Your Friday EFFing Memo

Making Sense of the 1st 10 days of 2025

The Memo:

Re:

EFF cycle updates for Markets and Real Estate.

DJIA, S&P500, NASDAQ, Median Sales Price of Existing Homes, Case Shiller Index, Existing Home Sales, Homebuilder Sentiment and…..Los Angeles.

From:

Mr. Awsumb

Comments:

The only late Friday afternoon memo you won't hate getting….. every EFFing Friday.

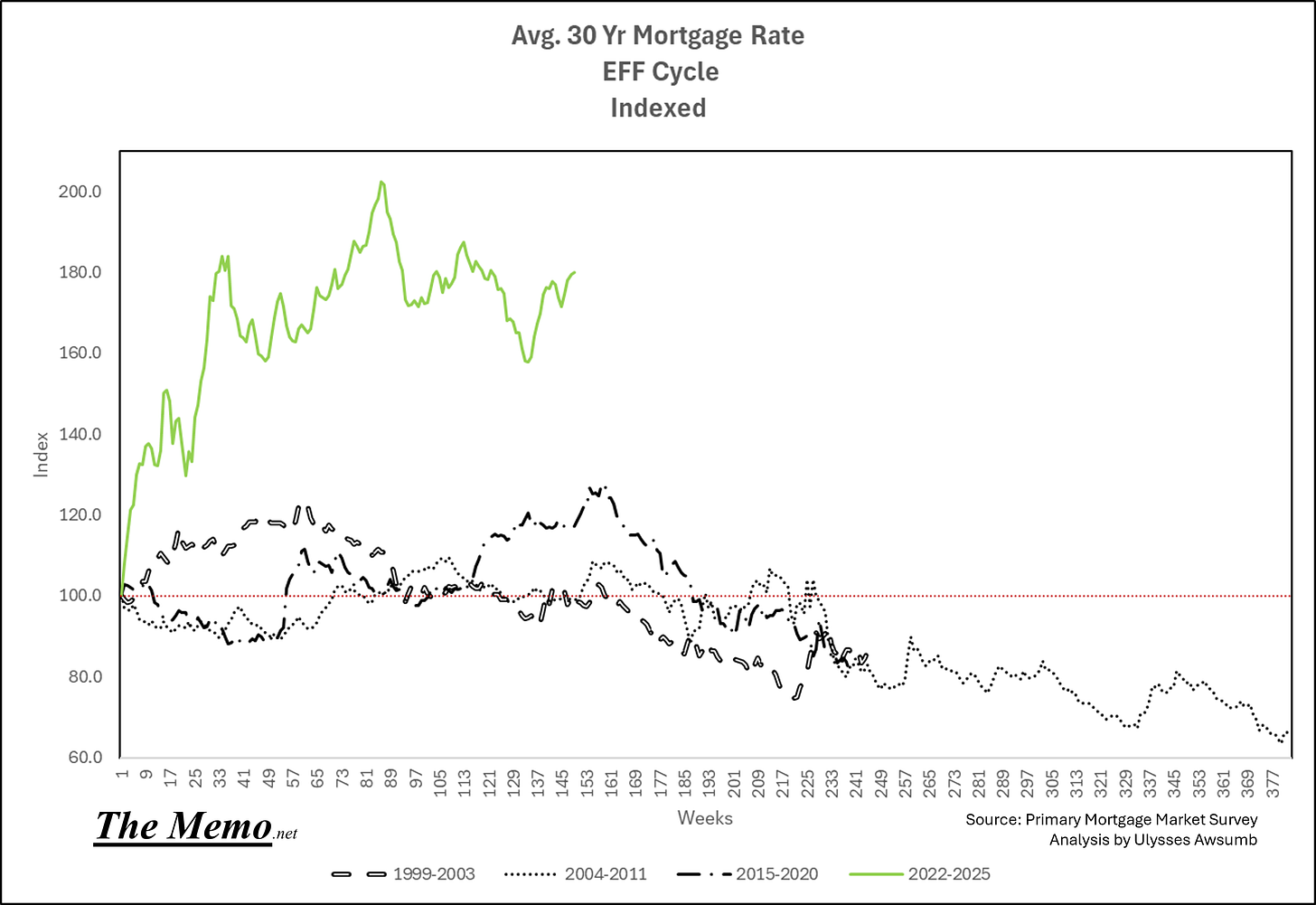

Mortgage rates continued their increase. On schedule. Looks like we're due for them going the opposite direction…unfortnately we’ve got comparisons of another 12 weeks of increase in store. Just in time for the Spring Market.

Existing Home Sales (for November) continued their downard trajectory. The resemblance to Cycle 2 is, remarkable.

Continued pressure.

The NASDAQ and SP500 ended the week on par with the 2015-2020 cycle. While the DJIA is essentially at the Average of all past cycles, we’ve got another 6 weeks until the first one “hits the wall” of the average Fed Funds Rate. More cuts expected.

Happy Friday.

End Memo

The Research

Housing

With even more elevated interest rates, there’s going to be mounting pressure on home pricing. November’s (release) credit access survey by the Federal Reserve, showed an enormous year over year increase in mortgage application rejections.

The elevated rates and elevated rejections are highlighting the pressure seen on the Median Sale Price for an Existing home. As of November that price was $406,100. That payment at 7.08% (as of today), with 20% down comes to $2,603. A whopping 38% of the Median Household Income.

For reference, the other months of the previous cycles we’re at are:

July 2018

February 2007

November 2001

Here’s that pressure visualized: