Tuesday Night Memo

50 Fu...EFFing Years

The Memo:

To:

My Fellow Americans

Re:

Housing Debt: The days are long but the years are short.

Comments:

We are all more blind to what we have than to what we have not

-Audre Lorde

End Memo.

I don’t even know what street Canada is on. - Al Capone

The Report

This past weekend, the nation received word (via Xtwitter) that preparations for 50 year mortgages were underway as a solution to the “affordability crisis” (funny how the “shortage crisis” doesn’t really exist anymore.

The online outrage was swift. The “defense” to the public outcry was:

“People sell their homes on average after 10 years…..it doesn’t create a debt problem”.

The truth (all of it), is that this notion of extending mortgage debt doesn’t help anyone. Not even the future loan originators and home brokers.

Since no one else (to my knowledge, which I acknowledge is not omnipotent) has bothered to produce a financial reply, I thought I’d do so here and now.

The Situation

If someone were to purchase a “median” home in today’s market, and close on December 1st 2025, we can actually forecast the (relatively) precise valuations associated with their purchase money mortgage and cash at closing in 10 years.

We can even compare them across 50 vs 30 year loan terms. Caveat Emptor: This is only regarding the purchase of a house to live in.

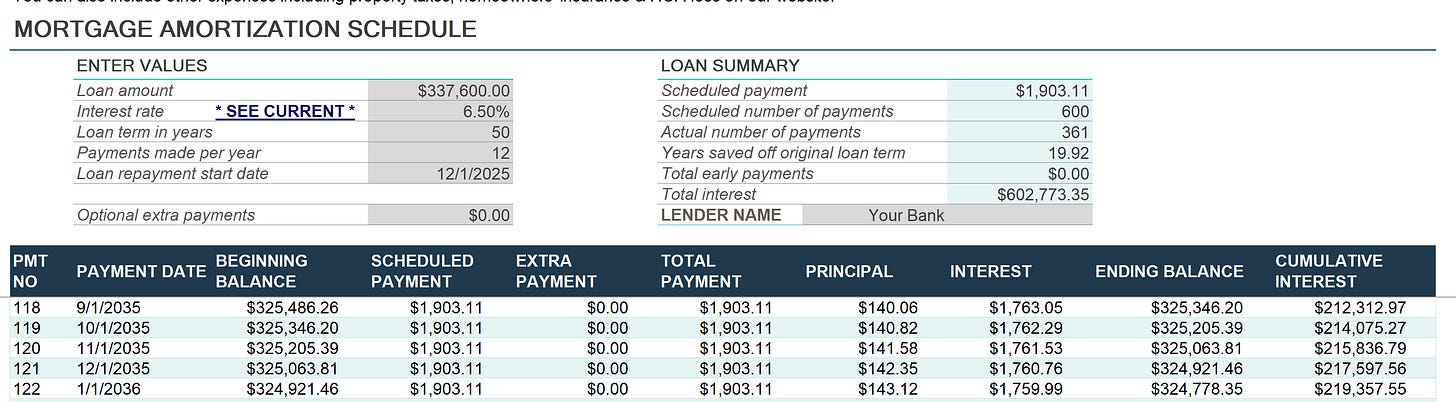

Here’s a pair of amortization schedules: 50 vs 30 year:

Now looking forward 10 years to selling the home in 2035, we can apply the 36 year average home price “appreciation” rate of 2.15%, as measured by the median sale price of an existing home since 1989, tracked and published by the National Association of Realtors, and calculate the costs and returns associated with a sale price of $519,00+ in 2035.

The results aren’t great.

The ending loan balance at 10 years, for a 50 year loan is higher.

The interest paid is higher.

The cash at closing is less

The cost of money borrowed (purchase money) is higher

The principal and interest paid by the closing date is higher. By $50,000. or roughly $6,000 more than the down payment applied. Yikes.

But we can even measure this in “rates of return” on “forced savings” of said mortgage. Another familiar quip from those who know no maths.

Diminishing Returns

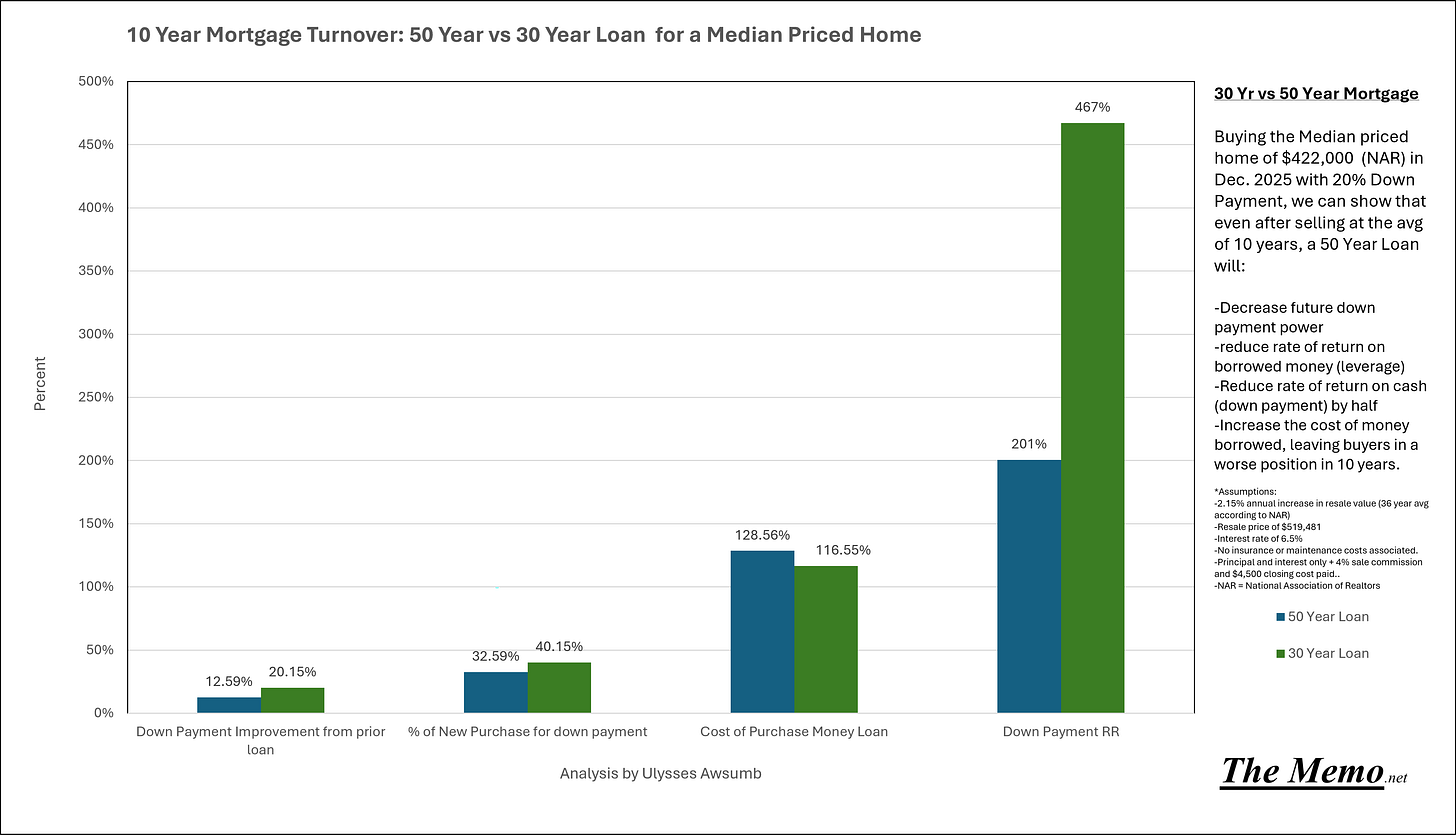

There’s multiple ways of looking at the situation, financially speaking. Gross dollars is one. Percentage return on initial investment (especially for your cold, hard earned, cash).

So let’s take a look. I’ve used the same metrics to look forward, but included sales commissions (at 4% split however you choose) plus $4,500 in closings costs (very conservative) to cover taxes, proration etc. etc. etc.

What becomes evident:

Future down payment ability is reduced after debt settlement in 10 years

Closing results in fewer dollars and percent of future necessary invested down payment %

Cost of the purchase money loan outweighs the initial invested cash returns

The rate of return on 20% cash down payment is cut in half.

All to save $230 per month, under the (maybe) misguided assumption that a 50 year loan would have the same interest rate as a 30 year loan. Which is about the equivalent of “not drinking Starbucks + canceling Netflix + canceling Amazon”. I’m sure that’ll improve home sales from 30 year lows.

So clearly, this isn’t “it” for home buyers. What about lenders and originators?

If cancelling netflix, amazon and starbucks is enough to meaningfully improve the current 30+ year low in home sales, we have much bigger problems than term extensions of 20 years to the debt burden. And if that instant gratification problem (allegedly) from buyers is causing lenders to “suddenly cry out in terror” at the lack of sales volume, imagine the shortsighted instant gratification implications on future sales.

Future implications

If current buyers, have less money to put down on future transactions at the “average” ten year hold of current mortgages, how will that improve their ability to qualify and pay for the next loan?

If current extension terms, only save the equivalent of $230 per month (again under the misguided notion the loan rate will be identical, despite the 20 year (240 extra payments), how does this help the other “loan growth” metrics that require some form of “discretionary” income”

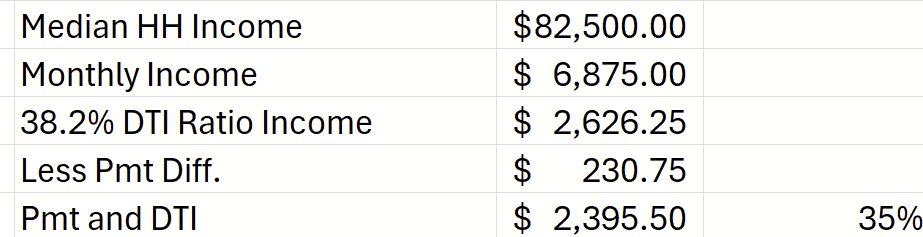

Current FNMA (Fannie Mae) debt to income (DIT) ratios are at 38.2%. Meaning 38.2% of the average buyers income goes to paying the debt service on their home. (only other time this happened outside of 2023-2025 was 2005-2007)

Using the Median Household Income in the U.S., of $82,500, lowering the payment $230.75 brings the DTI ratio down to 35%.

I’m sure that’s gonna solve the lack of qualifying mortgage applications.

By the by: Housing and Urban Development (HUD) defines “affordable” as 30% DTI on a monthly basis.

LOL

-Me, Myself and I

Not only does that keep the DTI 10% above the current lending “standard” DTI, the future outlook leaves buyers with less down payment, higher principal paydown at closing, which furthers risk THAT WHICH SHALL NOT BE NAMED or “negative equity” (because of course I’m going to say it out loud) becomes a reality, and thereby reduces even more sales opportunity, which would necessitate a higher risk premium than the 30 year loan rate, which was the entire point of the 50 year idea.

Only slightly less well known is this:

EFFing Policy

So what is helpful?

Leave real estate alone. Or better yet, protect gains, for everyone:

Through ordinary inflation/devaluation of currency

Through improvement of blighted real estate

Legislatooors have tossed about exempting capital gains on 1st homes. Which are already exempt (up to $250k/500k in gains/single/married) and isn’t going to move the needle, especially for seniors who would and do need a place to live, a reduction of expenses and reduction of taxes to live the rest of their lives without undue burden of risk at an old age.

Ordinary inflation/devaluation of currency

By removing capital gains tax entirely on REAL ESTATE (all real estate), perhaps some of the 6 million second homes (US Census Bureau ACS estimate) could come to market, as well as some of the 18.6 million investor owned homes.

Investors facing capital gains tax on exit at current median sales prices compared to 2015 could face up to $39,760 in capital gains tax (on a $198,000 basis) by doing nothing other than holding the property for 10 years. Not exactly a “gain” via effort. If anything, it’s a “gain despite stupid monetary policy”.

Furthermore, facing depreciation recapture increases the burden they face on exit. On a 3% per year depreciation rate, on basis of $223,000 acquisition, this could add an additional $13k+ in recapture taxes due on sale.

And lets face it, a home with 10 years of deferred maintenance probably needs $13k in upgrades due to real depreciative lifecycles.

These two removals alone potentially reduce the necessary sale price of 24.5 million US Homes on their 2015 cost basis. (combined 17% of US Housing units)

Which is good for buyers, sellers, loan originators and home brokers. A sizeable tent.

Not to mention it reduces the time sensitive nature of 1031 exchanges which capture price increases and reduce potential improvement to capital deployment which could go towards job creation and the CRE (commercial real estate) apparatus in general.

And in the event someone actually takes an empty or dilapidated property, spends the time, money and effort to turn it into something useful, that created job opportunities, that benefits the users and community around it: taxing them for doing seems: genuinely idiotic.

Improvement of blighted real estate

The current administration need look no further than: the current administration’s previous administration.

The 2017 Tax Cuts and Jobs Act cemented “Opportunity Zones” into law. Theses “OZ’s” were low income census tracks, as designated by all 50 State Governors (a truly bipartisan effort among all US States) in their State. All of which were considered blighted, or extremely low income due to lack of jobs, growth or upward mobility hopes, among other reasons.

Think East St. Louis, Gary Indiana, West Virginia towns, etc. But every state has these areas.

The opportunity zones reduced tax burdens for developers who improved the value basis of real property through development in said zones.

The results are undeniable. According to Novogradac as of 2023, Opportunity Zone Funds had raised $150,000,000,000.00 (one hunnit fity billion) of capital. At 20% LTV that equates to $750,000,000,000.00 in real estate development/redevelopment in blighted US areas alone.

These helped fund the most amount of apartments ever built in the United States at any one time in recorded history, for 5 years straight from 2018-2023.

Which have begun to help alleviate rent prices, and offered “affordability” options to would be buyers.

In other words, this policy has helped create jobs in multiple sectors, reduced rents (eventually and if you discount what FEMA spent on housing, this is a different story), created more supply, redeveloped parts of cities with the lowest incomes and most blighted real estate, helped create loan originations, brokerage commissions, management fees, created new businesses, and reduced the overall tax burden for doing so.

At the end of the day, you’re either under-pacing inflation via home purchase and expenses that go with it, (not a gain) or you’re trying to improve the property/area and taking a lot of risk to try to outpace inflation. Capitol Gains really innit.

Tent, meet revivalists.

Unfortunately, what we’re getting is a lot of mumbo jumbo about ten years, thirty years and fifty years.