Real Estate Round Up

The Good, The Bad, The Ugly, and the Ugliest

The Memo:

To:

Everyone

Re:

Them real estate headlines of the week. Just make sure the Ennio Morricone score is playing in your head while you read it.

Comments:

The Good

Netflix is joining the retail/experiential real estate marketplace. 107K sq. ft. opening in Dallas with their “Netflix House” venture. I consider this a version of a step in the right direction for regional/super mall space retail. Now if we can just put out some good films again.

The Bad

Multifamily Delinquency jumped 39% at community banks between Q3 and Q4 2024, per CrediQ (see attachment)

Gamestop closed 590 stores in 2024. They’re going to continue closing in 2025. I wonder if current FHFA Director (Federal Housing Finance Agency) and heir to Pulte Homes, is going to tweet about buying GME 0.00%↑ anymore. Hi Bill. You can send me $ anytime you want to. I won’t be buying meme stonks with it though.

The Ugly

Another half Billion dollar bankruptcy (They’re beginning to pile up this year). This time a farm outfit. “Vertical" farm operator Plenty Unlimited seems to have hit limited ability to pay it’s debts. Chapter 11 filed this week.

The Ugliest

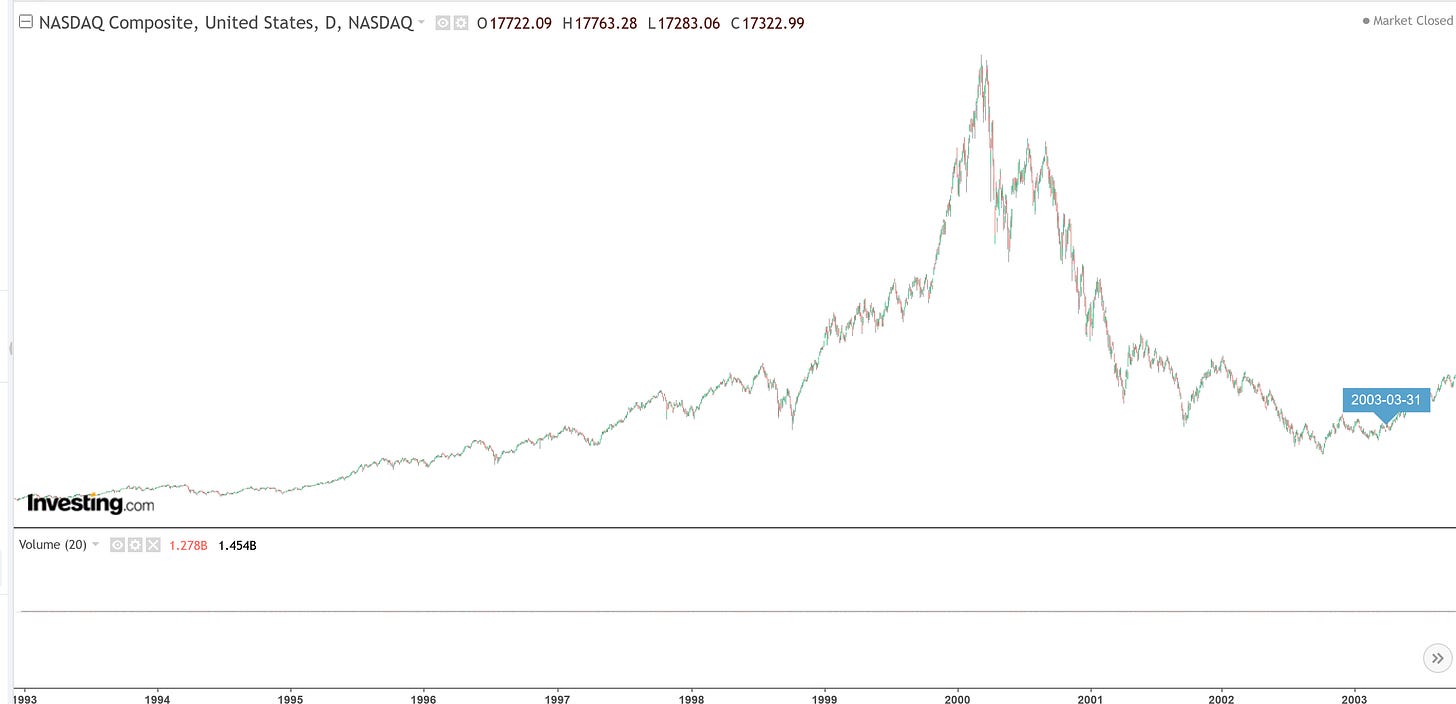

Why does this chart of the second largest home builder in the nation look like the the start of the Dot Com Bust of the NASDAQ?

Deal of the Week

3 year average Cap rate of 32%. (you’re not the only one asking, wait wut?). Catch is you gotta run the bar in St. Germain Wisconsin yourself.

I promise, there are still a lot of great places to invest in the US.

I can even see someone enjoying running the pizza pub. Not sure about spending $500k for this one though.