Friday EFFing Memo

Don't get Sentimental

The Memo:

To:

The Team

Re:

The usual EFFing Business

Comments:

What a week of data reporting this was. Fresh off our 3rd rotation around the sun playing the current version of monetary policy games.

The short version:

Homebuilder sentiment fell again

We’re building even fewer housing units

Supply is piling up and pricing is under pressure

Lennar reported earnings. Margins are back below pre 2020 levels and compressing further

Existing home sales declined Year over year

The Cost of Money is changing at a snails pace

Gold keeps hitting new all time highs

Markets had a rally for ants

Federal Reserve Board Chariman Jerome Powell said “Transitory again”. No cuts for you.

I think I’m actually more excited for Sunday’s Real Estate Round Up for a change, there was so much to share this week.

A reminder, especially for the new folks:

We’re just studying and relaying the reality of what we see economically. If you’re data sensitive, please don’t read further.

Also, if you are, the worst “recession” we’ve had in the last 100 years, 75% of people were still employed, so we got that going for us. Which is nice.

Welcome to the new folks.

End Memo

The Report

Homebuilding

It’s not your imagination, there’s less construction happening in the world of building housing. Here’s the Government Cheese chart. No EFFing timeline comparison necessary. All types.

Chart Here: https://fred.stlouisfed.org/graph/?g=1F643

Are we “Permitted” to fix this yet?

I went way back to when they started measuring new homes for sale for this one.

It doesn’t look so bad until you remember that the index just shows how much the increase or decrease is from the start. Here’s the numbers. Are we having fun yet?

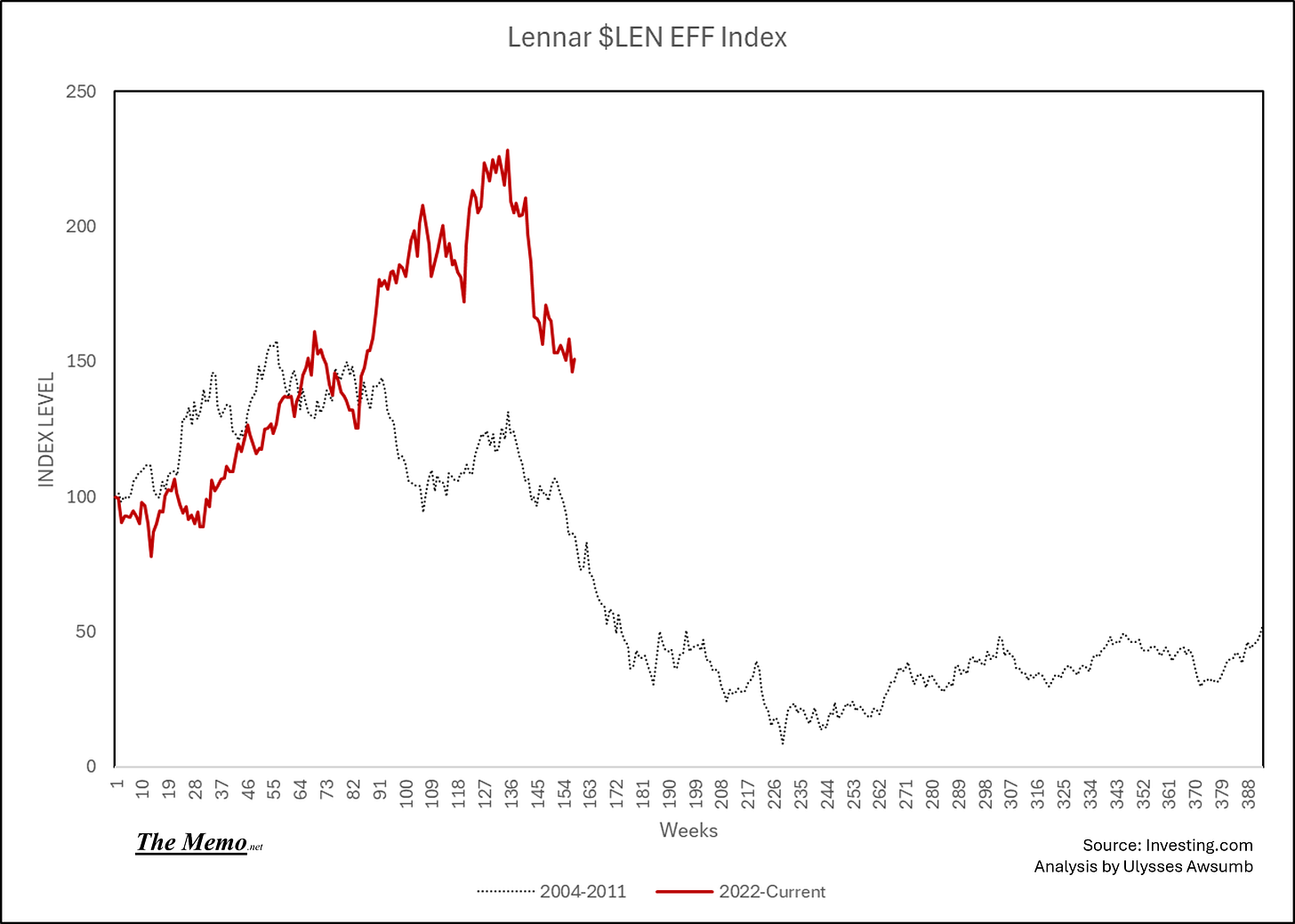

Lennar reported earnings yesterday.

C.E.O Stewart Miller had some interesting remarks:

They’re also back to sub 20% gross margins, and 10% net margins. He went on to say they are “targeting construction cost reductions”. Which is short for “hey subcontractors, take less margin with us or we find someone who will”.

They bought back more stock. $700m worth. It’s more comical when you realize they also bought $500M more back at the peak of this chart.

Weeee.

April 2nd Tariffs go into effect Don’t go into effect Tariffs go into effect Don’t go into effect Tariffs go into effect Don’t go into effect Tariffs go into effect Don’t go into effect Tariffs go into effect.

Is this team stable?

Why buy new when slightly used will do?

Existing home sales (despite all the headlines telling us otherwise) declined year over year, and are not boding well for the spring selling season. Here’s the boring “actual” numbers. (I will never use seasonally adjusted annualized numbers, and if I ever did, I’d make sure you knew with A HUGE DISCLAIMER SAYING HERE”S SOME DATA THAT DOESN’T, HASN’T AND WILL NEVER EXIST”).

This isn’t that.

And here’s the EFFing comparison. We’re marching right to the crosshairs of the 04-11 cycle.

Here’s a look at the last 3 Februarys of median sales prices and existing homes sold. Maybe Stewart was onto something.

The Cost of Money

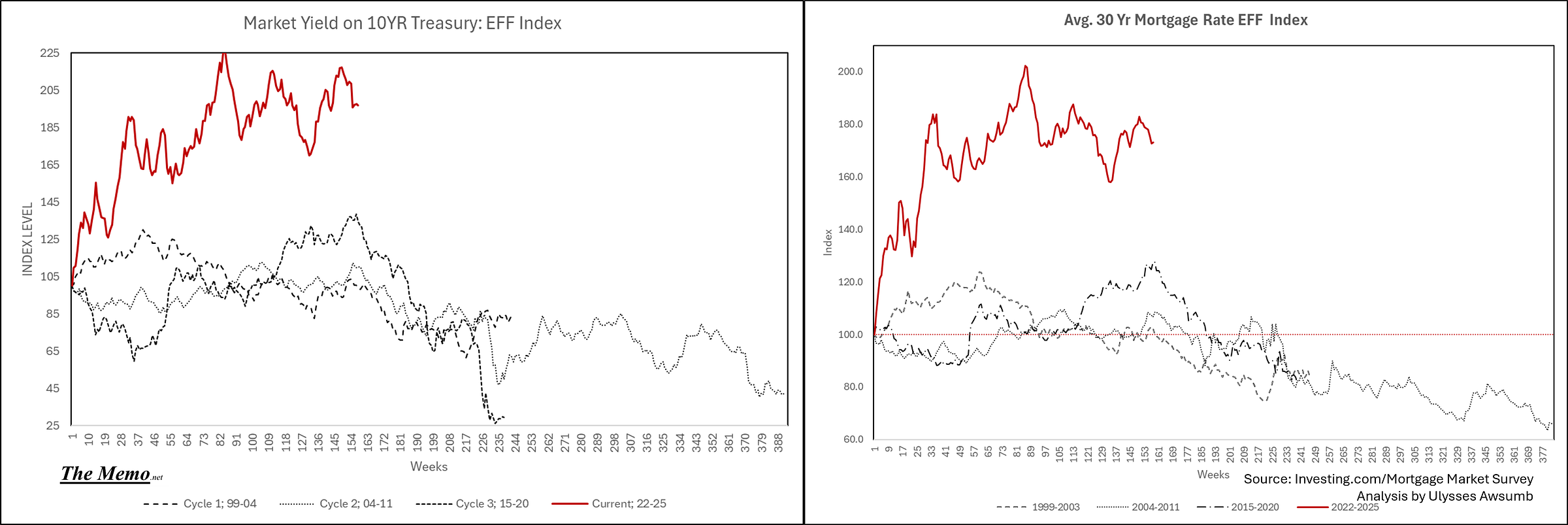

Left is the cost for the Gubmint to borrow money from you (currently at 4.24%) and Right is the cost for you to borrow bank money to buy all those homes. (currently at 6.67%)

Do they share compounding periods? Did congress authorize more debt? Did DOGE do anything yet? Does it help your personal situation if they did? Does any of this help refinance bridge debt used to employ people to build anything? Does this help return capital deployed? Does firing social security phone respondents improve this? Is this 3 percent growth? Is this targeting? Is anyone paying attention to the economy?

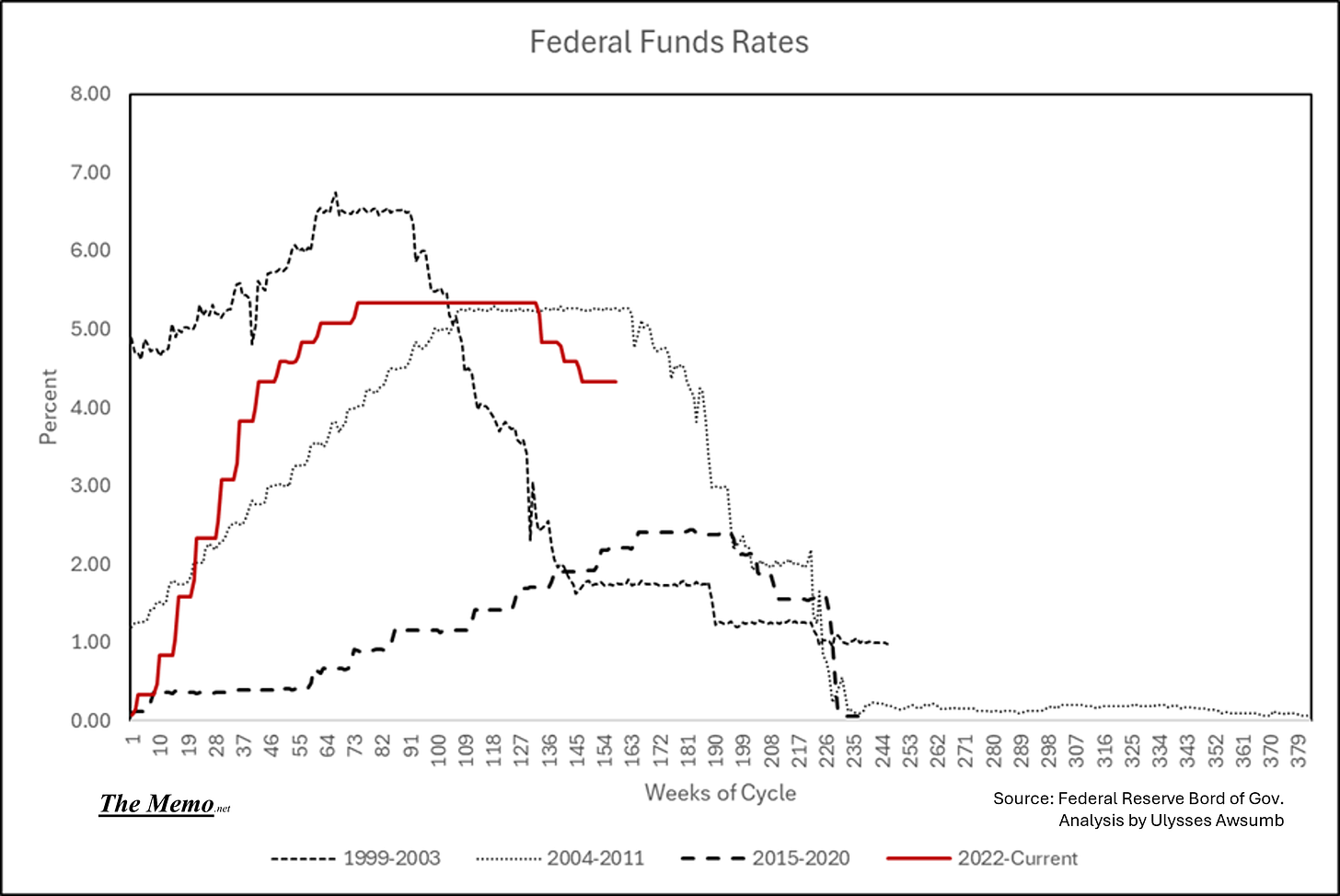

Let’s check in on Sauron though. Cost for banks to borrow from “other financial institutions”. There were no cuts this week.

If I didn’t know better (wait, do I?), I’d argue J Pow is waiting to hit that magical 07 cut mark of week 161 before cutting again. Fun fact: the Next FOMC (Federal Open Market Committee) meeting is May 6th. 7 weeks away. Or 5 weeks too late.

Other People’s Money

Money, it's a crime

Share it fairly, but don't take a slice of my pie

Money, so it's said

It's the root of all evil today

But if you ask for a rise

It's no surprise that they're giving none away

Away, away, away

Away, away

Away, away, away

“oh by the way, which one’s Pink?”- Pink Floyd

The 49er

It might be finer to be a 49er in this day and age.

Fuels

I wonder if Dinoco is hiring. I heard Lightning McQueen retired.

(un) Employment

Don’t sleep on this. H2 of 2025 might come unhinged.

Equanimity

No Chappelle jokes here. But I haven’t seen anything remotely resembling fear from people on XTwitter. I’ll let you all decide if today is more like 2018, 2007 or 2002.

Today in Money Policy it is:

There’s your dot plot folks.

Please consider a paid subscription to help further study how we just keep repeating the same behavior over and over and over and over and over and…. Sorry, record scratched.

Also, please share this with anyone you think will enjoy it.