Hit Parade

Of Homes

The Memo

To:

The Team

Re:

The Creation, Distribution and Consumption of Loans, Houses and Skilled Trades.

Comments:

In the last week + we’ve got plenty of new housing data sets published.

-KB Homes joins Lennar in seeing YOY net income declines. Down 36% year over on year on the Q. Unlike Lennar lowering prices and improving sales, KBH choose to do the opposite. Of both. Does that make 3 strikes? Share prices of both builders are down >40%

-The number of homes under construction is still contracting.

-National Association of Homebuilders “Wells Fargo” Index tied its cycle low. All 3 components dropped.

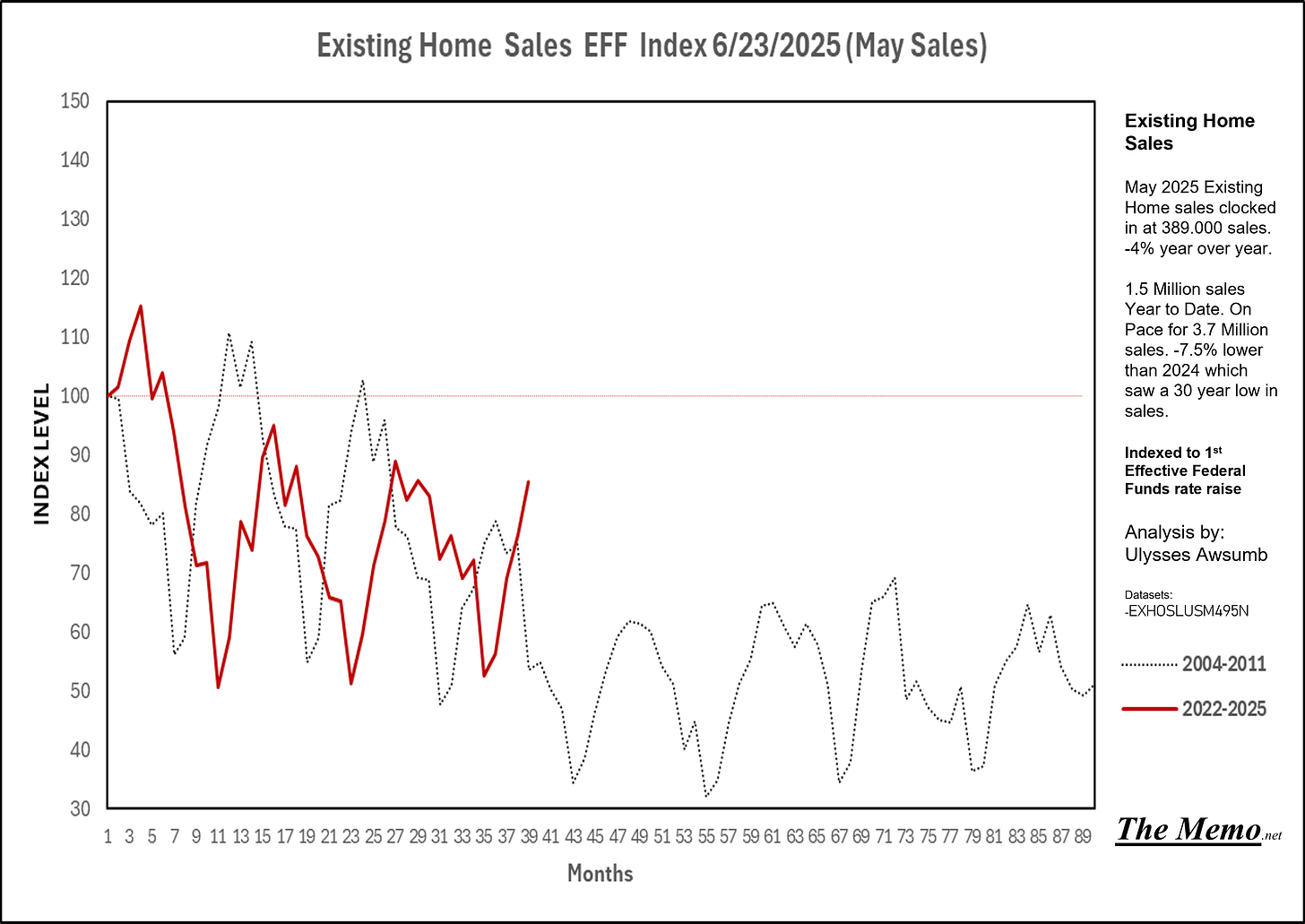

-Existing Home Sales disappoint. On pace for 3.72 Million Sales for the year (never seasonally adjusted) and lower than 2024

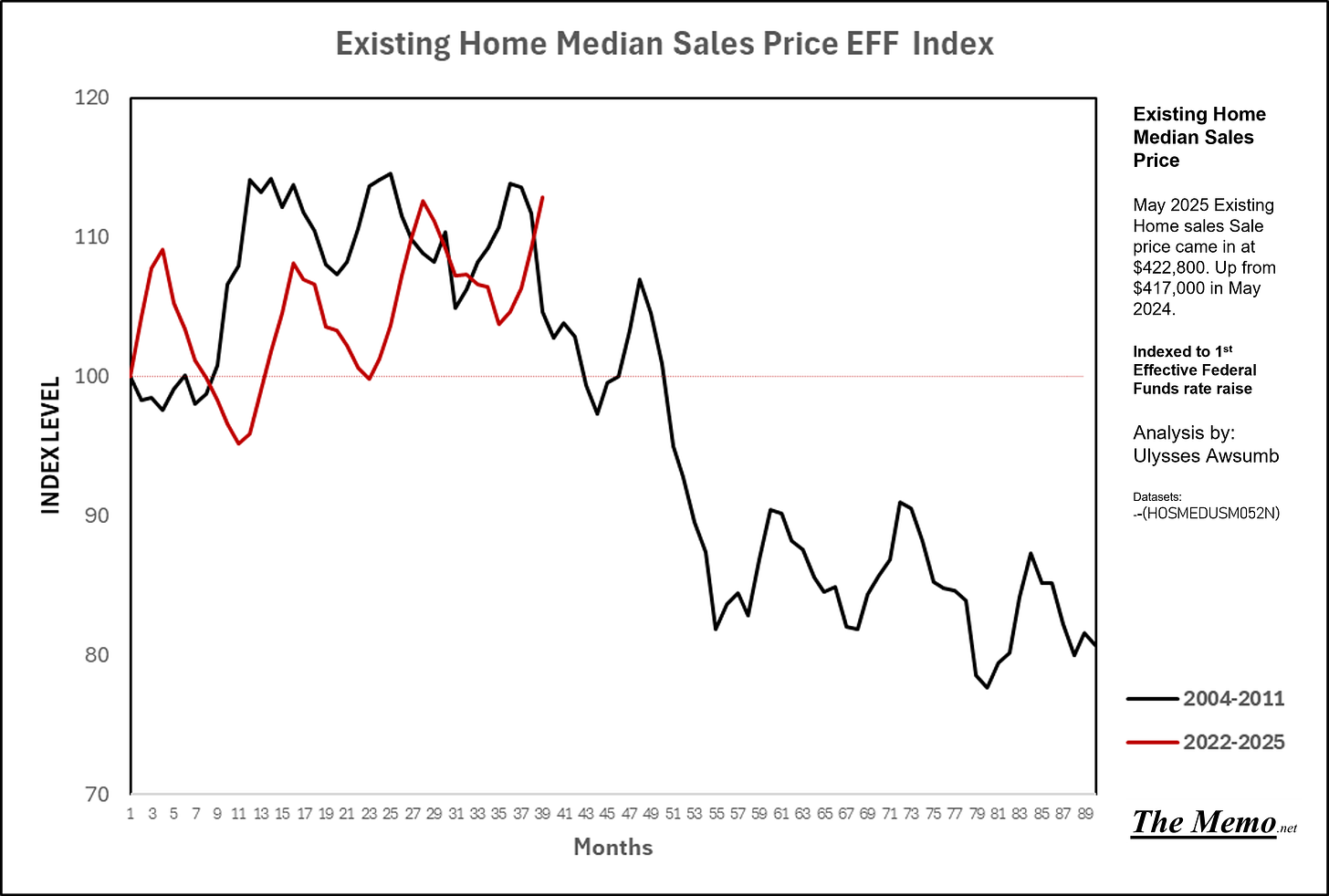

-Median Sales Price for Existing Homes still tracking the 04-09 cycle relative to the 99-03 or 15-20 cycle.

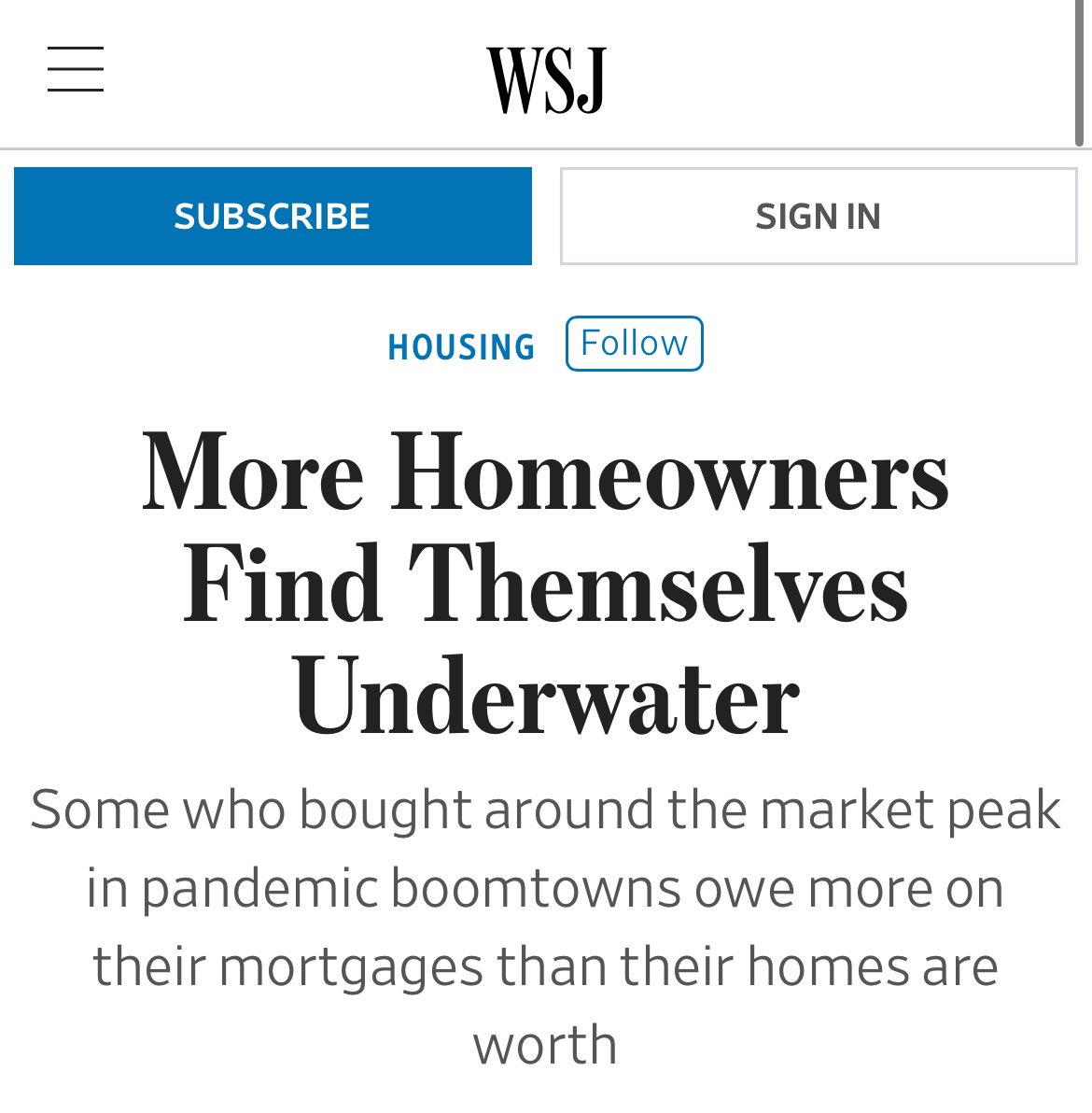

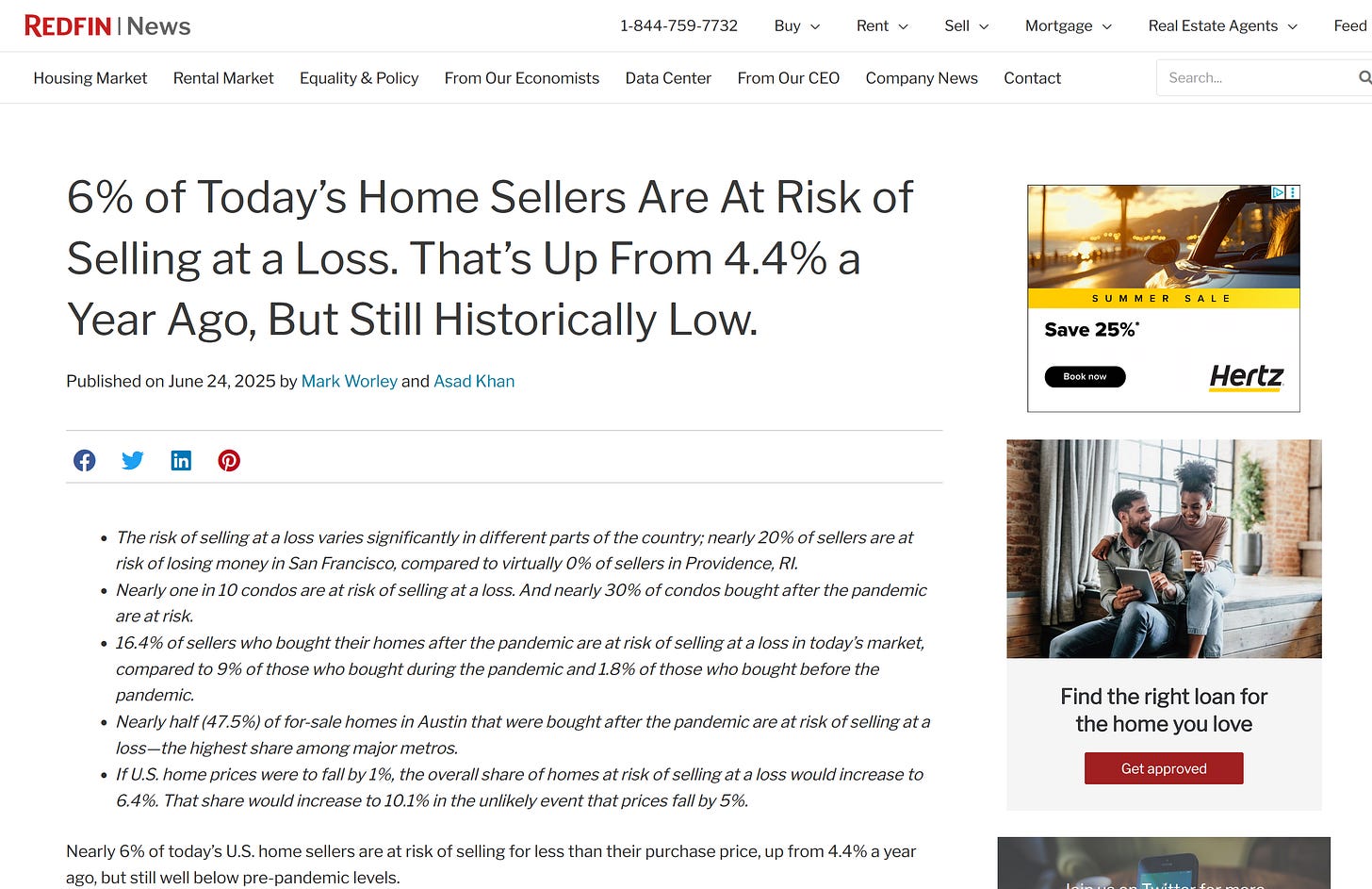

-News From Redfin and WSJ

-A Comparison of cases in Irrational Exuberance: Dot Com vs Housing Shortage

End Memo:

The Report

Building housing continues to see strain. Tracking right between the 1986-93 contraction and the 06-12 contraction. The majority of decline has been in one off contract homes and customs, with apartments joining in the decline. For sale continues apace for now.

This got me curious. How long does it take for the contraction to affect employment significantly?

Let’s take a look:

The average contraction to weak employment, is 24 months. The 1986 contraction saw 38 months before significant employment weakness, whereas we are at 32 since this current contraction began. Within recent historical context, albeit on the long end. I used the start of the Residential Construction Employment data, which only goes back to 1985.

Homebuilder Stocks

Is the Housing Shortage a new paradigm of financial fancy?

Regular readers will recall I asked a while ago why Lennar’s share price looked like a Dot Com chart.

Here’s why.

LEN 0.00%↑ stock down 46%. Earnings down 50% year over year. Sales increased 2%

CANI

Constant and Never Ending Improvement.

That was one “company culture” point from a place I used to work at. I’m a firm believer that “company culture” is only as good as the folks who genuinely adopt it, in their own authentic way. Otherwise it comes off as brainwashing. If you’re in a spot managing people, and they exceed expectations in delivering results; let em run.

CANI was pretty easy culture to accept and adapt. To that end, I’m still applying it even to my charts. I’ve added share price levels to these charts on the Right index, so while the Left is still indexed to 100 as the first day of federal rate raises, the right will show ranges of dataset being used, be it Market level, or Stock Price

I also get a chuckle out of applying CANI to an entirely different builder as the initial improvement to the charts.

In any event, KB Homes just reported earnings. Let’s hear what their CEO had to say via earnings call:

“We continue to take a balanced approach in allocating capital, adapting to prevailing market conditions while maintaining our priorities of future growth and returns to our stockholders. In this environment and given our strong existing land pipeline, we are scaling back our land acquisition and development investments while increasing share repurchases.” concluded Mezger.

Scaling back land and developments eh?

KBH 0.00%↑ by the numbers:

Net income -29%

Homes delivered -10%

Gross Revenue -8.9%

-Earnings per share -23%

But hey, average home price increased 3%. Sometimes CANI requires elbow grease and introspection.

From the report:

Sentiment Check

The National Association of Homebuilders Index was published. From the Report:

And here it is, in EFF Index format.

Existing Home Sales

Sales continue to dissapoint. We’re on pace for 3.72 million sales, non seasonally adjusted. Well under last years 30 year low.

Prices nationally are becoming a topic again. Directionally for different reasons.

An updated on past directional chart. Trendline held. The longer economic conditions persist that do not favor sellers, the weaker any growth in pricing becomes. Or the other way.

Real Estate Roundup

News bits from across the internet.

Oh yeah, Case Shiller was published too. Fantastical bit of a sell side tool.

That’s all folks!