Tuesday EFFing Memo

Mission Impossible: Soft Landings and Fairytales

The Memo:

To:

Re:

The economic situation, pop culture and fairy tales

Comments:

A Tuesday EFFing memo? Let’s start with the reminder of what the EFF cycle is:

EFF (Effective Federal Funds) Index is the measure of economic data using the Federal Funds Effective Rate cycles as a timeline

The day/week/month/quarter the Fed raises rates is the day the cycle begins, and ends when it reaches its lowest point. Trough to Trough

Day 1 of the cycle = 100

Using this we can compare the data and behavior behind it to gauge where we are in the cycle and where we may be headed

Combined with the Fourth Turning framework of Strauss and Howe’s book, we can break the cycle into the same seasons: Spring, Summer, Fall, Winter. Each season itself has 4 seasons.

Using the EFF cycle to gauge our timeline in The Fourth Turning, we are in the final fall, of the Winter of the Current 4th Turning. This is the 16th EFF cycle/ Season since the current cycle began in 1945 with the Bretton Woods Accords

Using the timeline and Index, we can also correlate the exact dates/weeks of the current cycle to past cycles, and measure the effects on and of civilization in general.

This is the 166th Week of the Cycle, and this report covers events of last week, the 165th.

End Memo.

The Report

4 Cycles Ago, the Week ended March 3rd, in 1996.

That “spring”, like many before, I was prepraring for baseball tryouts. Springs in MN were cold, which meant I speant a lot of time at indoor batting cages. I practiced obssesivley, I read, studied and perfected the mechanical aspects of my game.

Whenever I wasn’t at school or working, I was trying to improve my game. And I was good at it. But it would also become a pivotal year, in which I had to learn some hard lessons about how money and “boosters” in sports worked. How merit or skill isn’t always enough, and that it isn’t who you know, but “who knows you” that opens doors to different games in life.

Despite putting on what would then be called a “clinic” at tryouts that year for the top level team, I would watch instead as far less skilled players, who’s parents spent money on team sports would land spots on the roster. At the time, my disgust knew no bounds. And I would wind up deciding to play two sports.

American Football would be my second game. For a year. Until I tore my MCL, PCL and ACL. I recovered just fine, and would go back to playing baseball, even being given the chance to play for a dozen MLB team scouts later on. I never landed a contract, and didn’t play beyond school/local traveling teams, but it did provide some great life lessons that started 29 years ago.

My point in this, is that even though I was at the time obssesed with baseball, I paid enough casual attention to the world around me, to notice that despite things in the US seemed swell, it wasn’t the case everywhere. And now looking back to the year that the Mission Impossible films first hit the box office and what some people call a soft economic landing, I’m reminded that very often, there isn’t anything new under the Sun. And that includes the headlines we read today, and the effects of past political and monetary policies.

That Same March of 1996 saw geopolitical unrest, just as we see today.

In Russia, the USSR was a memory, with Boris Yeltsen relected to the Presidency that March.

Oh by the way, do you recognize the author of this excerpt? I digress. Yeltsen would go on to hire that same year for a cabinet positon a name you likely know well. And even handpicked the man as the Prime Minister of Russia in 1999. His name is Vladimir Putin.

Further East, March 1996 saw the 3rd Taiwan Straight crisis unfold.

A series of missile launches into the waters surrounding Taiwan by the Peoples Liberation Army of China, meant to influence the first Presidential Election in Taiwan. Which was also in March of 1996.

Until the year prior, the US official diplomatic policy had been to recognize the “One China” policy, and hadn’t even granted visas to Taiwanese leaders.

1996 also saw its share of animal disease related scares. Mad Cow disease had become a large concern, and in March of 96, the British Health Dept would acknowledge its effects on humans. The net effects were not a soft landing for the British beef farmers.

While we read about the war in Europe today, and get claims of peace deals or broken ceasefires, the same thing was going on in Europe 29 years ago.

1996 saw the Bosnian War, Chechen/Russo War, Yugoslav Wars and Kosovo.

And personally, I don’t know how anyone could have forgotten that this was going on routinely:

Maybe because it was referred to as “The troubles”. Also reignited in March of 1996.

Pop culture, at least across time as I know it is littered with references to the happenings of the world at the time. A few years prior, before that “ceasefire” ended, Patriot Games and The Cranberrie’s Zombie would bring the IRA/UK conflict to the screens and radio stations, while folks in the UK lived through bombings and police violence.

Even in the US, we had become “entangled” in “peacekeeping” and “assitance” roles in multiple confilcts. 1997’s Wag The Dog would even reference the ridiculous situation in US politics, including the bombings in Haiti. All while the President was Mean Tweeting & Grabbing them by the Having sexual relations with interns.

And of course, who could forget the aftermath/tail end of that cycle, that is if you study markets in any way at all:

The 1993-1999 Cycle may have been claimed as a soft landing in the US, but it certainly wasn’t seen that way across the world, and eventually lead to the Government bailing out LTCM (Long Term Capital Management), a “Very important” hedgefund, and the subsequent stock market insanity that lead to the dot com implosion. The same one in which the Bitcoin Man of today lost $6 billion. Mr Saylor had an ok 1996 though, having been named KPMG’s “High Tech Entreprenuer of the Year”. Wonder what he’s up to this cycle.

The US shifted its economic and monetary policy to “MOAR Moral Hazzard”, ignited the ZIRP era, loosened financial regulations to create the “Dot Com Mania” AND the “GFC”, sending US jobs overseas to appease demand for cheaper labor, 1996 even saw the Presidential Administration cutting Federal Jobs. Just like past alleged soft landings: 1985 saw the destruction of American Farmers, 1967 saw mass social unrest and state brutality to “colored” folks (read American Citizens) in an effort to uphold segregation, just to name two.

It intoduced the world to new conflicts in Asia, Europe and the Americas, the players at the heads of State tables today, and the geopolitical theater that gets rerun day after day.

There is no such thing as a soft landing. Someone has to hold the bag.

We didn’t start the fire

It was always burning

Since the world’s been turning

-Billy Joel

The signs have always been there. Did you read them?

Modern Day; May 9th 2025

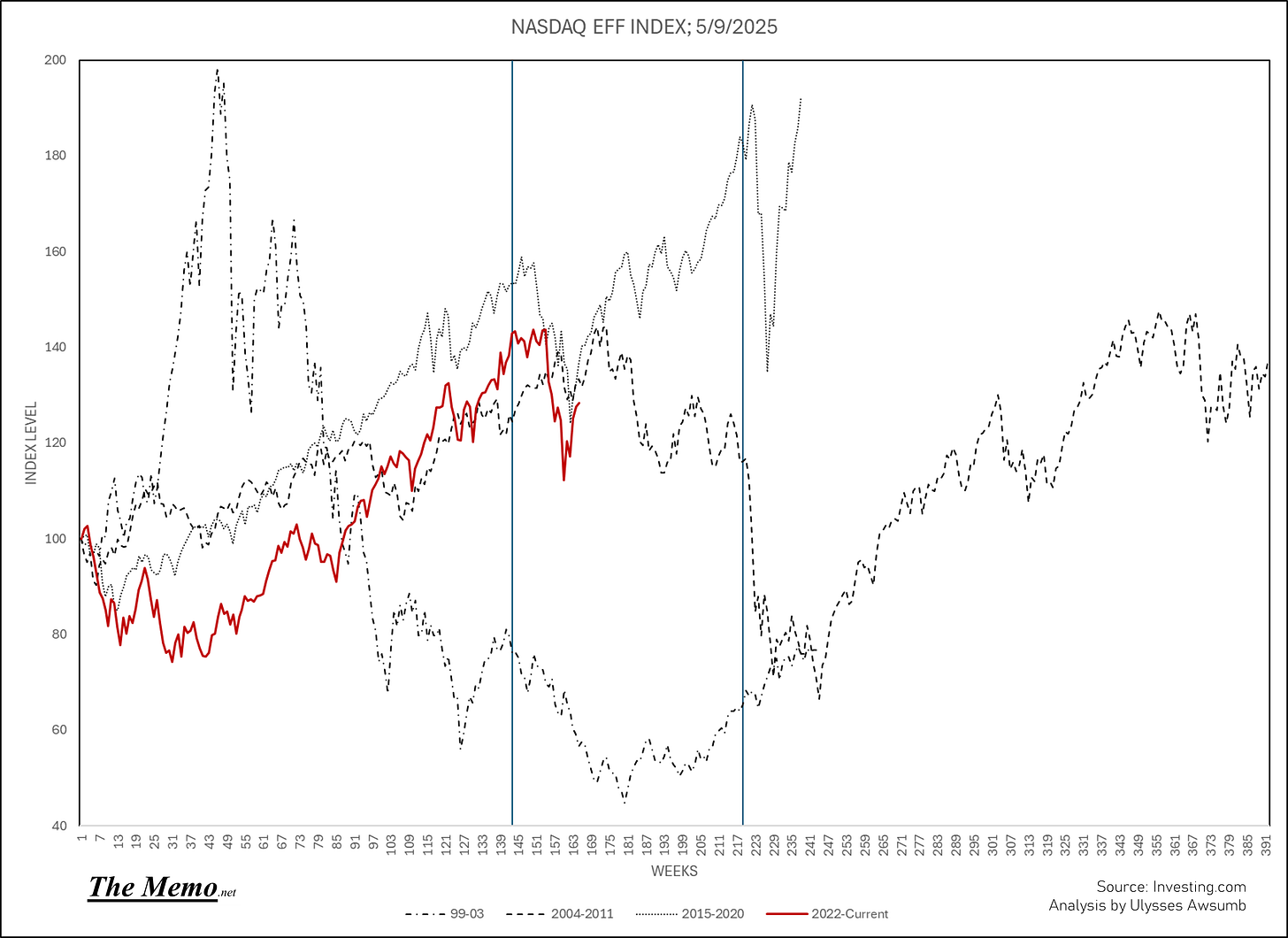

As we repeat behavioral patters of the past, the equities markets are echoing both the 2018/2007 drawdown/bounce patterns, as expected and discussed here prior. I could very easily see the Nasdaq going back to 19.2k range before it tumbles it’s final tumble in the Winter of this 16th cycle.

Inextricably linked, is US ally and friend, Japan. Here’s a comparison of the Nikkei vs Nasdaq since 2001. I will have more on this in episodes to come.

Commodities

West Texas Crude needs to turn a corner to repeat its cyclical past. I can see typical summer cost increases as well as output cuts to combat price levels having the same effect as past cycles.

Lumber is softening, when sellers need it not to. Again.

Employment:

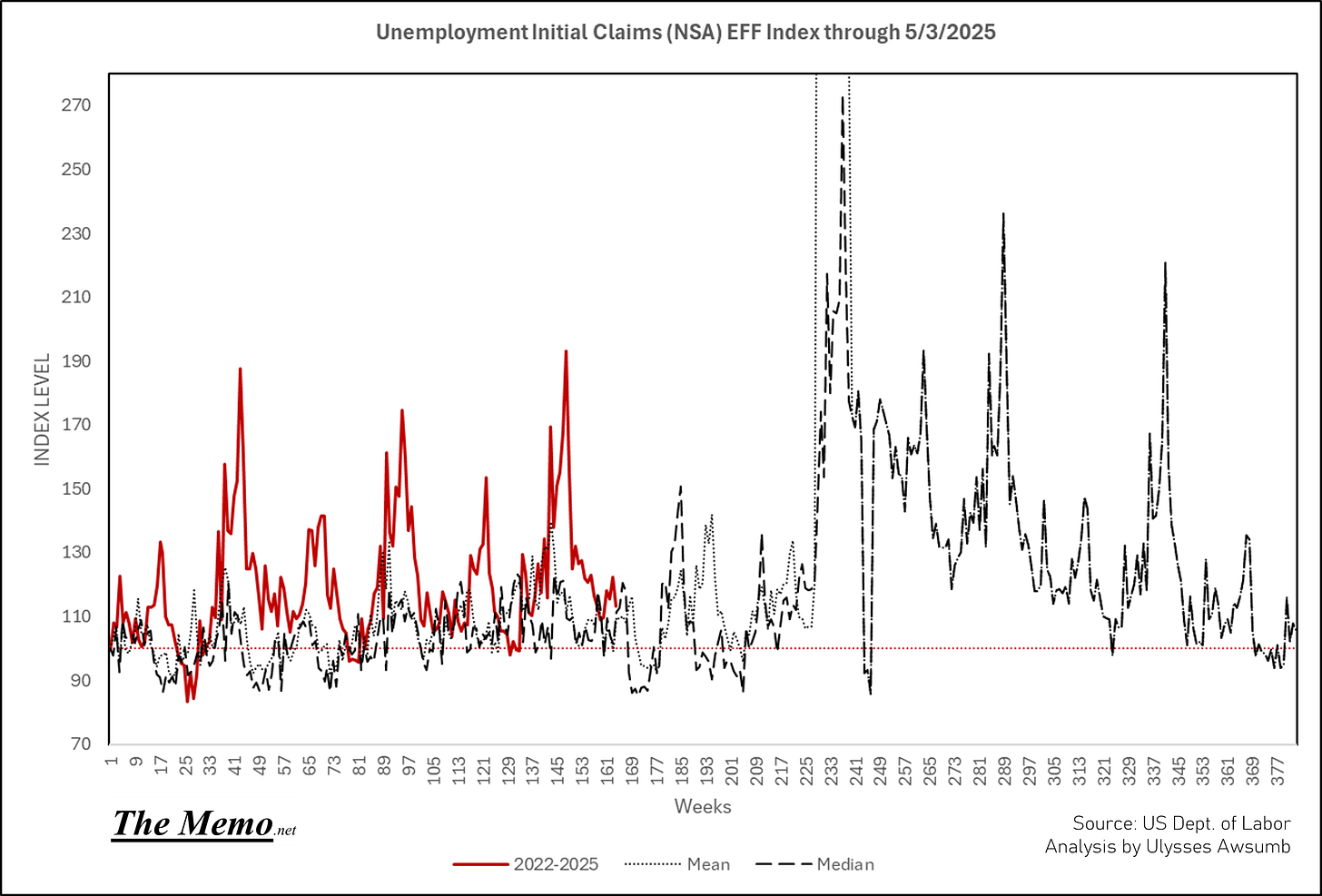

As noted prior, we are nearingthe cyclical point of elevated unemployment that begins to form in recessionary periods. Something that didn’t happen in 1996, as dual income households became the norm, the population was growing, and the US added dot com/service jobs en masse in exchange for its manufacturing base.

Something the tarrifs were meant to bring back to the US. Until they weren’t meant to bring it back to the US.

May saw the restart of student loan debt obligations. Depending on how servicers approach this, 90 day delinquency actions take effect now. Or in 90 days from now. Also in 90 days from now we’ll see the effects of the awful spring/early summer sales happening amongst Homebuilders, amid high interest rates and declining new prices. With the wicked impact on net income from Q1, several builders won’t have too much room before they have to cut costs. Buybacks will remain, longer than employees. Post July 4th, from July 11th to August 27th, it is my expectation to see initial claims rise again. Both because “that’s how it always happens” and because in that time frame we’ll be past the US Memorial Day/Independence Day (ID4 was also released in 1996) Holidays, which coincidentally shorten working days, and see the effects current monetary costs have on construction, and associated industrys, as well as impacts from Q1 tarrif tango moves.

Here is the current ICNSA EFF index, and current verses the past 3 cycles.

I ran a model using the current cycles average comparison to the past 3 cycles, by peak we could see between 750k-1m Initial claims if it holds, by the time it’s all said and done. Even with gig work, even with Government intervention, which I have no doubt there will be.

Debt

We’ve reached the cycle stage where 10yr yields tend to drop.

Back in December, along with the MacroEdge team, I forecast the 10yr yield to end the year at 3.5%. My EFF index model also shows this. I’m not entirely sold we’ll see as steep a drop, despite the headline chart for this posting. I see plenty of potential people exchanging (read selling) treasurys to raise cash, which could put upward pressure yet on Bonds. And honestly, I don’t know why anyone wants to accept a tenth of a percent less than what they are paying now.

I had an interesting conversation this weekend with Economist Paul Allen Winghart, who writes at SurplusProductivity (go check it out) on this topic. Paul see’s potential bond demand coming from Corporate buyers needing balance sheet safety, in size enough to bring yields even lower than the 1 3/4% I can see by the end of the cycle. I found that compelling enough to give it more consideration and offer it to you here as well.

Currency Wars

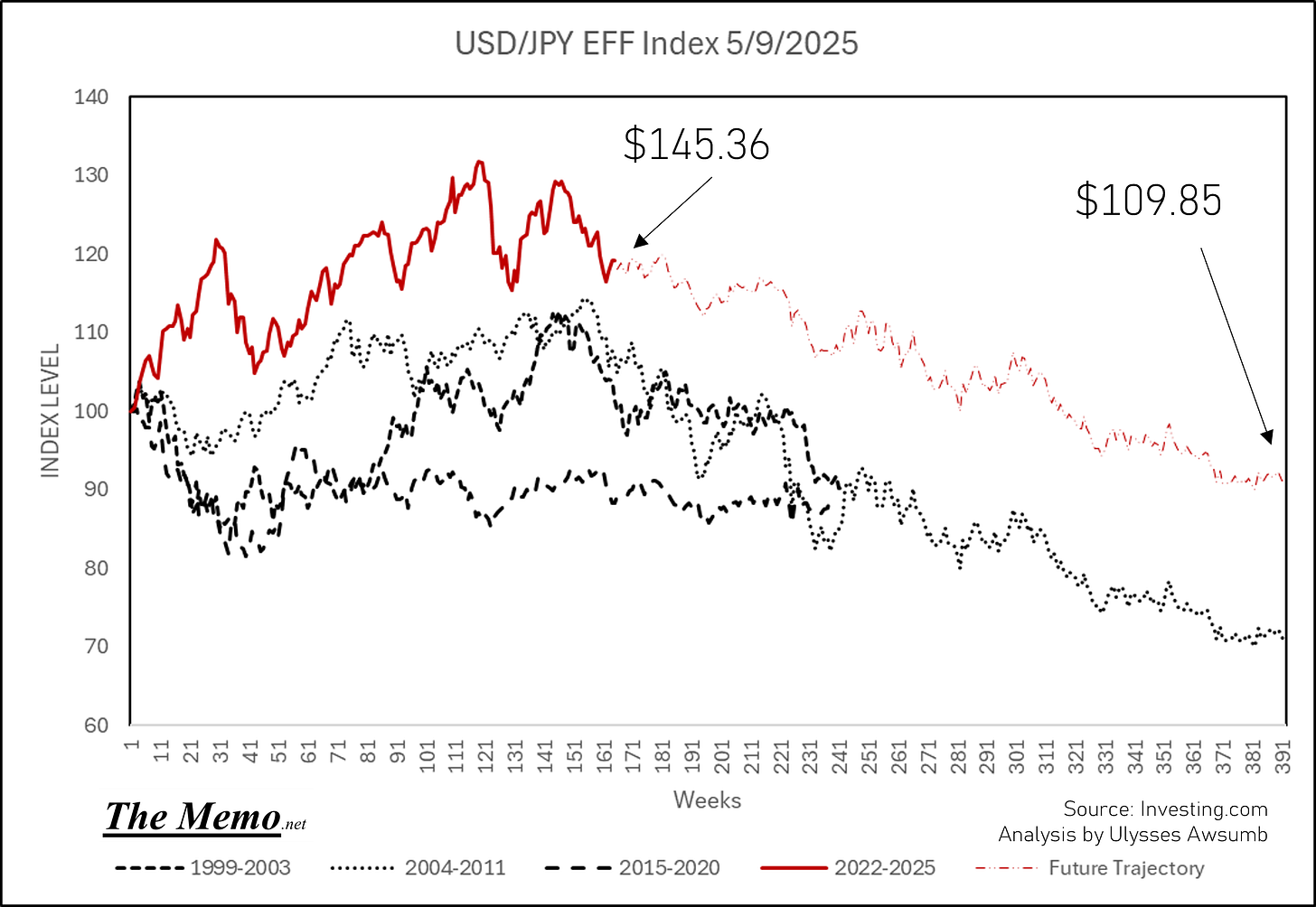

Or something like it. FX exchange rates should continue to move from here, in large sizes. But directionally the same.

Mr Buffet may have retired, but he made sure Berkshire Hathaway was positoned to win on the FX side of the Yen moving forward, based on hisorical data.

It always goes this way. THIS IS NOT FINANCIAL OR INVESTMENT ADVICE.

Now if you’ll excuse me, I need to go ice an injury I reaggravated from 29 years ago. And buy tickets to a film franchise that started 29 years ago about the clandestine state’s nefarious actions, to get a break from the the state’s not so clandestine actions.

Mission Impossible: The Final Reckoning. Same actors, same story. 8 movies later. Risk on, Risk off.

Anyone have the channel changer?

“I have a foreboding of an America in my children's or grandchildren's time, when the United States is a service and information economy; when nearly all the manufacturing industries have slipped away to other countries; when awesome technological powers are in the hands of a very few, and no one representing the public interest can even grasp the issues; when the people have lost the ability to set their own agendas or knowledgeably question those in authority; when, clutching our crystals and nervously consulting our horoscopes, our critical faculties in decline, unable to distinguish between what feels good and what's true, we slide, almost without noticing, back into superstition and darkness...

The dumbing down of American is most evident in the slow decay of substantive content in the enormously influential media, the 30 second sound bites (now down to 10 seconds or less), lowest common denominator programming, credulous presentations on pseudoscience and superstition, but especially a kind of celebration of ignorance”

― Carl Sagan, 1996 New York Times Best Seller: The Demon-Haunted World: Science as a Candle in the Dark