Date: June 25th 2025

Time: 9:00pm

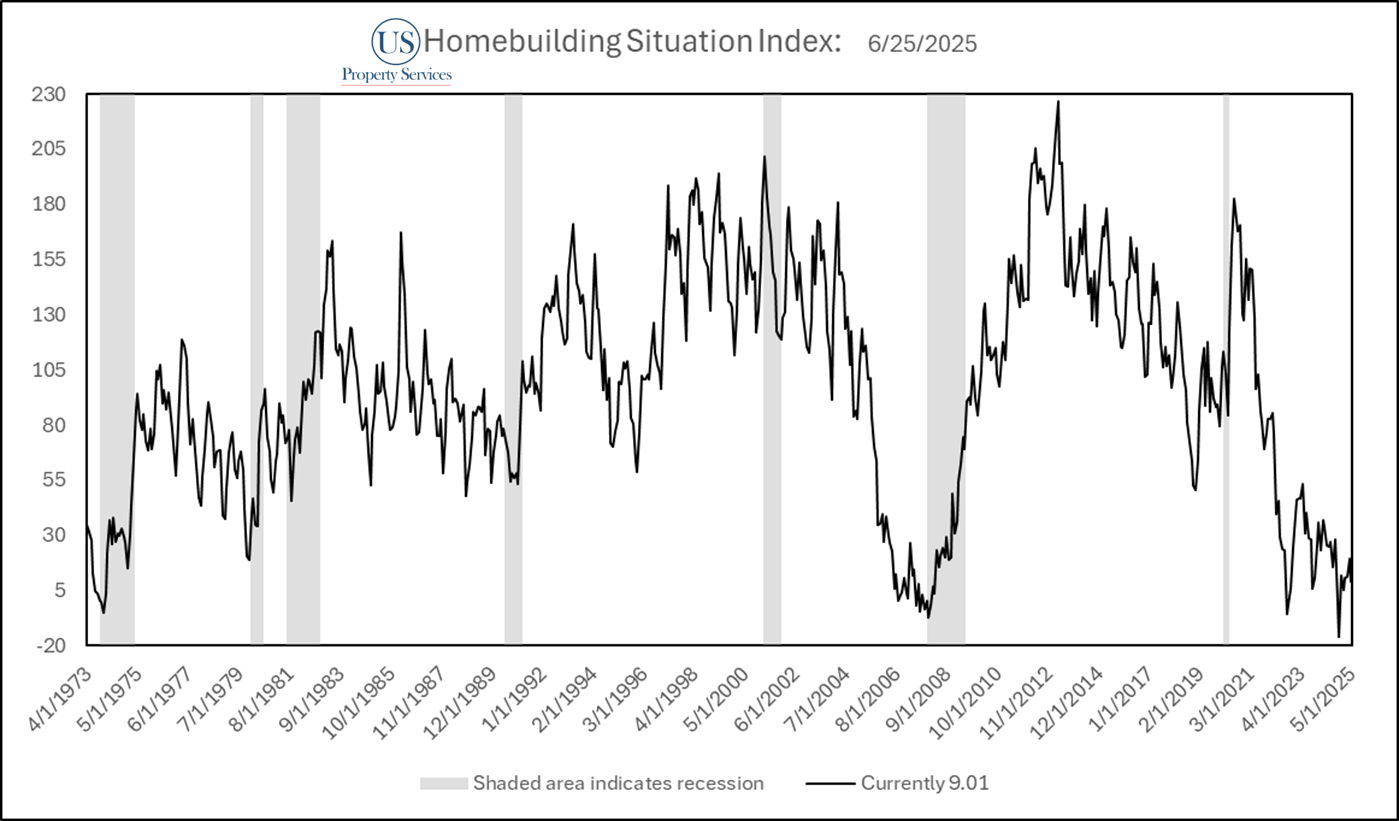

The Homebuilding Situation from May 2025 stands at 9.01 This is 90.99 points below the Average Situation for Homebuilders. The situation decreased by 10.21 points, or 53% from the prior month.

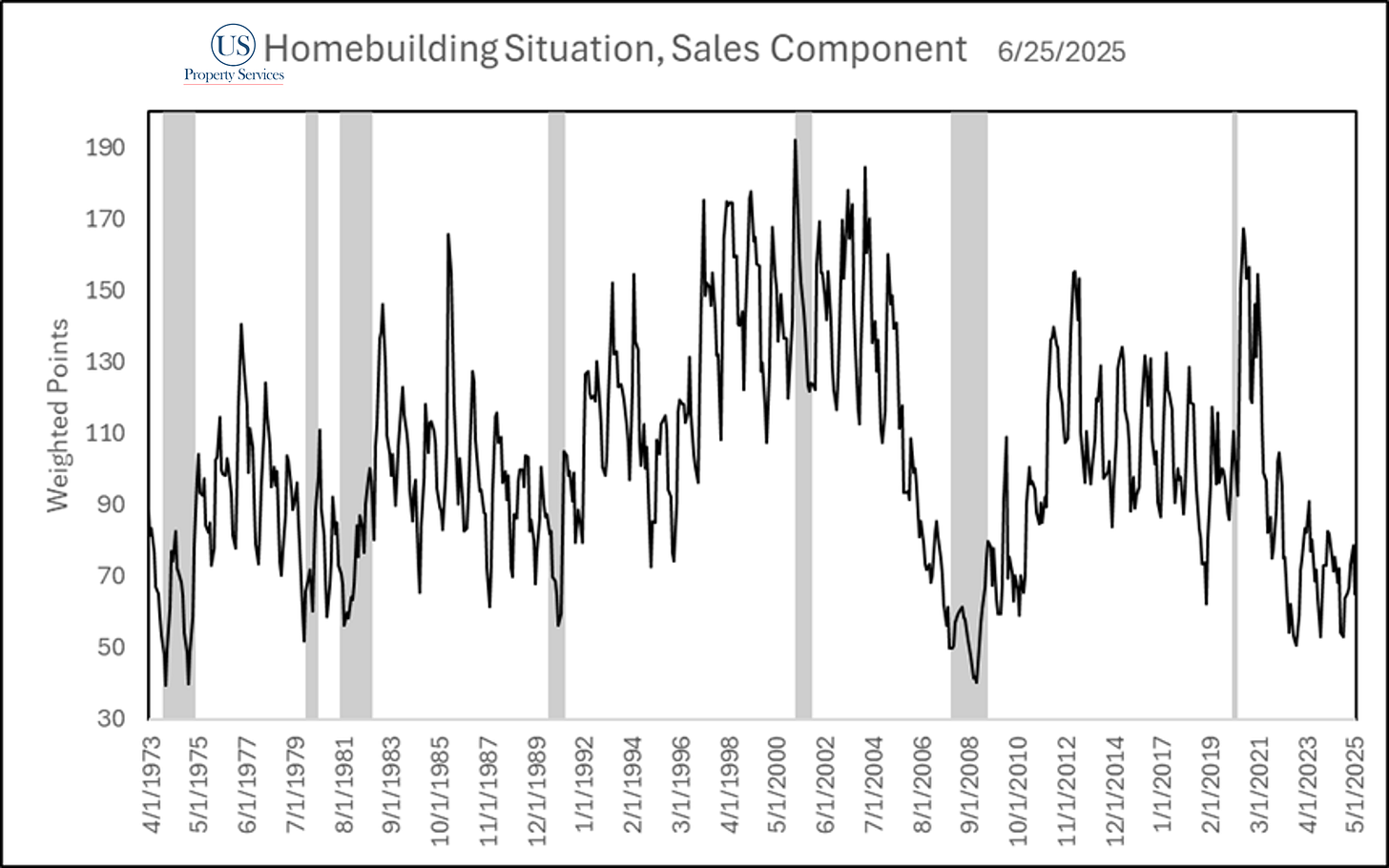

Sales

May sales fell to 56,000 units sold. 1,000 more than the average monthly sales rate across the last 52 years, a 22% decline month over month, and 9% decline year over year.

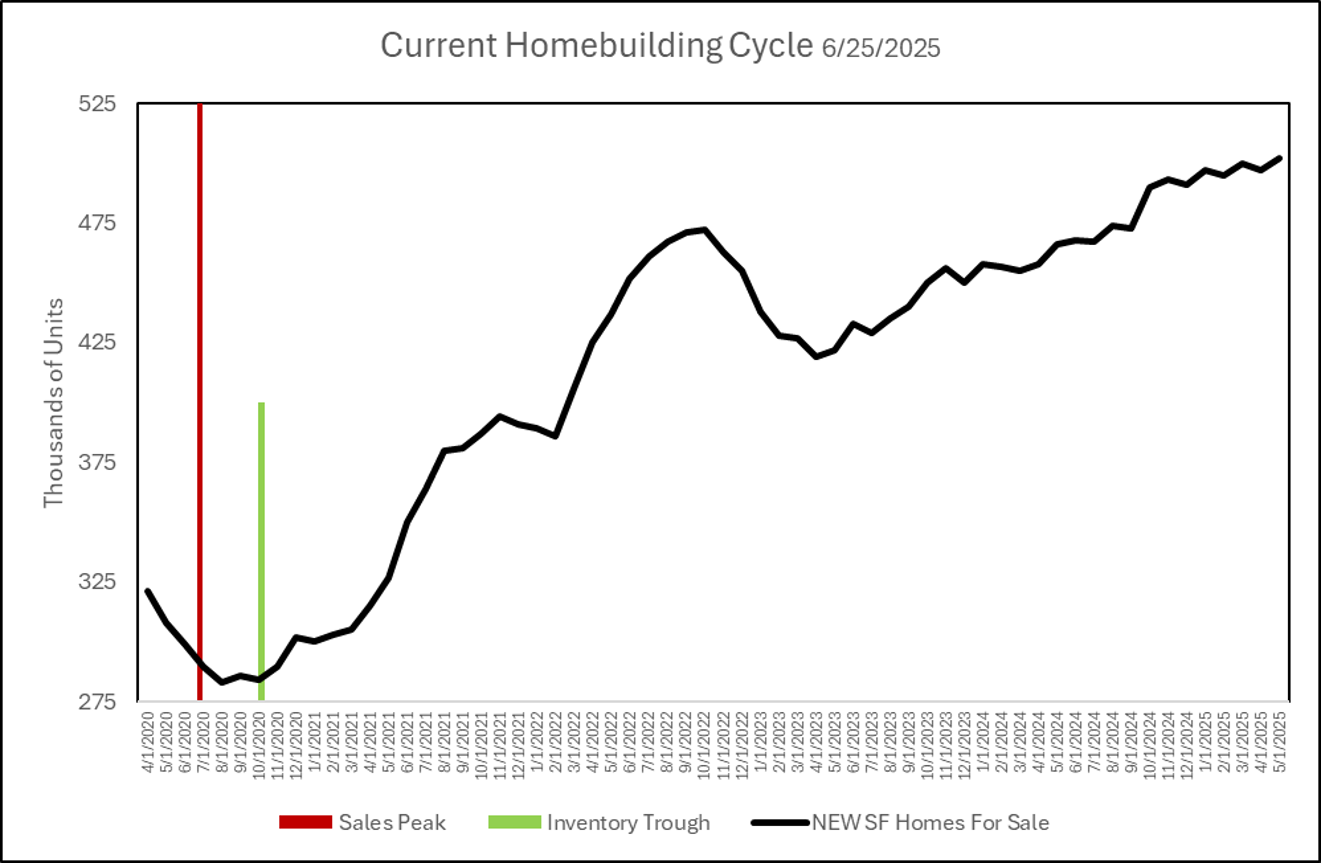

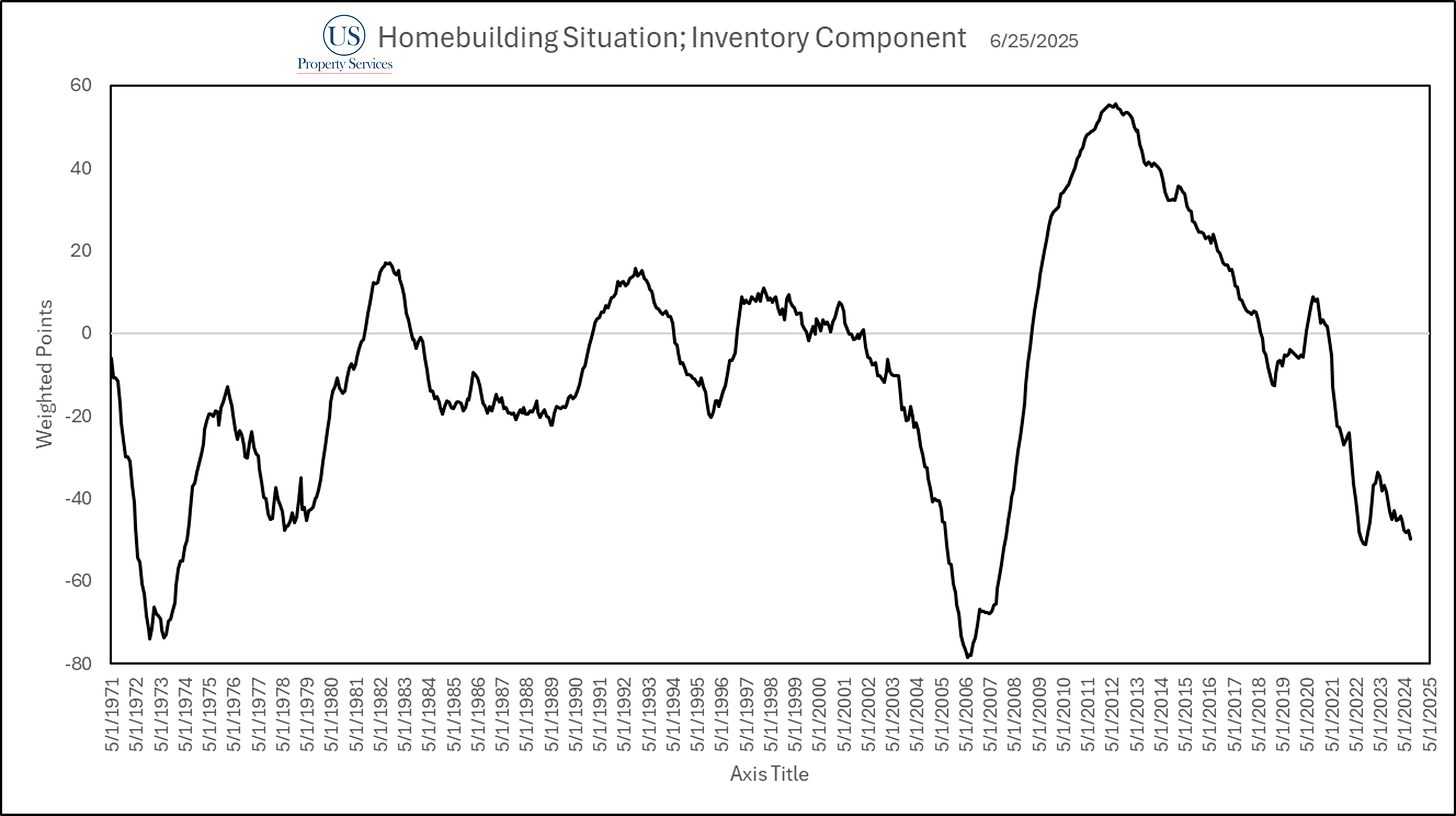

Inventory

There are 502,000 new single family homes for sale . Up 5,000 over the past month (revised). The past 8 months have been revised to remain between 490,000-502,000. Revisions of Note included revising inventory to 507,000 units for sale on a seasonally adjusted basis. The most inventory since November 2007, which saw 508,000 units for sale. It should be noted, this is currently the most inventory in recorded history outside of the two years from November 2005-November 2007. June 2006 was the peak inventory month at 570,000 units for sale. The current inventory is 88+% of that record. Sales do not include cancellation rates, which have been elevated this spring.

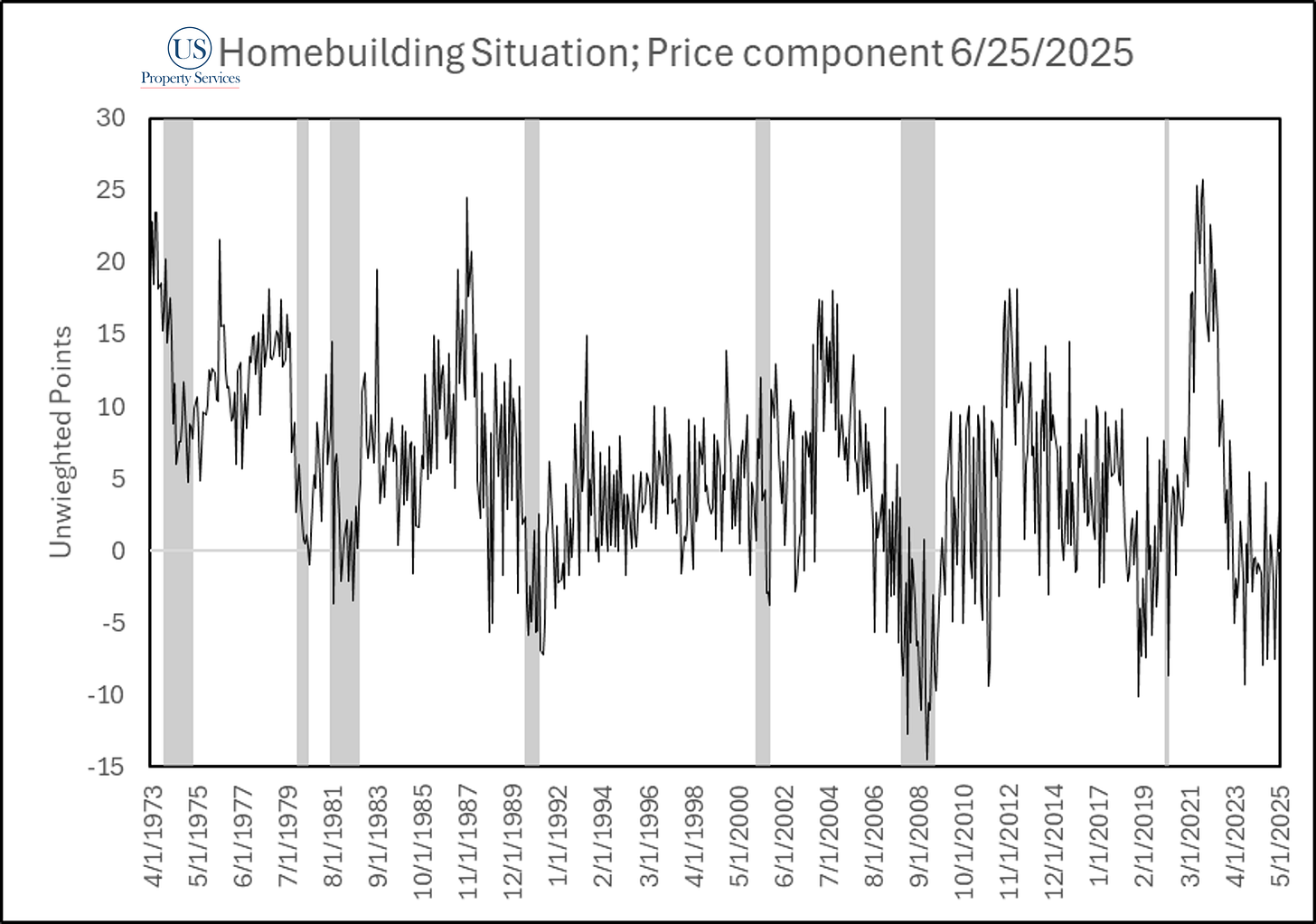

Price Direction

Median Sales Price increased year over year by 3%. The Median Sale Price for a New Home was $426,600, up month over month as well. The past 4 months received revisions to pricing.

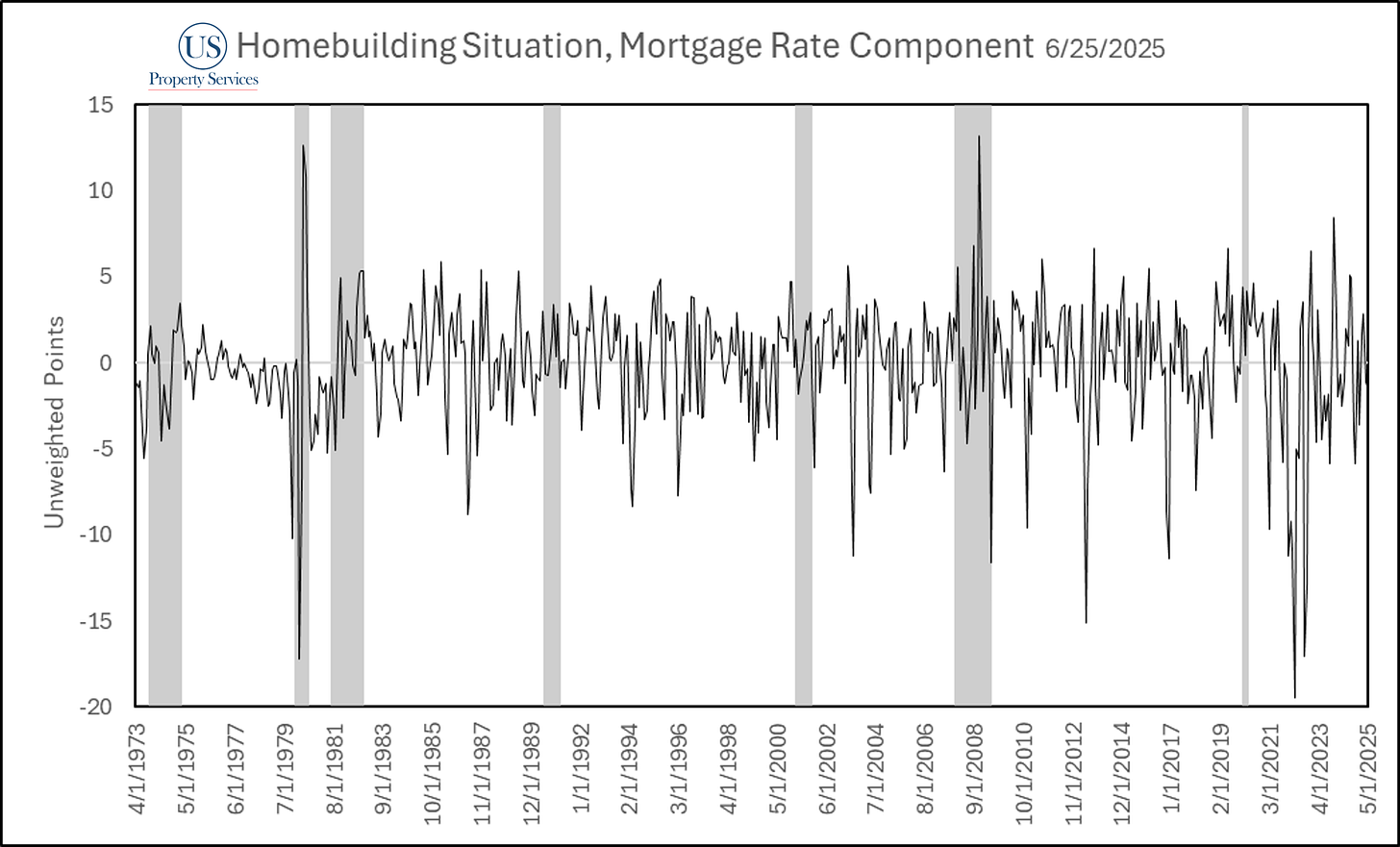

Mortgage Rates

Mortgage rate increased by 1.35% month over month. May’s average 30yr Fixed Mortgage Rate was 6.82%.

Additional Commentary:

The Last time we sat at this level of inventory, mortgage rates were 6.21%. vs 6.82%. The Median Sale Price in Nov. 2007 was $249,900 vs $426,600 (71% increase).

The Median Household Income in Nov 2007 was $50,230, at a 25% DTI ratio this left room for debt payment of $1,046. Or $175.36 monthly, short of safely paying for the Median Priced new home at the time. Nominally. In Real terms, the same borrower could cover $262 in excess of the principal and interest payment at 20% down payment.

In May 2025, the Median Household income is $80,610. Using the same DTI and down payments, the current median household is $556 short of covering the payment for the Median priced New Home. Or 25% short of being capable of making the payment.

Reverse engineering that payment structure, at current rates and prices, the Median Home price target for builders, to account for Principal, Interest, Taxes (at $3,012 according to CoreLogic) and Private Mortgage Insurance, the Median Price target for builders should be $288,522. or 32% below where it is today.

That’s all considering qualifying credit, and sufficient lack of other debt service payments required.

KB Homes and Lennar recently reported earnings, both have seen large declines in net income and margins, albeit taking different directions. Lennar is lowering prices, increasing sales and forsaking margin for the sake of continuing to grow their enormous footprint and maintain volume (sales cures all ills for business).

KB is cutting land acquisitions and saw price increases of 3%. Their sales decreased.

Q3 and Q4 have potential for large margin compression and layoffs, if conditions do not improve materially. Publicly traded builder earning report season is around the corner, the more debt service, and SG&A increase these builders face, the harder the situation will be for them. Even if the Homebuilding Situation improves.

A side note: Builders tend not to consider existing inventory competition. The target areas are either expansion in and of outer ring exurbs or master planned communities, with a smaller percentage of communities in longstanding suburbs, with a small footprint in CBD surrounding areas. Buyers however, may begin to see that differently if builders can’t meet payment terms favorable to buyers as they have. The race to cut seems to have begun.

He who cuts first, cuts best.

Today, FHFA Director Bill Pulte signed a directive to consider crypto assets for mortgage qualifications. In light of the cost burdens, and assets allowable to qualify the median household for a mortgage payment to buy these homes: Bitcoin does not solve this.

The research and method of the index can be found here: US Property Services