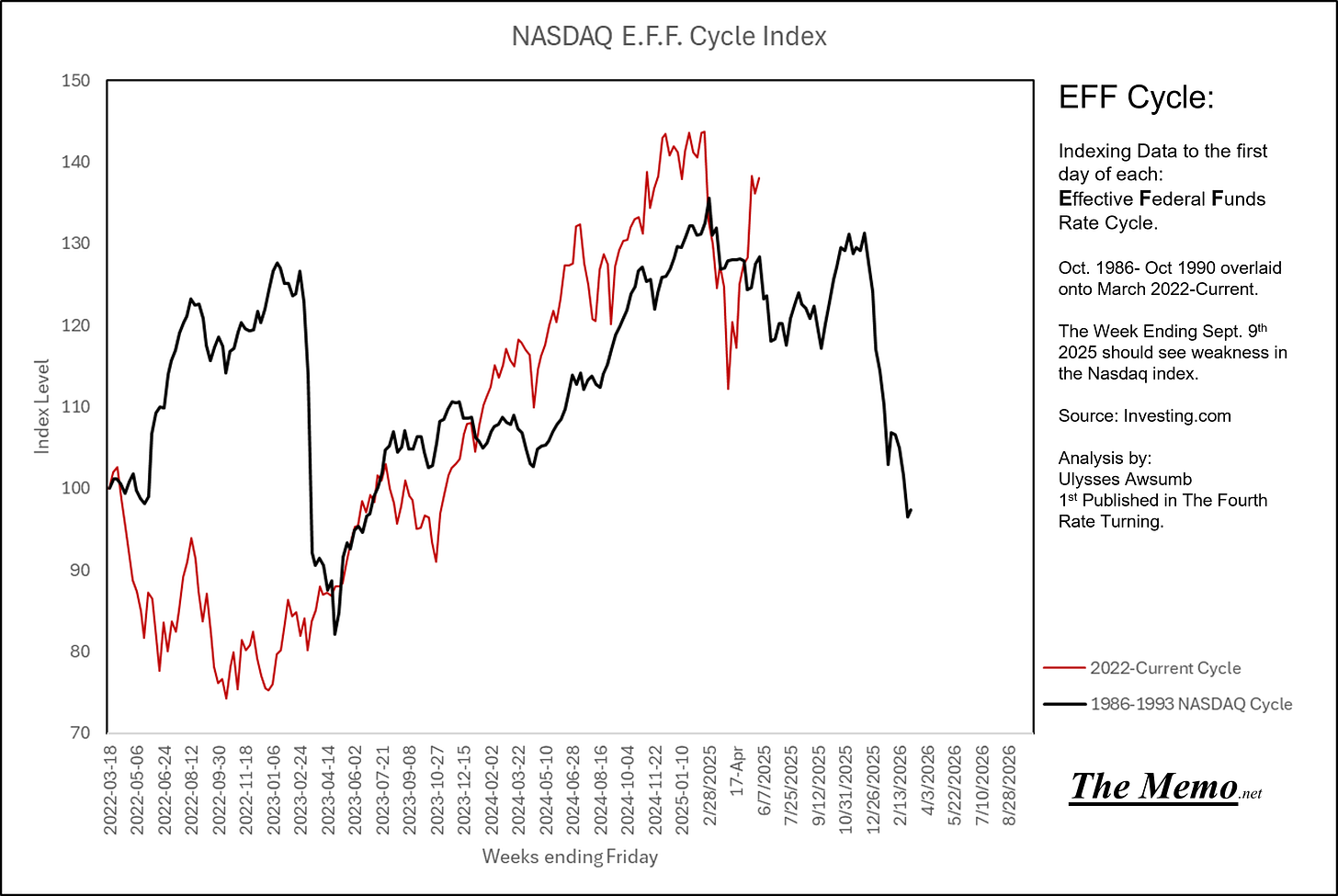

THE EFF INDICES

A Reminder: EFF Index is any data indexed to the first day/week/month that the Federal Reserve first raised rates. It measures from rate trough to rate trough. 100 equals the price/level of any data set measured, at first raise.

Now the sneak peak. I want these to be more functional, with clear dates and easy to view comparison of cycles.

Without further ado:

This last one is for you Gabe. Thank you.

Kat in HR Dept. calls this a Deja View.

This is reviewing another win. But this time: An Update! I promise I tie it back to today and current real estate.

Originally Published 8/27/2023 via MacroEdge Research

With the news that Rite Aid (Ticker RAD) is preparing to file bankruptcy, I thought this would be a good time to follow up from last week on the end of a business cycle, because in the end, the story of Rite Aid, is a story of how real estate is the economy. But first, there’s some bad news regarding the real estate industry in general. It’s been well publicized how poorly office property is performing and losing value at an incredible pace. But it seems the not so long ago “Retail Apocalypse” has been mostly forgotten, despite the fact that the sector is still in a free fall that started over a decade ago. It’s just a sign of how far the fall of a cycle can actually be. To illustrate, after seeing some store closure notices, I did some digging. This year there have been over 4,000 publicly announced store closures for 2023. Here’s the list along with their average store size and total square footage.

That’s 68+ Million square feet of retail space that will stop producing revenue this year, using the average store footprint. Using average US retail rent calculations, that’s $1.5 billion in rents that won’t be paid next year.

While some stores only rent spaces, like inside shopping malls (Champ Sports/Foot Locker) others anchor them (Macy’s/JC Penney) there’s a large subset of these that sell their stores and lease them back. Like Rite Aid, Walgreens and Burger King. Doing an analysis of brands that develop their stores to sell as NNN (Triple Net Lease) or sale/leaseback paints a startling picture.

This list of actual announced closures represents only 37% of the total closings, to the tune of $6 Billion dollars’ worth of real estate sales value impacted. These are using the average asking price nationwide at the time of publication. But these are what should be the focus. Because the model these companies use to grow is to develop their property, sell it to an investor, and lease it back. And at very low rates of return. In fact, over the last few years, they have sold at returns under what treasury bills will get you right now. Why? Well, some folks look at these as “passive” real estate, and they are less involved than other types, and others yet have bought them as 1031 Exchange properties (like kind to defer tax payments after a capital gain on property sale). 1031’s have been a bit of a bubble themselves of late because of the time frame given to defer taxes.

The important detail in all of this is what it does for the companies and their stock. They can grow because when they deploy capital to develop a property, they get the capital returned much faster by selling it off as a NNN instead of holding it as an asset. The capital can then be spent on product/marketing/stock buybacks etc. And it’s the only way that Rite Aid, CVS and Walgreens have been able to grow into the Oligopoly that they are.

This is the original Rite Aid. It started life as Thrif D in 1962. This was a typical pharmacy in the not too distant past. Pharmacies have been the subject of one of the longest running business “roll ups”, including Rite Aid.

In 1972 Rite Aid operated 200+ Locations. By 1983, they were buying 420 stores along the east coast. By the 1990’s they were acquiring stores literally by the 1000’s (Thrifty/ PayLess). Sounds like a roll up right?

Between Rite Aid, Walgreens and CVS all rolling up every location possible, at a certain point, there aren’t many left to roll up.

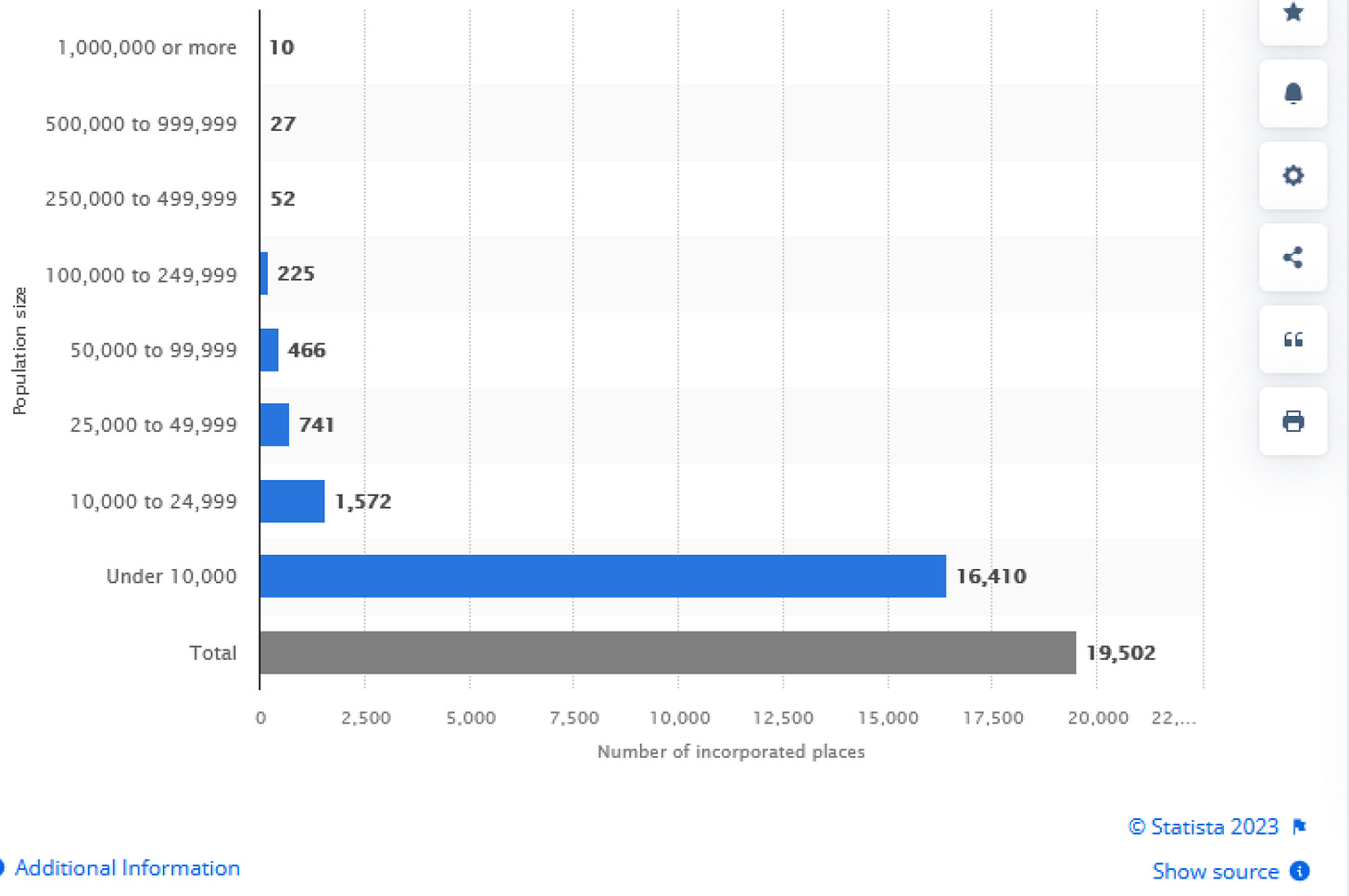

So, having bought out most of the pharmacy businesses in the United States, all three parties to the Oligopoly set out developing their stores and reselling them as their growth strategy. But there’s only so many locations you can build, put a new building in where you can meet enough demand to keep the doors open. See the next slide with cities and populations:

This was evident inside of the companies prior to 2015, when Walgreen’s announced it would acquire Rite Aid in a $9B deal. They have more stores than there are cities in the US that meet their criteria to invest in. (10k+ population)

That merger didn’t work out, but in 2017 Walgreens did acquire 1,900+ stores from Rite Aid. Let’s face it, the end goal was always Monopoly. Now in the US, we have Anti-Trust laws that are supposed to prevent this from happening, but I digress.

Back to the basis of the effect of real estate and these companies.

This is what Rite Aid’s current assets to liabilities looks like. No wonder they’re preparing for bankruptcy. Unlike the recent filing of Yellow/YRC, Rite Aid doesn’t have much in the way of real estate to sell off, as we’ve discussed, they already sold off their stores as the means to build more stores which brought them more expenses via lease commitments. Here’s their Real Estate Assets from their latest financials:

Land improvements and Buildings consists of only $270+ million.

With Rite Aid ready to file bankruptcy, CVS closing 900 stores, and Walgreens lurking behind, Rite Aid is just the first domino. There’s no more NNN money to build new stores, no new markets, no more organic growth, they’ve pre-sold all of their stores, so they can’t recapture that capital anymore.

In pre internet days, to gain sales you either built/bought more stores, or had mail order catalogs. Companies like Sears and Victoria’ Secret were built on catalogs as their foundation. But Pharmacies as a roll up worked because they relied on people needing to be there to get their medications. When you need medicine, waiting for the mail isn’t ideal. With the advent of grocers and other retailers having small pharmacies in store, the need to be at the oligopoly is disappearing. And for all the other merchandise that these pharmacies sell/sold as a convenience, there are a multitude of other places to buy, including the modern mail order catalog: the internet. This is the wind down, of the long roll up.

It’s always been the real estate that’s allowed these companies to grow to the size they have. And in case you think this only affects the outlook of retail real estate, allow me to introduce you to the other assets retail companies impact:

Rite Aid Distribution Center on the left,CVS on the top, Walgreens on the bottom:

Maybe YRC won’t be the only one adding vacancy to the industrial market or freight industry this year.

The Update

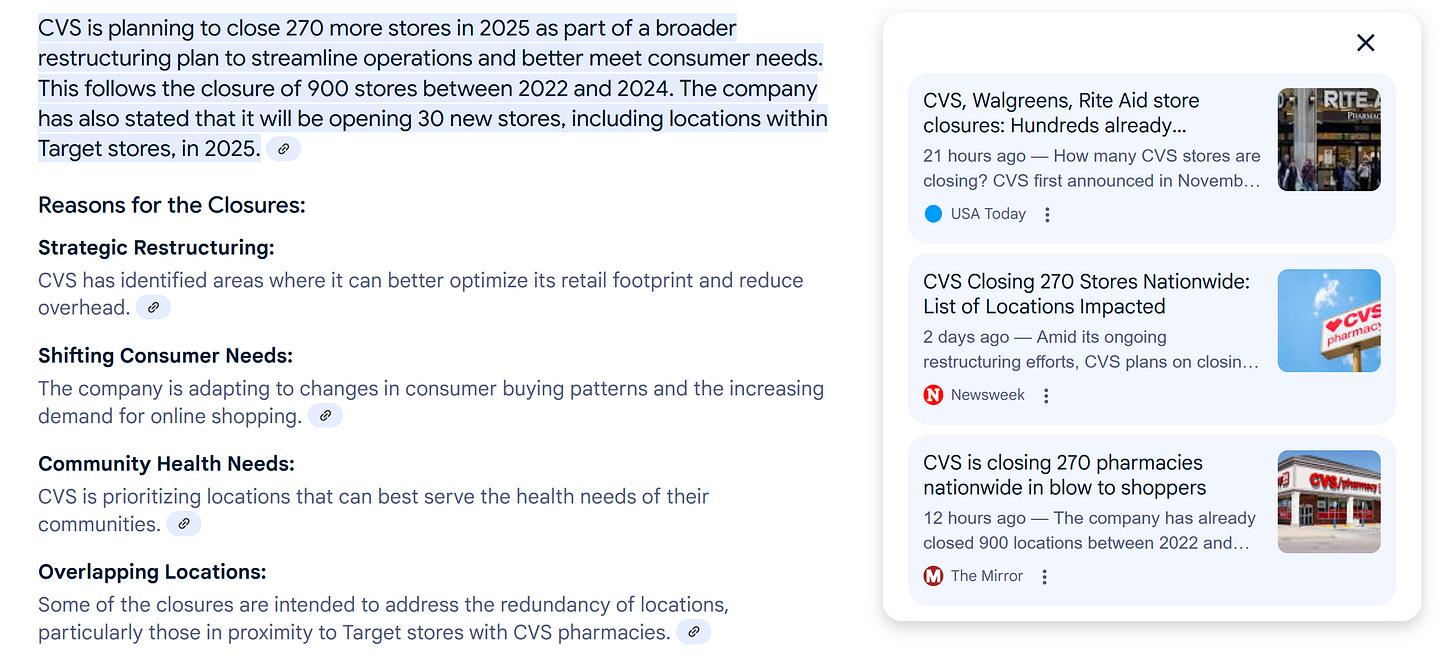

Since writing this, Rite Aid has filed Chapter 11 Bankruptcy. Twice. Walgreens just announced they are being acquired by Private Equity firm Sycamore Partners. And CVS is liquidating stores at brisk pace.

Is that shade from the author?

Just for count that’s:

1,170 CVS Closures

1,200 Walgreens Closures

887 Rite Aid Closures

For a grand total since I first wrote this piece to: 3,257 stores closed. SO FAR.

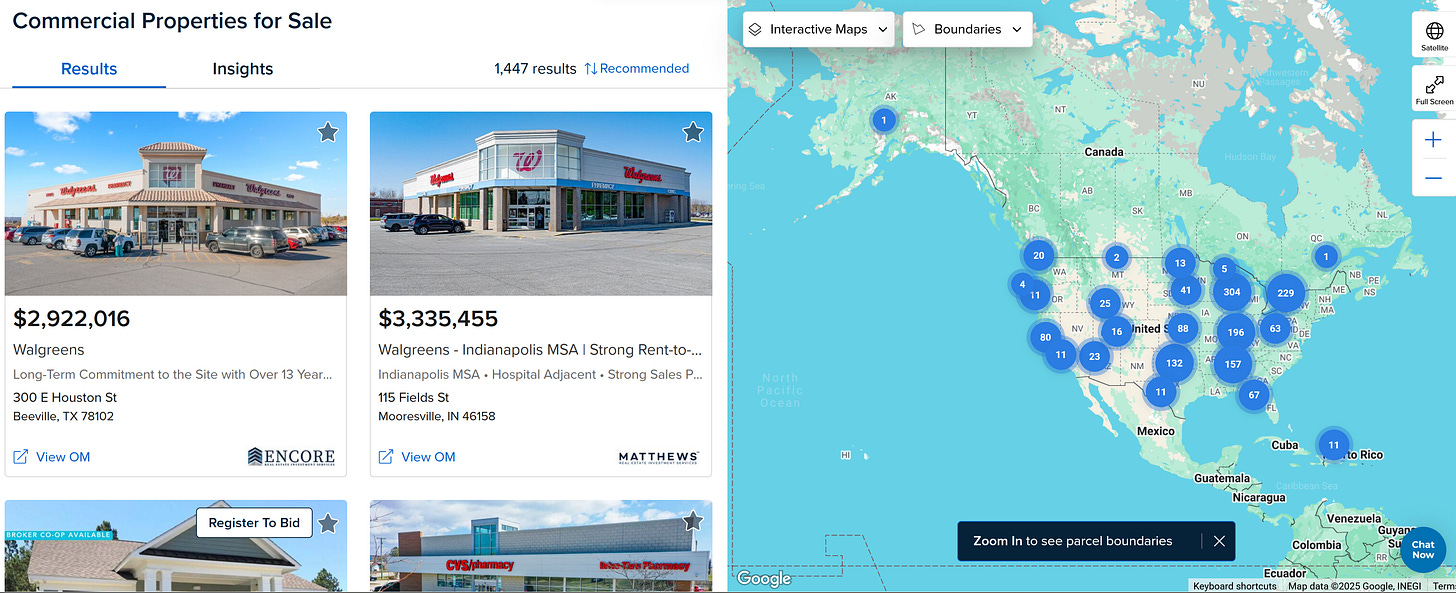

A quick search of Crexi.com HERE with the filter set to “Pharmacy” shows there’s currently 1,447 matching properties for sale. There’s a handful of oddballs mixed in, but the majority are NNN standalone former Roll Up darlings.

I wrote a brief follow up note for MacroEdge in the 2024 Year in Review/2025 Look ahead, Here’s an excerpt of construction spending on Drug stores as compared to Walgreens WBA 0.00%↑ stock price:

Something tells me there isn’t big demand for new versions. Also, on that “other type of real estate” these groups operate: Industrial? Presented, highlighted without further comment:

My point however isn’t to highlight that this industry needs to figure out what it can be, unburdened by what it is, as I did in December. Or that Industrial has issues.

My point is, there’s plenty of evidence to suggest that folks who own these buildings, might be willing to entertain all types of offers to lease/sell. If you have a creative vision for how to fill/convert/replace one of these buildings, it might be worth making some phone calls. You miss 100% of the shots you don’t take.

Strip away what isn’t necessary and take your shots.

Housekeeping says:

Also a first: comments section is open on the site.

None of this is financial or investment advice.