US Homebuilding Situation

Turns Negative to End Q2

Date: July 25th 2025

Time: 7:00am

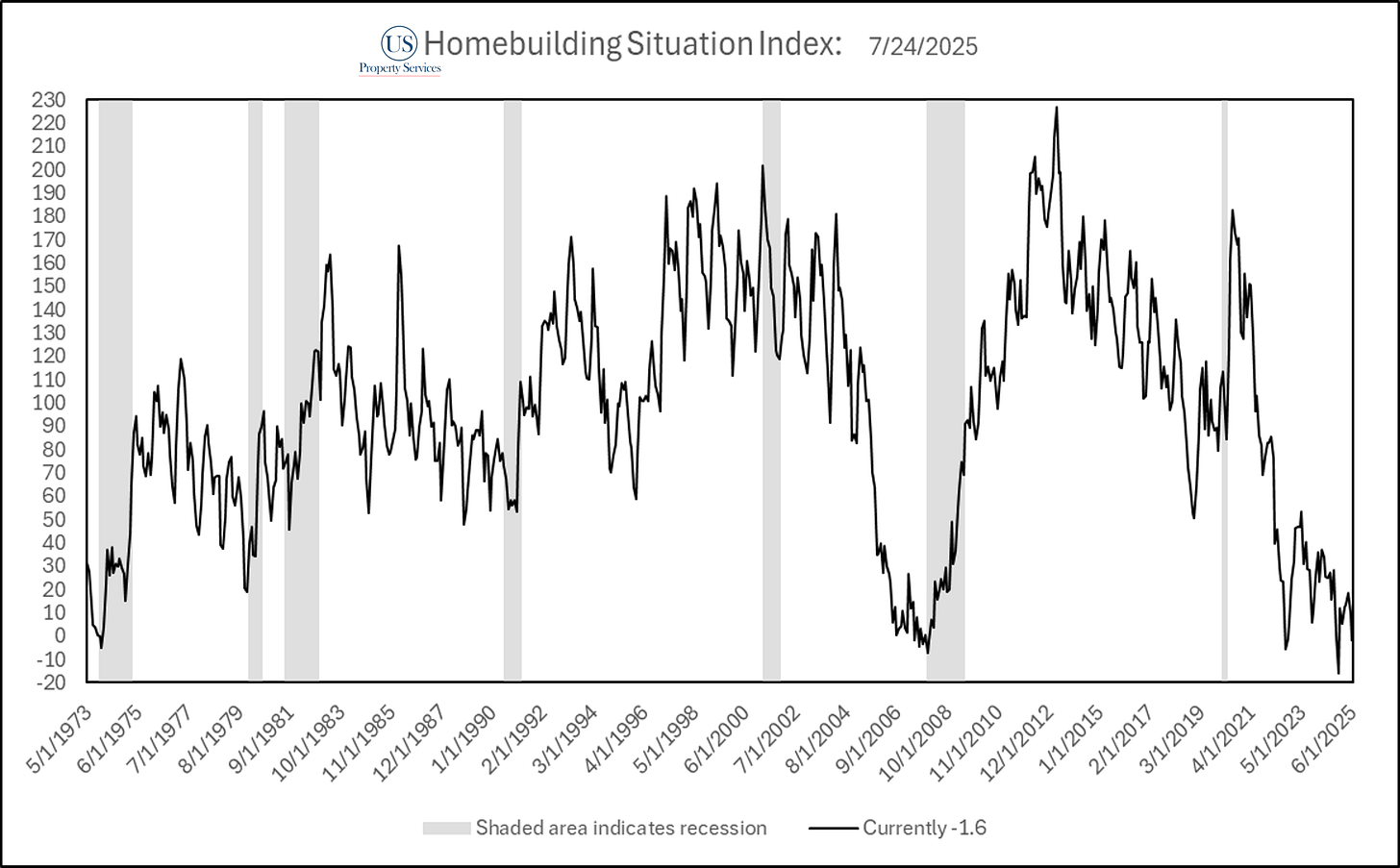

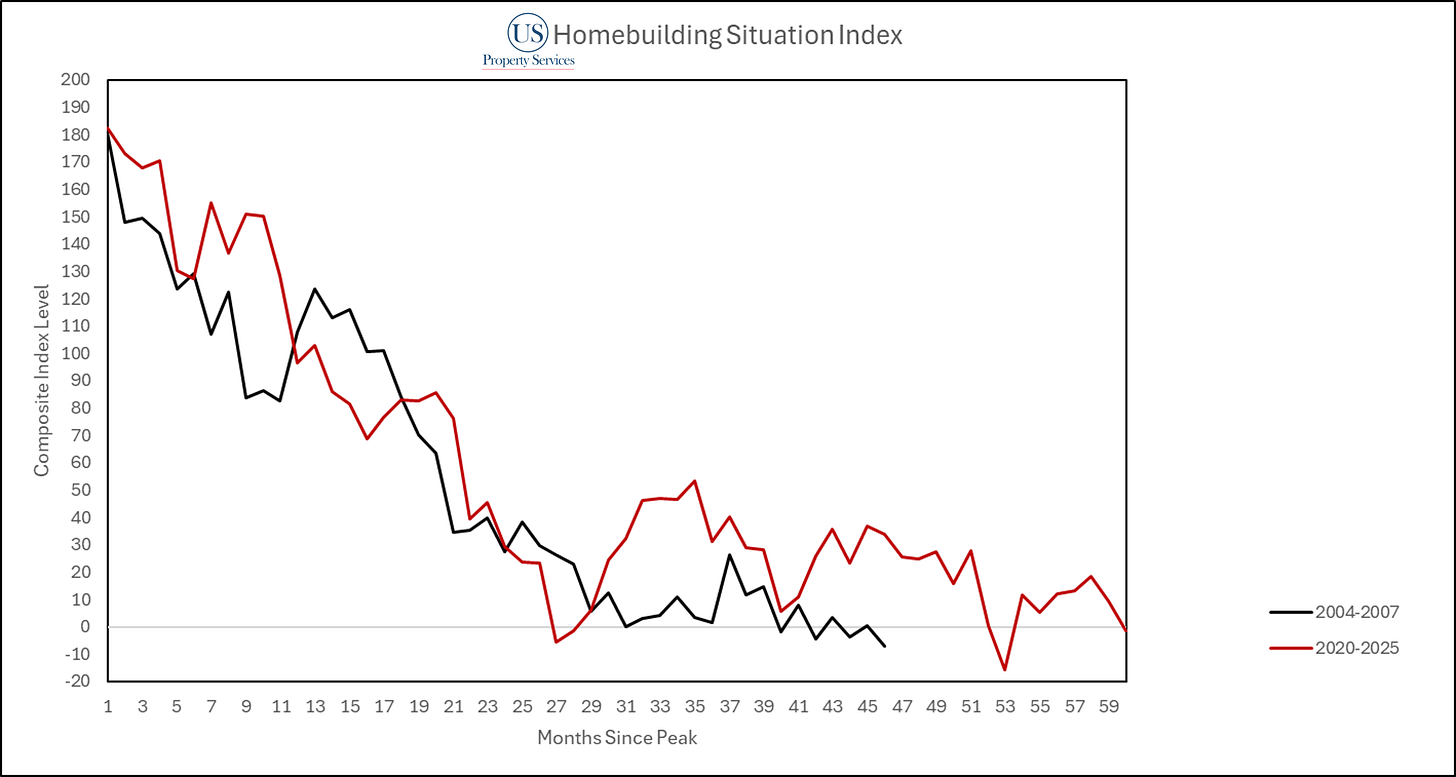

The Homebuilding Situation (Composite index measuring sales, inventory, price and mortgage rate direction change) from June 2025 stands at -1.6. This is 101.6 points below the Average Situation for Homebuilders. The situation decreased by 10.8 points. The current level stands among the worst recorded by the index.

This report contains builder earnings analysis as well as the index.

Sales

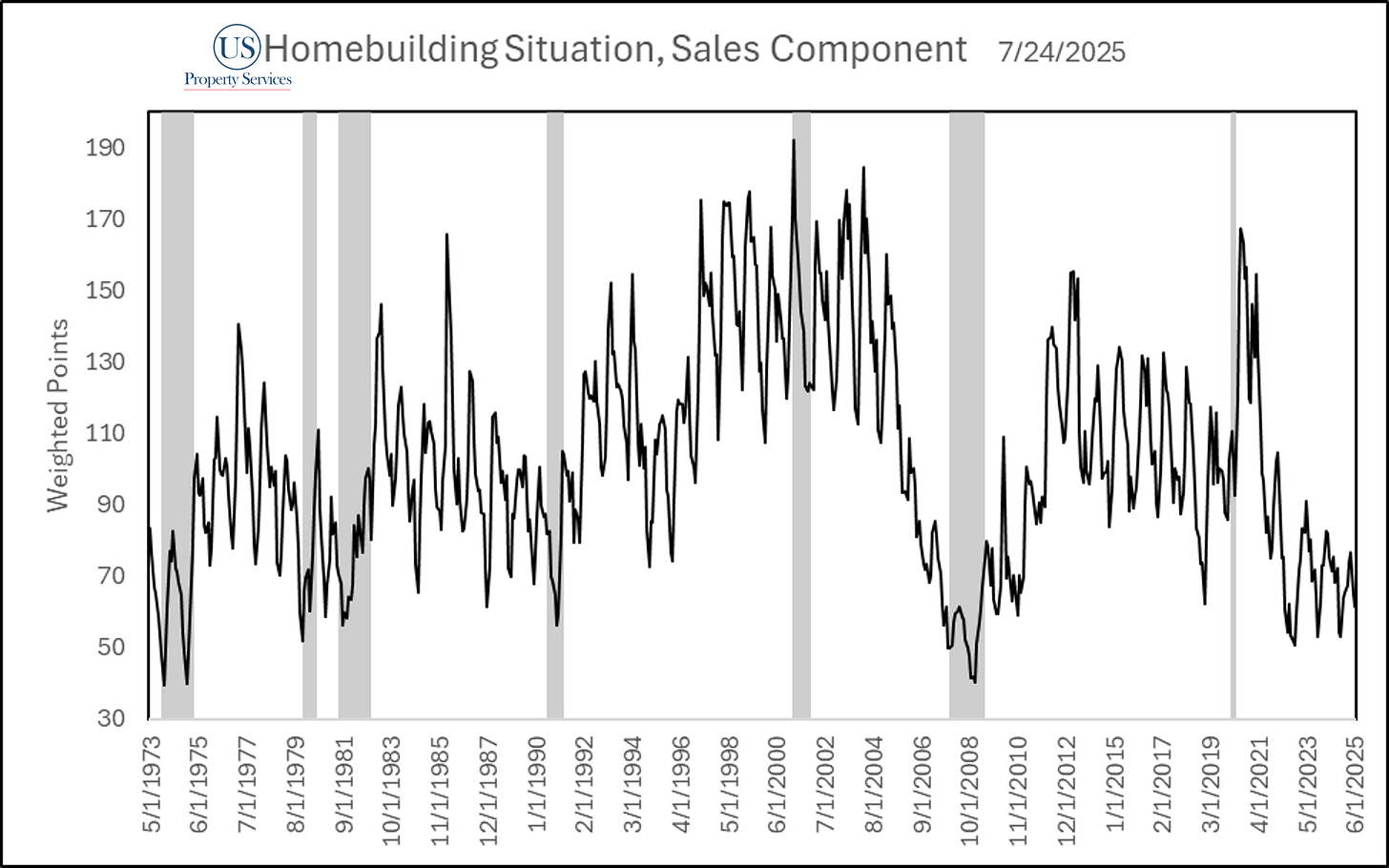

June sales fell to 54,000 units sold. 1,000 less than the average monthly sales rate across the last 52 years, a 3.5% decline month over month, and 25 point decline year over year.

Inventory

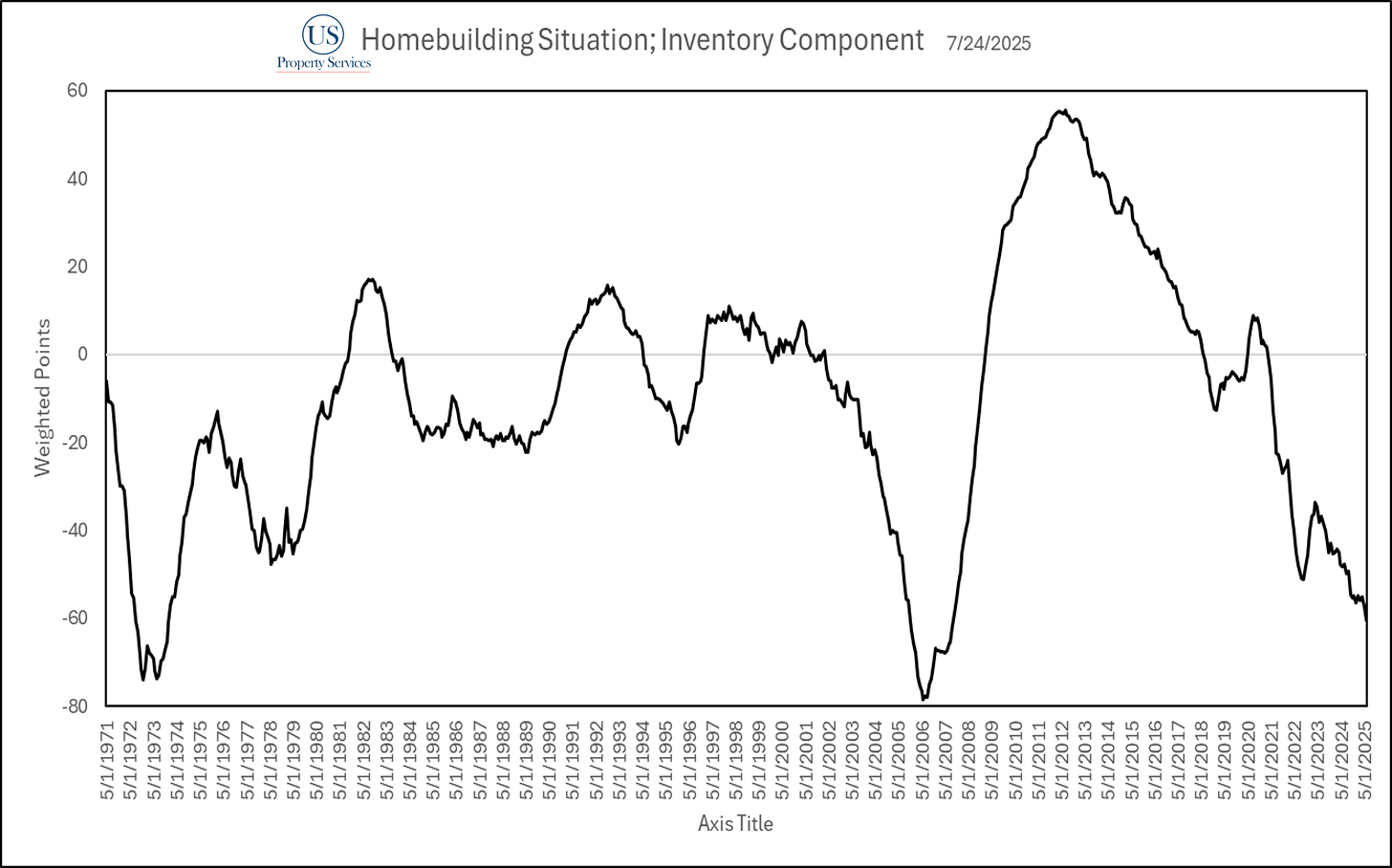

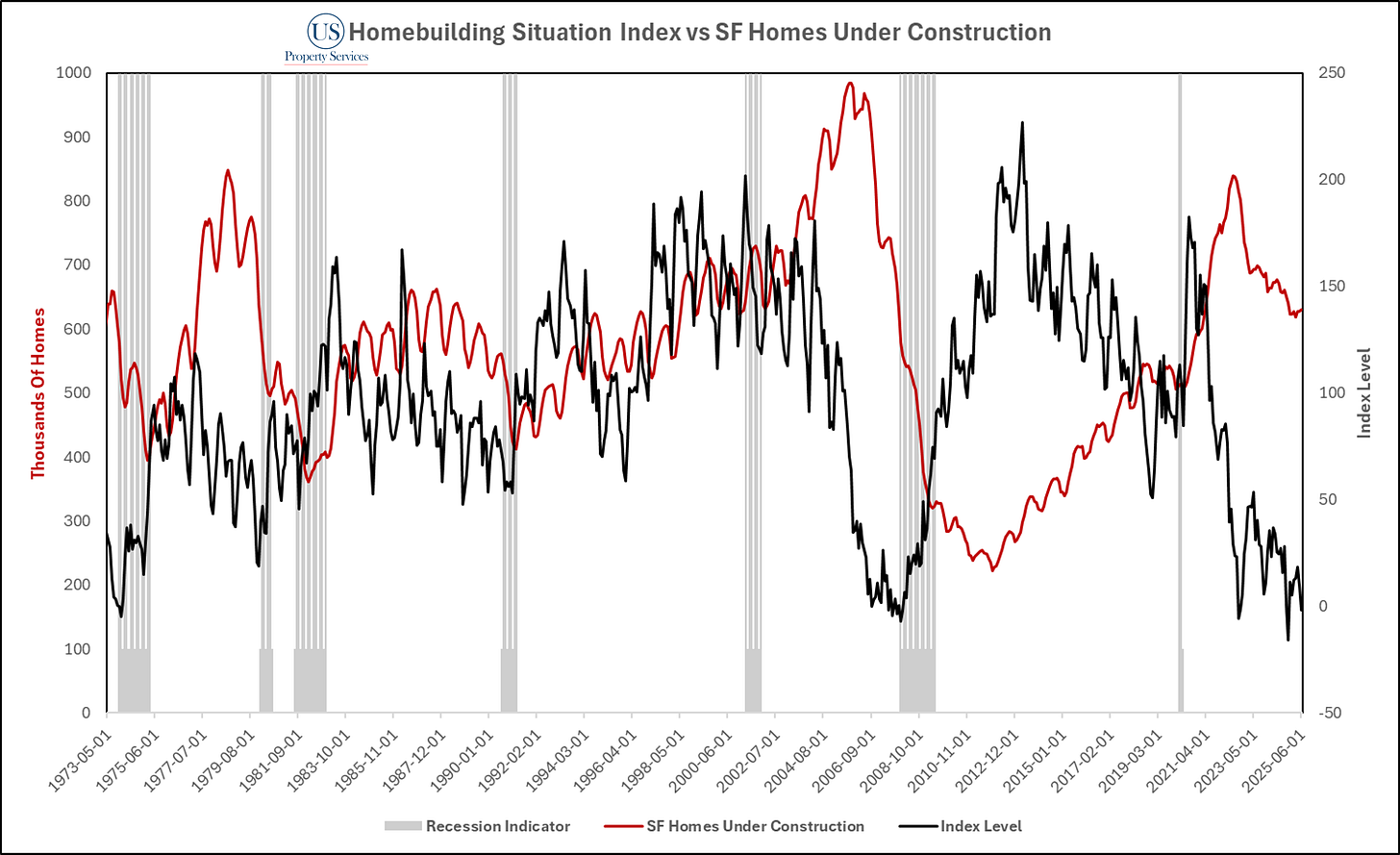

There are 511,000 new single family homes for sale . Up 10,000 over the past month (revised). The past 9 months have been revised to remain between 490,000-501,000. Of Note: inventory to 511,000 units for sale on both a seasonally adjusted basis and non seasonally adjusted basis. The most inventory since October 2007, which saw 518,000 units for sale. It should be noted, this is currently the most inventory in recorded history outside of the two years from November 2005-October 2007. This is one month in reverse to the prior matched high of November 2007. June 2006 was the all time peak inventory month at 570,000 units for sale. The current inventory is 88+% of that record. Sales do not include cancellation rates, which have been elevated this spring. Current “speculative” inventory, consisting of completed homes for sale and lots with specific permitted homes for sale have reached 89.6% of the all time record high. Said another way, there is currently less than 10.4% of inventory to hit market before matching the all time high of inventory available.

Price Direction

Median Sales Price decreased year over year by 2.9%. The Median Sale Price for a New Home was $401,800, down 4.9% month over month as well. The past 4 months received revisions to pricing.

Mortgage Rates

Mortgage rates increased by .02% month over month. June’s average 30yr Fixed Mortgage Rate was 6.82%.

Additional Commentary:

The Last time we sat at this level of inventory, mortgage rates were 6.38%. (Oct 2007) vs 6.82% in June 2025. The Median Sale Price in Oct. 2007 was $234,300 vs $401,800 (71% increase).

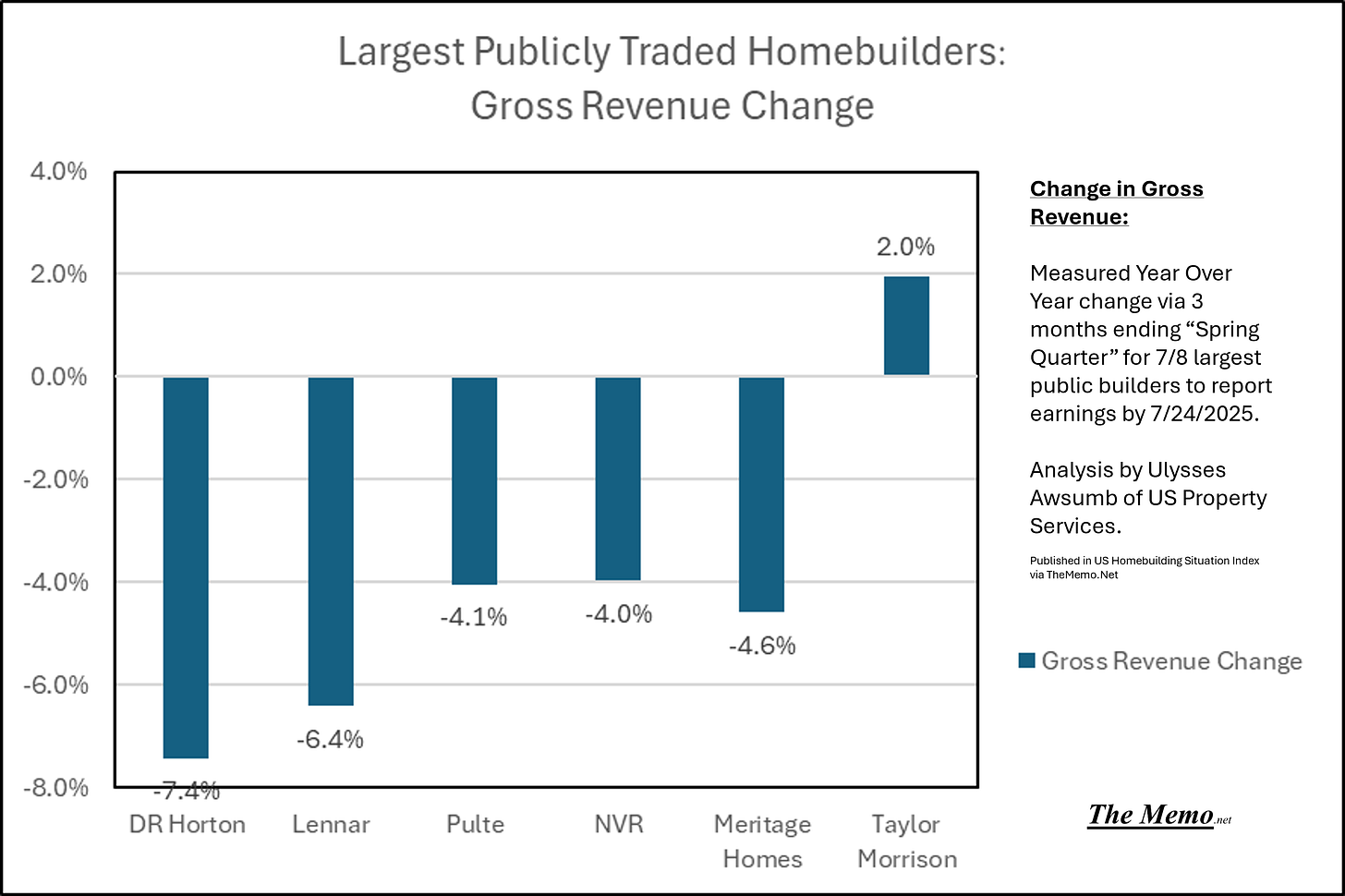

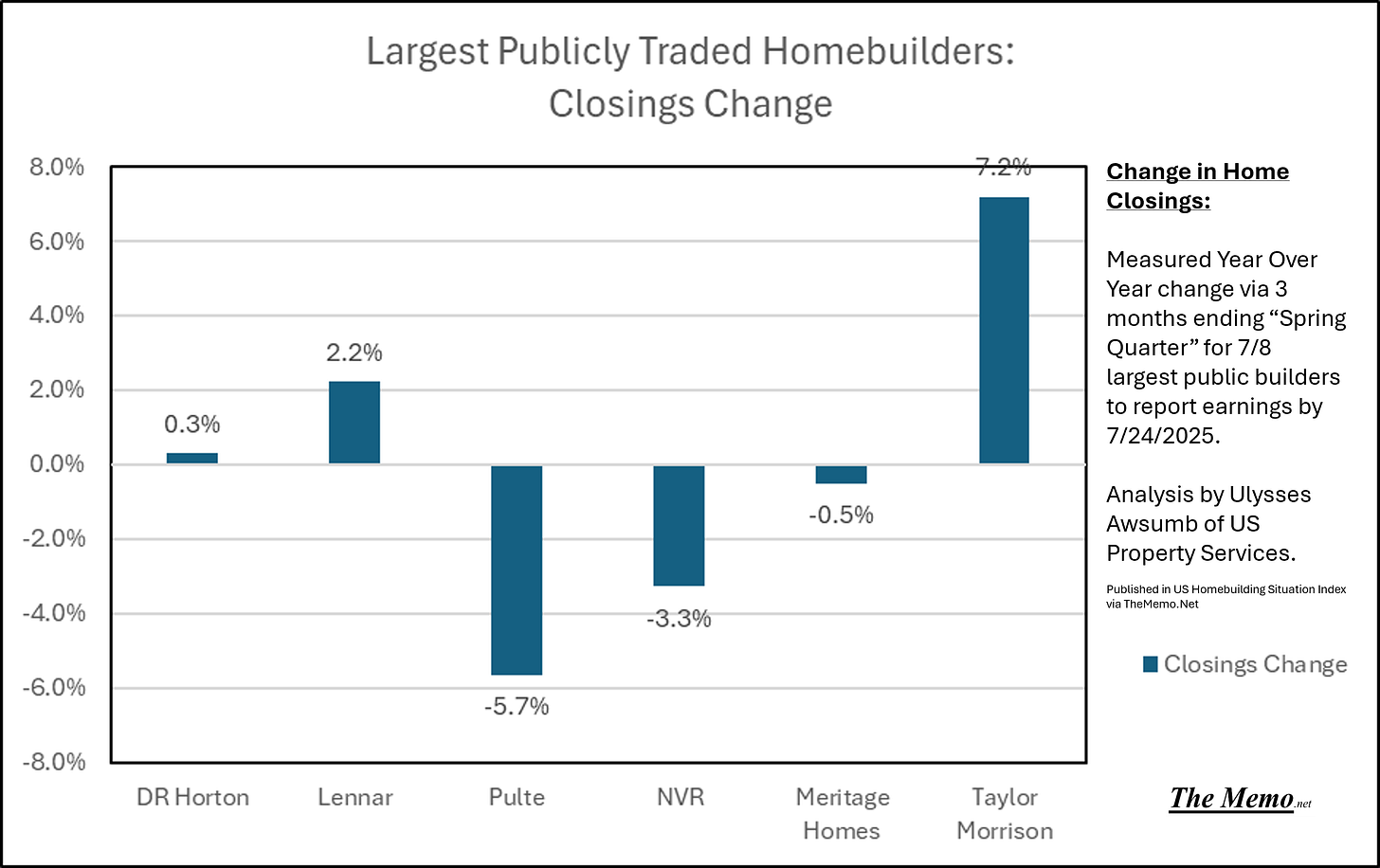

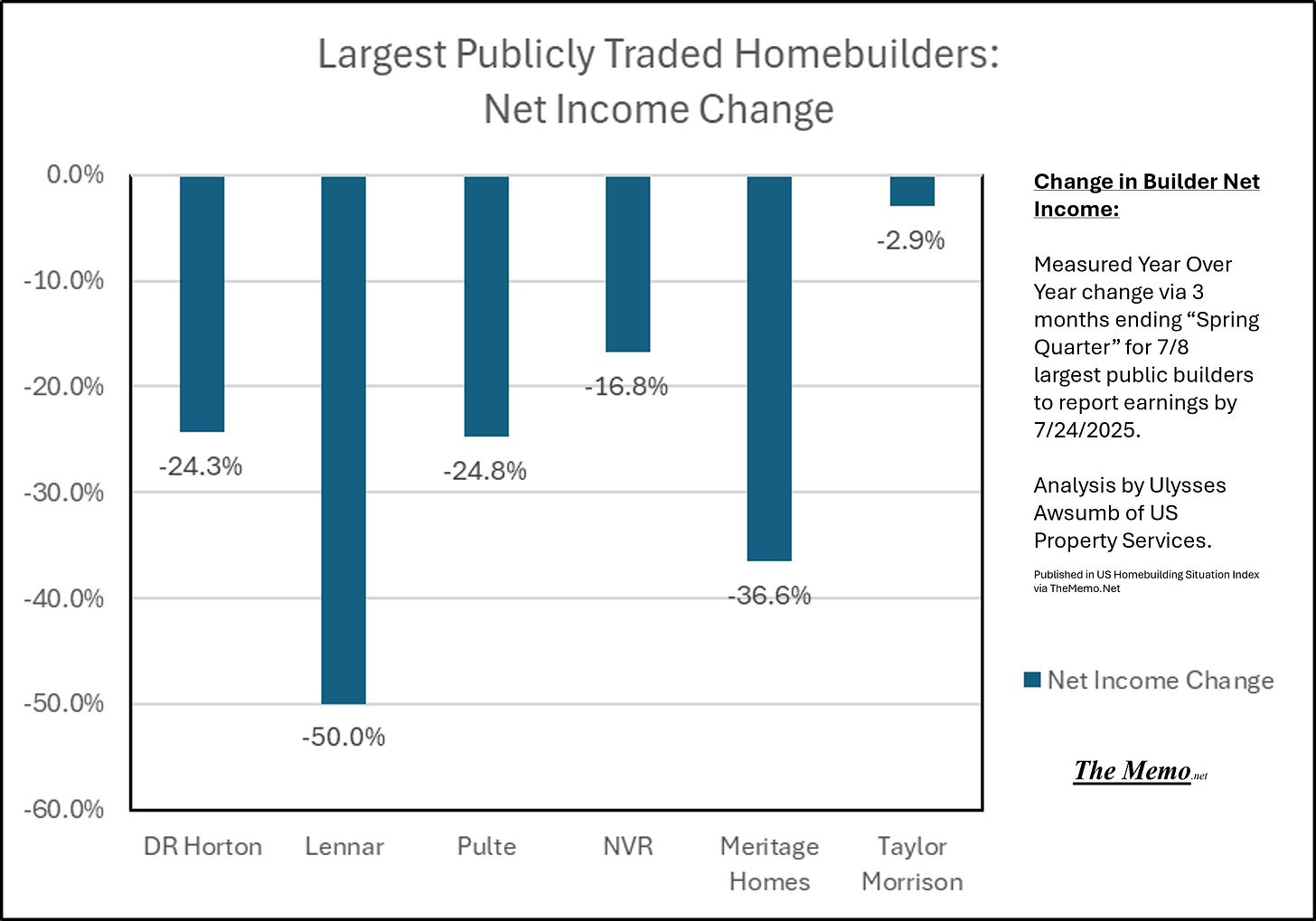

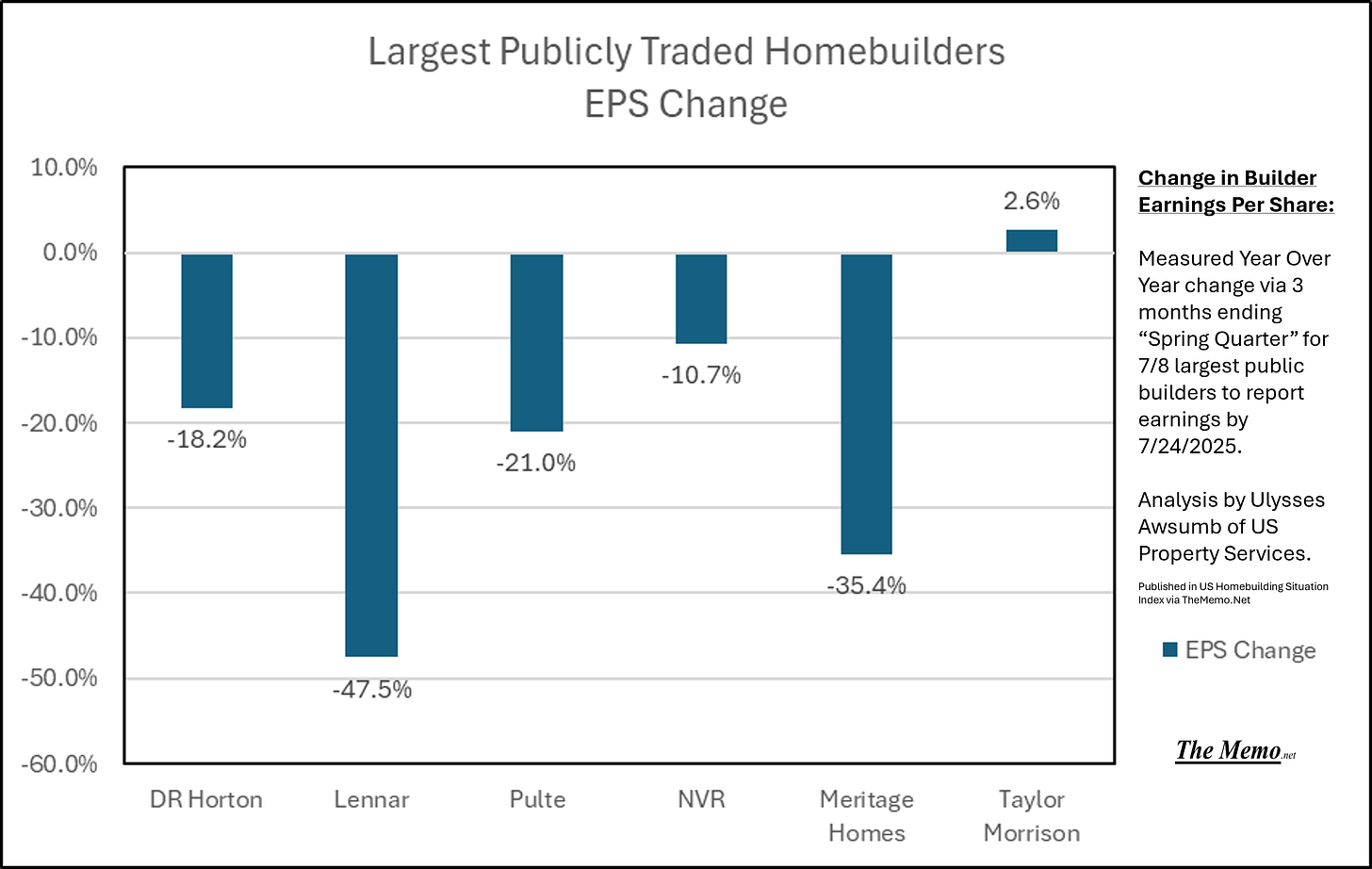

The end of Q2 2025 for 6 of the 7 largest publicly traded homebuilders to report earnings (less KB Homes) was particularly challenging financially. On a 3 months ending “Spring Quarter” Year Over Year basis:

5 of 6 Builders reported decreased Gross Revenue. #1 Builder by sales volume DR Horton saw the largest decrease.

3 of 6 reported declining closings (completed sales) for the Q with Pulte Homes fairing the worst and Taylor Morrison fairing the best

All 6 reported declines in Net Income. Averaging -27.3% declines. Lennar (2nd largest by closings) faired the worst at -50% decline, and Taylor Morrison faired best at -2.9% decline.

Earnings Per Share Declined on average -23.%. Lennar lead the declines at -47% while Taylor Morrison was the only builder to see an increase at 2.6%

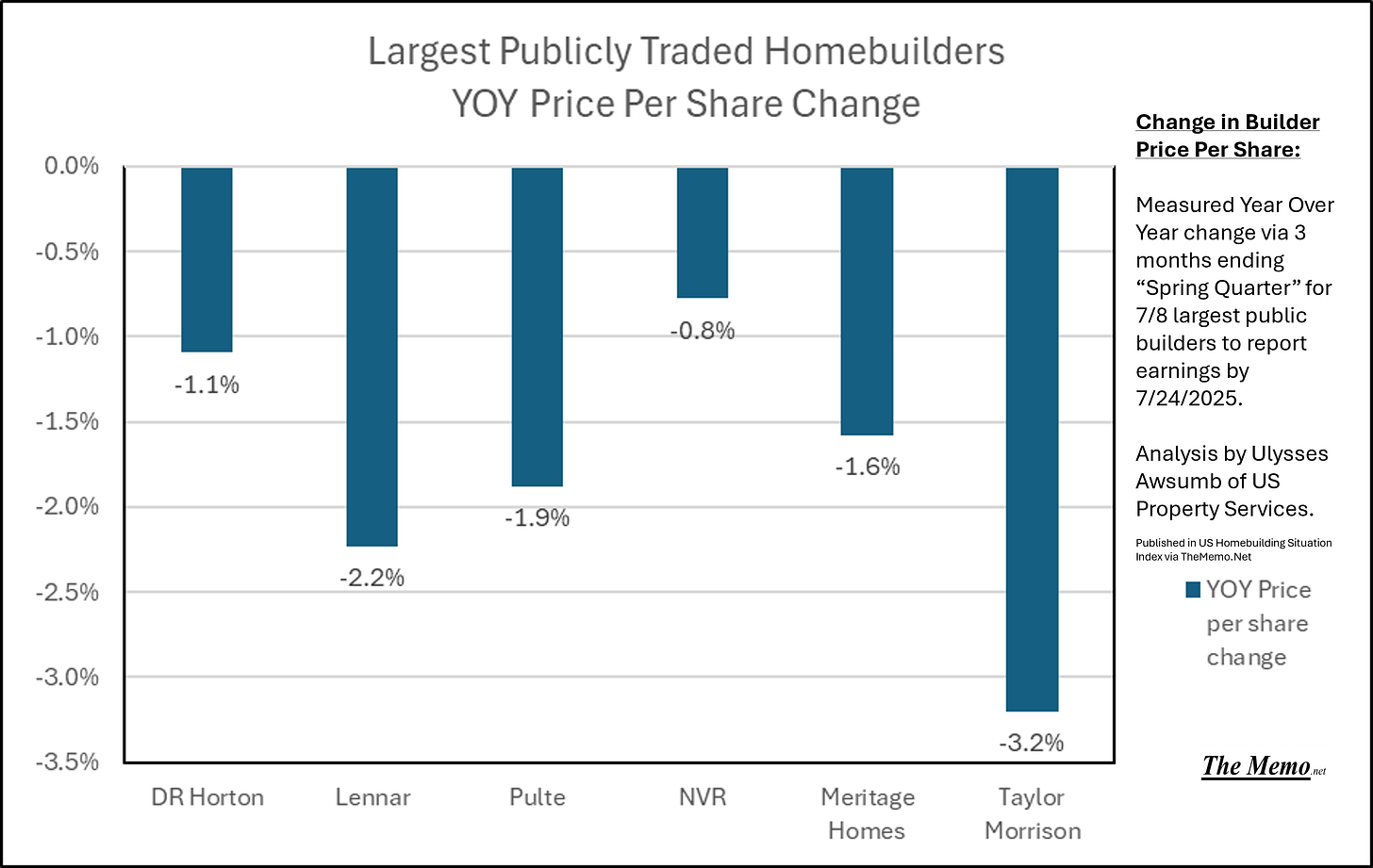

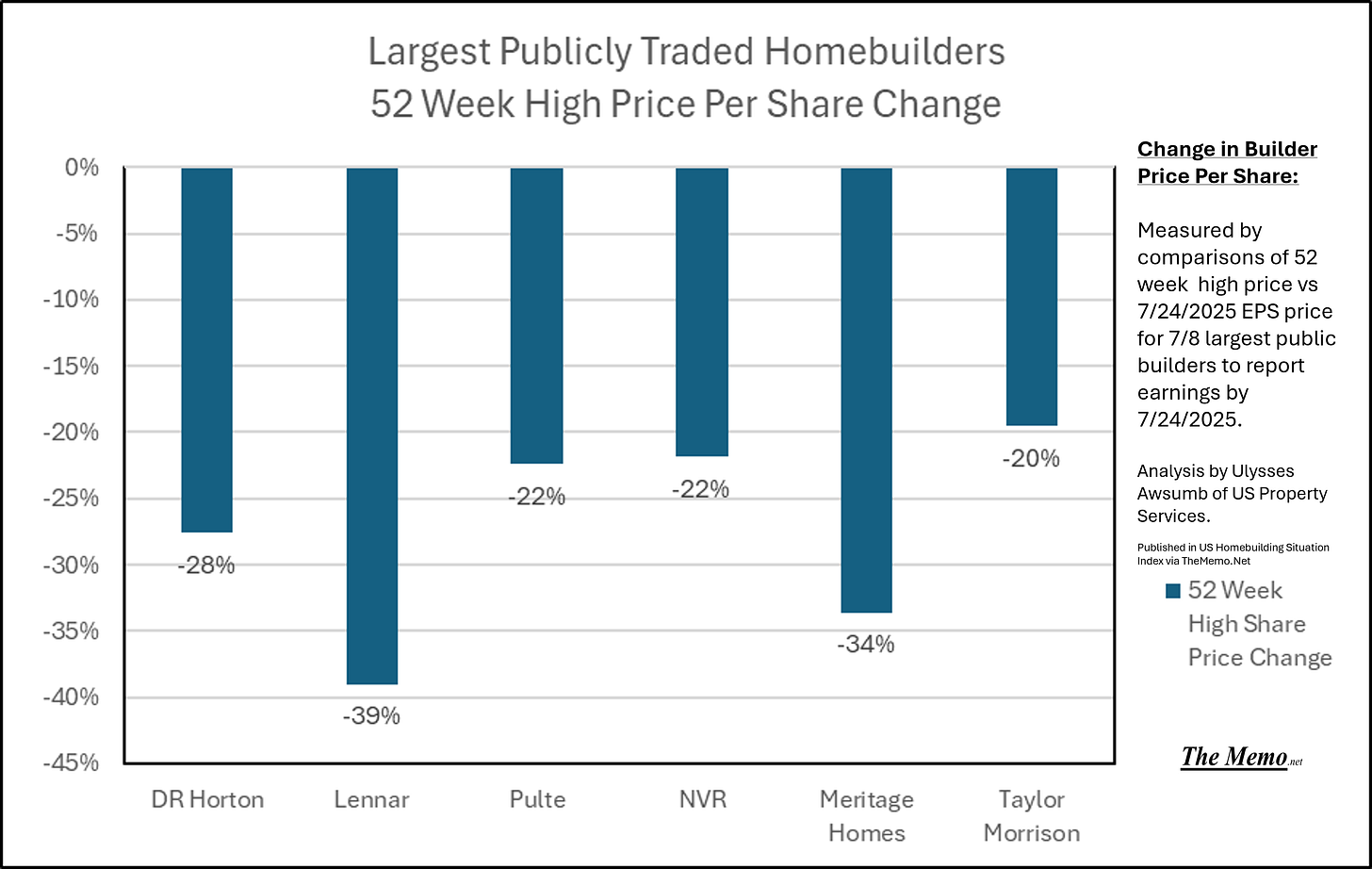

All 6 reported negative year over year share price changes. The worst being a -3.2% decline by Taylor Morrison. However when compared to the 52 week high share price, all 6 reported massive declines. Average decline was -27% per share price, while Lennar marked the worst at -39% from its 52 week high.

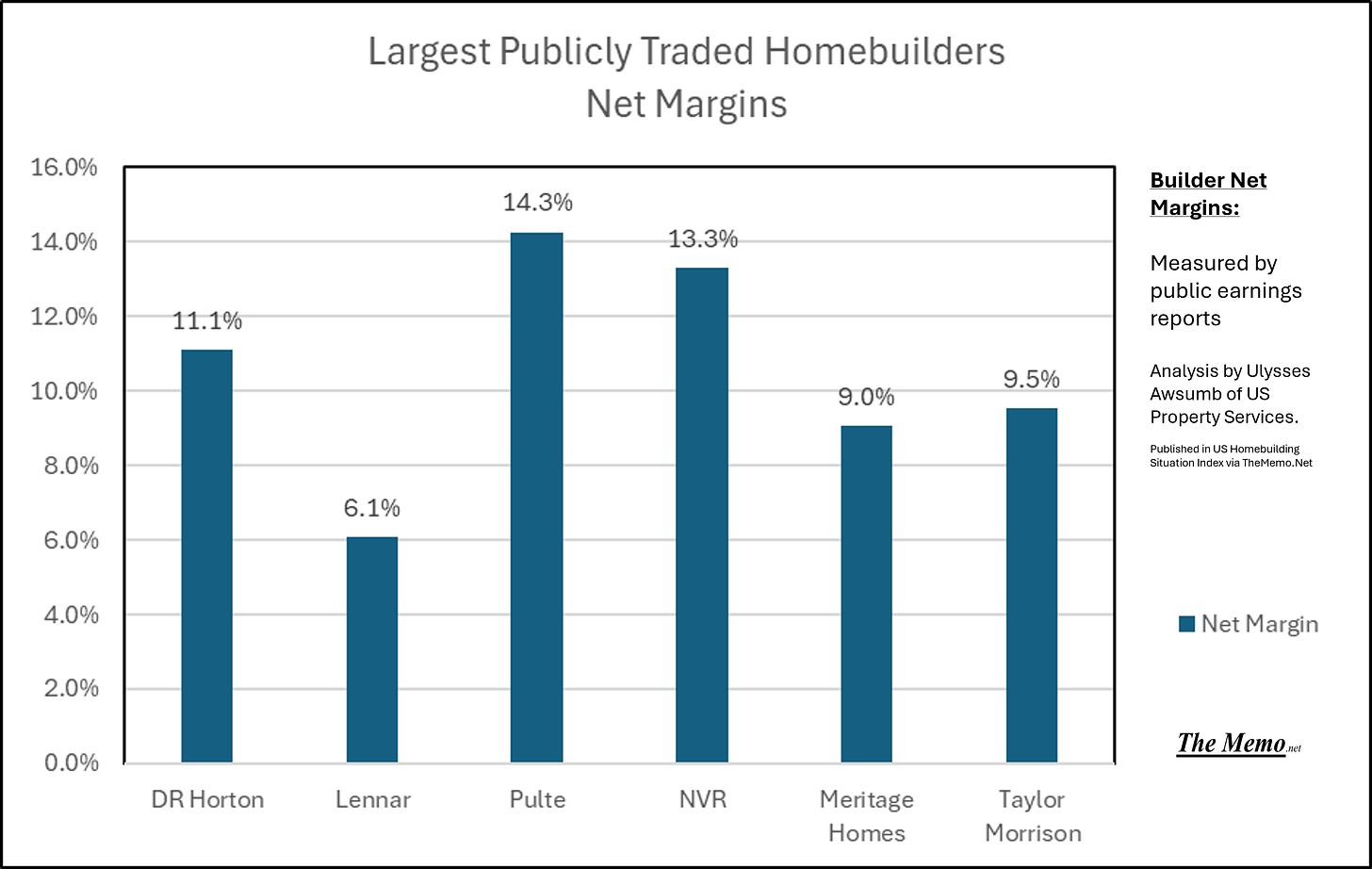

While much discussed, Gross Margins are a relatively useless metric outside of setting pricing for Goods and Services sold. Net Margins however, represent an accurate depiction of what percent of revenue, a company retains as actual earnings. To that end, all 6 reported Net Margins under 15%. 3 of 6 under 10% with Lennar, the 2nd largest builder in the country, posted a 6.1% net margin.

Every 1% increase of SG&A (Selling, General and Administrative cost) as a percent of Gross Revenue is equal to an average of 11% decline in Net Income based on current Quarterly reports.

All 6 bought back shares en masse during the Quarter.

Earning Report Quotes

Meritage Homes -4.6% Gross, -36.6% Net Revenue

We were able to navigate the challenging selling conditions despite elevated mortgage interest rates and weakened consumer confidence," said Steven J. Hilton, executive chairman of Meritage Homes. "We believe our go-to market strategy of move-in ready inventory will allow us to remain competitive in the changing environment and focus on growing market share."

-Steven J. Hilton, Executive chairman of Meritage Homes

Pulte Homes -4.1% Gross, -24.8% Net Revenue

“Over the course of the 2025 spring selling season, we saw consumers dealing with a range of issues from high interest rates and challenged affordability to macro concerns about the strength of the economy. We are encouraged, however, by the positive consumer response we saw to the pullbacks in interest rates in late June and at times earlier in the year.”

-Ryan Marshall, President and Chief Executive Officer of PulteGroup.

Lennar -6.4% Gross, -50% Net Revenue

"While we continue to see softness in the housing market due to affordability challenges and a decline in consumer confidence, we adhered to our strategy of driving starts, sales, and closings in order to build long-term efficiencies in our business."

"Reflecting softer market conditions, our average sales price, net of incentives, declined to $389,000. As mortgage interest rates remained higher and consumer confidence continued to weaken, we drove volume with starts while incentivizing sales to enable affordability and help consumers to purchase homes.”

-Stuart Miller, Executive Chairman and Co-Chief Executive Officer

DR Horton -7.4% Gross, -24.3% Net Revenue

“New home demand continues to be impacted by ongoing affordability constraints and cautious consumer sentiment. We expect our sales incentives to remain elevated and increase further during the fourth quarter, the extent to which will depend on the strength of demand during the remainder of summer, changes inmortgage interest rates and other market conditions.”

-David Auld, Executive Chairman

NVR -3.3% Gross, -16.8% Net Revenue

“The cancellation rate in the second quarter of 2025 was 17% compared to 13% in the second quarter of 2024. Settlements in the second quarter of 2025 decreased by 3% to 5,475 units, compared to 5,659 units in the second quarter of 2024.”

NVR Press Release: unattributed

Taylor Morrison +2% Gross, -2.8% Net Revenue

"In the current sales environment where competitive pressures, especially for spec homes, have intensified, our overall bias between pace and price leans more heavily towards price, and ultimately margin and returns, given the value of our attractive land positions, desirable communities and discerning customers. We continue to believe that our strong emphasis on working with each customer—hand in hand with our Taylor Morrison Home Funding team—to personalize incentives is the most effective way to create value for both our buyers and our company. The success of this approach is evident in our home closings gross margin," said Palmer.

Palmer continued, "Taking a step back from the current sales environment, we believe the need for affordable, desirable new construction remains intact across our markets of operations given the aging of the population, migration patterns and evolving buyer preferences.”

-Sheryl Palmer

At some point, even Taylor Morrision will have to choose one: margin or sales volume. Gross Increase and Negative Net is still: Net Negative.

Based on US Household Median Income, the threshold to meet half the potential market of buyers, at current mortgage rates, Median Sales price target is $280-300,000 maximum, on a national basis.

August and September have a chance to bounce slightly given historic patterns for the Situation Index, though without signifigant changes, Q4 in 2025 could be worse than Q4 of 2024, which set a record low.

The research and method for the index can be found here: US Property Services

Charts

Sources:

US Census Bureau: Survey of Construction; New Residential Sales

Freddie Mac Primary Mortgage Market Survey

Public Builder Earnings, 10-Q/Press Releases/Quarterly Presentations

US Property Services (All Rights Reserved)

Analysis by Ulysses Awsumb