The EFFing Memo

EFFrankenstein's Monster.

The Memo:

To:

The Board of Directors

Re:

Human Behavior

The Next Leg down in NASDAQistan is just around the corner

U

23: Rattle and HumA pair of magic tricks

Today in EFFing Time

Comments:

As I track data sets week in and week out, I find myself more interested in the similarities to previous cycles. Maybe that’s introspection, maybe it’s the confirmation that there isn’t much new under the sun. And maybe some of it is knowing this is probably the last cycle this information will ever be useful again, as what lies beyond is likely a New World Order. Which will still be made up of the same human behavior, we’ll just need a new EFF index when the dust settles.

That is to say, human behavior rarely changes. In 1818, Mary Shelley wrote the Novel:

“Frankenstein, Or The Modern Prometheus.”

Prometheus, being the Greek Titan who defied Zeuss, gifting humans with the knowledge of Fire. Which is important. As the years have gone by, the concept of the story continues to be lost, or deteriorated upon the generations. But at its core, its origin, the story isn’t so much about Monsters or Horrors of the unkown or those cast as villains as it is:

The monsters and horrors of those cast as the main characters, those who throw aspersions upon their own percieved villains. Or to remove even the impropriety of the apperance of aspersion, all of our human behavior as we face a goal, conciously or subconciously, surmountable or no. And our subsequent response to it.

You see, Victor Frankenstein’s Monster wasn’t really the Monster of the story. Victor was chief among the villains. From his obsession with Alchemy, to creating life with zero regard for the life itself, to making no objection in the false prosecution of his brothers alleged murderer, to his willingness to create yet another Monster, only to make the decision to destroy it when the concept of their potential procreation worried Victor so, that the life forms he created indeed had their own free will. Part and Parcel of the moral of the story.

Much in the same fashion, those who say recognizing deteriorating economic data is a horror story, they miss entirely the story of hope, humanity and opportunity that comes with life itself, even the life of alleged monsters. Despite all the horror that Victor wraught, his creation mourned his passing, and saught his own life, liberty and pursuit of happines. However imperfect it may have been.

While the novel references Paradise Lost, and the previous literature before it, so too we can recognize the passing of time, and that which is and is not similar to the lives we’ve all lived, and the effect of monetary and fiscal policy, while we all strive for our own pursuit of life, liberty and the pursuit of happiness. Mary Shelley’s mother happened to author “A Vindication of The Rights of Woman”. Some struggles take longer than others to come to pass.

The constant brightness is: we always have choices, and knowledge only offers more choices.

End Memo.

The Report:

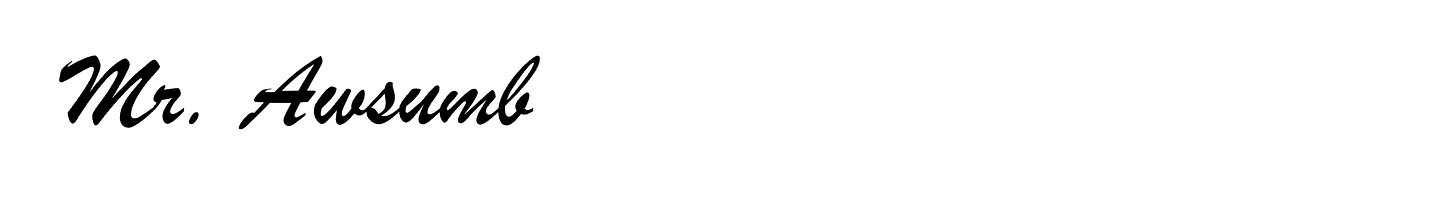

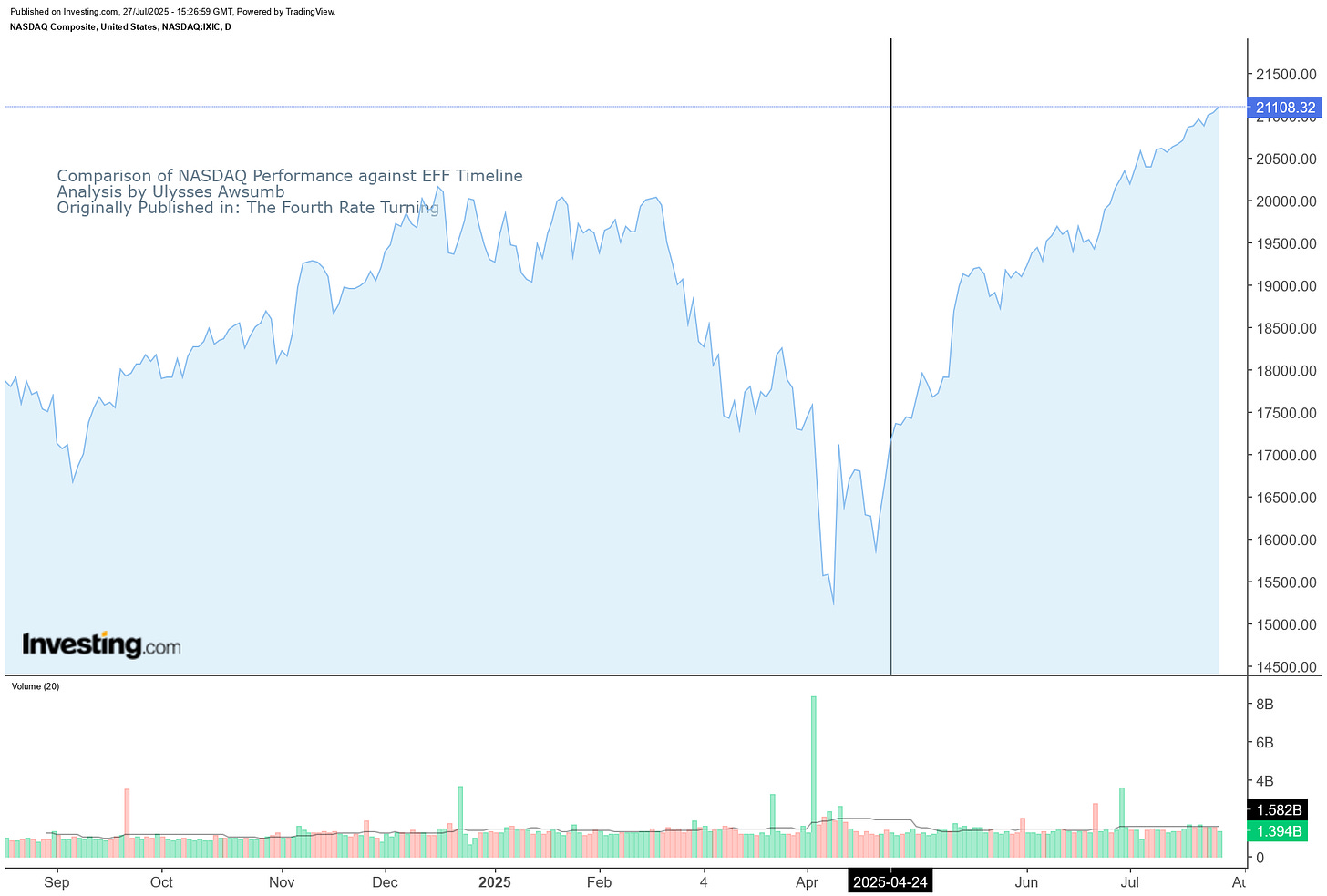

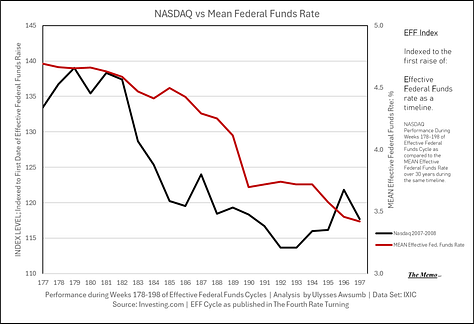

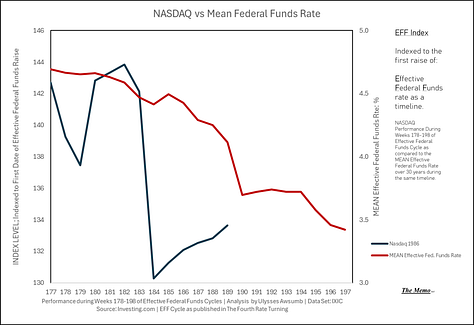

A quick revisit of Nasdaq performance, and the Time Flux Capacitor that I laid out in January of this year. Along with the results.

Using the Effective Federal Funds rate as a timeline, I created entry/exit points, with the idea in mind that:

Drawdowns in markets have happened many times and will happen again

Finding a place to exit and re enter without losing capital was a necessary component to this exercise.

Having some sytem for not just understanding, but explaining them would be vital.

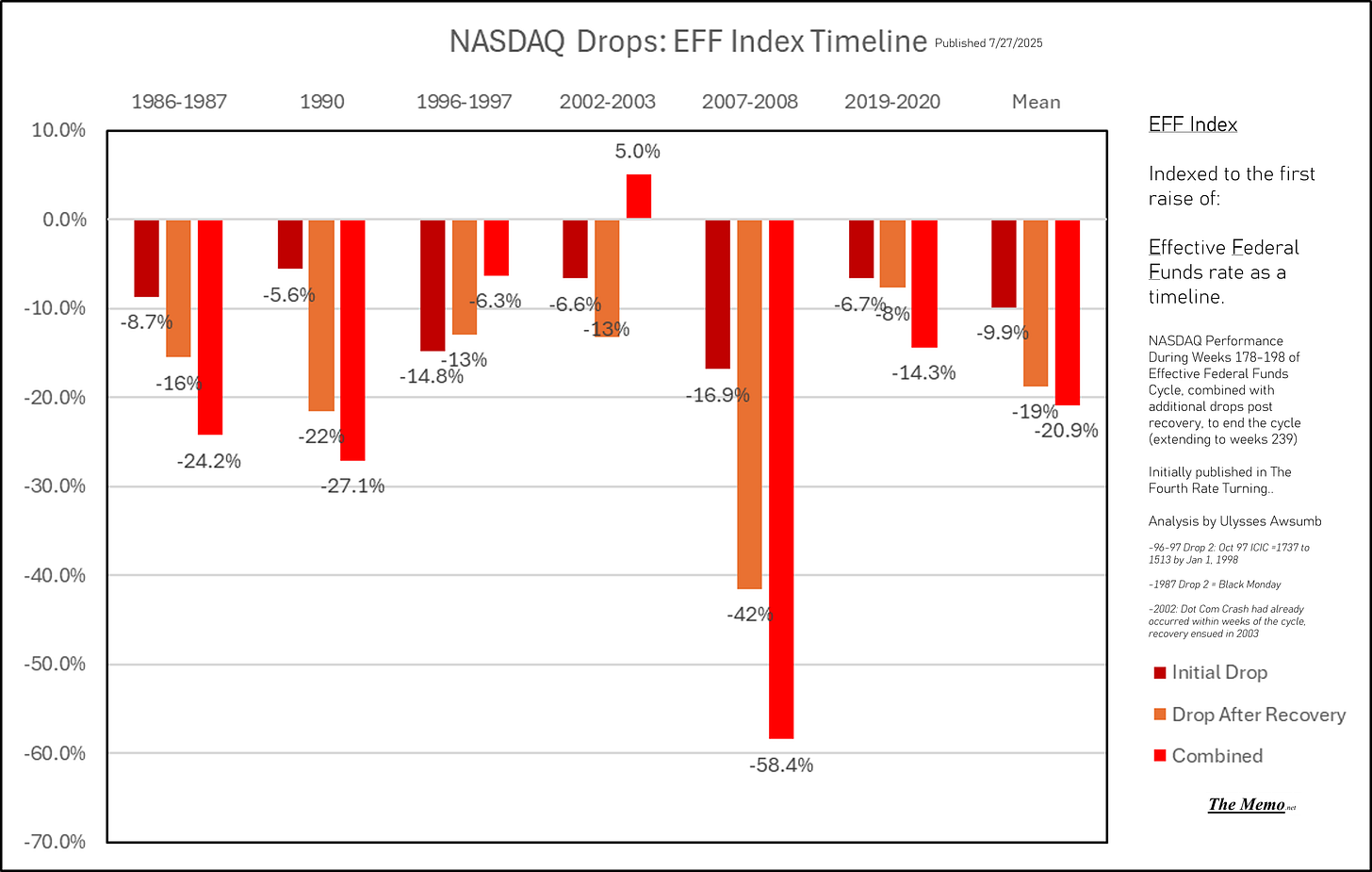

To that end, after pouring over data, finding patterns, studying rate changes and of course, needing to find behavioral reasons behind them (actual human behavior) , I set out creating this chart. Overlaying the EFF cycles across number of weeks since rates began increasing. The Storypoles are the “safe out” points I described in a previous memo. As in, the point at which the drawdowns in question would find future suppport.

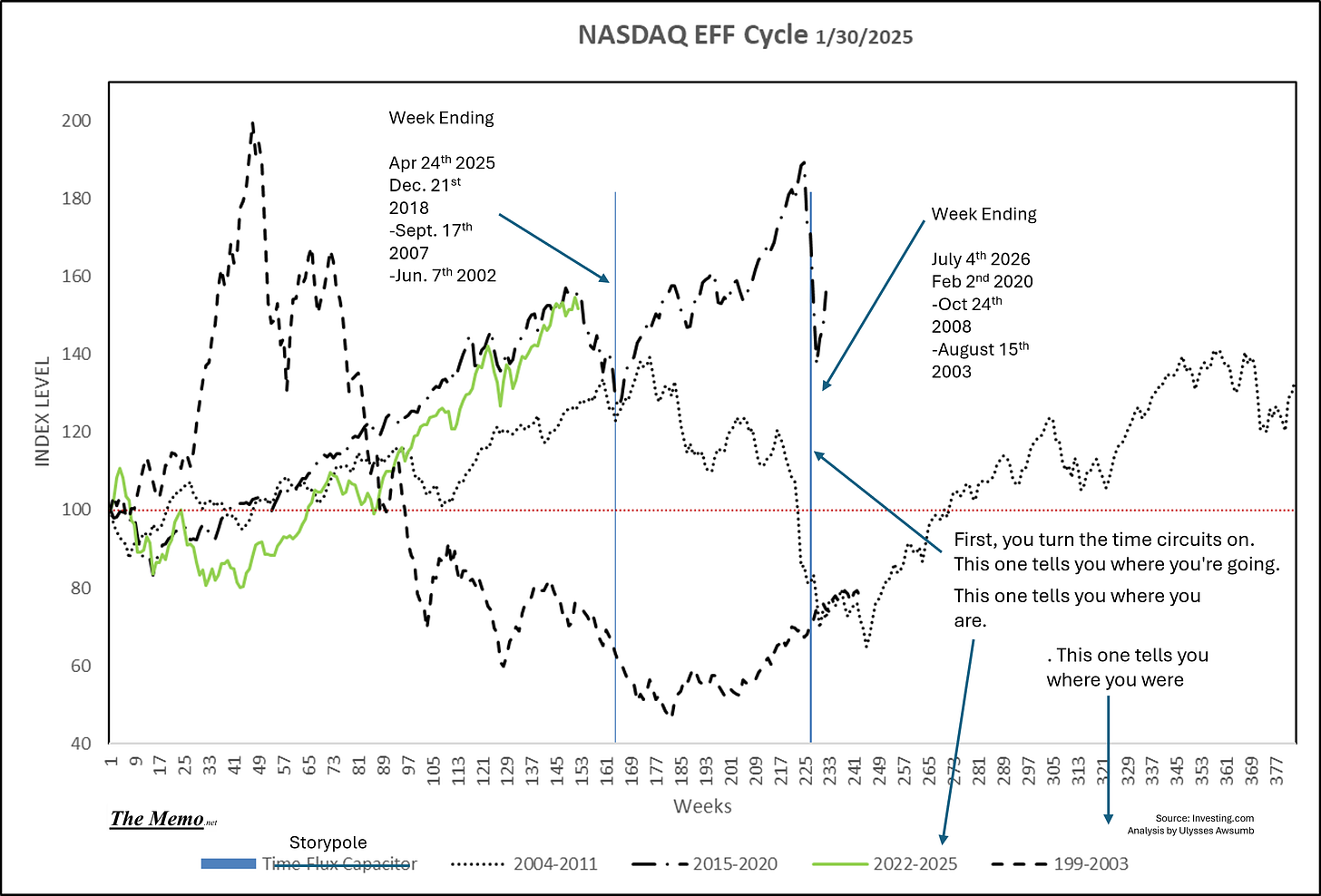

Compare that with this chart, in which I elaborated in The Memo, the level we would likely see support, based on the last 44 years of cyclical behavior.

And again, comparison of the same, using only a single linear time frame, of the current cycle. Found support at and reached my previous estimate post recovery.

Proof of Life.

NASDAQistan and Magic Trick #1

We stand at a crossroads. Not because we don’t know what happens next. Instead, it’s evaluating the conditions that are most similar, and disimilar to those we have already experienced. More momentarily.

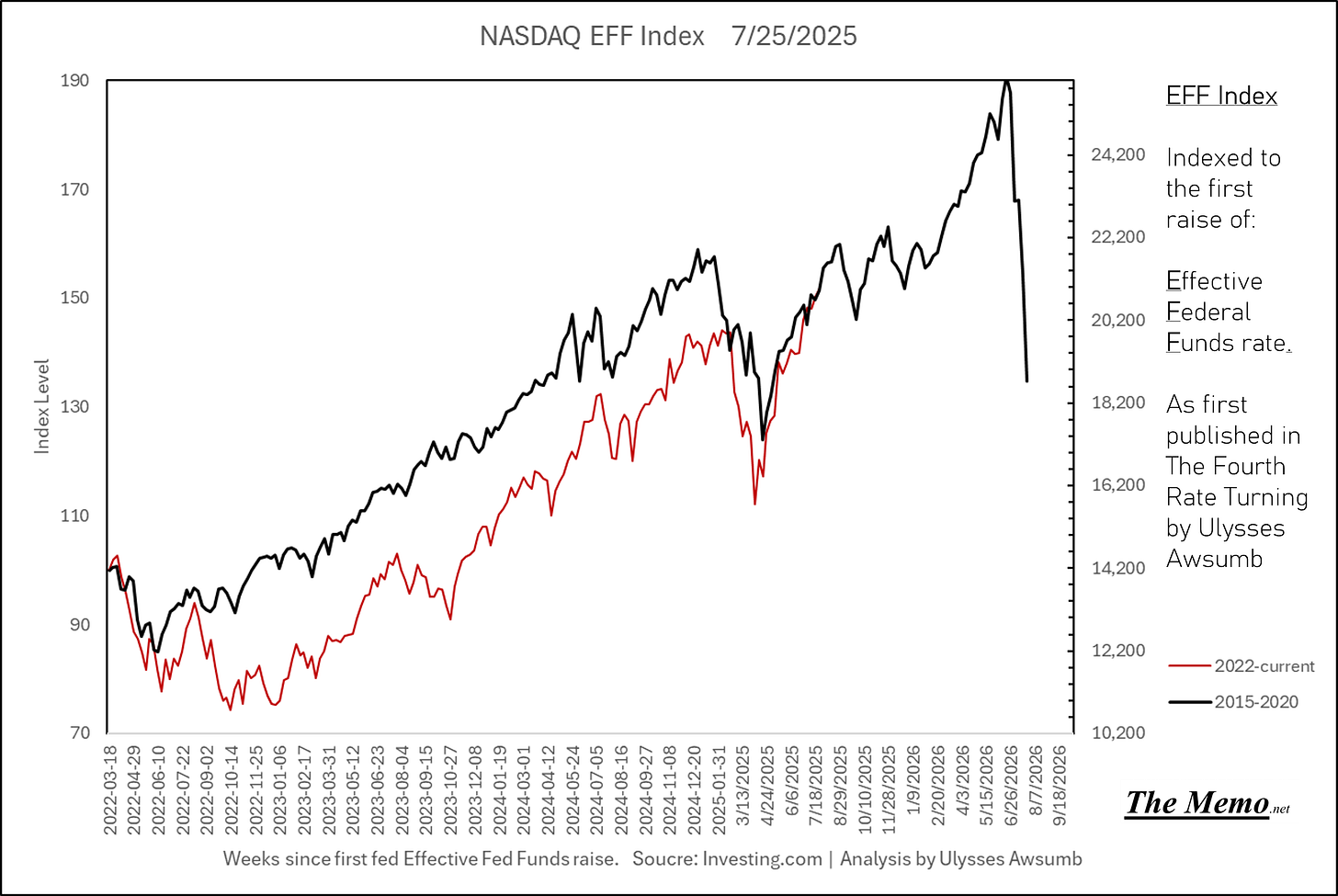

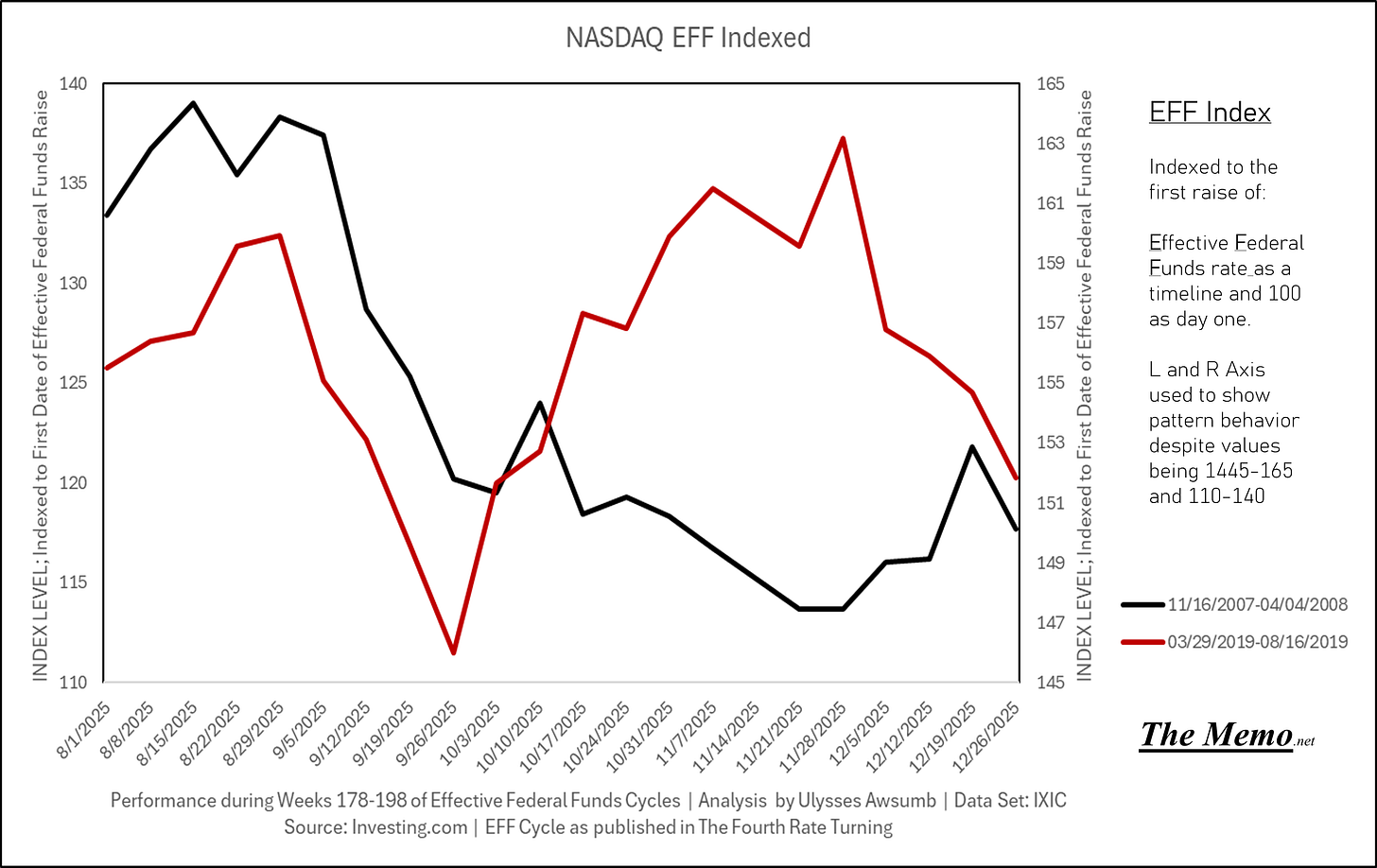

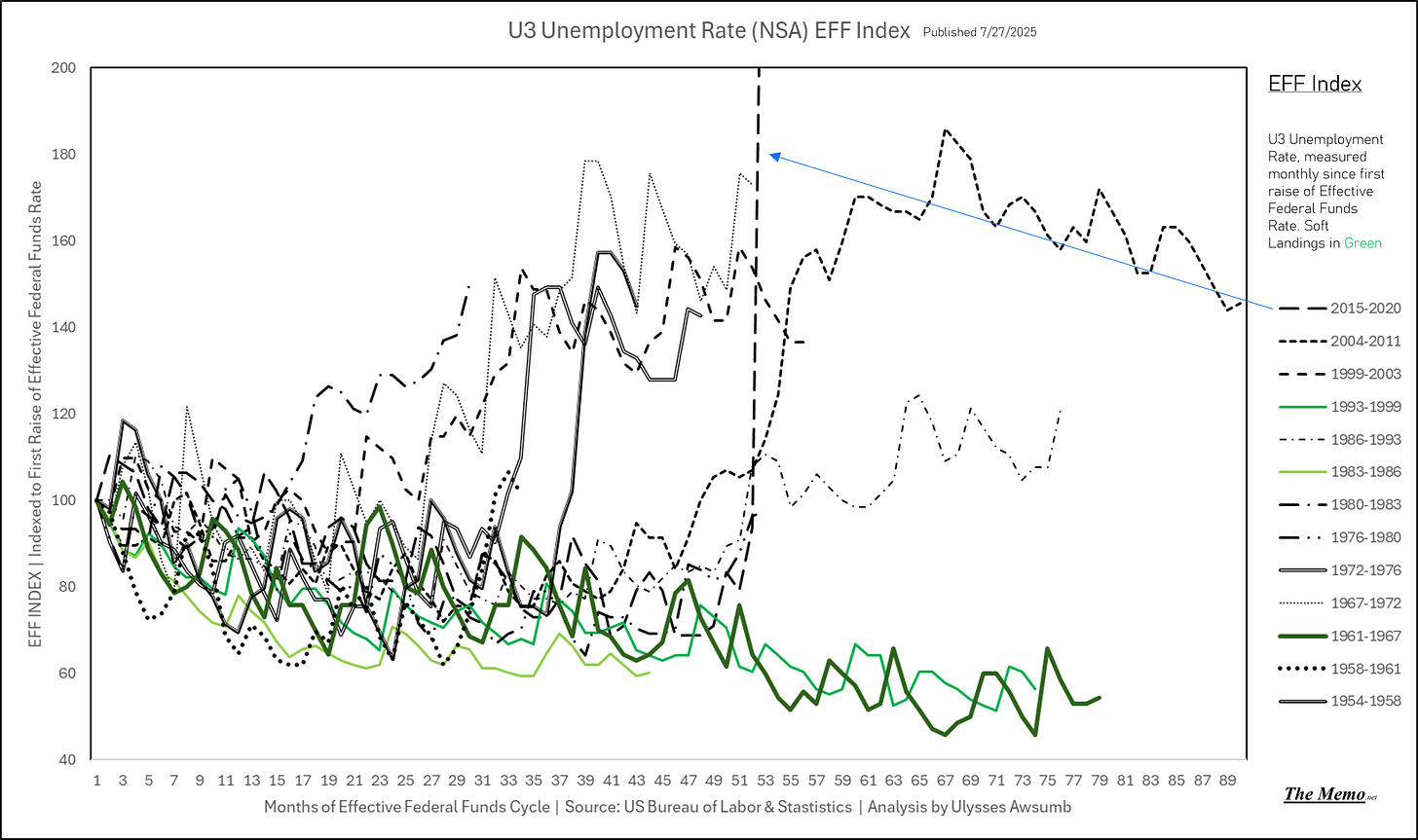

This is a chart of the NASDAQ EFF index comparing today to the 2015-2020 Cycle.

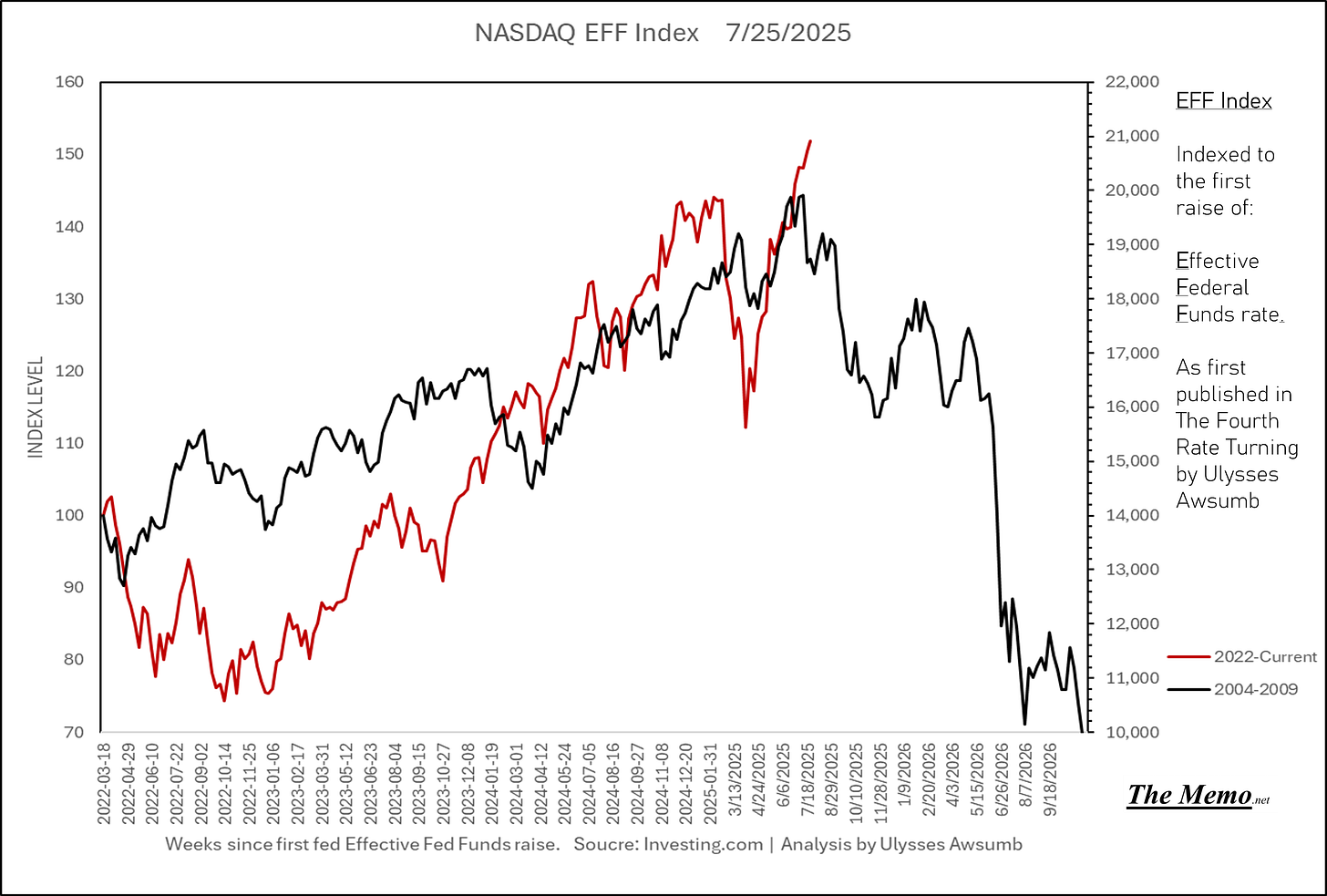

And this to the 2004-2011 cycle.

Similar. And disimilar. I will provide a factual, data and behavioral based argument any day needed, that 2020 was a natural end to the cycle. But I also recognize the differences between each cycle, and the behavior that goes along with those specific circumstances.

To that end let us simplify the situation, and walk through our Magic Trick.

The Pledge:

The day and date has changed, but the human behavior has not. We will repeat what we have done.

Each chart I’m about to show you, can be traced back to this origin. They are identical.

The only difference is: I have indexed them to the first day of the rate cycle (day one =100). This is the same chart. But instead of NASDAQ levels, they are EFF Index levels.

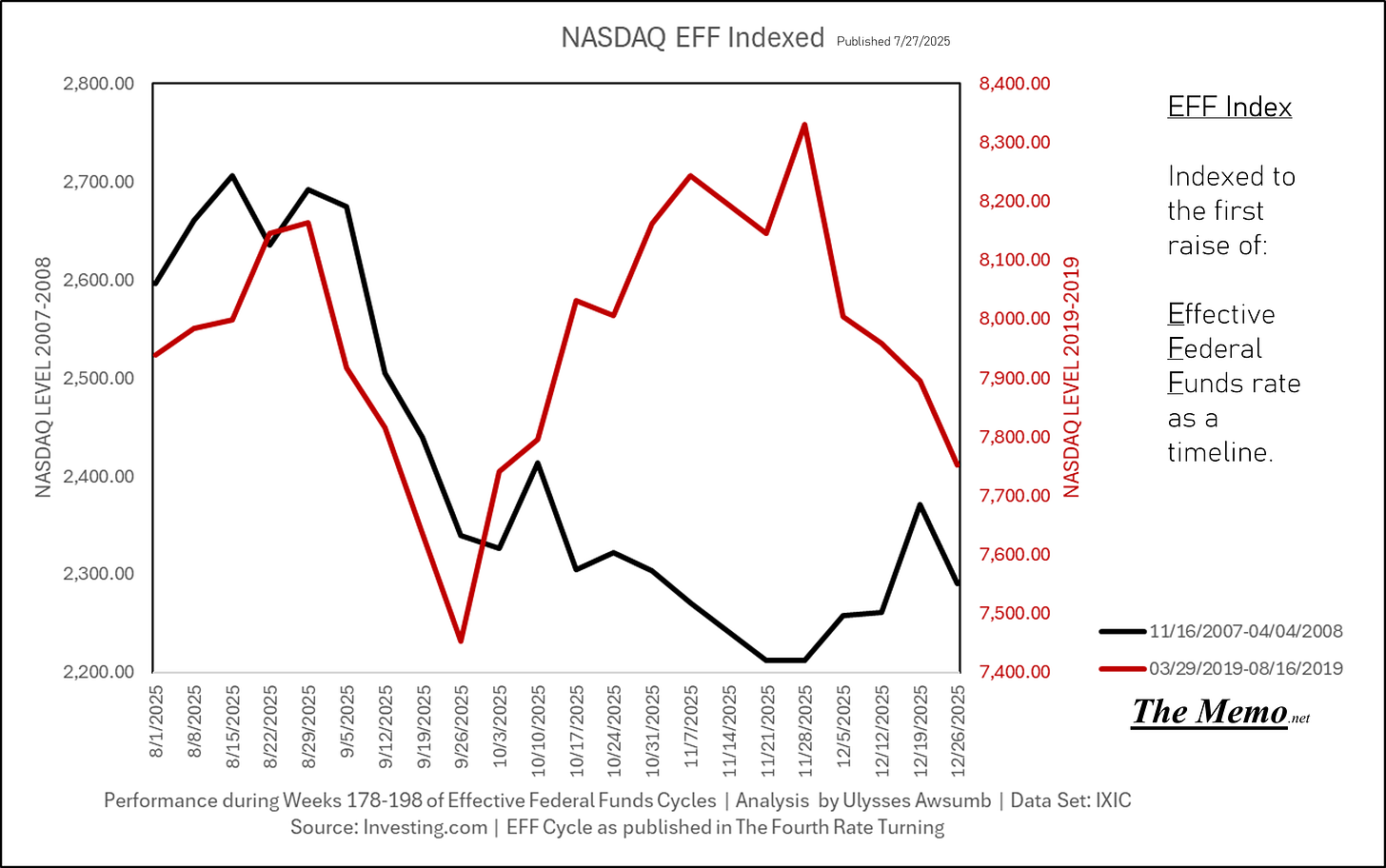

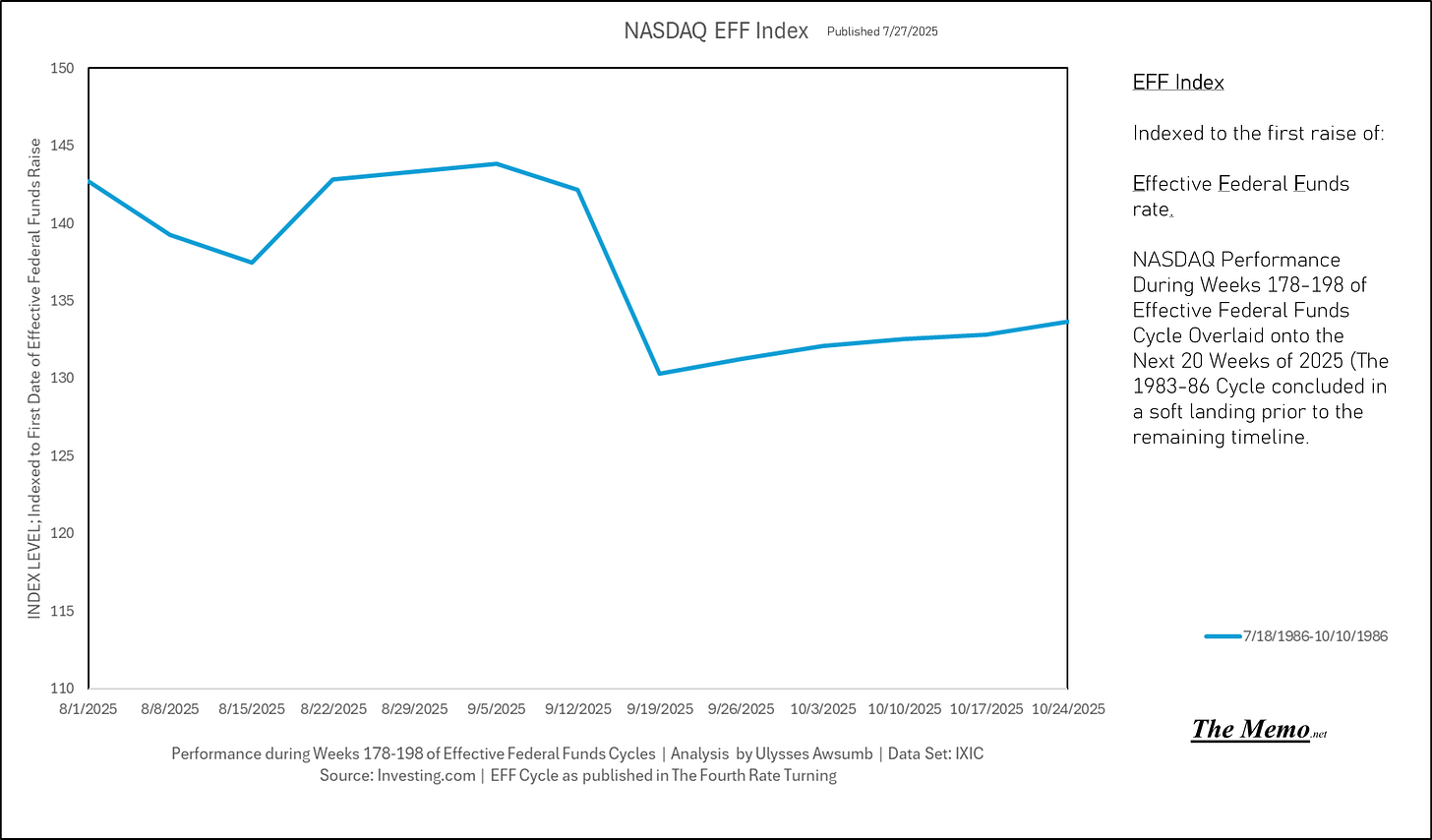

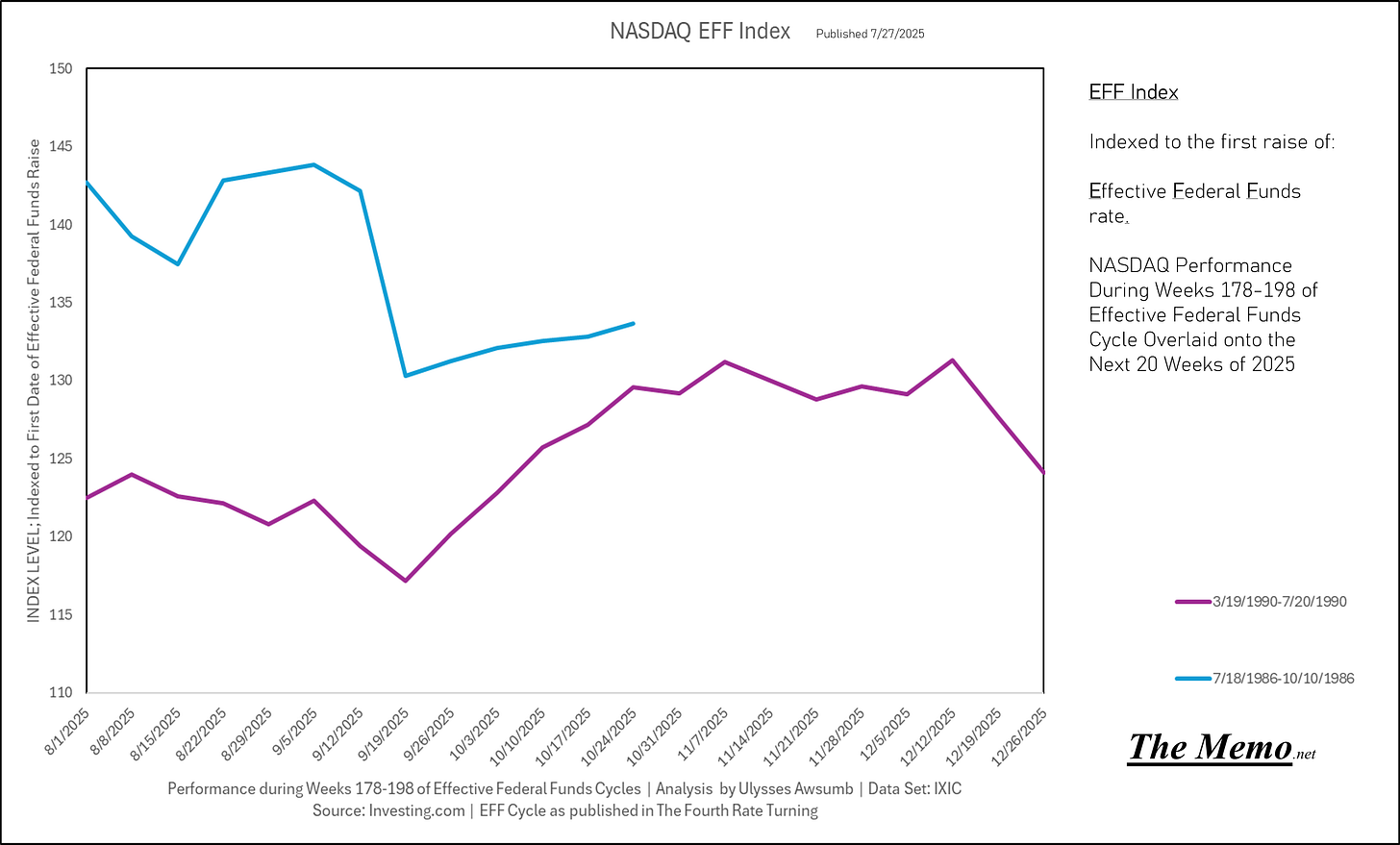

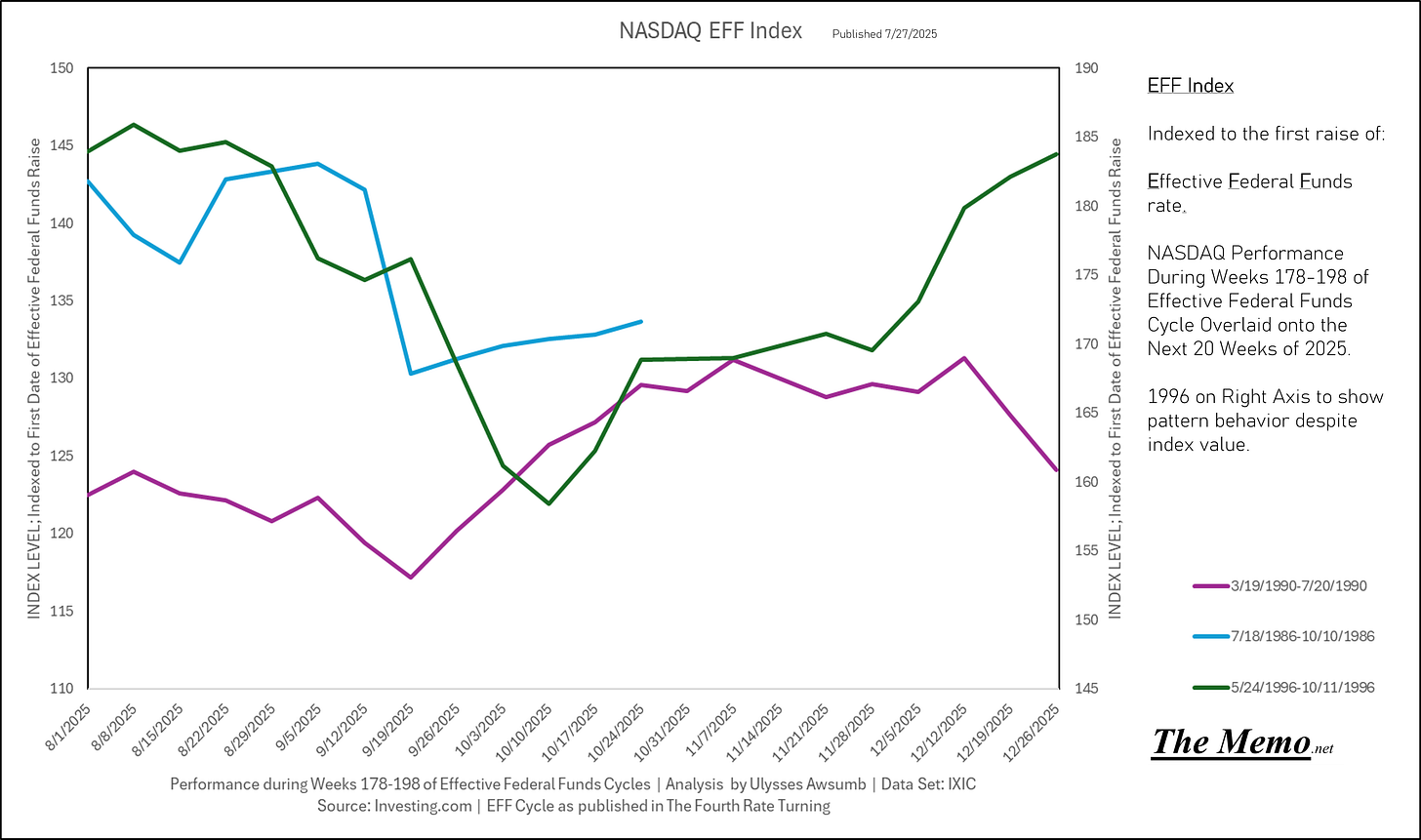

I deliberately overlaid the previous cycle weeks over the current future 20 week period, because despite what you may hear about the past not repeating, we aren’t discussing the past. We are discussing human behavior, and responses to economic conditions.

The Turn

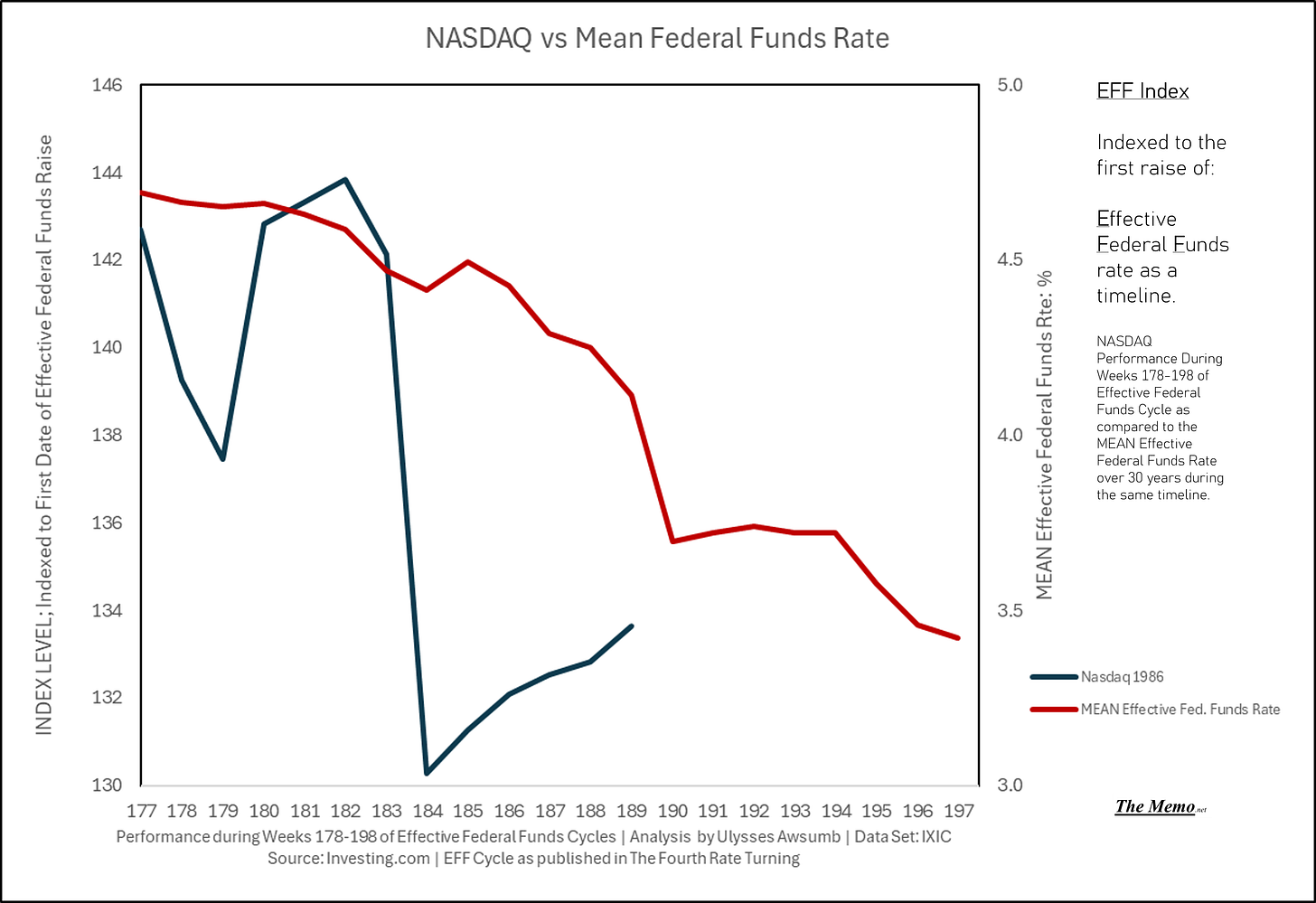

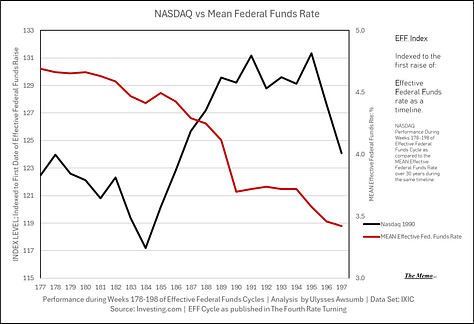

The end of the 1986 cycle from week 178 on.

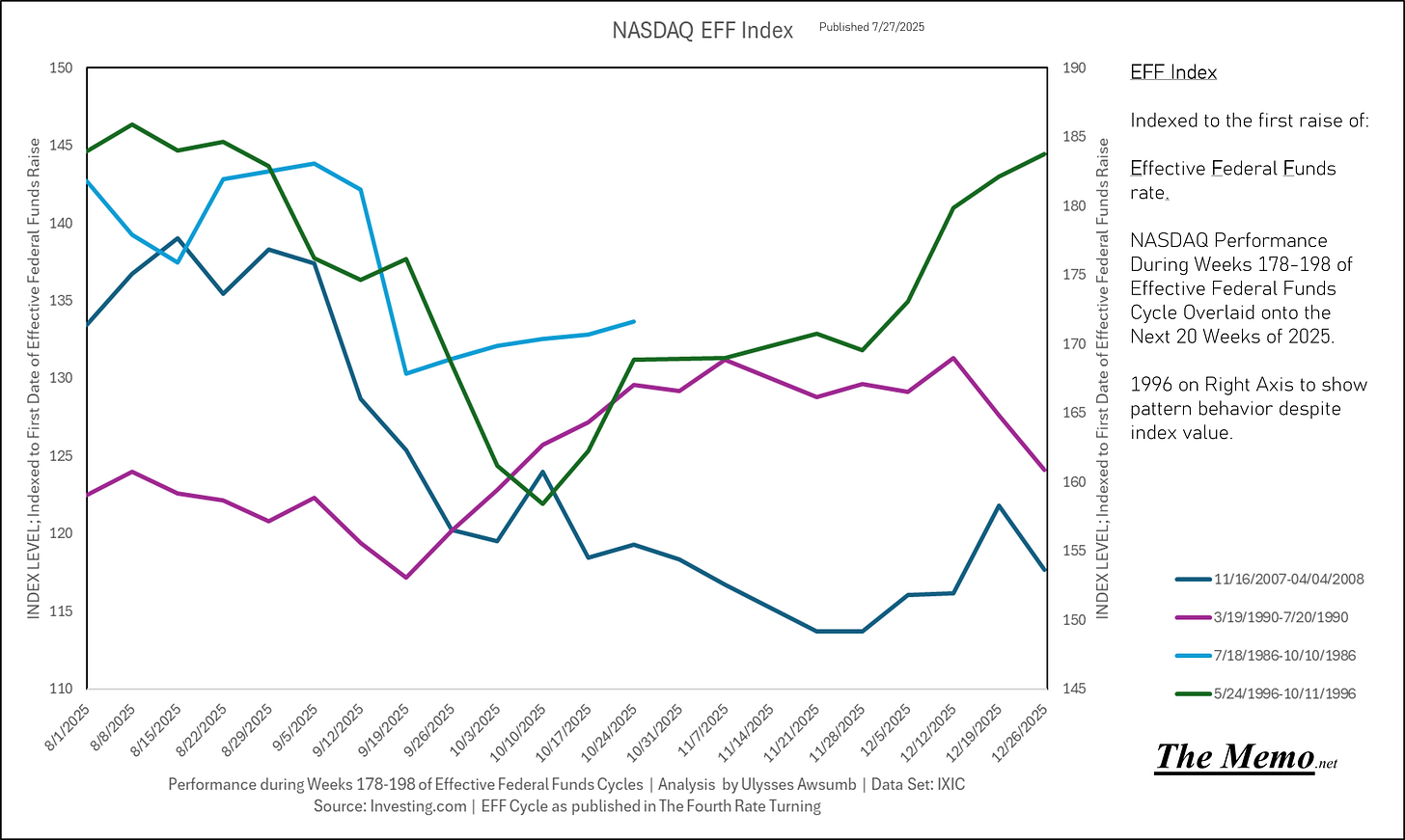

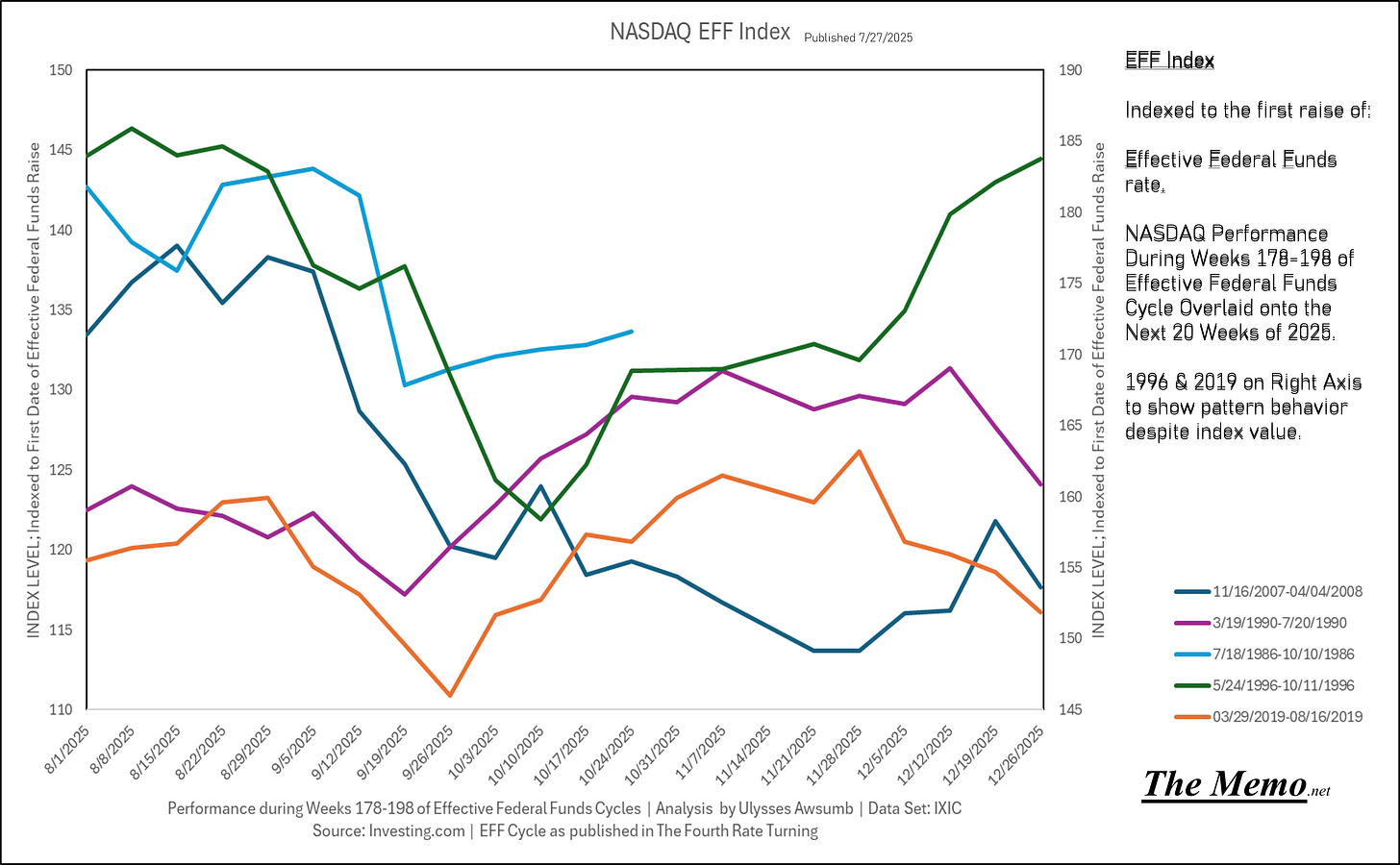

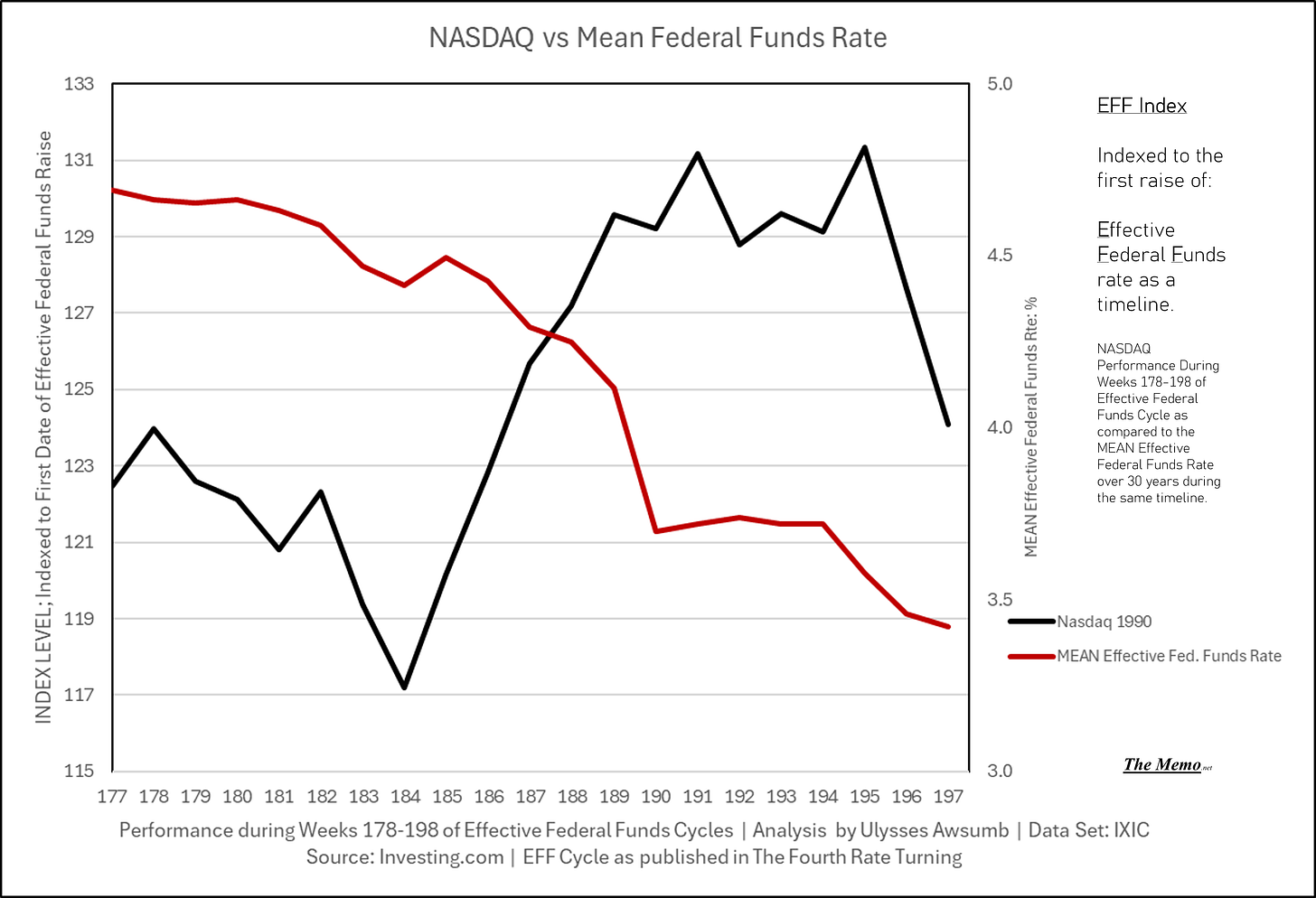

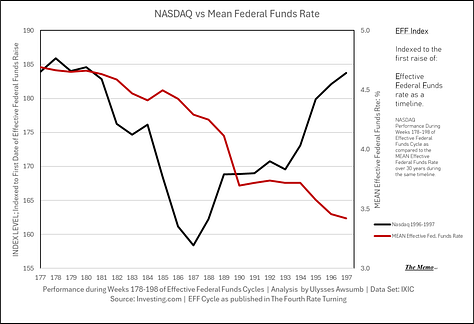

The 1986 and 1990 cycle, from weeks 178 to 198

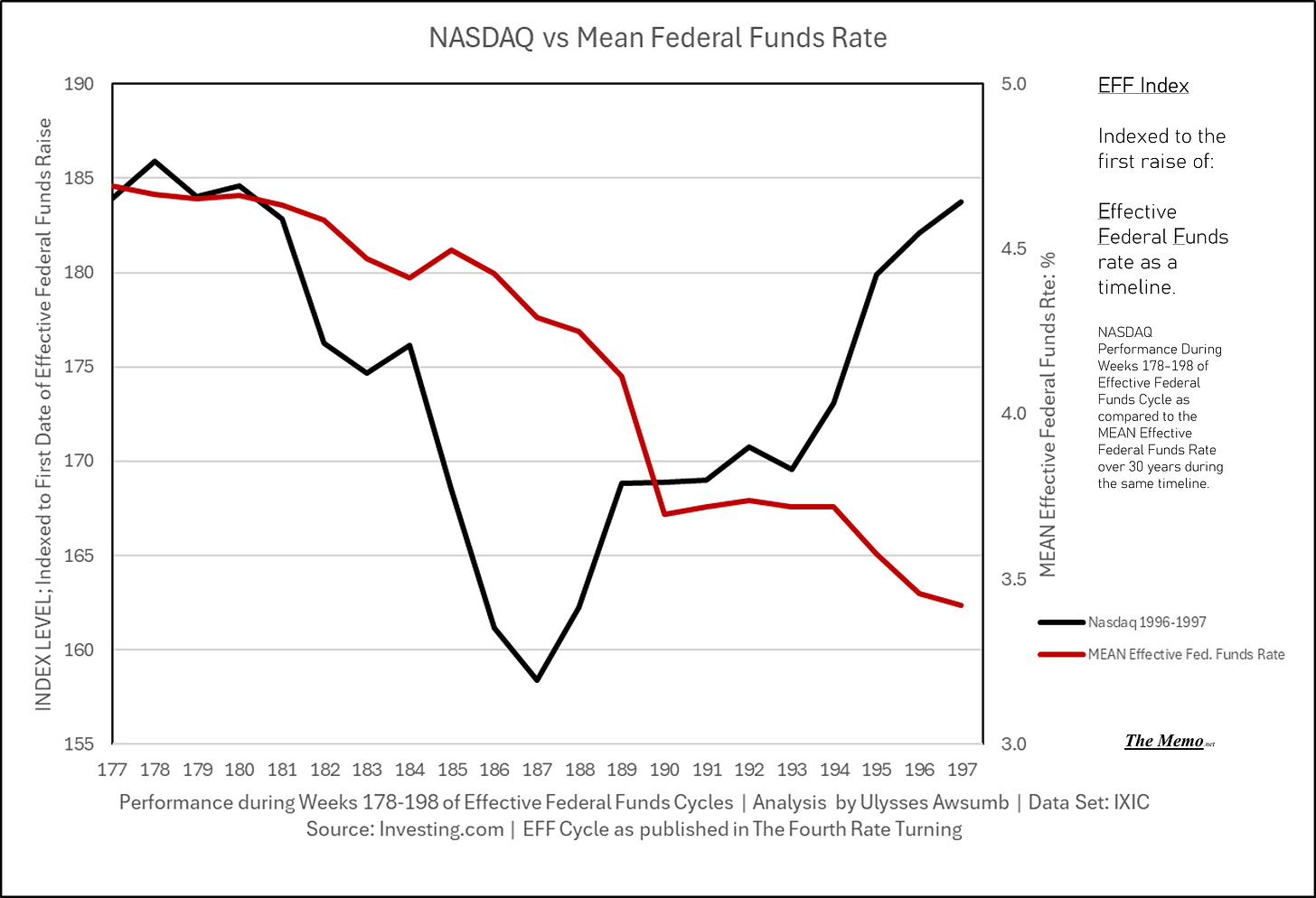

Adding 1996

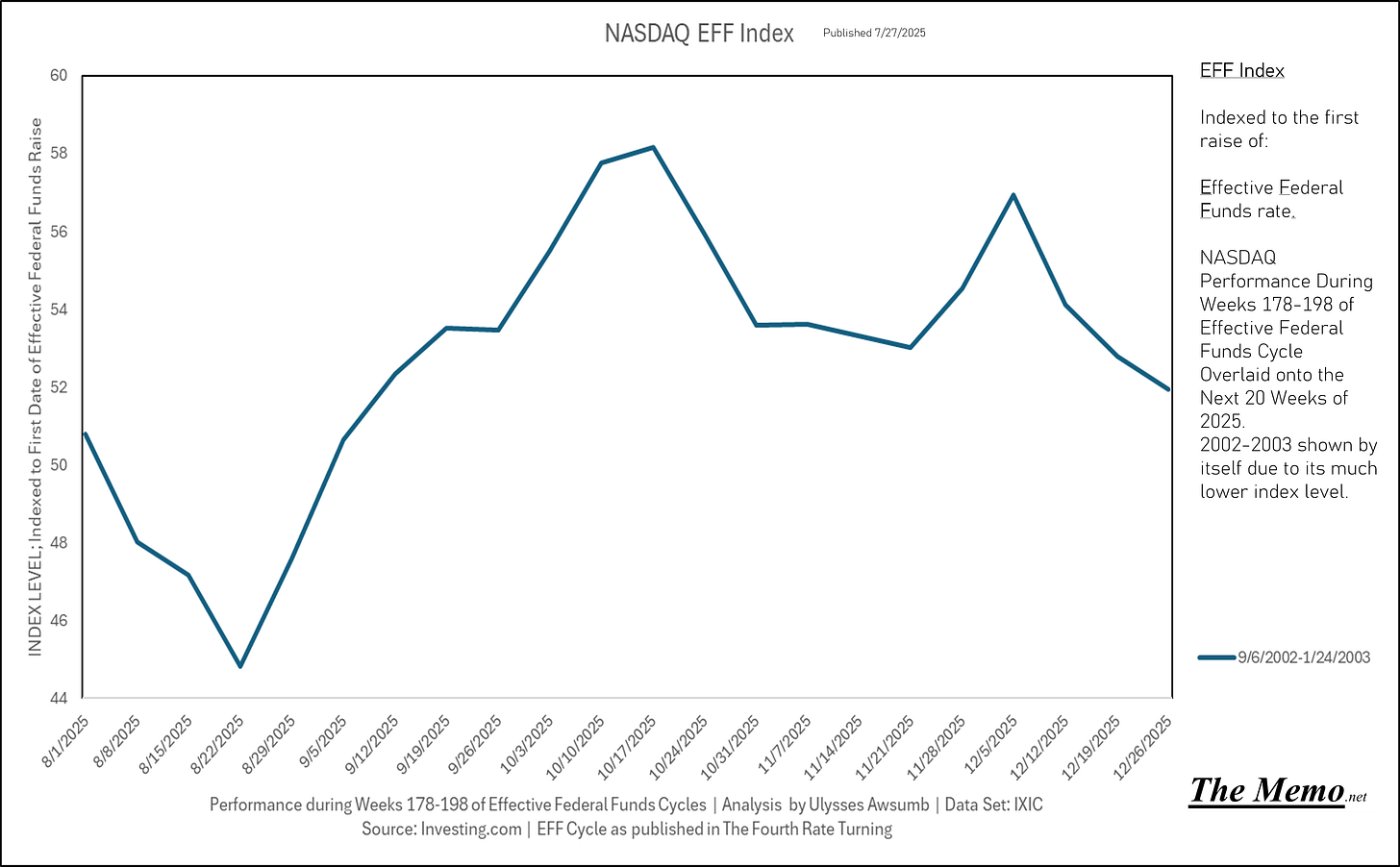

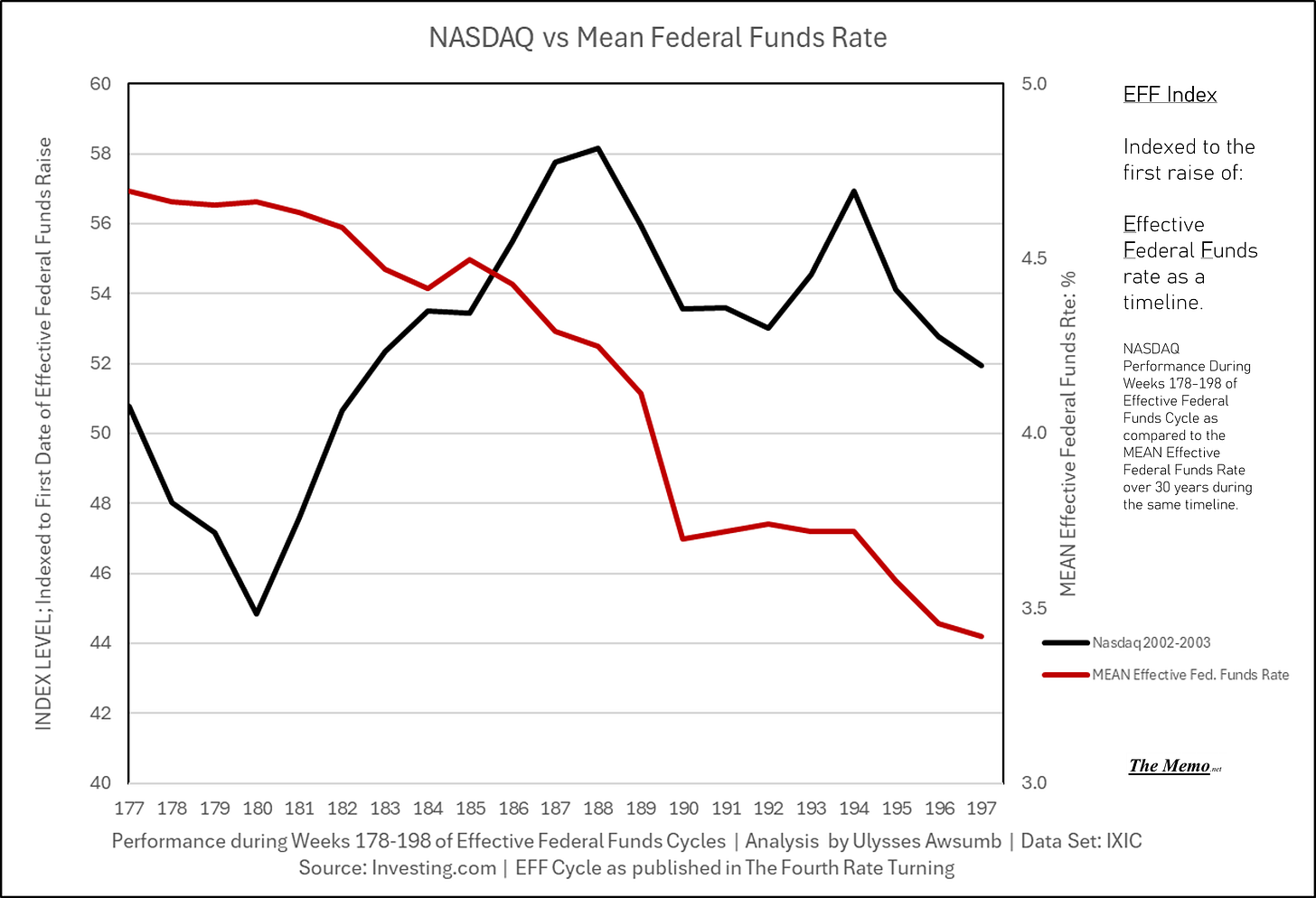

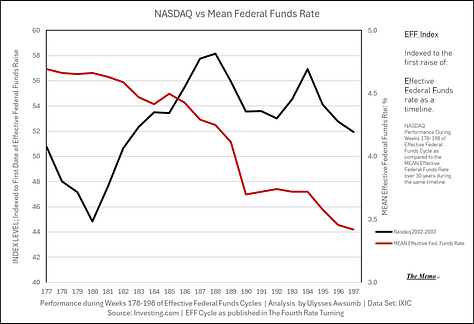

And 2002 alone. Due to how much lower the level was relative to the other timeline comparisons. After all, the Dot Com impact was felt even years after, only recovering in 2003.

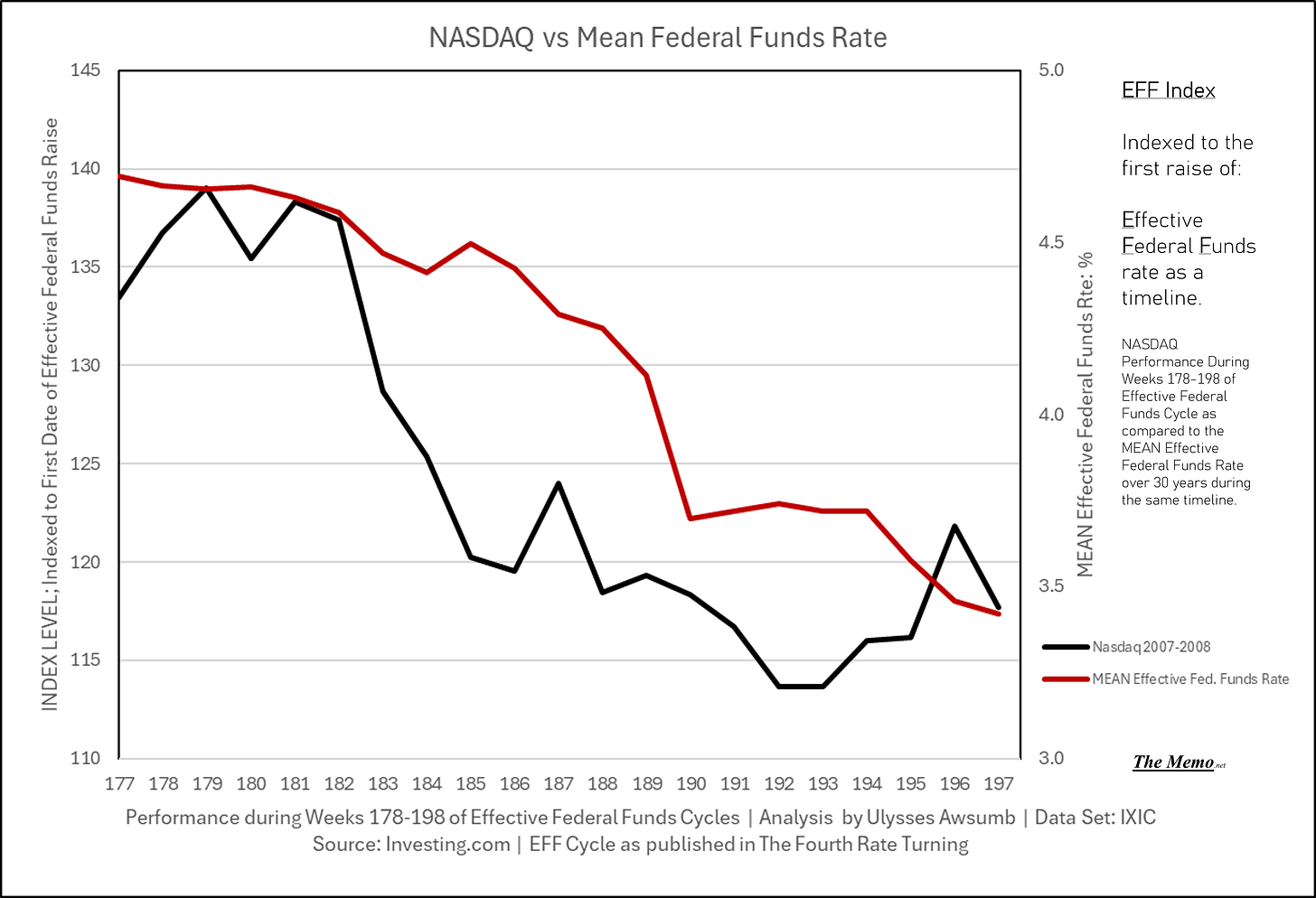

2007 into 2008 included.

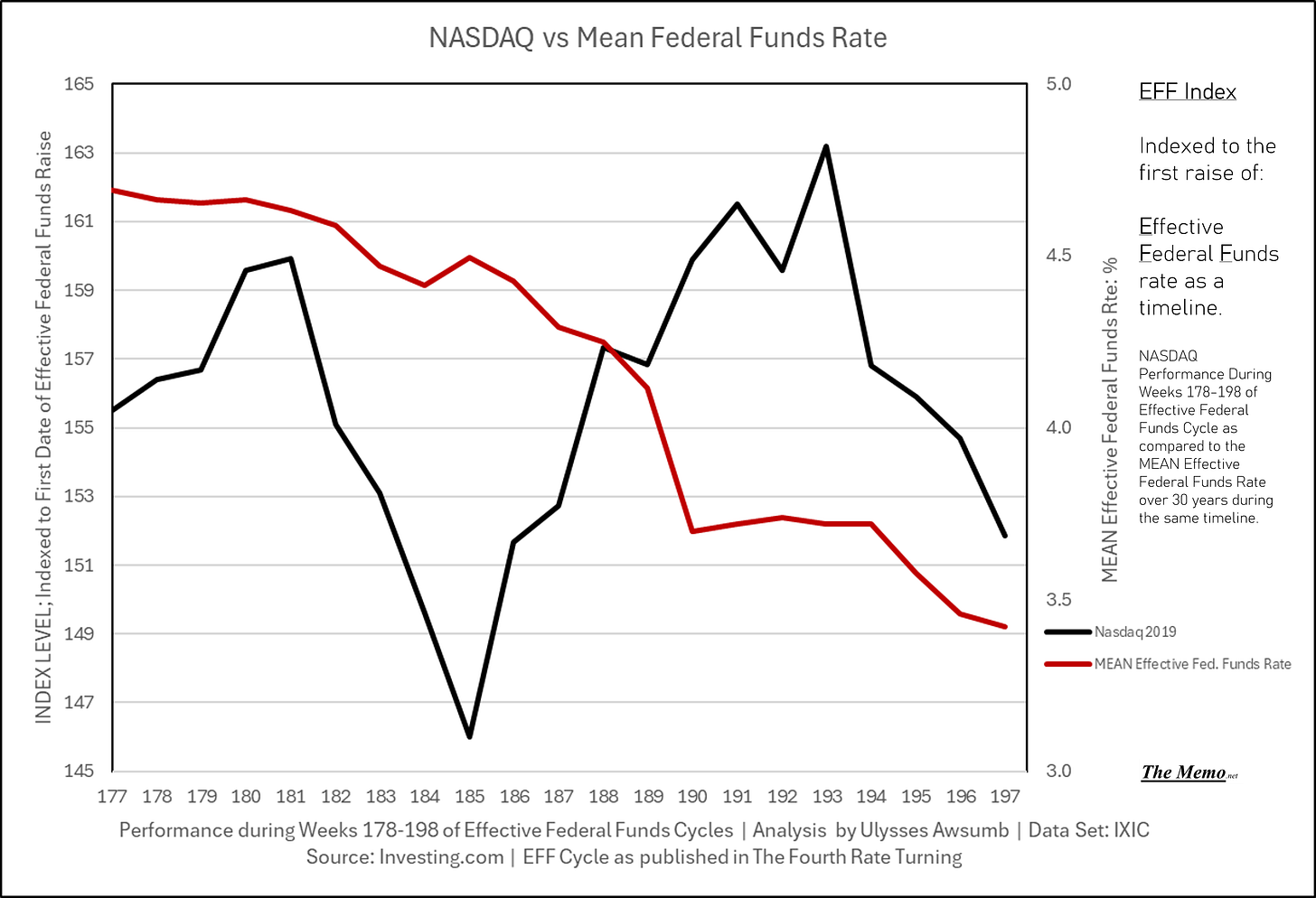

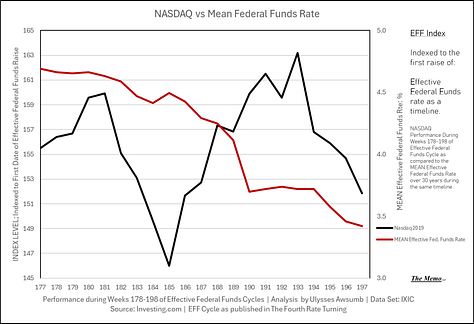

And finally, 2019 onto the future 20 weeks. August may see up to 3 more weeks of NASDAQ increase, but by mid September, we are going to repeat the same thing we have, for the last 44+ years. Drawdown incoming.

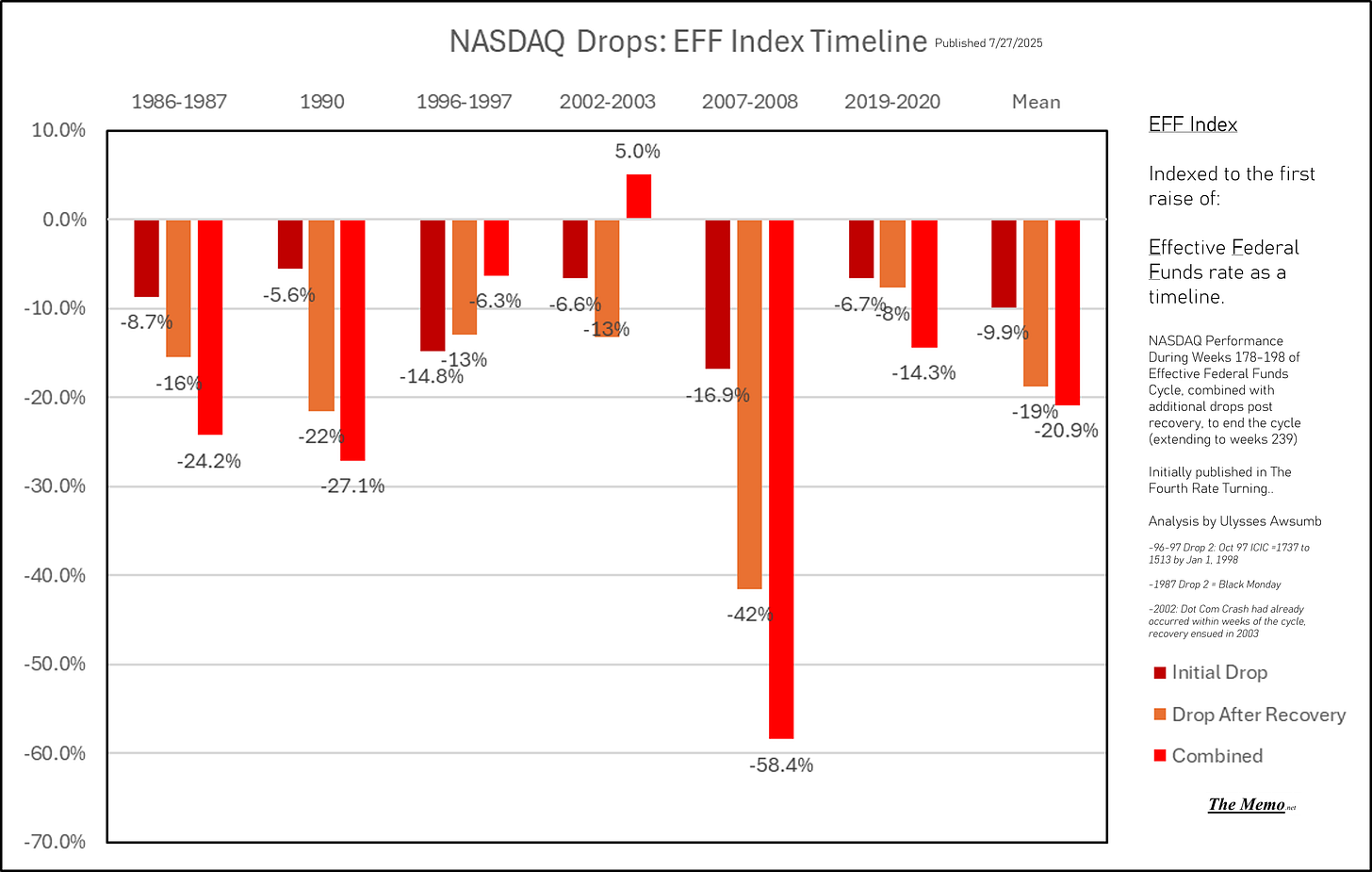

The next 6 weeks we will see drawdowns. But to further illustrate this point, let us break them down. As I have published here before, comparing these cycles to those of “The Fourth Turning”, we are on the precipice of the change from the Final Autumn to the Final Winter, of the Fourth Rate Turning of the Fourth Turning.

The exodus of “Fall” sees a drawdown in each cycle, followed later by another fall in “Winter”. Or behaviorally, an effort to reshift and shuffle the deck chairs, only to later accept the cycle has concluded before another cycle begins.

Here is a comparison of each “Next” drop in NASDAQ level, compared to the subsequent final drop at or just prior to the cycle’s end. There are two exceptions: Black Monday was immediately following the 1986 soft landing, and Dot Com was also at the beginning of the next cycle, albeit a 2+ year nonstop runup was inbetween. Things had deteriorated so much, that by the time “Winter” came around for this data set, the second drop was actually the third, and ended higher than the second. Regardless, they all share the same behavior, with two exceptions to the rapidity of response due to their prior “soft landings." Said another way, a soft landing is assured of a hard start. Alchemy may have its place in this world, but it is no match for human behavior.

All that to say, even if after this next leg down, the subsequent drop after recovering, will leave the index, at it’s level best: even, across the timeframe regardless of how much higher it goes through its bounce. On the correct timeline.

The Prestige

Ladies and Gentlemen: the EFFECTIVE Federal Funds rate.

I give you:

1986

1990

1996

2002

2007

2019

For those of you reading on the app: a collage.

U23: Rattle and Hum: Magic Trick #2

Helter Skelter

Look out! Helter Skelter,

Helter Skelter,

Helter Skelter, ooh.

Look out! 'Cause here she comes!

When I get to the bottom

I go back to the top of the slide,

And I stop and I turn and I go for a ride,

And I get to the bottom, and I see you again,

-Helter Skelter, originially written and performed by McCartney and Lennon of The Beatles, later released by U2 on the album Rattle and Hum in 1988. (The only U2 Album worth listening to (that’s conjecture though)

From the information I read (by economists) tracking unemployment, I’d be left feeling Helter Skelter about the conditions of the U.S. Job Market. Fortunatley for me, I find my own answers to things that interest me and ignore opinions of little worth.

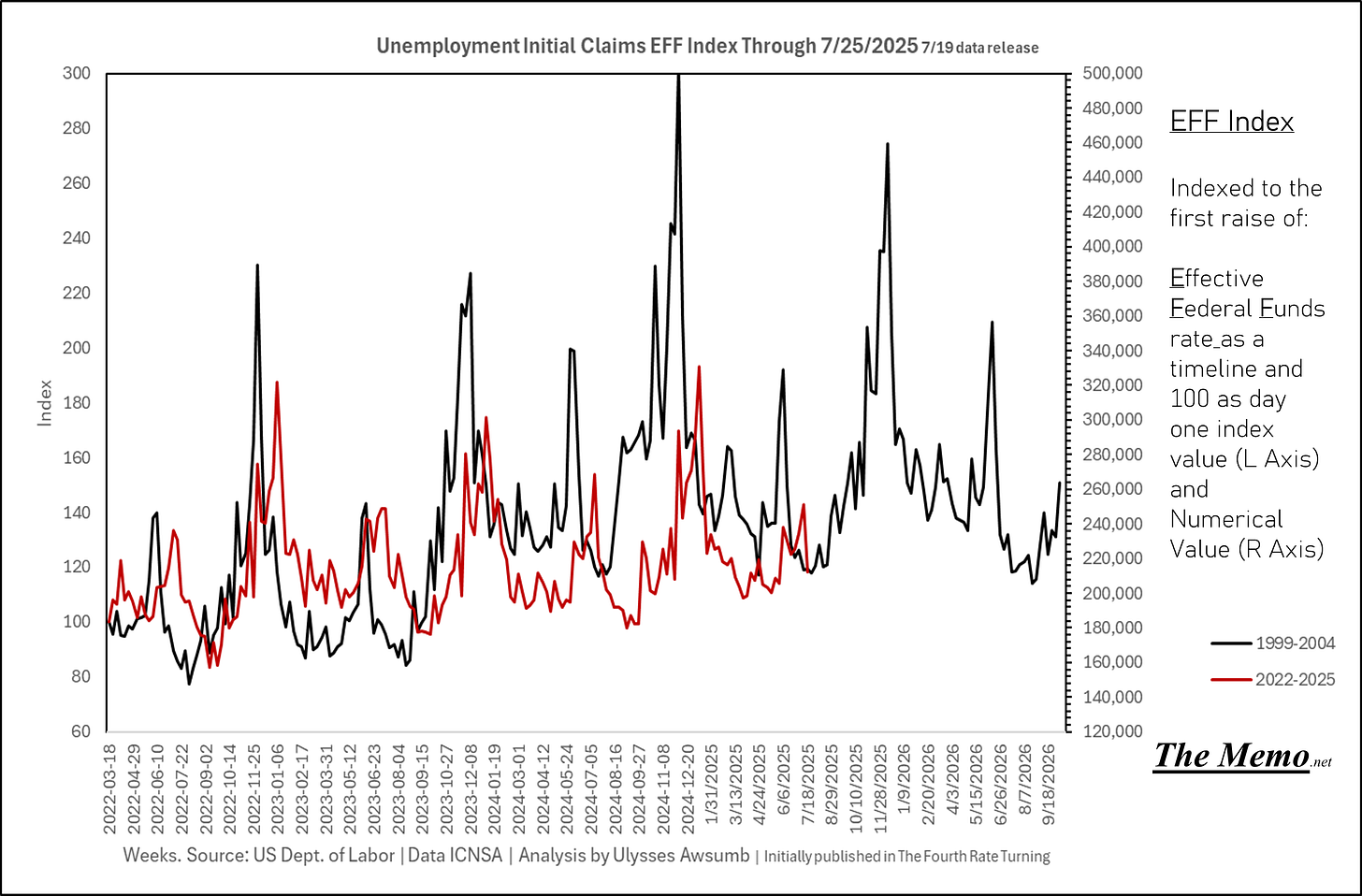

I’ve discussed the same crossroads, or rather similarities in this data set here several times. This chart compares initial unemployment claims to the 1999-2004 cycle.

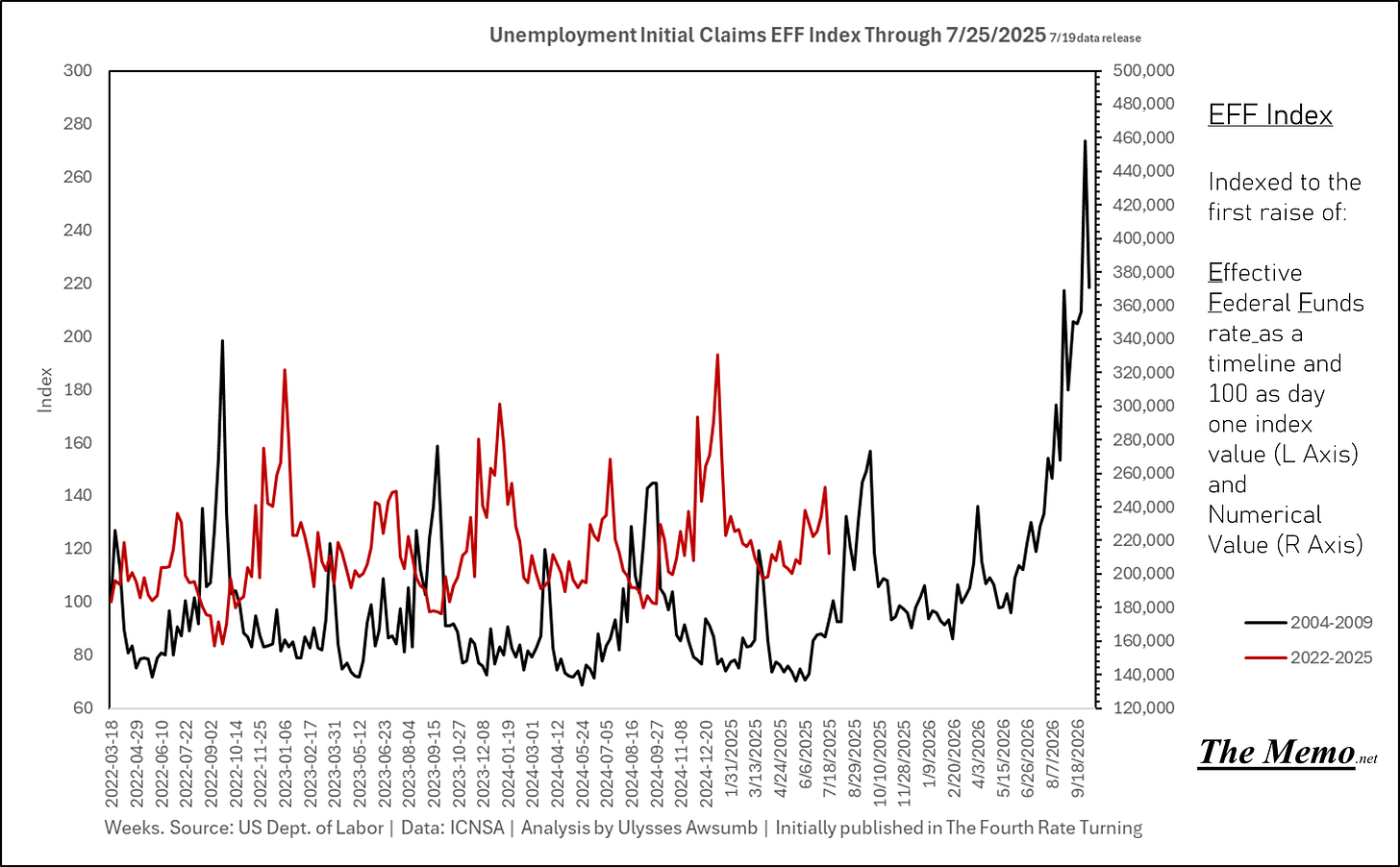

And this to the 2007 timeline version.

The Pledge

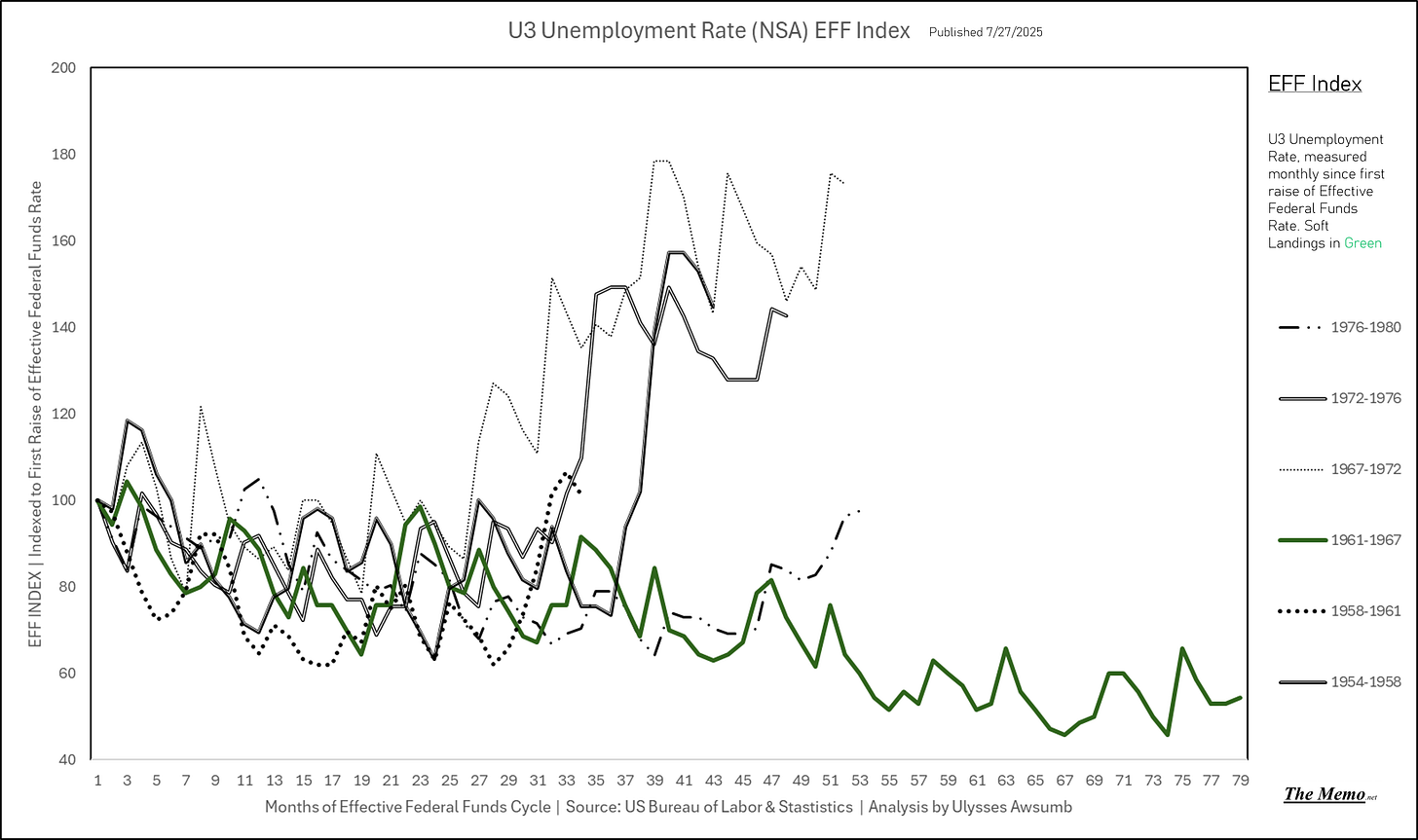

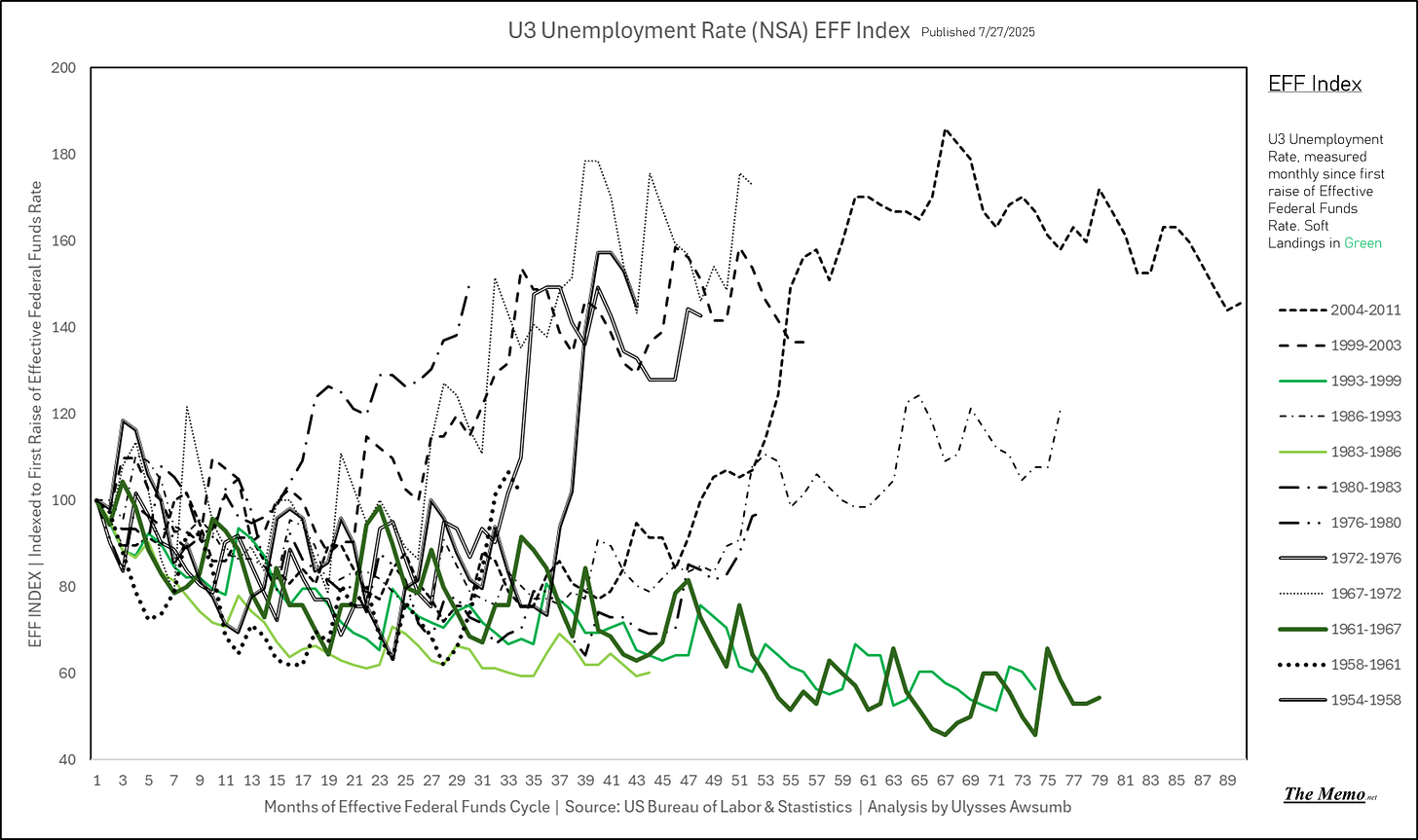

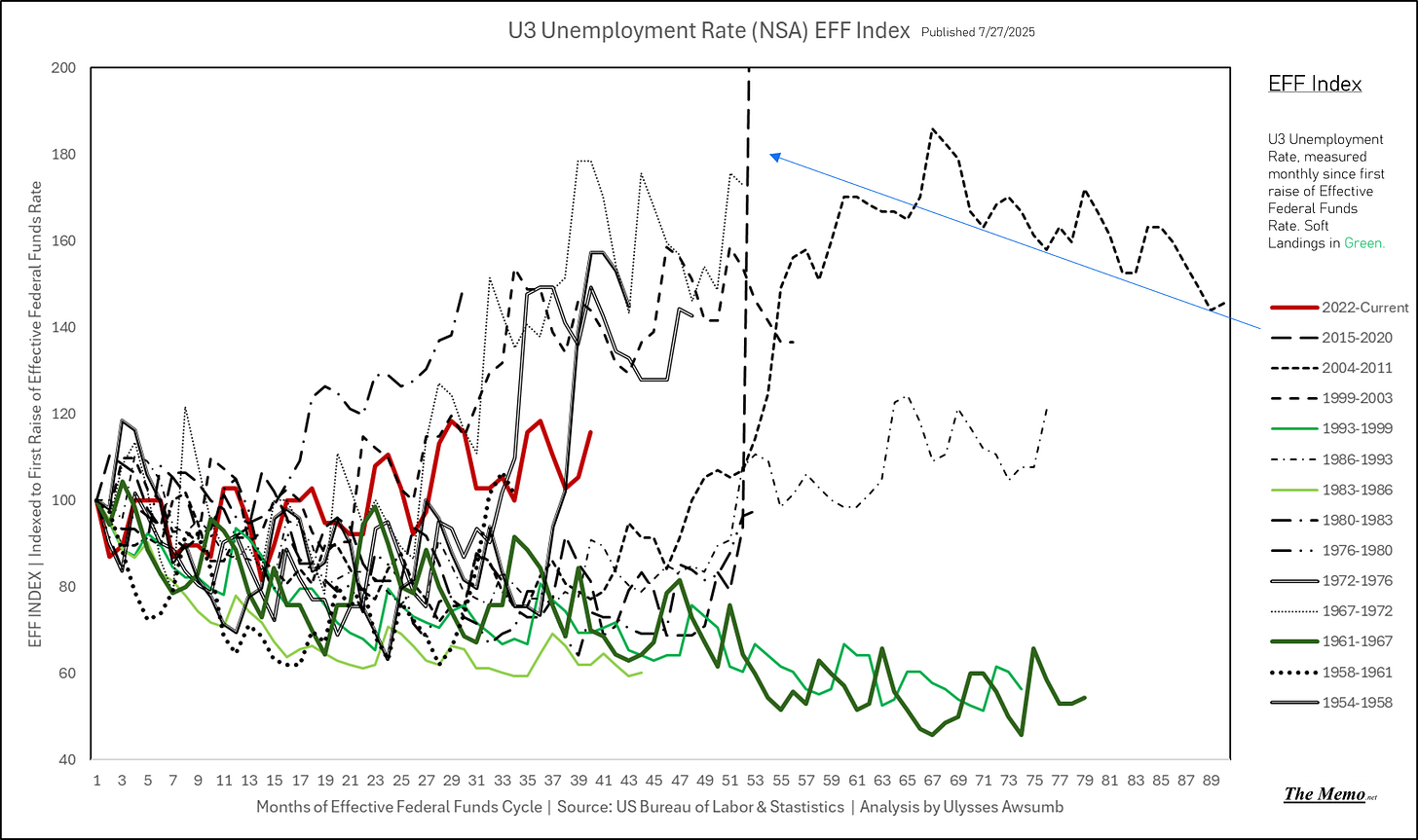

Let’s apply the same magic trick to the rate of unemployment shall we? If 40 years of data wasn’t enough, let’s go back 71 years instead.

The Turn

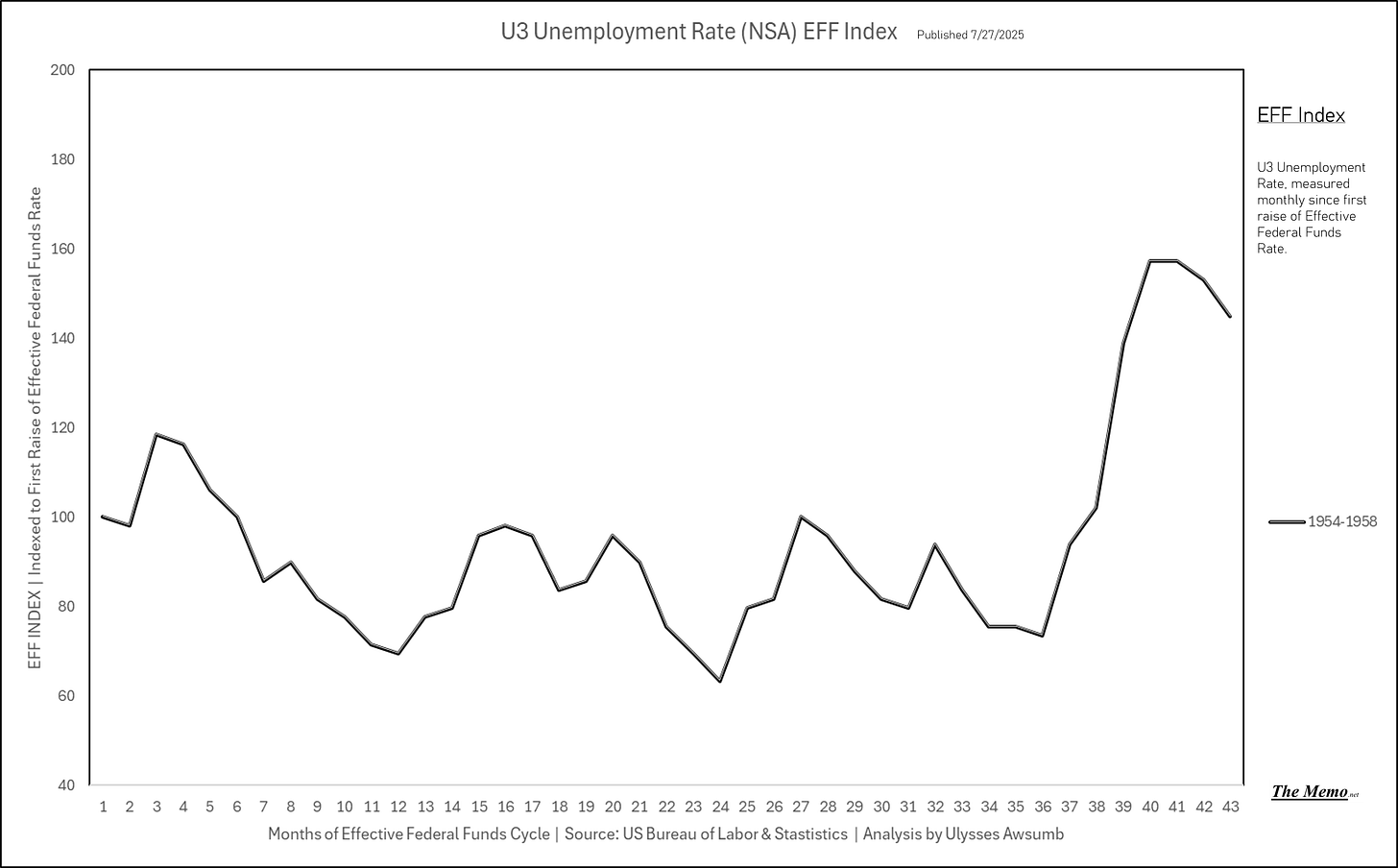

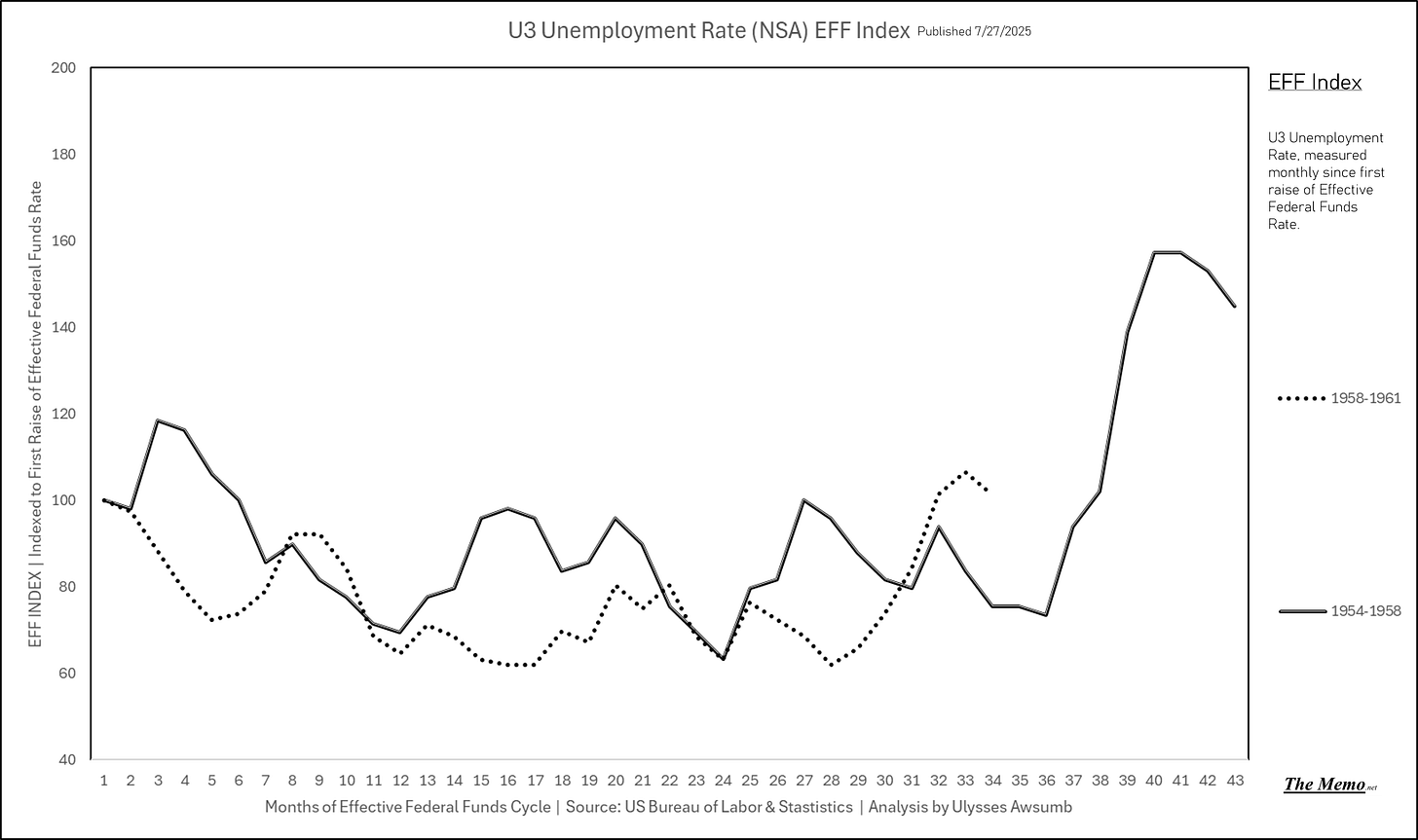

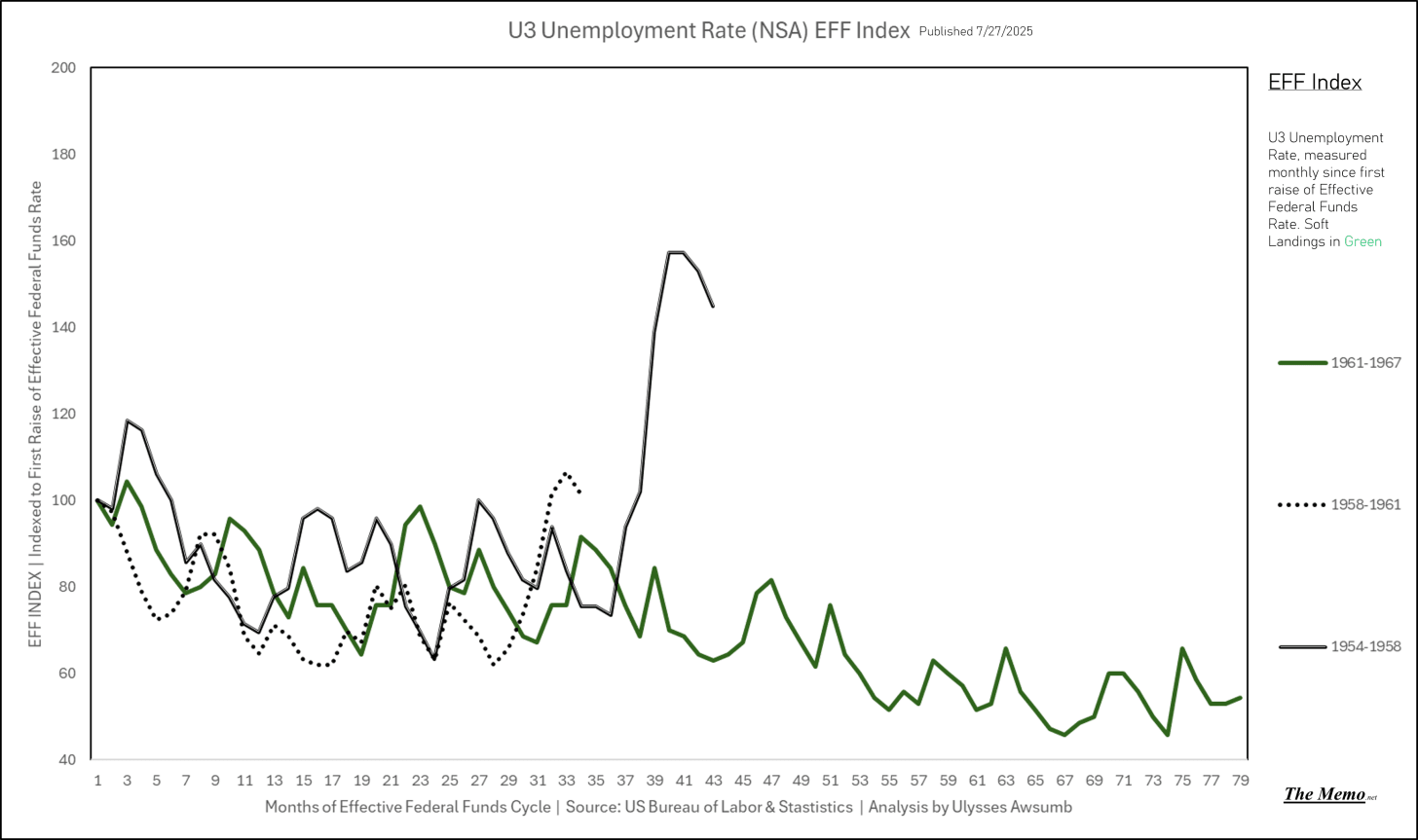

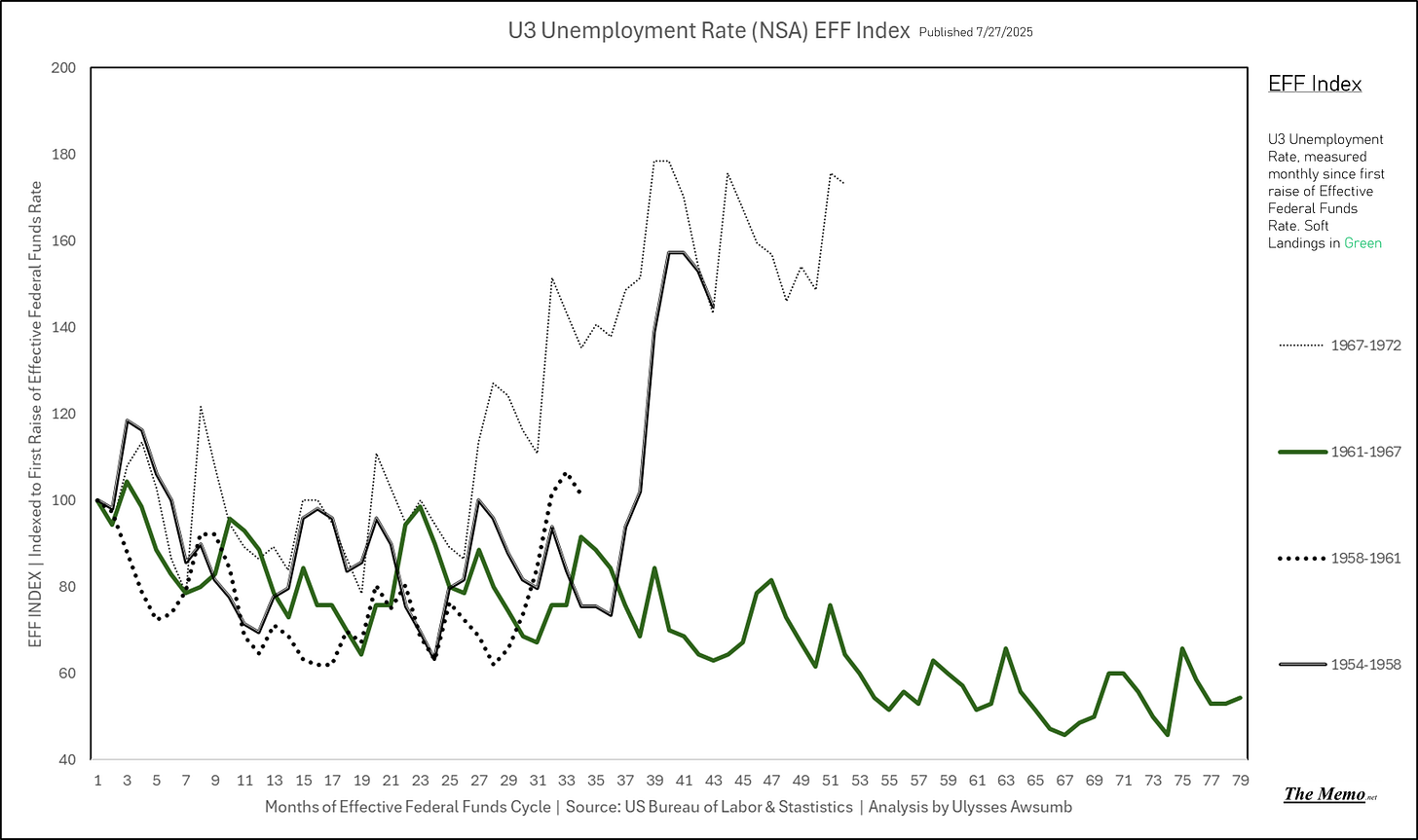

U3 1954-58

58-61

Adding 67 (our 3rd soft landing, or 1st depending on how you’re looking at time).

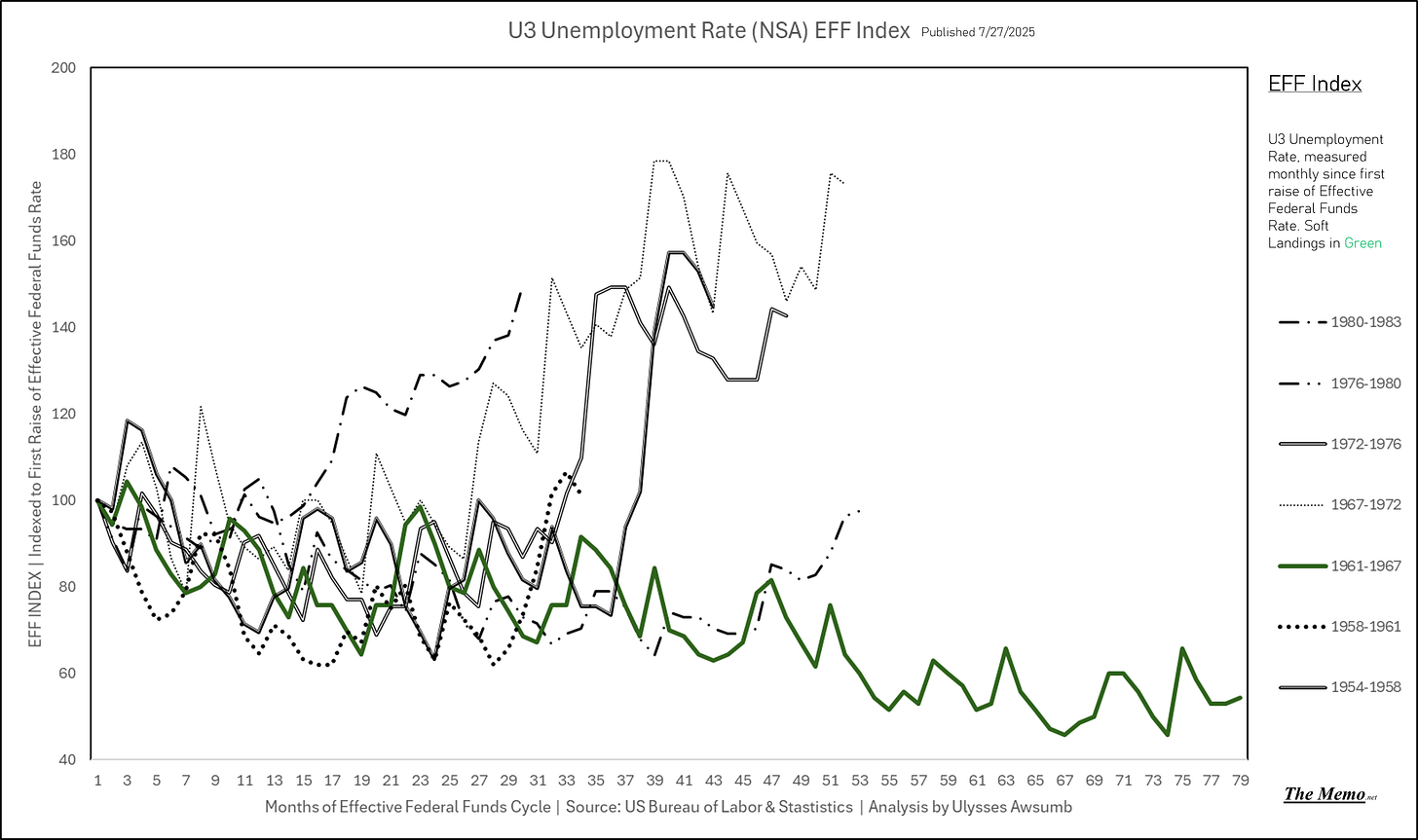

67-72

76-80

80-83

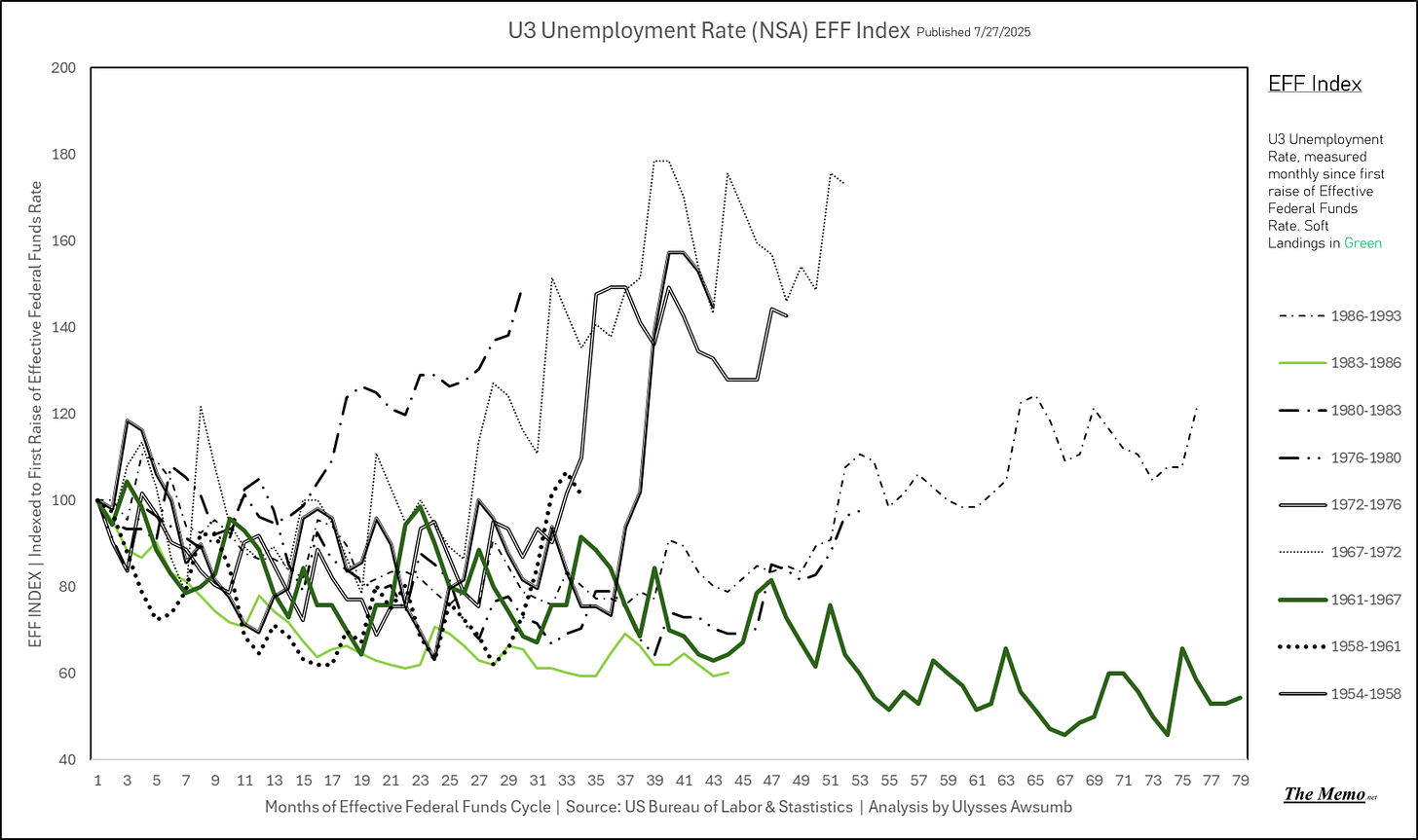

86-89

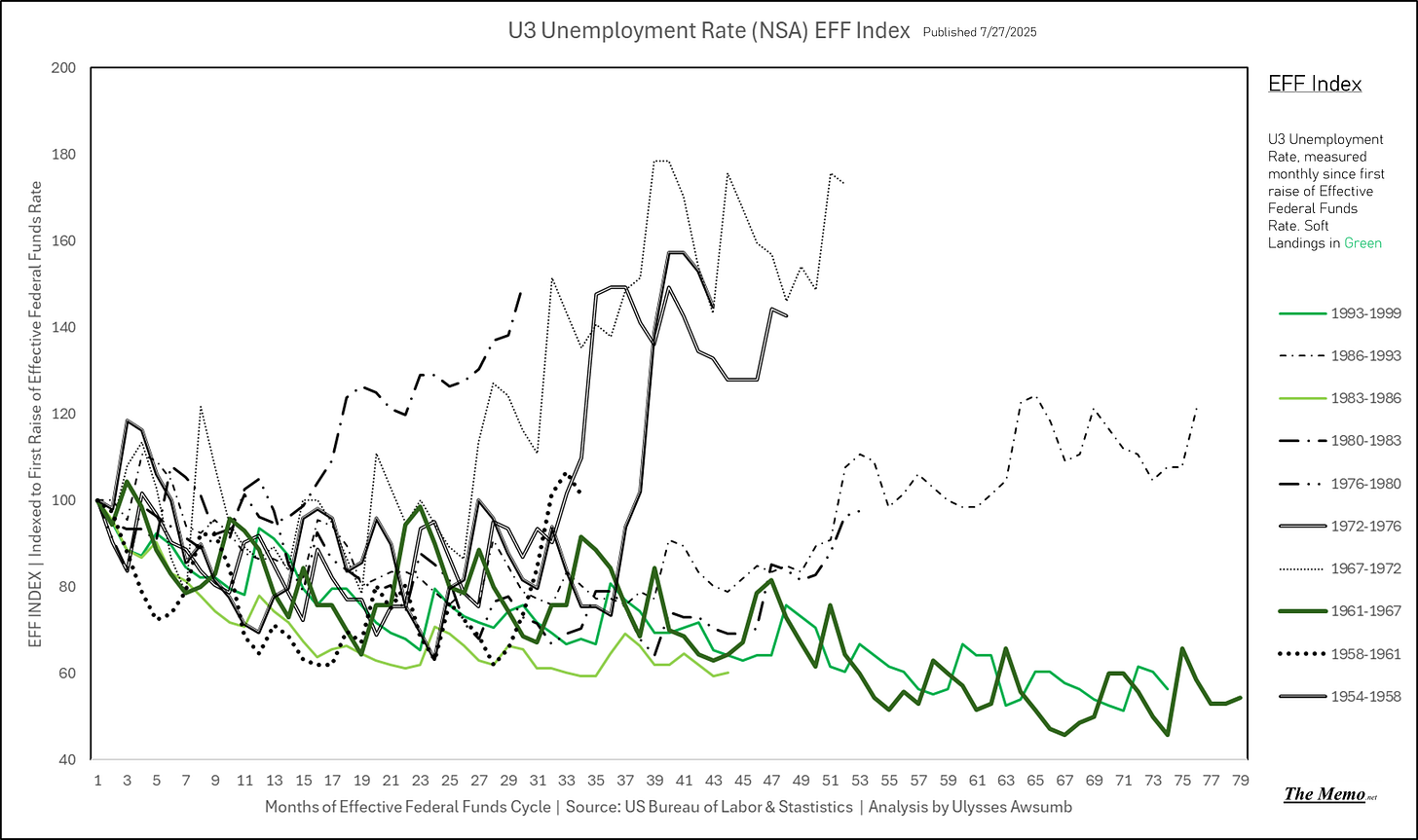

93-99

04-11

2015-2020

The Prestige

The folks at home asking for the 2020 ending version of the NASDAQ should probably also hope we don’t get the 2020 ending version of unemployment that goes along with it. The song remains the same.

Today in EFFing Time

Today marks the end of the 177th week in EFFing time. The past is also:

April 19th 2019

November 9th 2007

September 6th 2002

Ozzy is fresh off the release “Live at Budokan”

Hogan refreshes his Hulkamania again, and goes on to face Dwayne “The Rock” Johnson in a subsequent WWE match.

May 17th 1996

Hogan, fresh of TV show fame, has returned to Wrestle in WCW. In July he recreates himself as Hollywood Hulk Hogan. The NWO was born.

Ozzy promotes the first Ozzfest, held in 1996. Paving the way for the reunion of Black Sabbath.

January 1st 1990

Ozzy releases “Ten Commandments”, a compilation album of a decade of post Black Sabbath success.

Hulk Hogan is in full promo mode for Wrestle Mania VI, which would see his first time turnig over the Championship belt to newcomer and fellow heavy, The Ultimate Warrior

June 6th 1986

Ozzy Osbourne releaes “The Ultimate Sin” in January, by June it went Platinum, in part to the single “Shot in the dark”.

Hulk Hogan was laying the groundwork to square off against Andre the Giant in Wrestlemania III

The 1980 cycle had ended

Hulkamania is born as Hulk wins his first WWF Championsip belt in 1983

July 6th 1979

Ozzy is fired from Black Sabbath

Hulk Hogan makes his WWF debut

June 20th 1975

Black Sabbath completes the album Sabotage, to release one month later.

March 12th 1971

Ozzy Osbourne records then releases Master of Reality in August of 1971

August 14th 1964

The 1958-61 cycle had ended

March 28th 1958

October 22nd 1954

Terry “Hulk Hogan” Bollea turns 1 years old.

May 14th 1948

Ozzy Osbourne born 7 months later in December 1948

Goodbye to Ozzy and Hulk, thank you for the memories. And hello to the newly inspired popultion of the world, and to new opportunities.