US Homebuilding Situation Index

December 2024 US Homebuilding Situation Index

Date: December 2024

Time: 2:30Pm

The Homebuilding Situation sets a new record low at -14.69

Sales

November sales stayed suppressed from October, at 19+% below the average sale volume of 55k units, down to 45k units sold. This is the second consecutive month where sales were under 50k units.

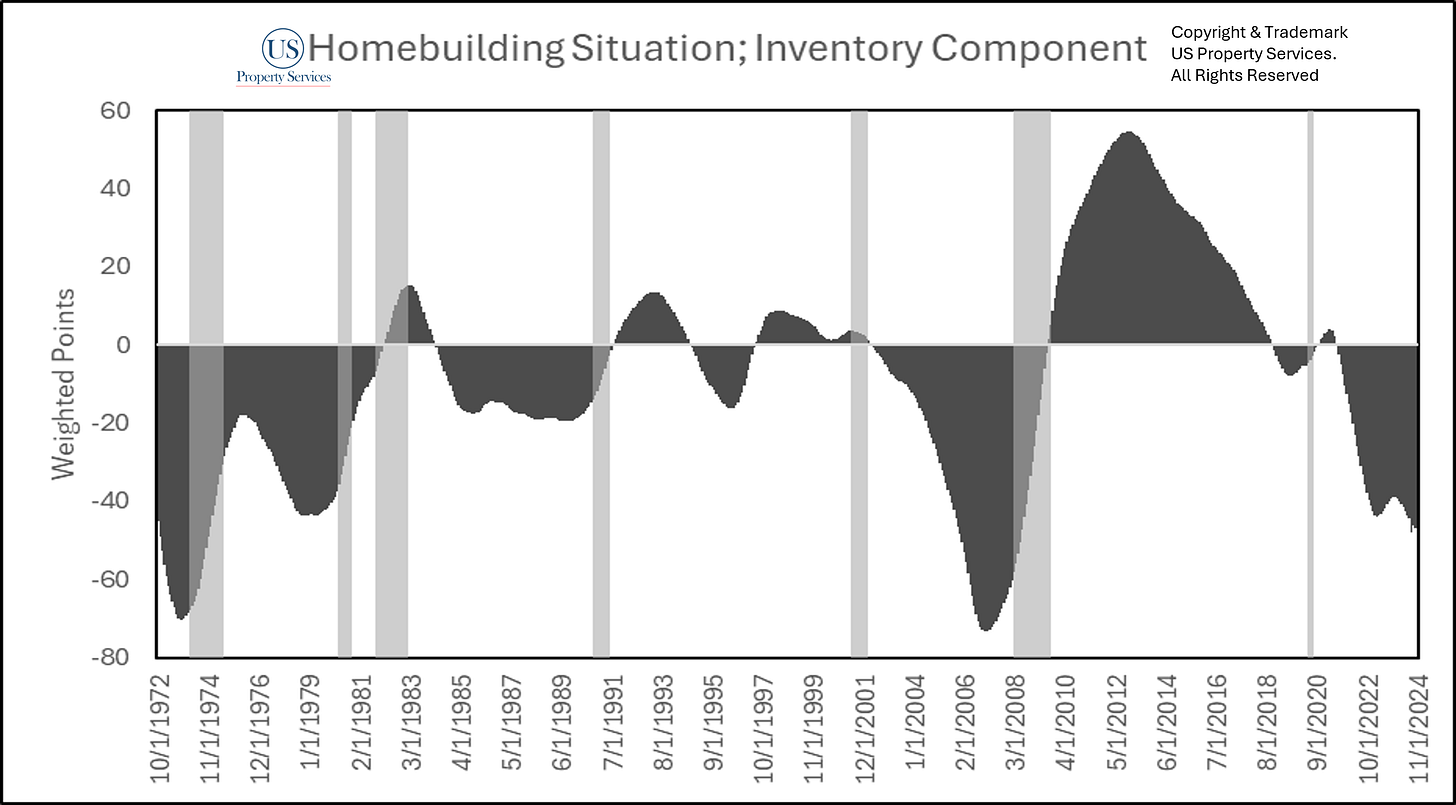

Inventory

Current single family homes for sale hit 493k homes. This is 155% of average inventory for sale across all categories, not started, completed and under construction. Inventory continues to build.

Price Direction

Price direction trended down yet again by 6+% year over year. Further pressure is mounting on price direction to the negative side.

Mortgage Rates

Mortgage rate increases have been relentless since the Federal Reserve cut interest rates. Rates continued to rise into November.

Homebuilding Situation

Builders are facing an uphill battle going into the final month of the year. The combination of elevated inventory, decreased sales, rising interest rates and depressed pricing will likely lead to some further industry turmoil in 2025, as the pace of delivering units remains elevated. I discussed last month the news of Lennar acquiring Raush Coleman Homes. From the previous index email:

“Details have yet to be released but I can easily see this being a $1-2B merger, likely in the $2-500M cash range with stock share. Rausch’ average unit sale price does fall within the means of affordability to the Median Household Income level, so this is a potential net positive all around.”

The details that have been published include $900 million being funded into Lennar’s new “Millrose” REIT, to be used to acquire the land owned by Rausch Coleman over time.

Speaking of the new REIT (Real Estate Investment Trust), Lennar is moving land off it’s balance sheet into a new entity, that will be a standalone company unnassociated with Lennar and managed by an external third party. It’s my opinion this is a move to get holding costs off the books as the homebuilding situation becomes more challenging.

Additional Commentary:

Sales were revised going back to September and units for sale also received slight revisions.

With rates up, sales down, inventory rising and the last week of December mostly vacation time, the year may just end lower than the current new record low.

The next report will be the the January 2025 mid month report. A note, the US homebuilding situation will be moving to a new publication. Details to come soon.

If you enjoy this report, please share with someone and ask them to subscribe.