Friday Effing Memo

Welcome to Fall

The Memo:

To:

The Team

Re:

First Day of “Fall” of the Fourth Rate Turning, of the Fourth Turning

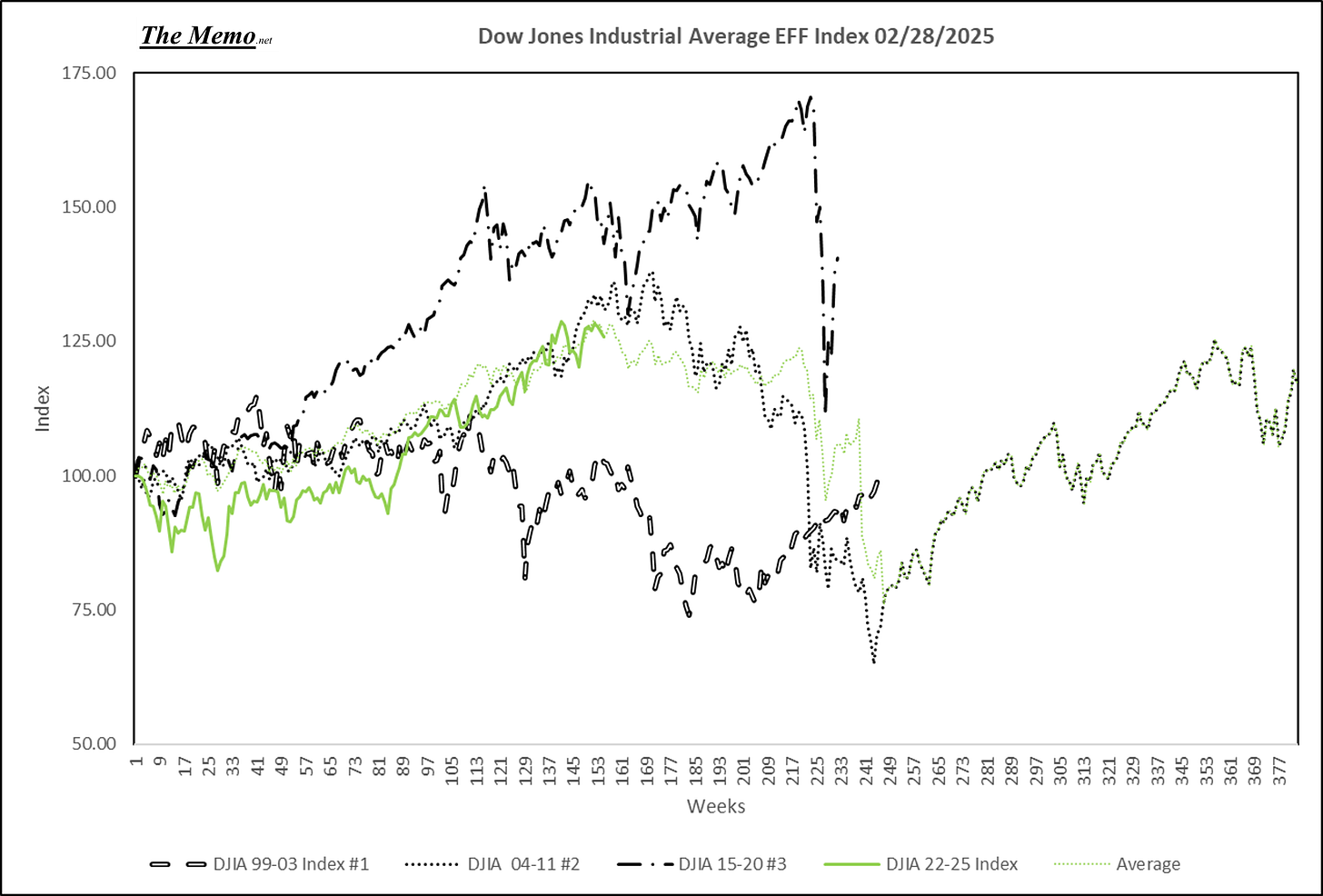

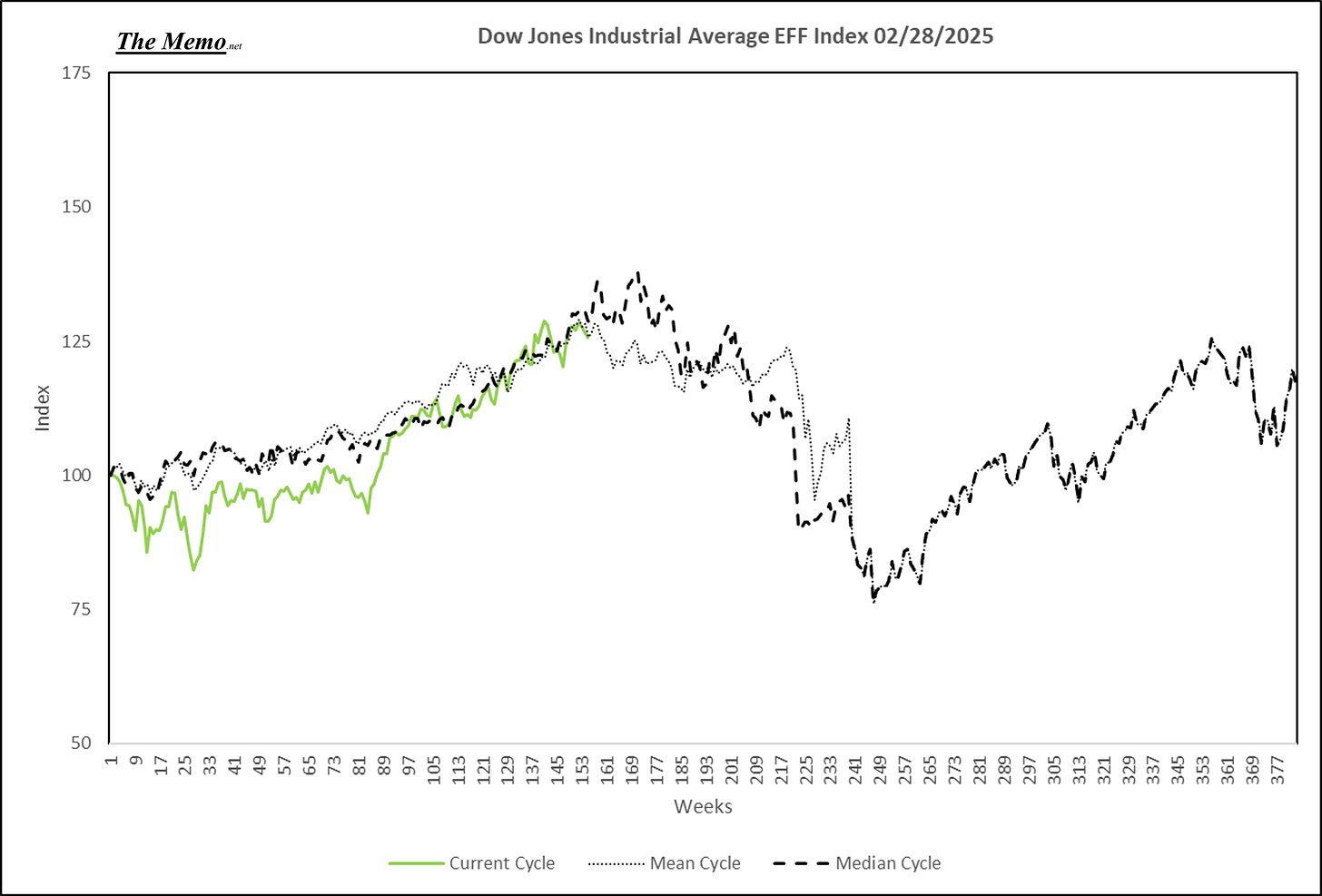

Equity Indices

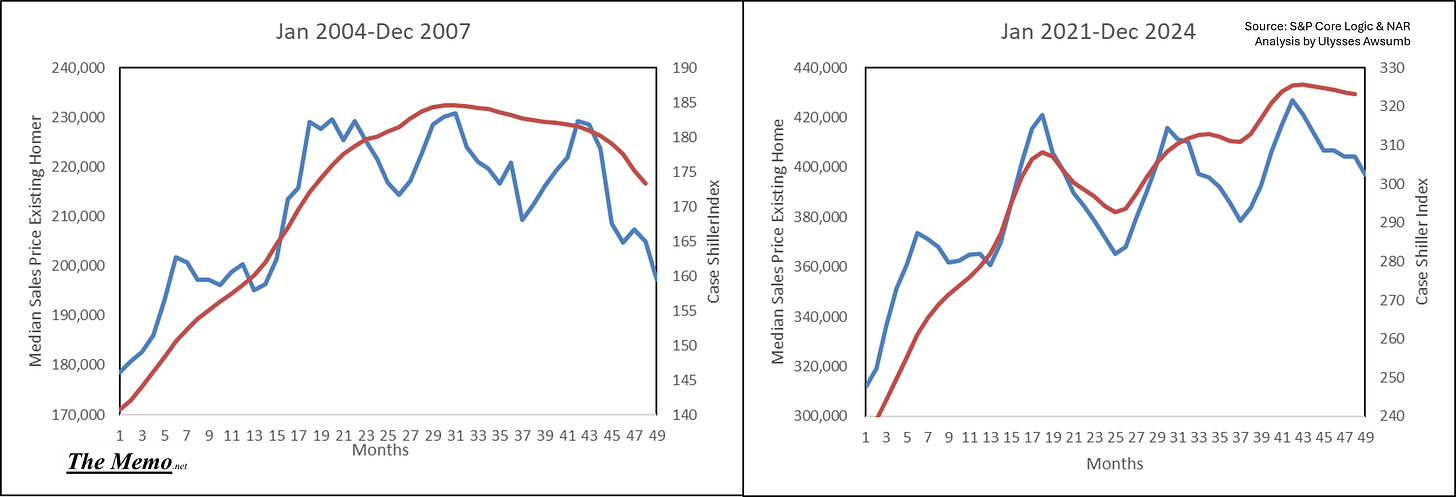

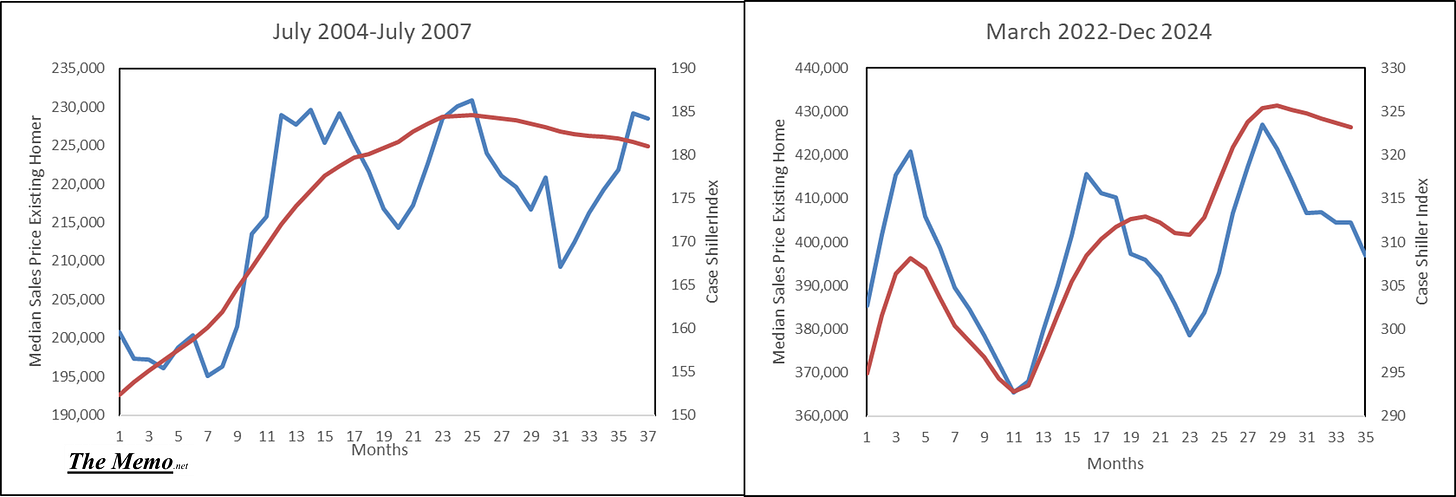

Case Shiller Index (making up for that Friday EFFing oversight of skipping this chart set.

Comments:

Welcome to the First day of Fall, of The Fourth Rate Turning, of The Fourth Seaon, of The Fourth Turning.

Today (this week) didn’t disssapoint. Despite the NASDAQ being up 1.63% on the day , it closed at 18,478.28. Down 7.6% since last EFFing Memo closing at 19,962.36 . I can’t wait for you to see the charts.

Oh yeah, the report may be a lot.

Good luck out there,

All the leaves are brown, and the sky is grey. California Dreamin, on such a Winter’s Day.

End Memo.

The Report

The indices

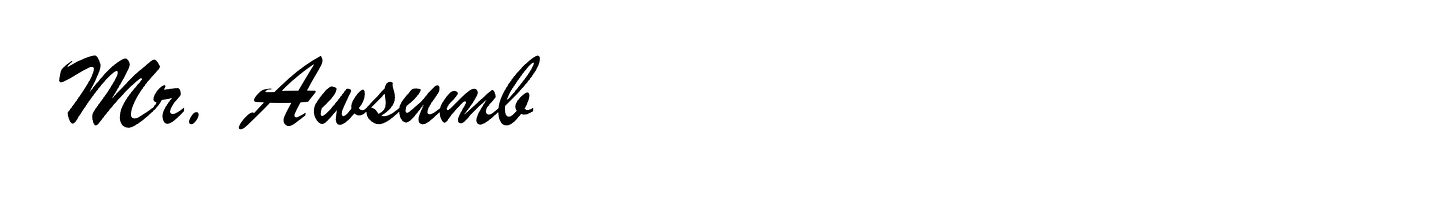

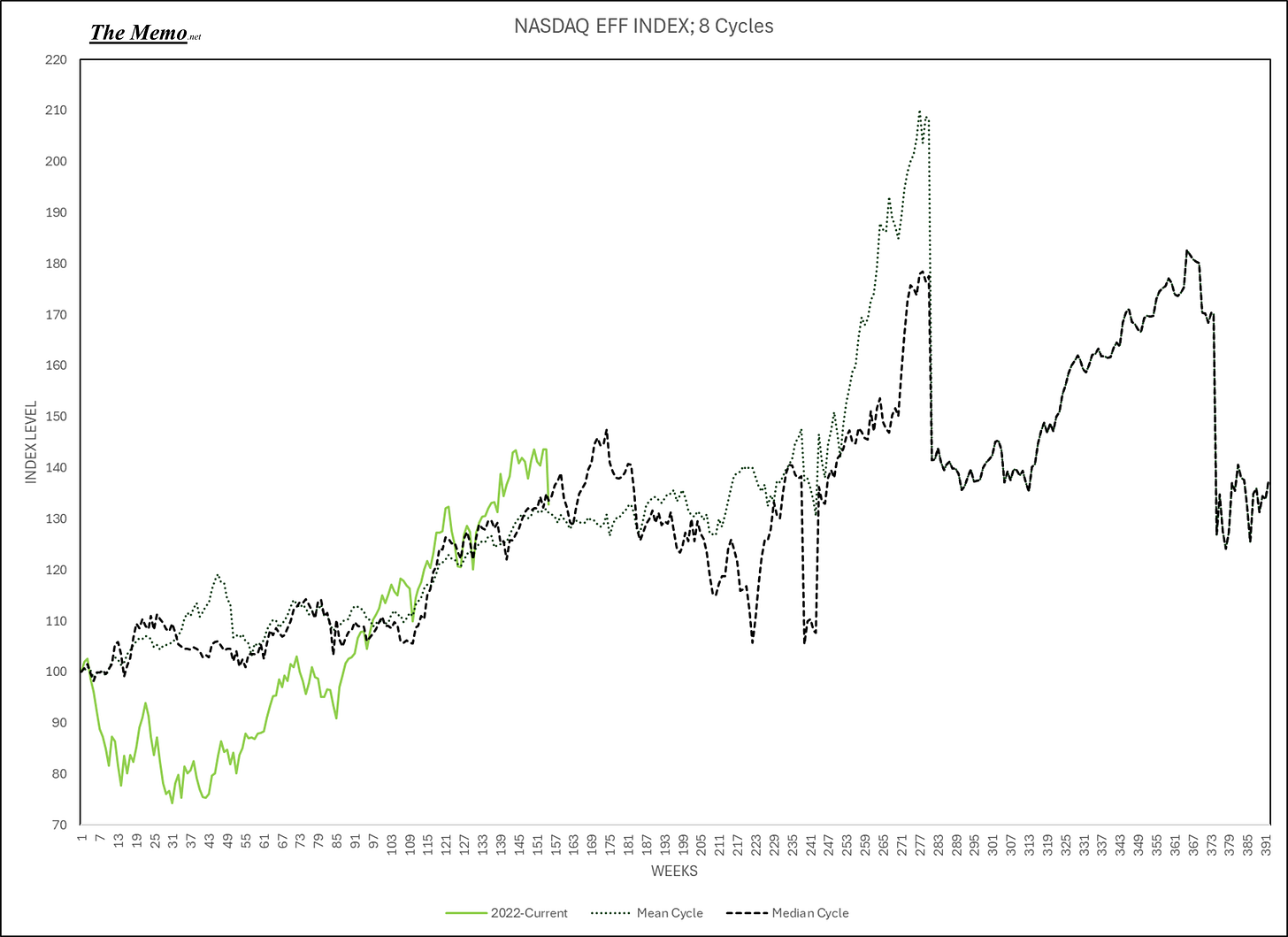

NASDAQ

88 MPH!

Do you know what this means? It means this thing works!

The only question left is, Which Way Western Woman? Here’s the High and Low. Conveniently the high lead to the low. So, do we get the Median or the Mean (Tweets) version?

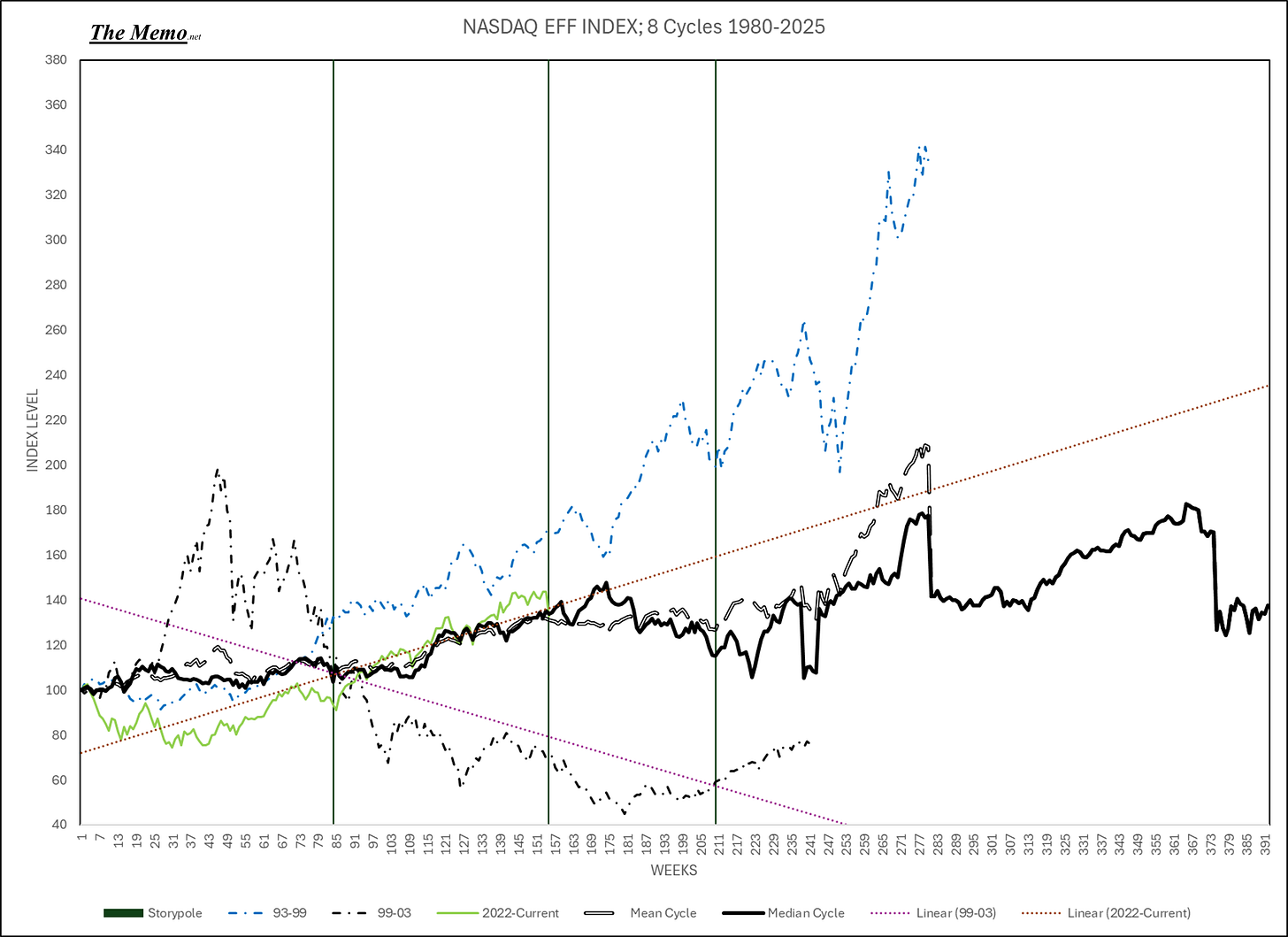

S&P500

Uncanny.

Dow

Mean again.

NYSE

Coin toss?

Case Shiller.

I don't enjoy or particularly want to measure existing home price data. I'm not a NIMBY or a YIMBY. I don't prescribe to the notion of “price only go (any direction)” , and I don't prescribe to the notion of “the only thing that exists in housing is suburban attached garage homes or uptown condos”. I have no interest in 15 minute cities, and I don't begrudge people for wanting something that I'm not interested in. Real Estate is local. Monetary policy is not.

I understand that many people have emotional and financial ties to home prices continuing to escalate perpetually. And I understand for every person who holds that view there's someone equally desperately wanting prices and rates to come down for a chance to “own” their own place in this world or for their lineage to have what they've had in life.

I don't have control over the nation's monetary or fiscal policy, and therefore, I can do nothing to ameliorate the current situation.

I also recognize, the impact this particular data set and tool of time has on our place in history. And for that end, I endeavor to measure and share my findings.

Let's skip the pretext that there haven't been similarities in the price run-up and subsequent mottled ups and downs in comparison to pre “GFC”. I also don't abide that term: GFC, so let's just call a spade a spade. Similarities in patterns from 2004 to pre recession beginning in December 2007.

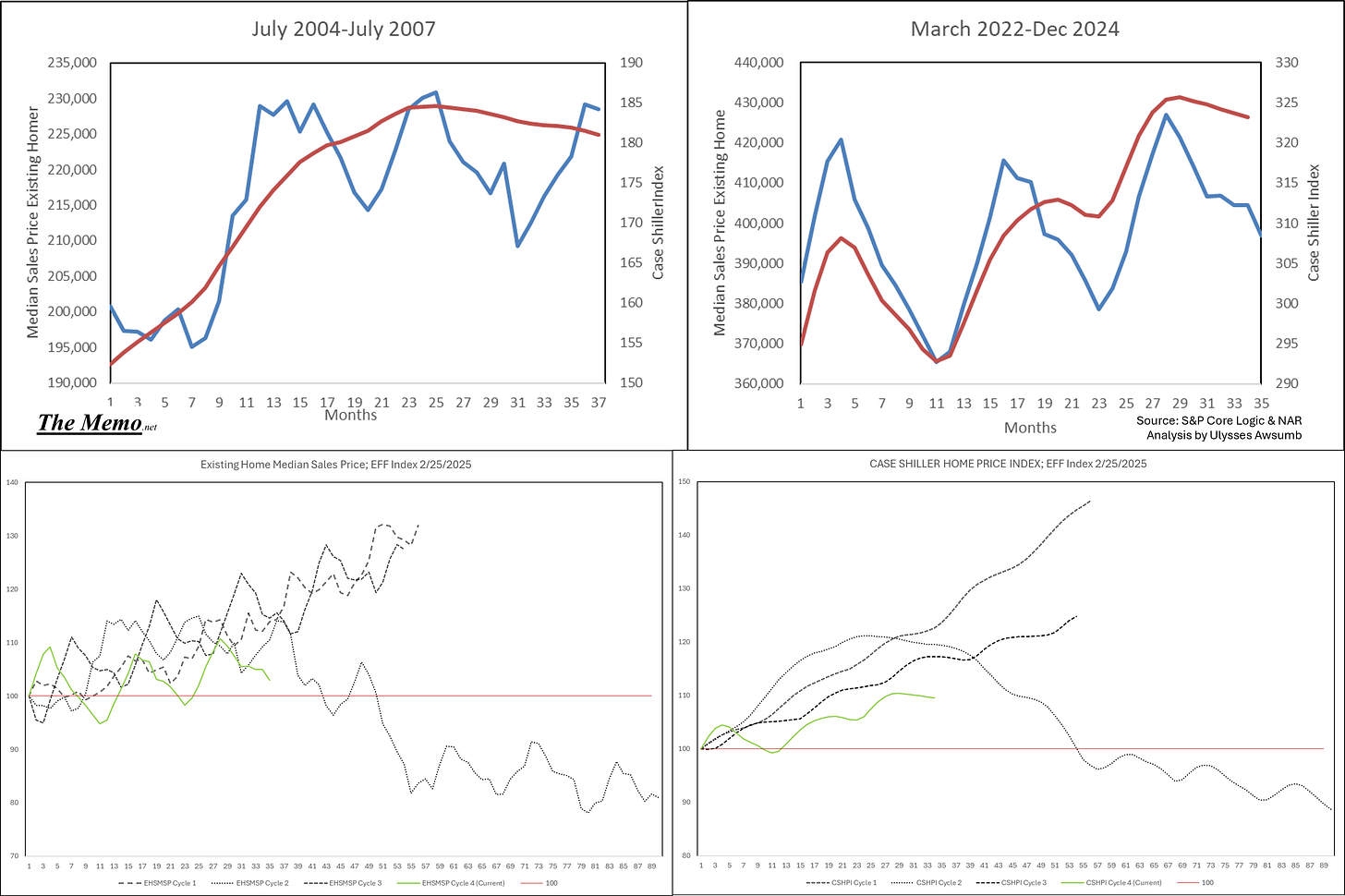

Case in point. Left 2004-2007, Right 2021-2024. 4 Year intervals. Median sales price for an existing home compared to Robert Schiller’s now S&P Core Logic Case Shiller Home Price Index.

But, as 1/2 the point of me starting The Memo and my continuing research here is to put proper context and “time”line to economic behavior, I also don't abide the notion of “these 4 years are the same”, without some type of scientific or theoretical control or focus on why that is. So let's look at the same data, but instead of January of year 1 to December of year 4, from the first day the Federal Reserve decided they needed to raise rates to “slow inflation”.

So, here's July 2004 vs March 2022, in that timeline which those of us who have been working here (I've no doubt reading my publication can be work) affectionately call the EFFing timeline (Effective Federal Funds)

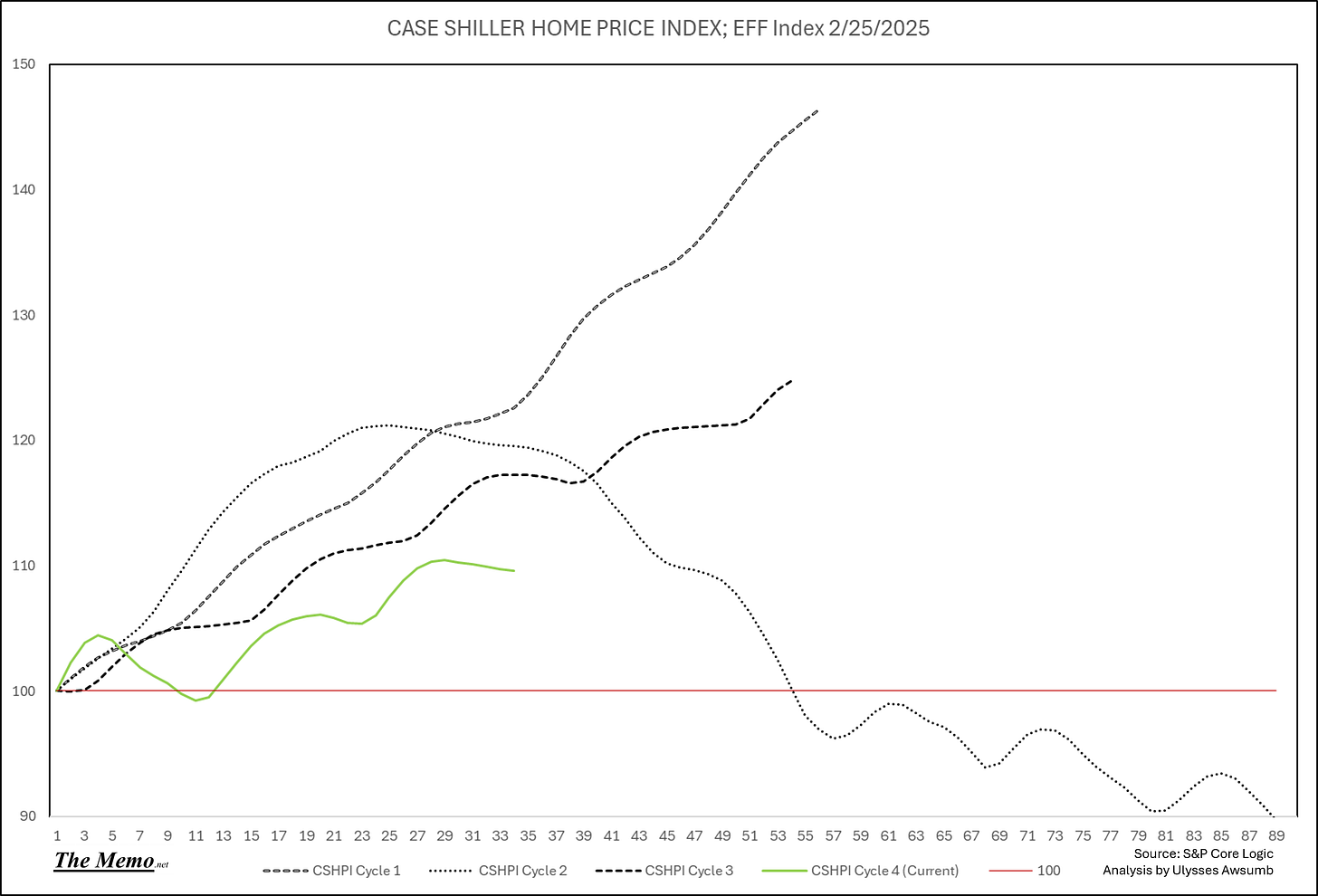

And as we normally measure these things, here is the as released this week, December 2025 Case Shiller Index as measured by the four Rate Turning Cycles of the 21st Century.

If it isn't already clear from the chart, this is the most anemic growth “cycle” post Fed Rate hikes this century. For this data point. Please understand this doesn't include the period from June 2020-Feb 2022 when prices went haywire. Remember, it’s the post raise Reactionary Period.

If we just measure the same two data points separately, the existing home median sales price is only *up” by 3% since March 2022.

Here's where I tell you I'm not sorry if this just broke a narrative, and I'm not sorry if I didn't. I'm not interested in sell side or buy side analysis. I'm literally just interested in reality. Good, bad or indifferent. I've been punched enough to understand Mike Tyson's quote: “everyone has a plan until they get punched”. I've also lived enough to understand Rocky’s “it ain't about how hard you can hit, it's about how hard you can get hit and keep moving forward”.

In March of 2022, the Median sales price of an existing home was $384,900. It's now $396,900. +3% since the Fed’s first raise .

Case Shiller Home Price Index (CSHPI) is a lagging indicator of housing. It's literally measuring the 3 month moving average of the prior three months. More on that momentarily. (Sorry Robert, I respect you and your work, but you know I’m right on this)

Here's both sets of Data together.

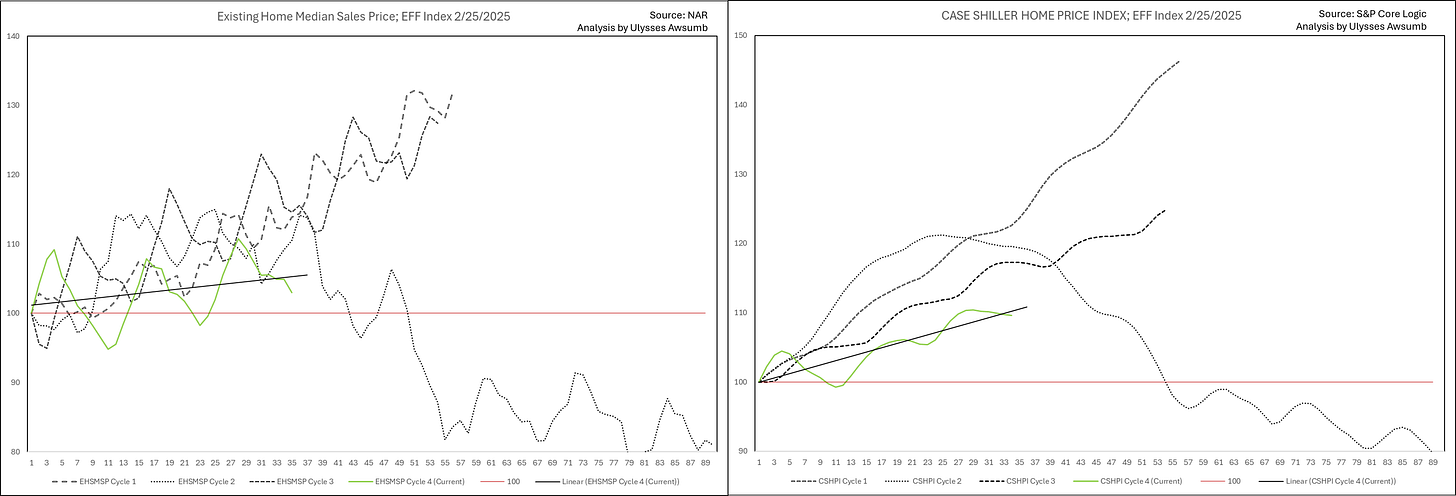

I asked Excel to apply a linear forecast to each chart. This is what it gave me. (I'm not going to get into anything other than that because the important part is: I didn't apply the data, the program did)

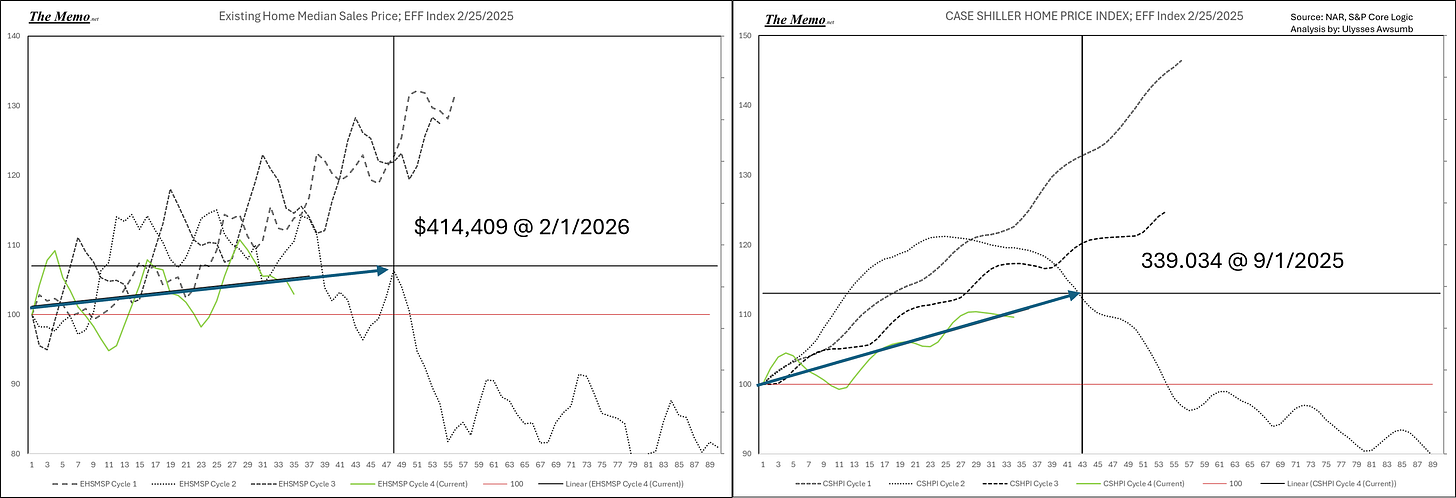

Let's extend the linear trend line forecast to 12 months out.

First, a reminder: Cycle 2 is 2004-2011. Second, CSHPI (Case Shiller Home Price Index) clearly lags median sales price. Despite both being down. But what's most interesting is, both data sets are the weakest post rate raise this century.

In 2018 we had a similar weakness while rates were elevated, but overall price appreciation/inflation clearly followed the first cycle (99-03) upward overall during that cycle.

Let's plot a course for January 2026 (12 months of data later) .

Same chart with same linear forecast, let's put a vertical marker at January 2026, and a horizontal marker of the current level of price (103 or 3% since rate hikes)

Is the target in the cross hairs yet or does the Fed say something about 2% targets? If you want me to expound more on that, and what’s similar or different, read or re-read my Fourth Rate Turning.

Will the shot work? If you can share windage, velocity and weight of the economy, I can probably dial it in further. (Interest Rates, sales numbers and jobs… oh we know those)

The point being, this is the current trajectory of:

“known knowns”

“What we don't know are the unknown unknowns - Donald Rumsfeld

I hate this data set, and I want to see everyone in this nation flourish. (And not just in America and no place else).

“As in prior years, it is important for you to know that I have absolutely no idea whether our tax returns or payments are accurate.

I do hope that at some point in my lifetime, and I am now in my 80’s (him not me) so there are not many years left, the US government will simplify the tax code so that those citizens who sincerely want to pay what they should are able to do it right and know that they have done it right “

Also Donald Rumsfeld

P.S.

Jerome, January’s hold doesn't come without consequences. But I also get it, your job is literally a lose lose situation. It's Doom if prices never stop rising exponentially and it's Doom if too many people lose their jobs and asset prices go down.

Maybe it's all really just about how hard you can get hit and keep moving forward. Whether it's Apollo Creed, Mr. T, Ivan Drago or Tommy Gun Morrison throwing the punches.

Robert Tepper’s *There's no easy way out* plays.

Fantastic analysis as always

Thank you very much