The Friday Effing Memo

We interrupt this regularly scheduled programming

The Memo:

To:

Everyone

Re:

The EFFing cycles

Groundwork for Upcoming Research Release

Previous Real Estate Disasters

From:

Mr. Awsumb

Comments:

“Didn’t you get the Memo Peter? “

“Yeah I’m gonna need you to come in tomorrow. Mmkay. We lost some people this week and we sorta need to play catchup”

Office Space © 20th Century Studios

I’ll be publishing the EFF indices updates this weekend, due to some staffing difficulties. Don’t worry though, I’ve made sure to provide a research piece for you that will provide important context into my forthcoming US Farmland Situation report, soon to be published here. This will serve as a primer for that research: Days of The Futures Past.

Happy Aloha Friday!

HR Dept. calls this a Deja View. This report was originally published via MacroEdge and Melody Wright’s M3 stack. The report has been updated since first publication.

Yeah, I’m gonna need you to go ahead and CC your colleagues with a cover sheet on your Memo TPS reports from now on. Mmkay thanks..

End Memo.

The RealEst80’s

Top: Ronald Reagan, photo © Dave Pickoff / AP 1980

Bottom: Jimmy Carter, photo © Harvey George/ AP 1980

1980 kicked off, what I would argue to have been a volatile decade. And while the cover photos of both President Jimmy Carter, and then Future President Reagan mark the starting point, they’re also the ending point of a previous real estate crash. Both Candidates campaigned in front of the same buildings in New York City, the Bronx to be precise. Carter in 77, Reagan in 80. Real Estate in The Big Apple has its own tumultuous history. Ending the 70’s having suffered through rising crime, poverty and entire neighborhoods having literally crashed, and hollowed out. To the point it's Police force published pamphlets about how to survive “Fear City”, later the basis of “Escape From New York” by the legendary Director John Carpenter, starring Kurt Russell. But we’re not talking about the 70’s today, save for a brief reminder of one topic that brought political change.

Tractorcade:

Warren Leffler (Library of Congress) 1979

In 1979, more than 3,000 US Farmers, drove their tractors, (and more without) to Washington D.C. to protest their then current situation. Farmland prices and fuel cost had skyrocketed, but produce prices had started to unwind the opposite direction, among other pressures. Several farmers had also been foreclosed upon. We’re going to leave this portion to the 1970’s and get back to the future. Because it might be the most important part.

In 1980, it was not just farmers that wanted a change. While both Reagan and Carter visited the Bronx for a photo op and campaign, Reagan used a slogan that some of you may associate with a different candidate today:

Rise so high, yet so far to fall

A plan of dignity and balance for all

Political breakthrough, euphoria's high

More borrowed money, more borrowed time - Megadeth

By the time Reagan made his Bronx visit, the US had already been in recession, having begun contraction in January of 1980. It wasn’t just the Bronx that started the decade in recession housing regression though:

Remind you of anything you’ve read lately? Maybe about FL or TX? Or even HUD?When I say, there’s nothing new under the sun, I mostly mean that.

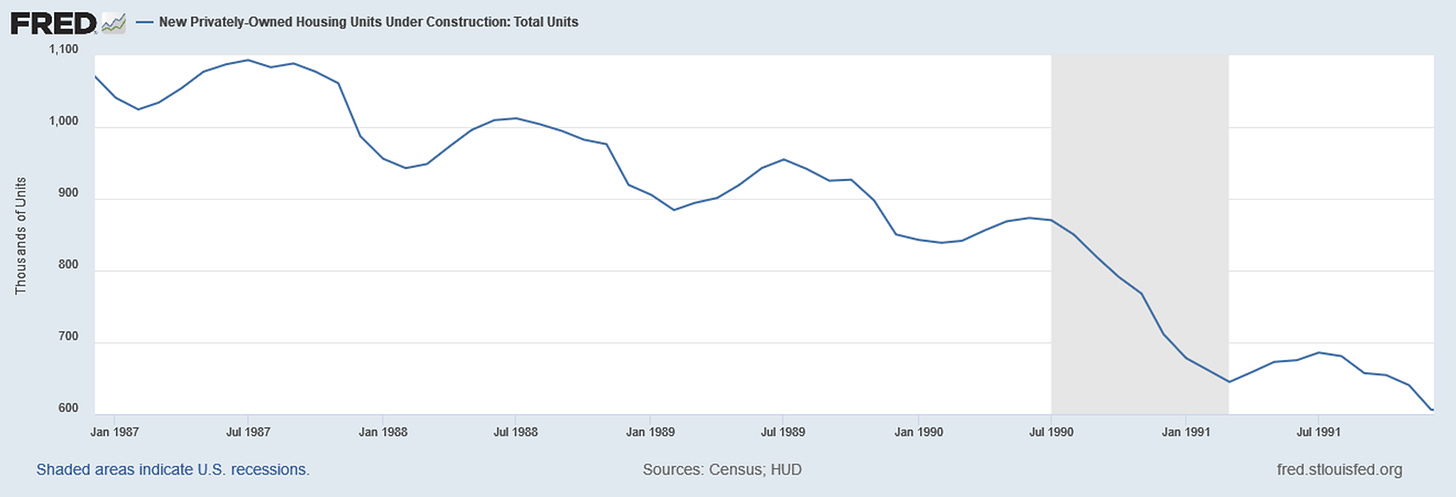

By 1981, the US had entered recession again. Famously Fed Chair Paul Volker is remembered for “declaring war” on inflation. Raising interest rates and bringing a sharp end to the credit and monetary expansion that had been ongoing. US small homebuilders were mostly devastated, literally.

By February, nearly 1/3 of smaller homebuilders had closed or gone out of business. The builders that did survive took drastic price cuts and paid down points for mortgages (sound familiar?), with rates being in the teens.

As the recession kept picking up downward speed, more industries felt the burden. The automotive industry saw sales collapse, layoffs increase, and even though foreign sales also decreased, they would begin to overtake US Mfg. market share, that would never return.

In the second half of the decade, it would be partly memorialized by the Ron Howard/Michael Keaton film “Gung Ho”:

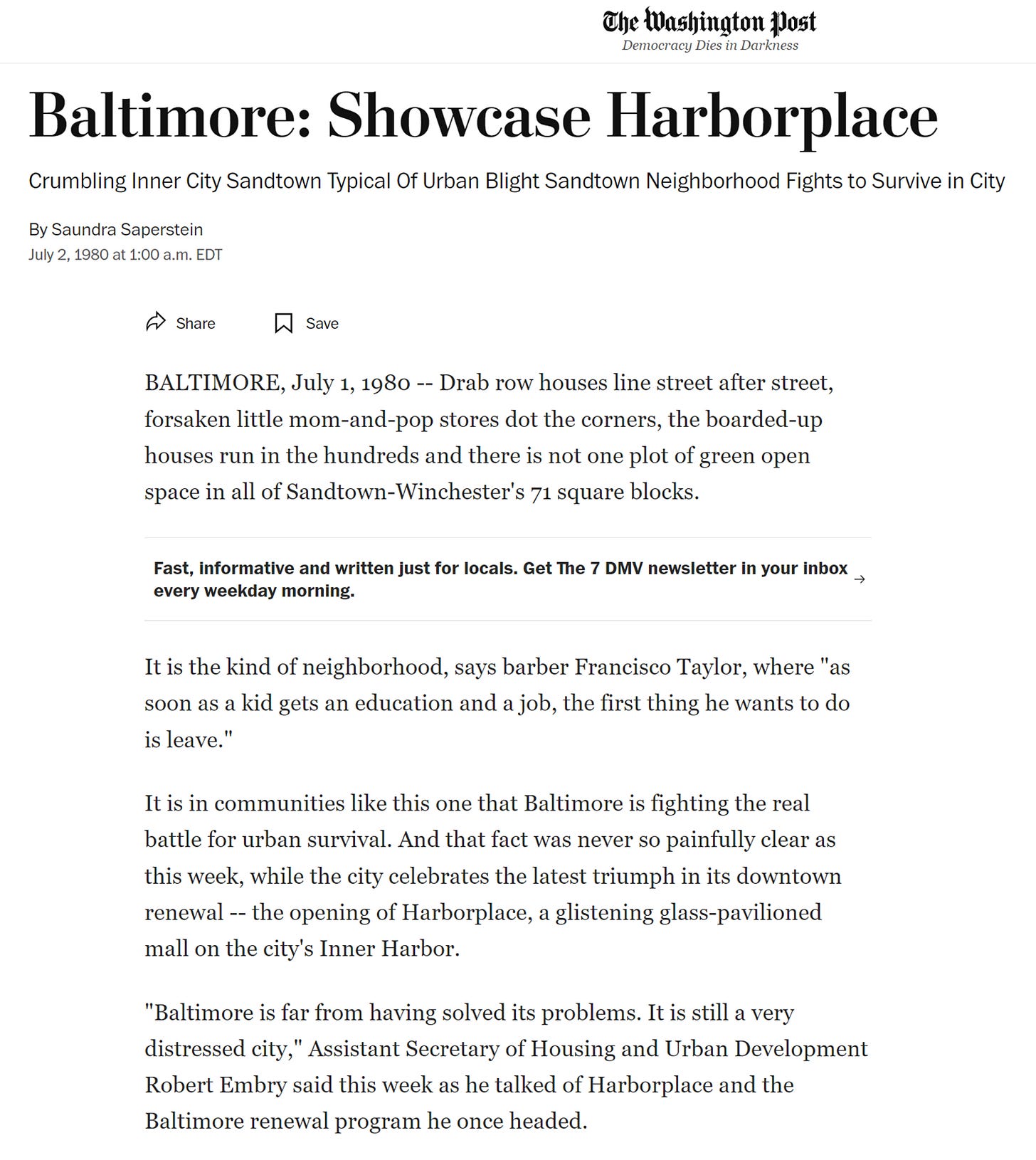

You might be asking me what that has to do with real estate. Well, during the 1981-82 recession, US manufacturing of every type was falling apart. The US unemployment rate kept increasing until it peaked in 1983 at 11.4%:

Nationally that took it’s toll, and home foreclosures reached levels not seen since or during the Great Depression.

But as things generally go, they don’t happen equally across the board. The Cities impacted the most, were Cities that had been industrial manufacturing outposts for the US. East Saint Louis had already seen it’s decline, only to be remembered through 80’s Pop Culture like National Lampoon’s Vacation. “Kids, are you noticing all this plight?”

© National Lampoon

All while cities like Detroit began contracting faster, and The Pacific Northwest lost its timber base. Georgia Pacific shuttered its Oregon HQ, and moved back To Georgia. The Oregon State unemployment rate went to 12.2%, while Douglass and Curry counties saw 18% and 20.7% unemployment rates. Gov Vic Atiyeh called legislature back multiple times for emergency sessions to get lawmakers to slash budgets. Including 10% of staff in the Employment Division. (Source: Willamette Week, Nigel Jaquiss, 2008)

20.7% Unemployment. Read that again.

It wasn’t just new homes that had to take price cuts though. This is from the Portland area Realtor’s association (that decline isn't 2008 it's 1980. The chart ends at 2010):

That’s 4 consecutive years of prices falling, both average and median prices for existing homes for the Portland MSA. This was happening in towns across the country that had heavily invested in their industries, that suddenly didn’t have revenue. By the time the lumber mills and automotive plants, and heavy manufacturing came back, it was with equipment that replaced much of the need for it’s previous employment base (CNC or AI?). Some cities pivoted to other industries, some just slowly died.

As the Governor of OR had acted, so too did congress. In 1982 they passed the Garn/St. Germain Act. Creating among other things, the Adjustable Rate Mortgage.

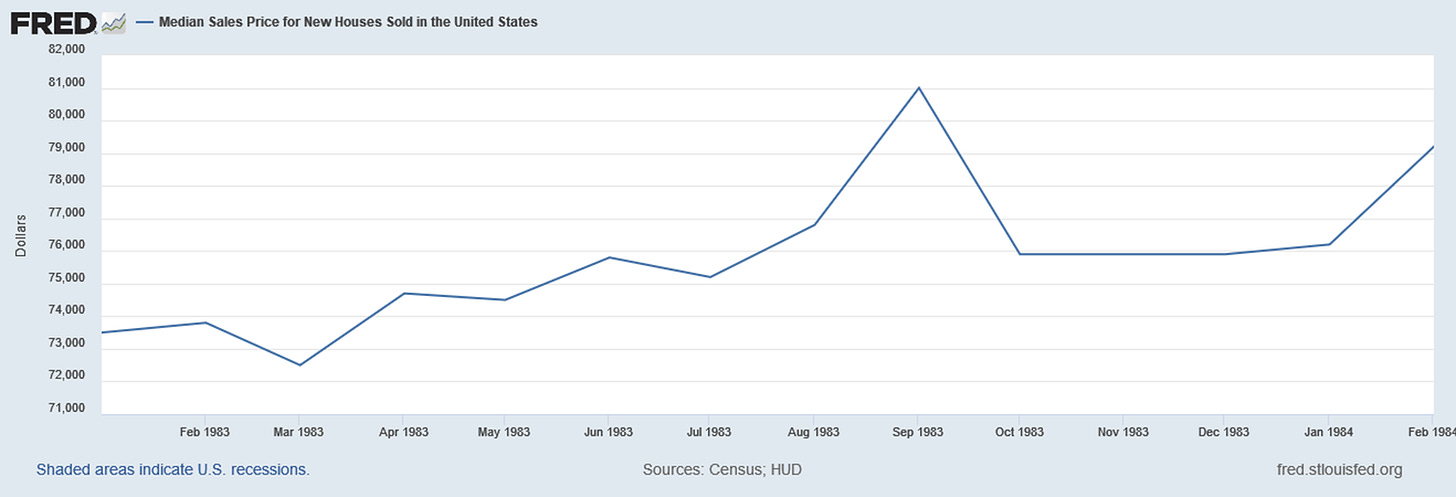

Nationally, home prices had started flatlining, and in large swaths going negative.

The result of the legislation was lower mortgage rates, and exiting recession, starting the credit cycle again. We’ll come back to that, because ARMs had a tremendously different outcome in the 80’s than they did in the 2000’s decade.

Having exited recession, with unemployment falling, as well as now mortgage rates, housing prices bumped along nationally, but mostly flat. While these are new homes, this is new product, putting people into jobs.

It’s important because in January of 1983, the same Garn (Jake Garn, who would wind up being the only US Senator to fly a space mission) along with help from a name you’ve probably heard mostly from the movie “The Big Short”, Lewis Ranieri, who is largely credited with inventing the Mortgage Backed Security in 1977) Introduced the Secondary Mortgage Market Enhancement Act. MBS weren’t legal in all 50 states. Until that is, 1984, when congress passed the Secondary Mortgage Market Enhancement Act, legalizing Mortgage Backed Securities (MBS) in all 50 states, regardless of State legislation on the matter. Lewis Rainieri was at the Oval Office for the signing of the SMMEA by Ronald Reagan. Photo Credit Wall Street Journal and Mr. Rainieri.

The ability to securitize more mortgage bonds made lending easier, leading to a bump in prices after being enacted, enough so that Volker sought to cool markets raising rates again, and slowing the pace of increase of credit use. I would argue that 84 into 85 could be viewed as an actual mythical soft landing. Nationally. Except….Which brings us to our next 80’s bust:

The Lone Star State

By 1985 oil demand and prices had slumped, and another area’s economic industry had gone backwards, namely Texas and the impact from the oil busts. Enter the term “rolling recession”.

In 1997, the Dallas Federal Reserve bank authored a good primer on the rolling recessions of the 1980s. I’m going to share a chart illustrating the concept here:

This represents the difference between real personal incomes of the Dallas and Boston Federal Reserve bank territories. Dallas Fed included all of Texas. Houston and Austin among others, which saw some of the biggest real estate crashes in modern memory. Right around 1985.

To illustrate the “rolling recession concept”, Austin and Houston were having real estate price declines, and industry contraction, while Dallas and Forth Worth had already had theirs. The world famous Forth Worth Stock Yards had closed earlier, once a testament to the US cowboy and beef industry, later popularized through government subsidy and trade group ad of the decade, narrated by the inimitable Sam Elliot:

Like the movie line from Necessary Roughness (1991), which features the repurposed Stockyards, that part of TX had already experienced it’s hard times:

Coach Rig: Not much of a crowd

Coach Gennero: Well, at least we have home field advantage

Coach Rig: The Alamo was homefield advantage

Photo : Scott Bakula and Sinbad in “Necessary Roughness”

Might be Bakula’s best work btw. (emphasis mine)

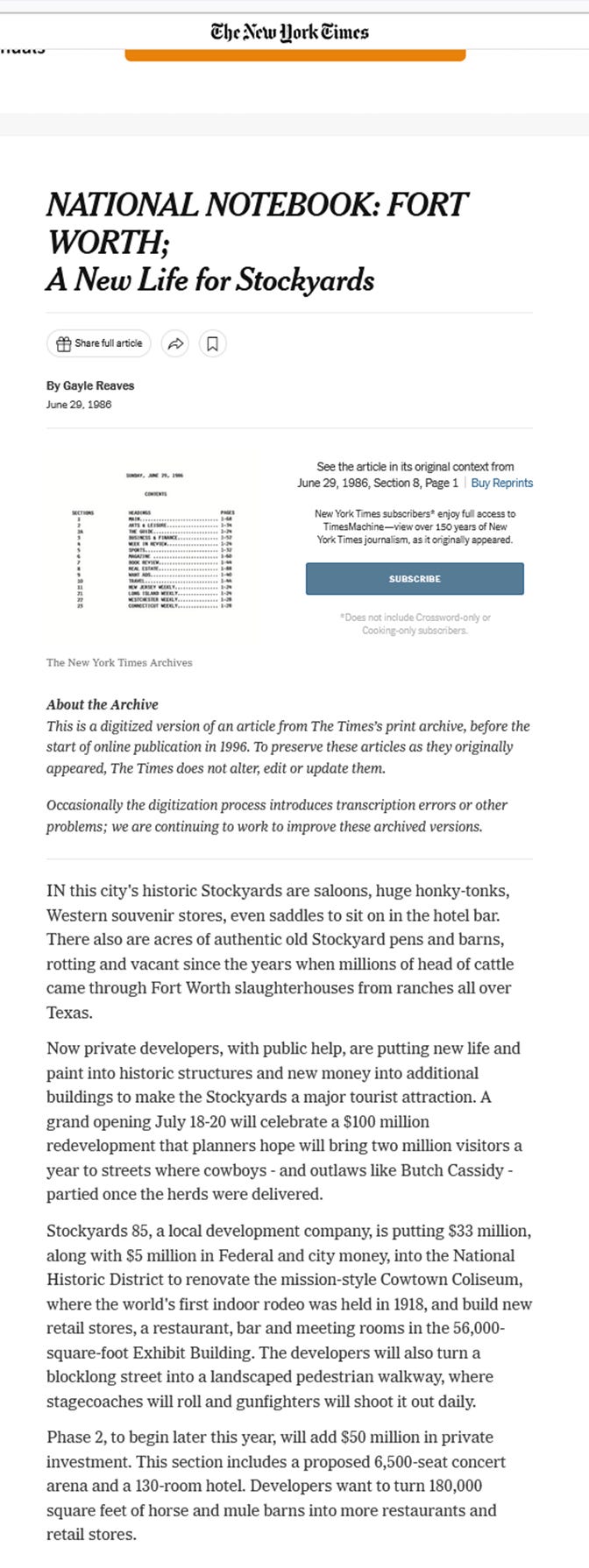

To that previous part of Texas, regarding Fort Worth and Dallas seeing their booms, and to the rolling recession continuance,: here’s the original article regarding the redevelopment of the Stockyards, from 1986:

While the big cities recovered, several Texas towns never did. I encourage you to watch Joe and Nic’s Roadtrip through the towns in Texas that are forever lost. And more across the country. Several of which were also later popularazided in FX TV’s “Justified” several post recessions later.

Now, while all this was transpiring, we had another type of bust underway. The Savings and Loan Crisis was in full swing by 1985.

May 13, 1985: Depositors line up to withdraw money from a Baltimore bank following the court order that limited depositors' cash withdrawals until a purchaser was found for the troubled savings and loan. (Photo: Bettmann/Bettmann/Getty Images)

Allow me to open this portion of our history with this quote:

The Reckoning

As a result of these regulatory and legislative changes, the S&L industry experienced rapid growth. From 1982 to 1985, thrift industry assets grew 56 percent, more than twice the 24 percent rate observed at banks. This growth was fueled by an influx of deposits as zombie thrifts began paying higher and higher rates to attract funds. These zombies were engaging in a “go for broke” strategy of investing in riskier and riskier projects, hoping they would pay off in higher returns. If these returns didn’t materialize, then it was taxpayers who would ultimately foot the bill, since the zombies were already insolvent and the FSLIC’s resources were insufficient to cover losses.

Texas was the epicenter of the thrift industry meltdown. In 1988, the peak year for FSLIC-insured institutions’ failures, more than 40 percent of thrift failures (including assisted transactions) nationwide had occurred in Texas, although they soon spread to other parts of the nation. Emblematic of the excesses that took place, in 1987 the FSLIC decided it was cheaper to actually burn some unfinished condos that a bankrupt Texas S&L had financed rather than try to sell them (see Image 2).’

This from Kenneth Robbinson at Federal Reserve History. I highly recommend you read the cited work.

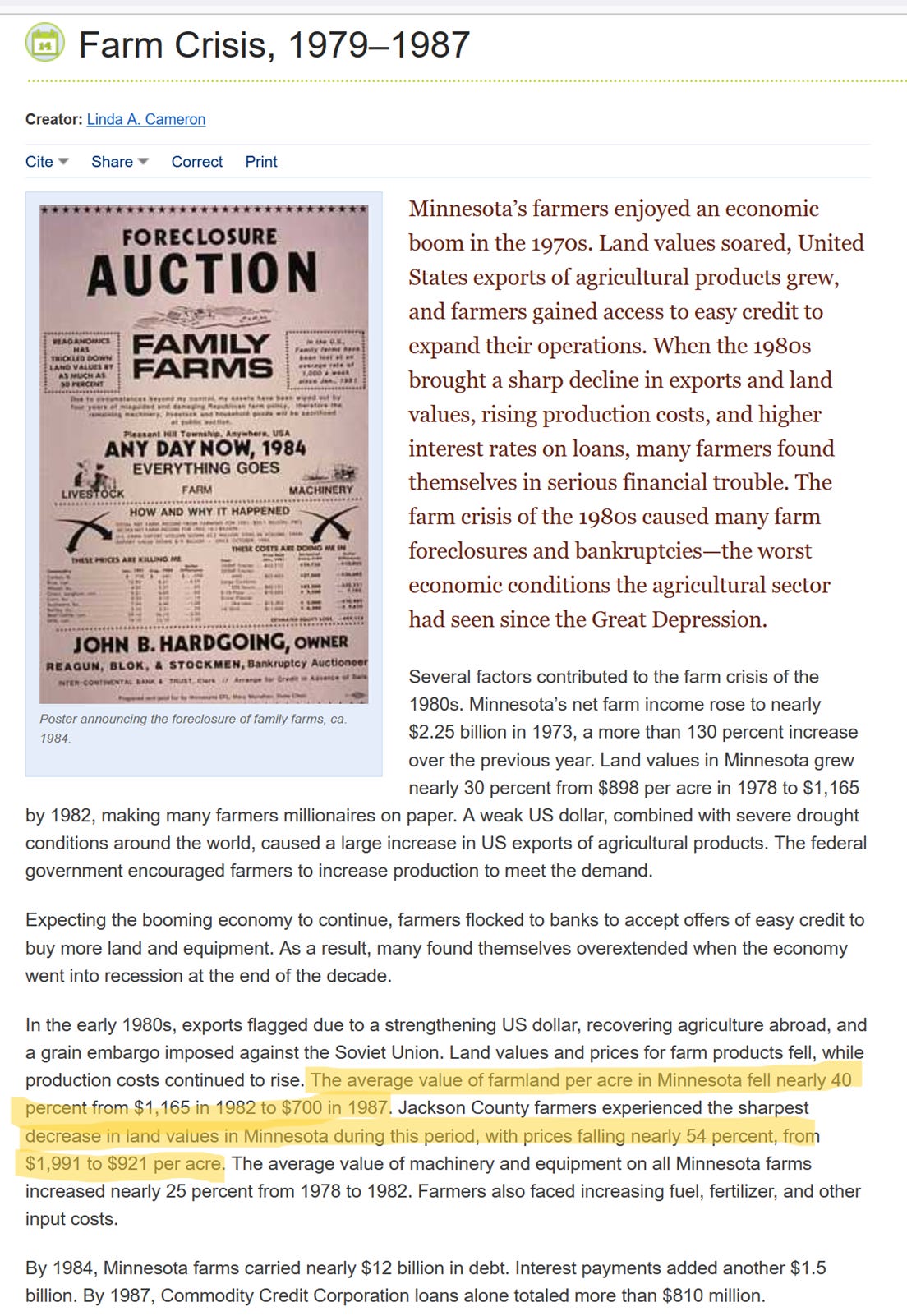

A huge portion of the S&L crisis came from investment speculation in all types of real estate, but a big portion of it came from farmers. Another quote, from Linda Cameron:

But it wasn’t just Minnesota. It was farmland across the country.

America’s “Heartland” was experiencing the worst real estate price crash since the Great Depression. I wanted to highlight this recent piece from the University of Nebraska, calling out the situation we’re facing. Remember I said, there’s nothing new under the sun?

During the 1980’s, and it’s early recessions, both farmers and S&L institutions were going bust left and right. We’ll get to the S&L’s shortly, but this was the end toll on Farmers:

The 1980’s were so bad to farmers, that their suicide rates skyrocketed. Challenging realities.

Here’s a look at farmland prices in a couple of states:

To add insult to injury:

The author goes on to elaborate that in 1985, Agricultural banks accounted for half the bank failures in the country. I highly recommend you read “A history of the 80’s”

Now, more on that farming situation from the Texas Agricultural Commissioner and chair of the Democratic National Committee Ag Council:

Just to clarify, both parties failed this country miserably in this regard. Including Hightower. That being said, to Reagan’s credit, at least he acted the line “We’re from the Government and we’re here to help” (yes I know his point and it's context, and yet). To that point:

That Payment in Kind program was paying farmers to remove crop land from production, and pay them for it on a partial basis as if it was producing.

Then came 1988. I remember it vividly. The grass was dead and crunched beneath my feet all summer long.

The resulting destruction from having removed American farmland for production, and drought hit farmers even harder. And the US. Homebuilding industry once again started it’s downward trajectory. Maybe we should have taken Tractorcade seriously.

Before we conclude the decade on the resultant busts of high profile cities like Los Angeles and Boston, we need to cover the final chapter of the S&L.

In 1980, prior to becoming Vice President, George H. W. Bush coined the term “Voodoo Economics”.

(Photo of Ben Stein: Courtesy Ferris Bueller’s Day Off, © Paramount Pictures)

In reference to the “Laffer Curve”:

The comment was regarding “Trickle Down Economics” which we could discuss at length. Suffice it to say, as I’ve stated prior, “as things generally go, they don’t happen equally across the board”

In 1988, after inflation of home prices reared it’s ugly head yet again, George H. W. Bush was elected President. Defeating Michael Dukakis. Famously promising “Read my lips, no new taxes.” In 1992, Megadeath entered that phrase into the pop culture lexicon through their song “Foreclosure of A Dream” via their Countdown to Extinction Album, which also referenced the farming bust.

An aside: Dave Mustaine altered the course of guitar playing and music history forever in a way not seen since Mozart, Bach or Beethoven changed music. Not even Chopin made such a mark. He was the first guitar virtuoso to play with a symphony, and not his own music, but along with the orchestra, as but a part in a play. To say nothing of the Man and Band’s political discourse, which has proven true time and time again, decade after decade. But I am most definitely digressing. Photo links to the video.

© Universal Music and Megadeth

Barren land that once filled a need

Are worthless now, dead without a deed

Slipping away from an iron grip

Nature's scales are forced to tip

The heartland dies, loss of all pride

To leave ain't believing, so try and be tried

Insufficient funds, insanity and suicide

Foreclosure of a dream

Those visions never seen

Until all is lost, personal holocaust

Foreclosure of a dream

Bush 1 did indeed raise taxes, and we subsequently went to war in the Persian Gulf, but that isn’t our story either.

By 1989, the S&L Crisis had become so hideous, that Four Thousand+ (4,000+) S&L institutions had gone under. As Congress does when Congress wants (or feels electorate pain) they take action. In 1989, Congress passed FIRREA: The Financial Institutions Reform and Recovery and Enforcement Act.

Things had deteriorated so badly; the only choice left was to dictate receivership and resolution. FIRREA authorized the Resolution Trust Corporation to receive, manage and dispose of assets, including real estate, real estate securities and mortgage pools. This was ten thousand times over a better response than anything the government has done in response to economic problems this century.

Just as farming reached it’s trough, the “Crown Jewels” of the 1980’s “Boom towns” went bust. Namely Los Angeles, Boston and Hartford (Courtesy of Robert Schiller) , and anywhere that defense spending declined. Just like the decade of industry malinvestments before.

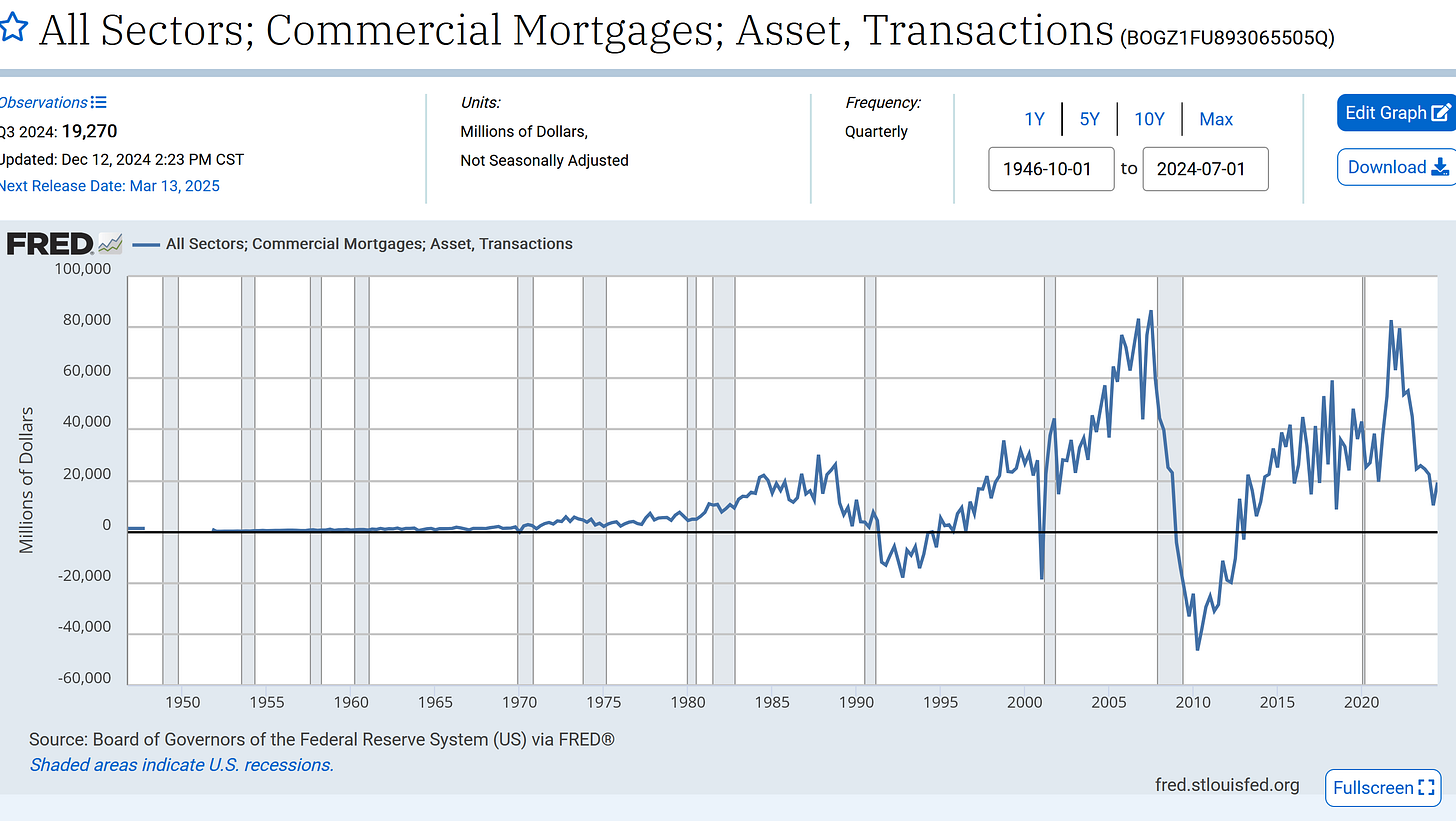

We don’t even need to discuss “Black Monday”. The resultant destruction at the end of the 80’s culminated in the biggest national real estate bust the world had seen prior to 2008. Mostly in Commercial Real Estate as evidenced by the delinquency rate shown here, which wasn’t tracked prior to, and the $120B (not inflation adjusted) mortgage asset losses:

On that note, in the 80’s, CRE (Commercial Real Estate) firms operated slightly differently: Brokers and agents had to travel from town to town to lease up properties. Be it Malls, offices or what have you.

That meant agents traveled a lot, and missed time with their families. And big opportunities were in Central Business Districts (CBDs) or Regional areas where they could be stationary and lease big chunks of space. That included in growing cities or repositioning failed spaces that were left on city tax rolls. The upside was, for enterprising individuals, this left them creative liberty where others failed, to reposition key real estate components. And subsequently pass on their knowledge to those who worked with them during the recovery phase.

Meanwhile, in “The Burbs”, most people were just concerned about the losses in value of their houses, while they worked in industries outside of real estate.

And for those that think the suburban development saved America, allow me to show you some “household statistics”, here’s some charts:

In case it isn’t abundantly clear now, why suburban homes were able to not crash in general/greater than 50% of the Nation, to levels on par with the “GFC” (Great Financial Crisis) at the start and end of the 1980’s, its because of how many Mothers went to work, to help provide for their families due to how volatile and difficult the 1980’s actually were for families across America. And for those of you who want to paint “boomers” as the problem, re read what I wrote, and tell me you can navigate that decade the same way.

Just to recap, the 1980’s witnessed the destruction of the timber industry, the homebuilder industry and consolidation of them and auto manufacturing, farmers and more. But hey, the lobbying groups survived. So you get the spoils of war.

Oh by the way, here’s just a small selection of people serving in Senate/Congress since the 1980’s:

That's a Baskin Robbins 3(1) flavor combo.

And for the Soup Du Jour:

“What’s the soup du jour?”

“It’s the soup of the day”

© New Line Cinema: Dumb and Dumber

There is always a real estate “bubble” somewhere. Just because an entire nation doesn’t partake at once doesn’t mean there aren’t “bubbles”. And just because the nation partakes doesn’t mean there aren’t areas who don’t partake in real estate bubbles. Real Estate is “local”. Money isn't.

Now back to my point about Adjustable Rate Mortgages: loan products aren’t boogeymen. They don’ t up and “get you”. During the 80’s many home owners benefited from rates falling while being locked into ARMs (adjustable rate mortgages).

The terms just naturally favor the lender when a borrower overextends themselves. As in someone who borrowed too much money, borrowed at too high a cost of capital, or at the absolute wrong end of market timing. The GFC was aided by the invention of text messaging and email in regards to speculation.

Suffice it to say, those who don’t learn history are destined to repeat it. Those who do learn it, are destined to watch others repeat it. Despite this, or maybe because of it, there is always opportunity somewhere.

Time is a flat circle.

© HBO Productions True Detective

A flat EFFing circle.