Friday EFFing Memo

EOQ2-ATH-ATM-ID10T-ID4

The Memo:

To:

The Team

Re:

All time high on the markets

Gold

Yields

Taxes

Independence Day

Comments:

Last EFFing Memo of the first half of the year…Time flies. Speaking of which, next time I write an EFFing Memo, it’ll be 28 Weeks later! As in 28 weeks since I wrote “28 Weeks Later” we got that market weakness, right on EFFing time no less. And now, we’re about to embark on the next wild 28 weeks.

It'll be Half Macro half Mad Magazine for this edition. I’ll be letting the charts do most of the talking, with some commentary in the report.

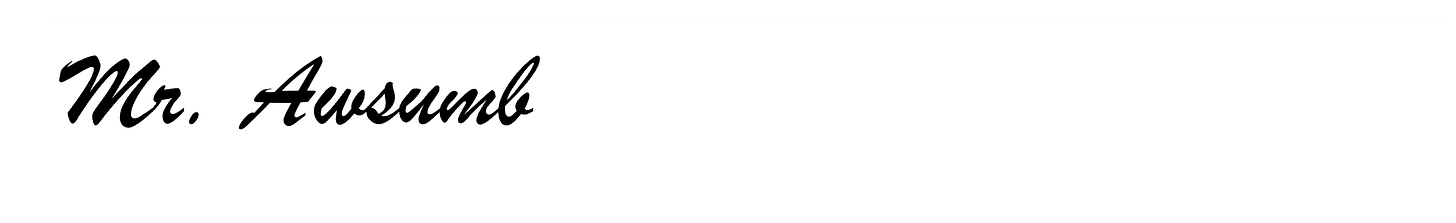

The NASDAQ retested all time highs, as we thought it would. I don’t expect the next 2 quarters to be any less volatile than what we’ve seen so far.

But we get to bookend Q3 with good old fashioned holidays.

So we got that going for us, which is nice.

-Bill Murray, Caddyshack

Thank you to all the readers who’ve joined The Memo. My gratitude to you is immense. The Memo gets read now in 39 U.S. States and 19 different Countries.

End Memo. This is the Fourth Rate Turning of The Fourth Turning. None of this is financial or investment or advice nor is it political advocacy. It’s for research and entertainment purposes. The complaint helpline just got a WARN notice, please respect their privacy at this time.

The Report

EOQ2

As discussed prior, the week ending July 11th begins what could make for further draw downs.

Earnings seasons begins that week with ConAgra & Levi Strauss. The week after kicks off big bank earnings, with America’s largest banks reporting over 10 days. Those include Bank of America, JP Morgan Chase, Wells Fargo etc, plus Charles Schwab, Citi and more.

Add in Fastenal, JB Hunt and DR Horton going out to the 22nd of July, and we should have a good picture of: Q2 earnings and H2 forecast (remember, Q2 guidance had already been revised down, so beating forecasts doesn’t mean much) plus a better picture of the already very soft homebuilding market and construction in general. JB Hunt is last mile service provider for many builders in addition to its other offerings, and DR Horton is the Largest builder in the Nation. Fastenal provides supplies for commercial construction.

Why better picture? Loans, Sales and Service. Jobs.

Unemployment

Softening Initial claims (for now) but the continued claims with higher lows and higher highs, shows it’s getting harder to find work for the unemployed. Which, the higher those go, the opposite effect it will have on the passive flow machine. (Paycheck → 401k→Fund→Stonks/ETFs→markets higher)

Just a quick aside, that’s not a criticism of fund/portfolio managers, you have to put the money somewhere. And if there was ever a time it would be hard to manage a big pile of cash and mitigate risk in equities, we’re all looking at it. To you I tip my cap.

ATH

Genuine Question: Up down up down up up up OR down down up down down down down?

Left Right Left Right Up Down AB Select Start

-Contra cheat code for Nintendo: Unlimited Lives

Gold

ATM

Might be folks cashing in here for a bit. Might be putting some of that into other things that reached ATH. Either way, Gold and Bonds hitting a quiet patch for a bit.

The longer this cycle goes on, the more this might keep going up though.

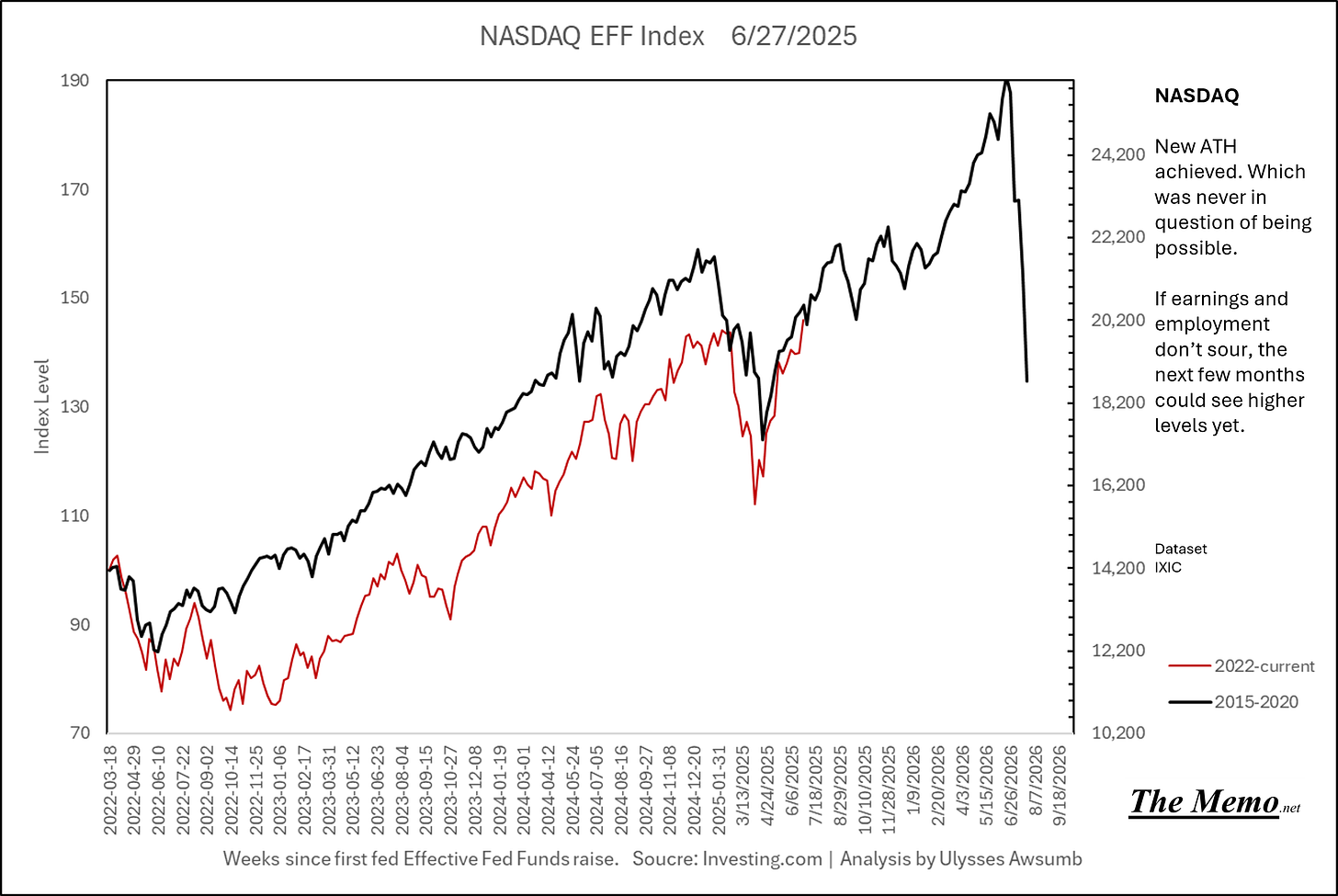

Mortgage Rates

The Housing Crisis. The same people who told us there was a housing shortage, encouraged folks to bid over above on everything, while espousing “Real estate never goes down in value” now face the consequences of changing monetary policy. Where sales have tanked, renters and would be buyers are livid as they’re priced out, the sunbelt market is unwinding, and now these same folks are calling for prices to come down, while others yet are screaming for lowering rates.

Who says lowering rates won’t increase the spread on mortgage lending?

Given a quick study of history, at this stage, it’s almost a certainty that once target funds rates are cut, yield spreads go up. (when one source of interest disappears, another must reappear, where one risk materializes, mitigation must be deployed).

But do go on about Jerome’s impossible position. Damned if he does, damned if he doesn’t.

As the proverb goes: Be Careful What You Wish For.

Treasury Yields

ID10T

Which brings us to this. We’re firmly at the stage where yields typically fall. When I put this out a few weeks ago, I didn’t expect it to be spot on at every week, my expectation was the direction, as it’s based on performance against previous cycles using the same timeline, and to be within a few points of accuracy. Actually, if it had been exact, I’d have much bigger concerns about humanity. Or maybe I need to gamble more. So far so good.

And given that we’re coming up on Independence Day, I thought I’d take a minute to point out that the entire situation we’re all facing, firstly in these United States is beginning to wear on everyone.

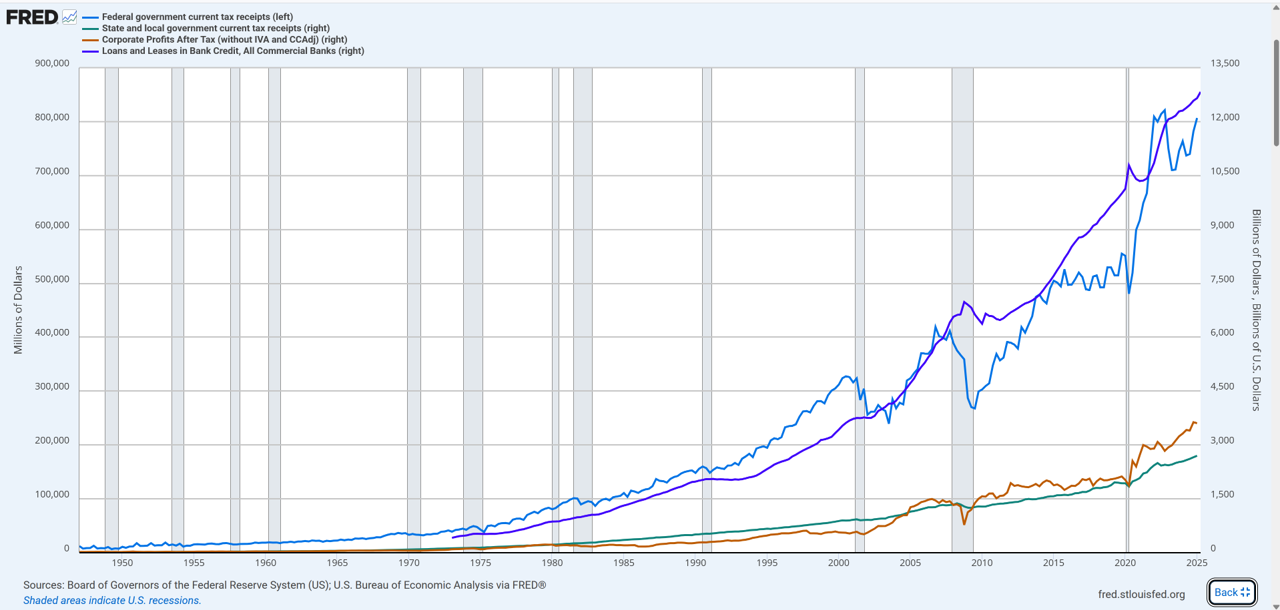

First the cost of money. As this entire EFFing research is dedicated to. But also, the entire point about folks from all political parties and varieties are screaming about Fed Rates is really just about one thing. Taxes. Spending more of your money.

From the notion of “The US will Default” to “We’ll destroy the Dollar” to “We’ll lose our reserve currency status to “Socialist in the home of Capitalism” to “Trade Wars” to “Actual Wars” to “BRICS will rEplAce the DollAr”.

It’s all bad public school theater. That actually is probably insulting to theater kids. Sorry. And it isn’t meant as a slight to other Nation’s either.

The entire problem is here in the U.S.

We’ve reached the stage where elected officials openly pander money to earn votes, where we nominate socialists in the home of Capitalism, and are more upset about that then we are about the socialism that has gotten it to this point. All while those same officials are day trading openly, brazenly and UN-apologetically. All while not even caring anymore if they publicly tell you they haven’t read the bills in Congress. And don’t read into that, because its been 27 years since Congress has actually done its job. And we’ve reached the stage where apparently folks BNPL for $1.50 Costco hot dog. (Thanks John Smith {.USD})

This whole theater, from Dot Gov to Lobbyist groups is nothing more than an effort to spend more of your Dollars, at a lesser cost of your dollars paid back.

For the thing they believe will get them votes.

All while it makes your dollars lesser. Forget the $DXY, look how they’ve massacred our dollar.

These are official government charts. If I wrote this as fiction, there’s only a handful of folks who read avariciously enough to say they’ve seen it before.

This insatiable demand for your hard earned dollars isn’t just limited to State and Federal Governments. This is the position we are in, we must defend that “corporations do indeed pay their fare share of taxes” while also reminding them to “Stop sending job elsewhere, Stop importing employees from elsewhere and start acting like you give an EFF about the Country in which call home”.

This, this could be considered National Parody:

Only, that’s the nature of the situation.

There is no bill before congress that stops this. Or even doesn’t make it worse.

Where are the Congress folk to reign it in?

And if this has you singing the blues:

Are there any more real cowboys

Left out in these hills?

While the rows and rows of houses

Come creeping up on the land

Where the cattle graze and an old gray barn still stands

Are there any more real cowboys in this land?

Are there any more real cowboys in this land?

Remember:

This Independence Day is as good a time as any to reflect on the choices we make. From where we spend our dollars, to how we vote. It’s a good time as well to remember, we have the ability to air our grievances and speak freely. To respect that others have different opinions, and that isn’t a threat in and of itself.

A good time to remember, a lot of folks died to give us the right to “Life, Liberty and the Pursuit of Happiness”, that a lot of folks died wanting to experience those very things in this Nation. And that there’s more than just cowboys out there making things worthwhile.

It’s also a good time to remember, the future is unwritten, to review our goals for the year, to Observe, Orient, Decide and Act, to improve ourselves along the way, and appreciate the freedoms we do have, and to make the most of today. Even if that means Overtime. One of the things that has always separated this Nation economically, is the desire and ability to work. And grind it out.

There’s still plenty of ways to make a buck in this land. May we all make them worth the most.

May we all live long and prosper, may we all be true unto ourselves, and may none tread upon ye.

Happy Independence Day everyone.

Smokestack, fatback

Many miles of railroad track

All-night radio

Keep on runnin' through your rock 'n' roll soul

All-night diners keep you awake, yeah

On black coffee and a hard roll, woo

You might have to walk a fine line (say it)

You might take the hard line

But everybody's workin' overtime

We’ve been here 15 times before

Today in EFFing Time it is:

Friday!

3/22/2019

10/12/2007

08/09/2022

04/19/1996

12/29/1989

5/09/1986

XX/XX/1980 Cycle out of time

06/08/1979

5/23/1975

2/12/1971

07/24/1964

XX/XX/1959 Cycle out of time

03/07/1958

10/01/1954

04/23/1948