Friday EFFing Memo

19-911

The Memo:

To:

The Team

Re:

Things that make the markets work

Bondage

Today in EFFing Time

Comments:

Credit unkown.

End Memo. This is not investment advice. This is for research and entertainment purposes only. You should share it with your friends though.

The Report

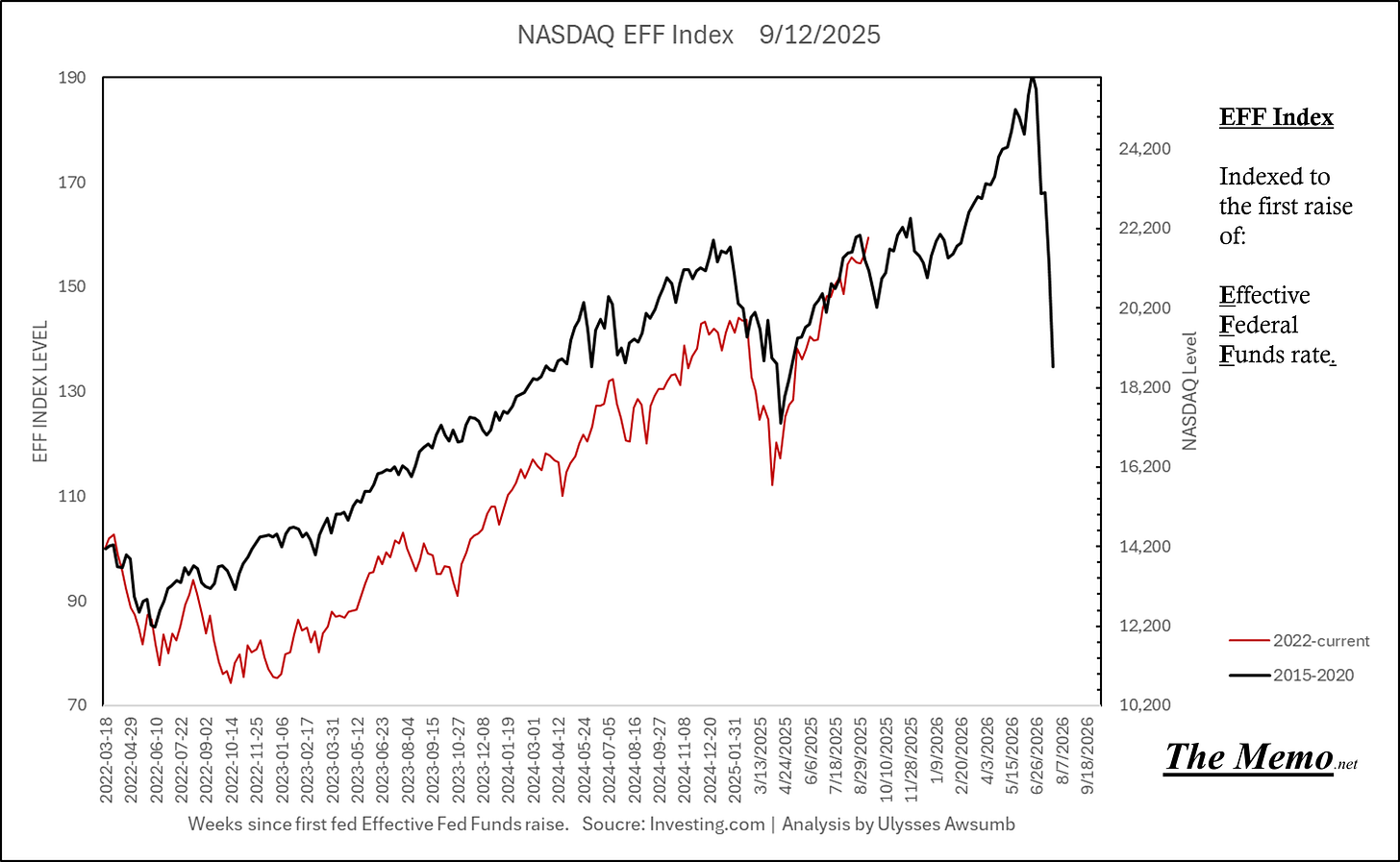

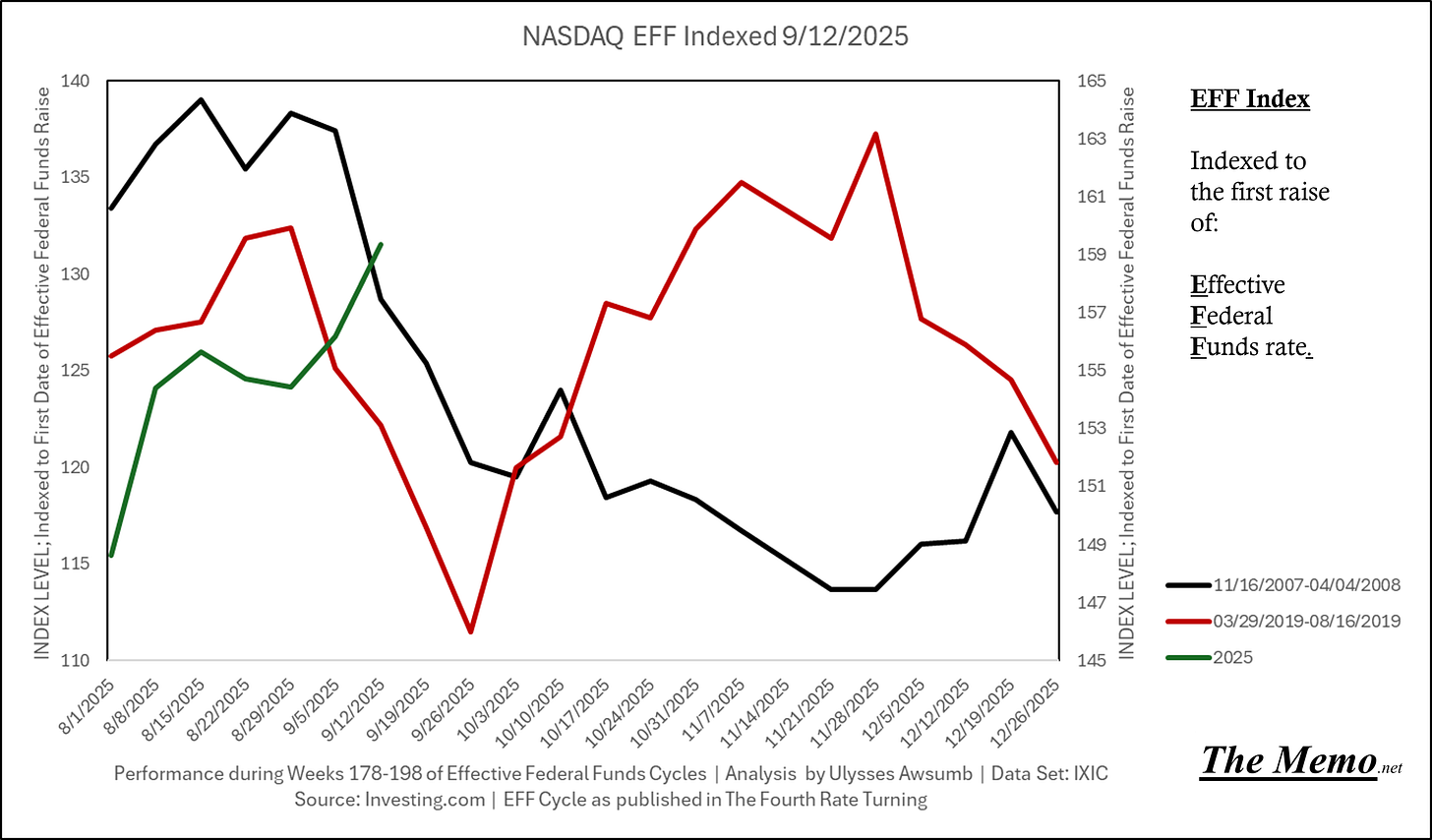

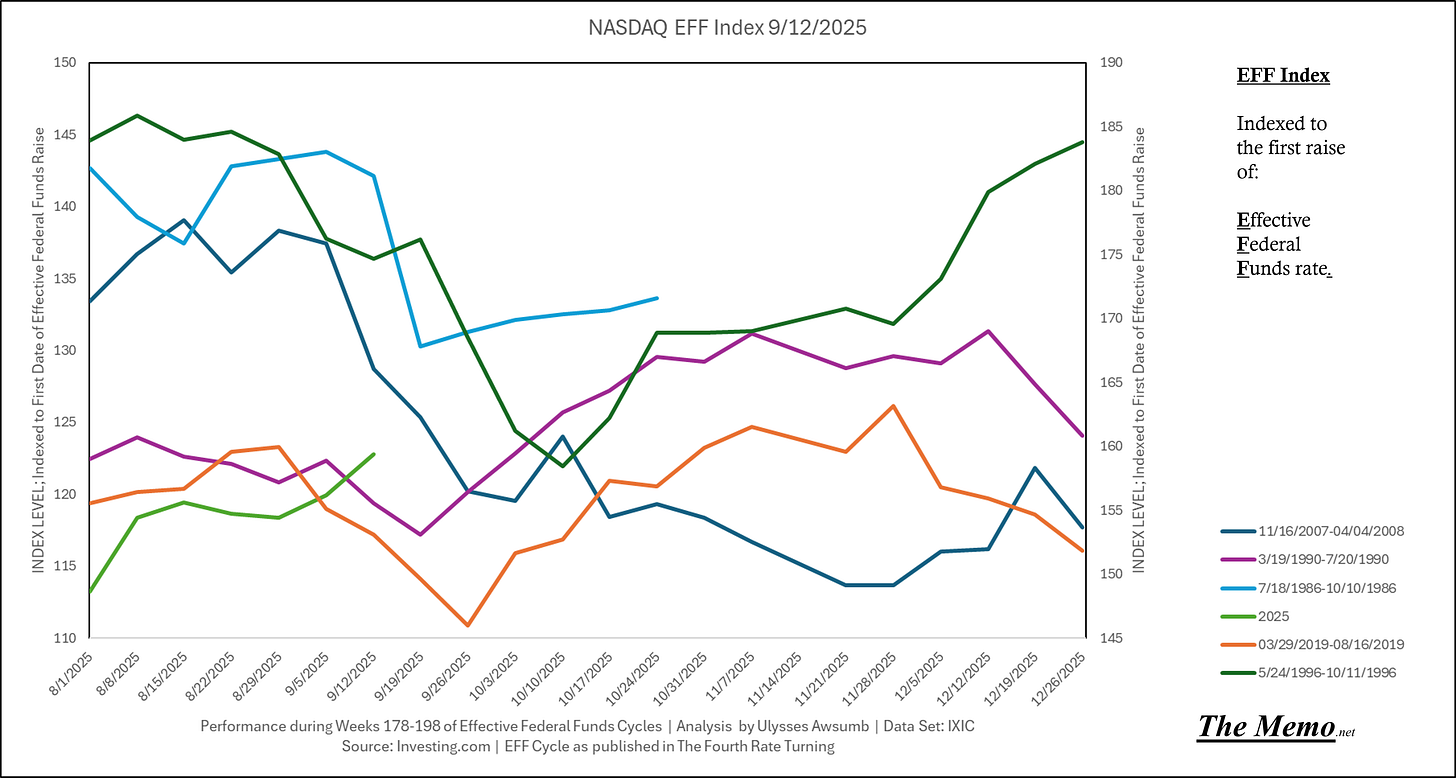

I last wrote about the leap at Rhodes, and the caution that the current market situation should warrant.

In the last week of news, we’ve seen initial unemployment claims rise, the unemployment rate remain elevated, remembered the events and losses of September 11th 2001, witnessed a young man get assassinated, witnessed a young woman get murdered, saw an entire manufacturing plant of employees arrested, read about Russian incursions into NATO allied Poland, heard from farmers across the country facing dire crop sales outcomes, read some heinous commentary,

And ATH (all time highs) in the Nasdaq.

Ulysses, you said we’d see another drawdown.

I did.

And we probably will.

That ATH has arrived despite some whiplash.

And ended the week with this nice red candle.

In other words:

© Warner Brothers | DC Comics | The Dark Knight

In EFFing time, we’re less than 4 weeks away from the passing of Heath Ledger, in January 2008. R.I.P.

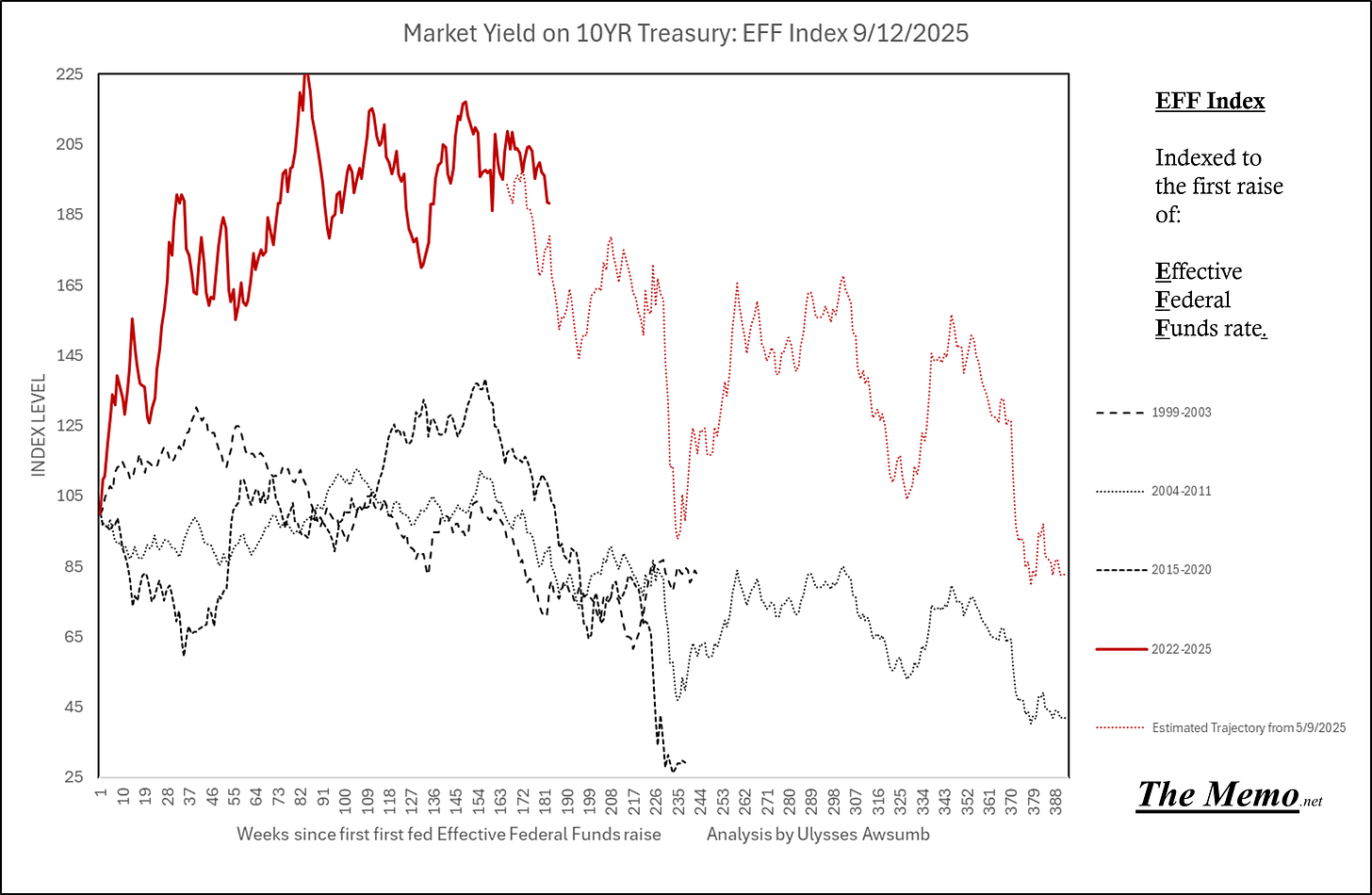

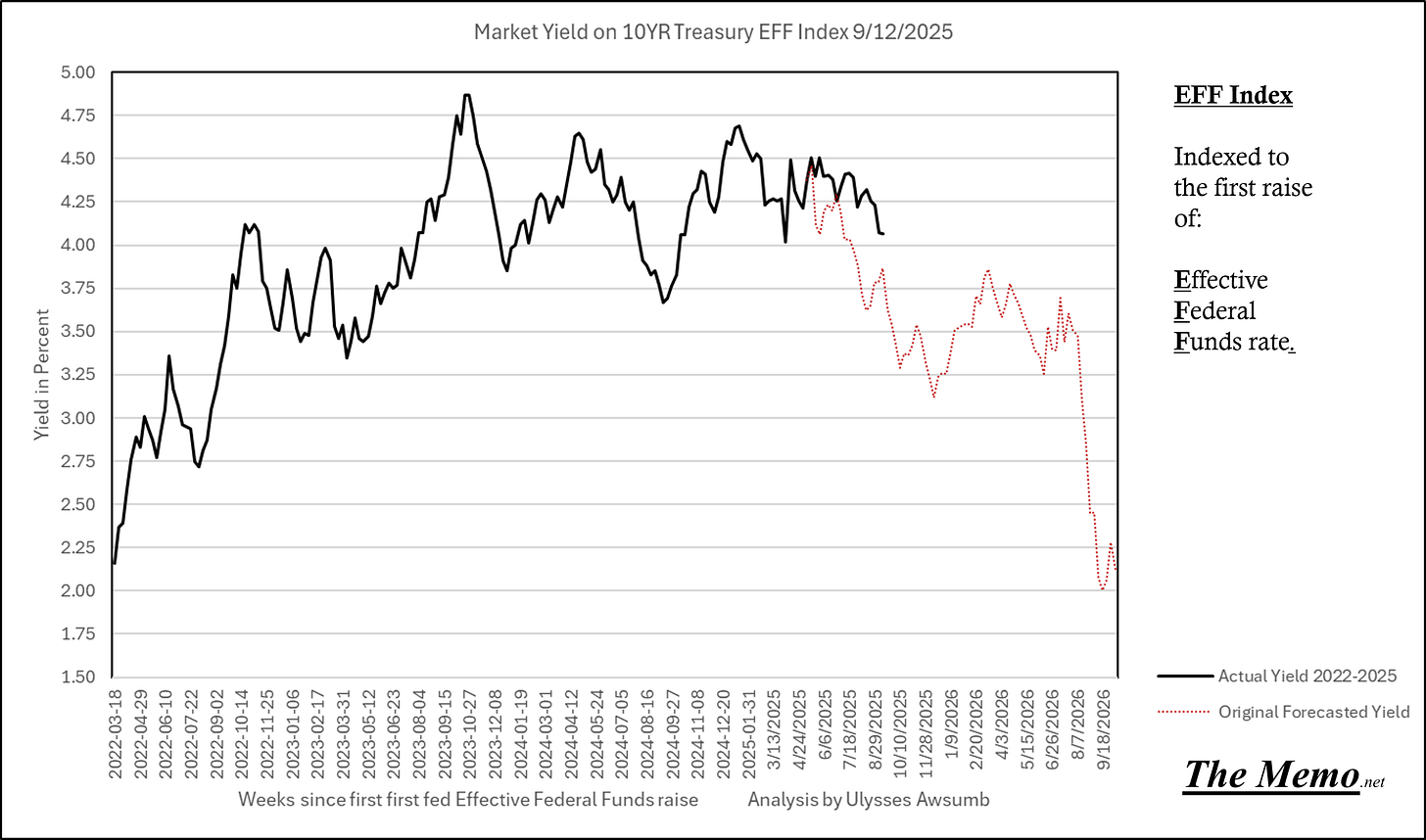

Notes, Bills and Bonds have had an equally volatile time period.

And are tracking the direction of my May 2025 forecast, directionally.

With some heavy red candles also.

Despite ending the week where it began.

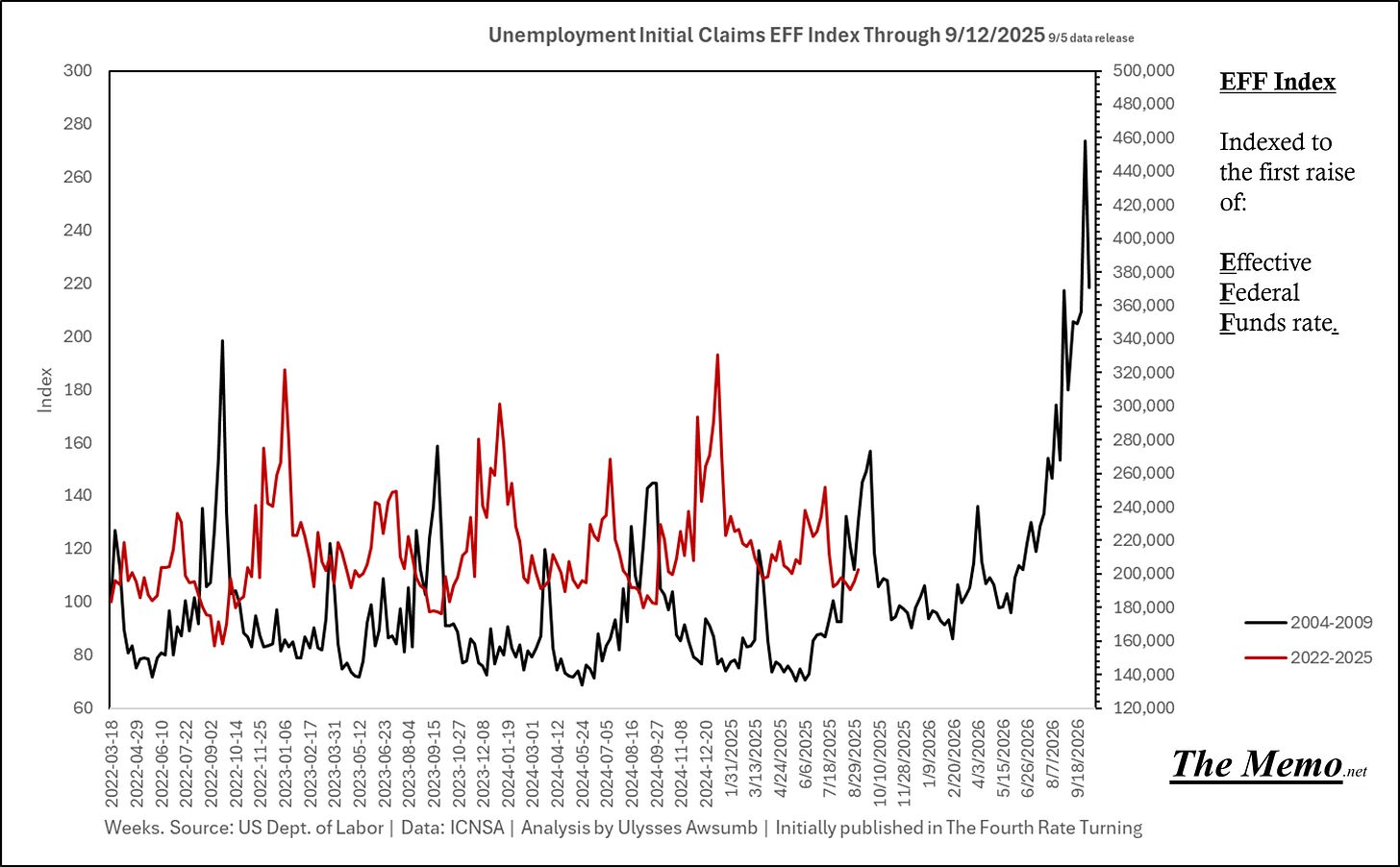

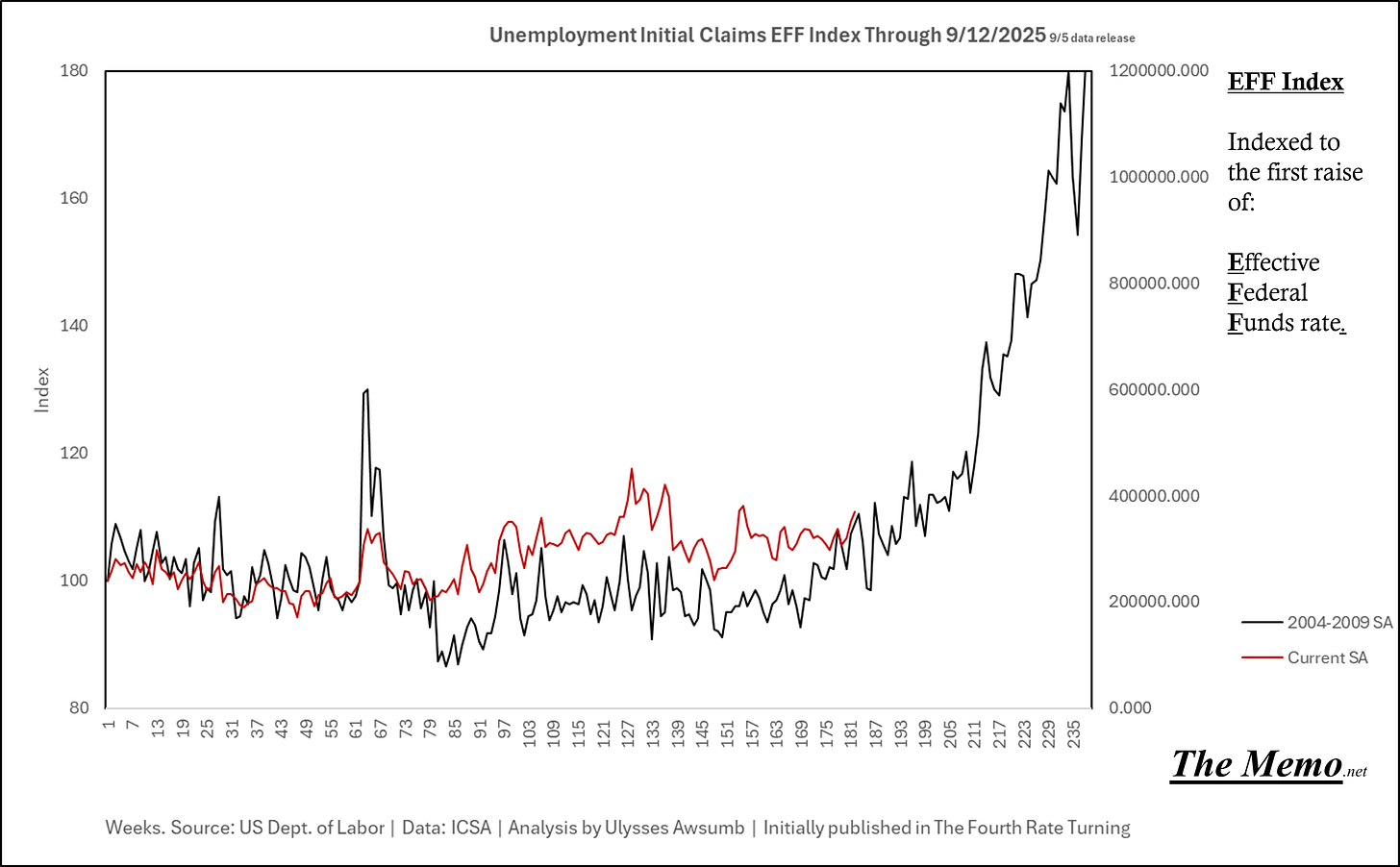

While headlines showed we’ve reached the highest number of initial unemployment claims since 2021, (on a seasonsally adjusted basis) the non seasonally adjusted data just turned up as well, despite being lower than the SA claims.

The seasonal factor increasing claims this time of year, can likely be traced back to the longstanding practice of holiday (read seasonal) hiring done this time of year. As retailers gear up for the Q4 holiday slate including Halloween, Thanksgiving and Christmas buyers shopping, which was such a staple, it lead to the now forgotten term: Black Friday. As in the day that retailers finally went from in the red (losses) to in the black (profit) for the year.

Despite all the legislation to curtail claims and use of unemployment, including in states like Texas who reduced benefits, the current situation still found a new cycle high. By the way, the claims spike was lead by: Texas.

One thing the seasonally adjusted data does nicely is smooth the noise.

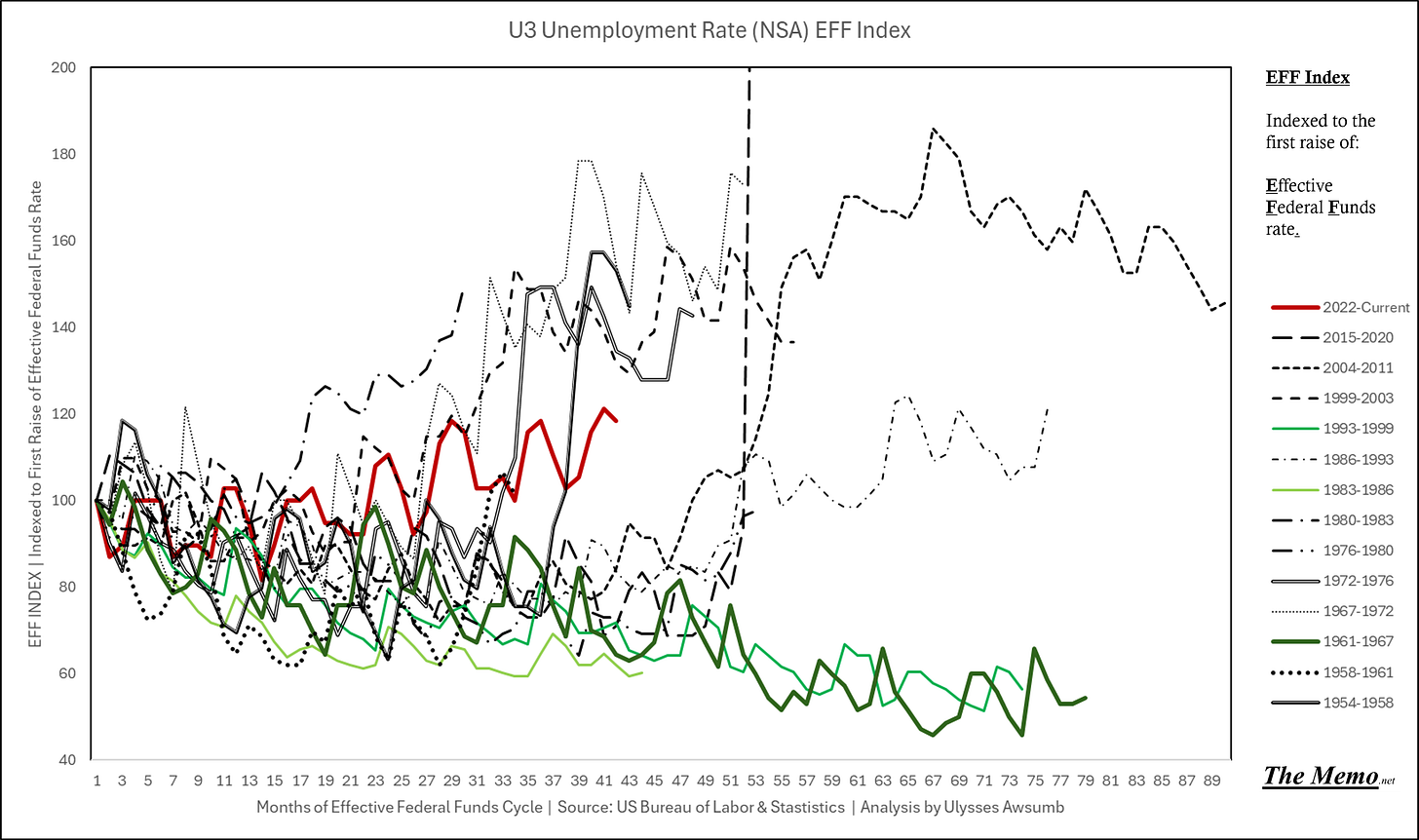

The Unemployment Rate (U3) dropped by 1/10th of 1 percent. Or 10 Basis Points.

Some things to remember regarding the current unemployment “rate”: we’ve just come off 3 years of excess deaths, and decreased participation in the workforce, from disabilities, retirements and age. If the workforce size decreases by two people no longer participating, and 1 additional person loses their job: Does the unemployment rate go up or down?

Now for some bad news, that presents some good opportunity:

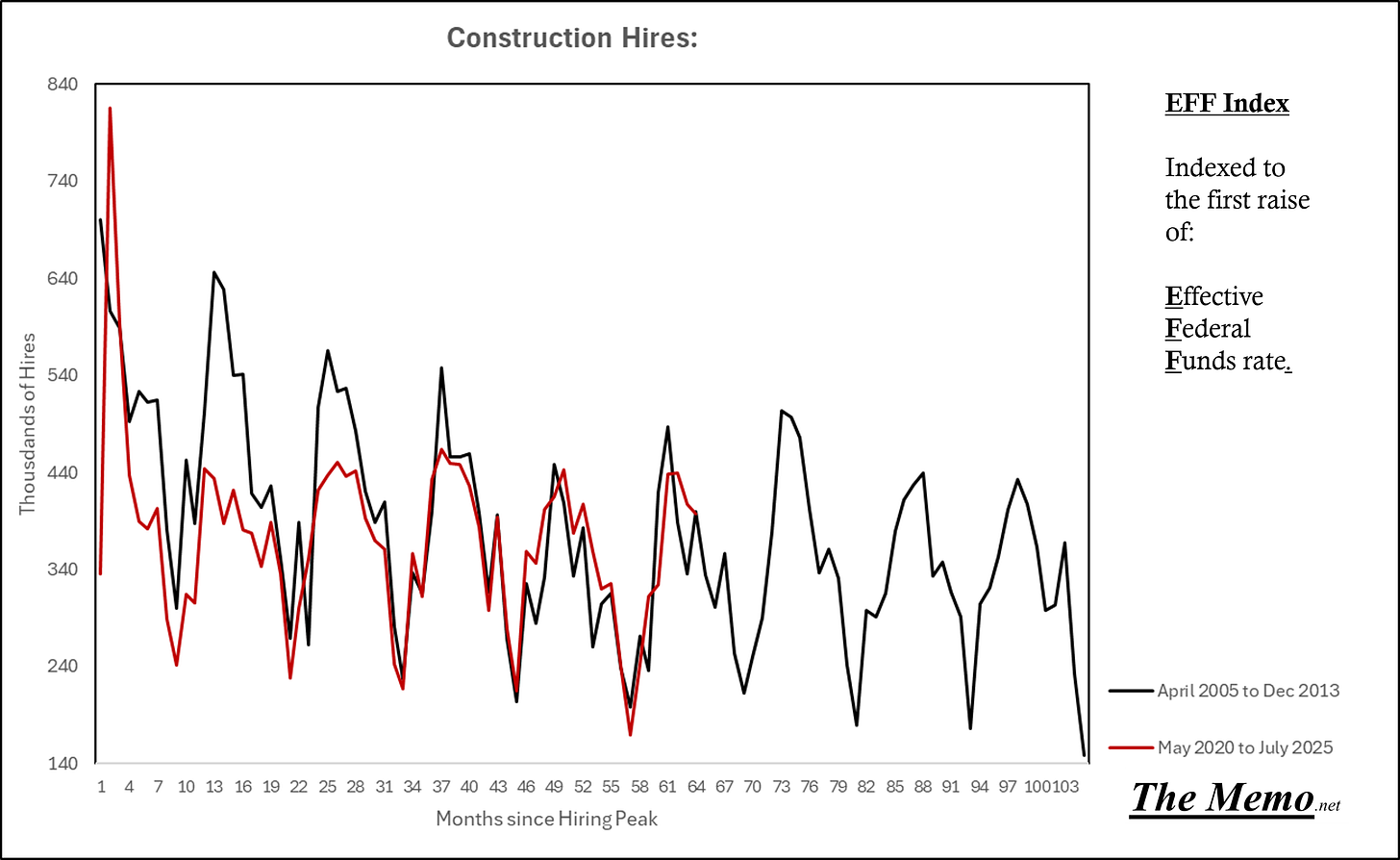

The JOLTs (Job Opening and Labor Turnover) survey showed construction hires continuing their downward trend.

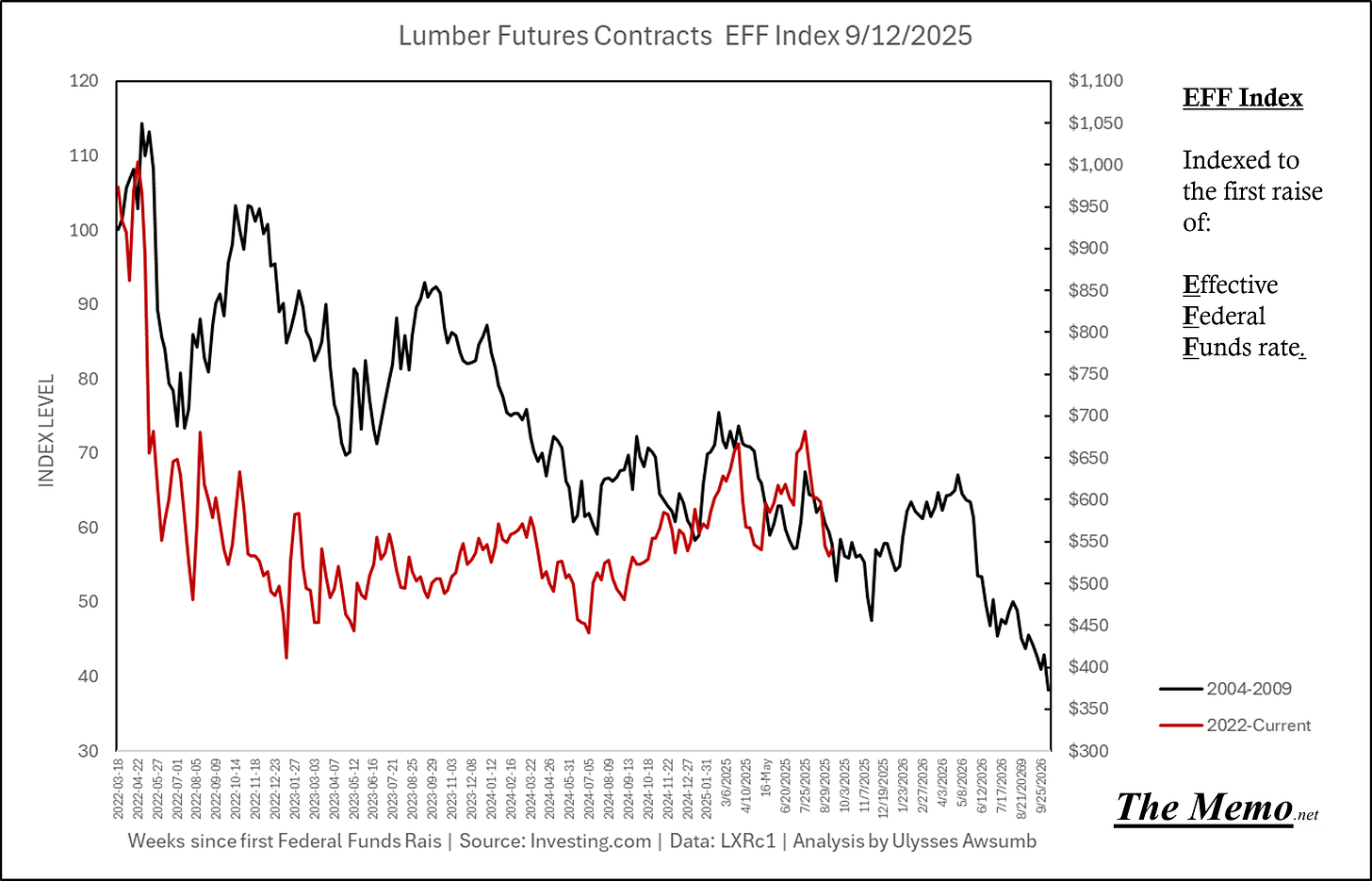

Lumber futures pricing continues to decline.

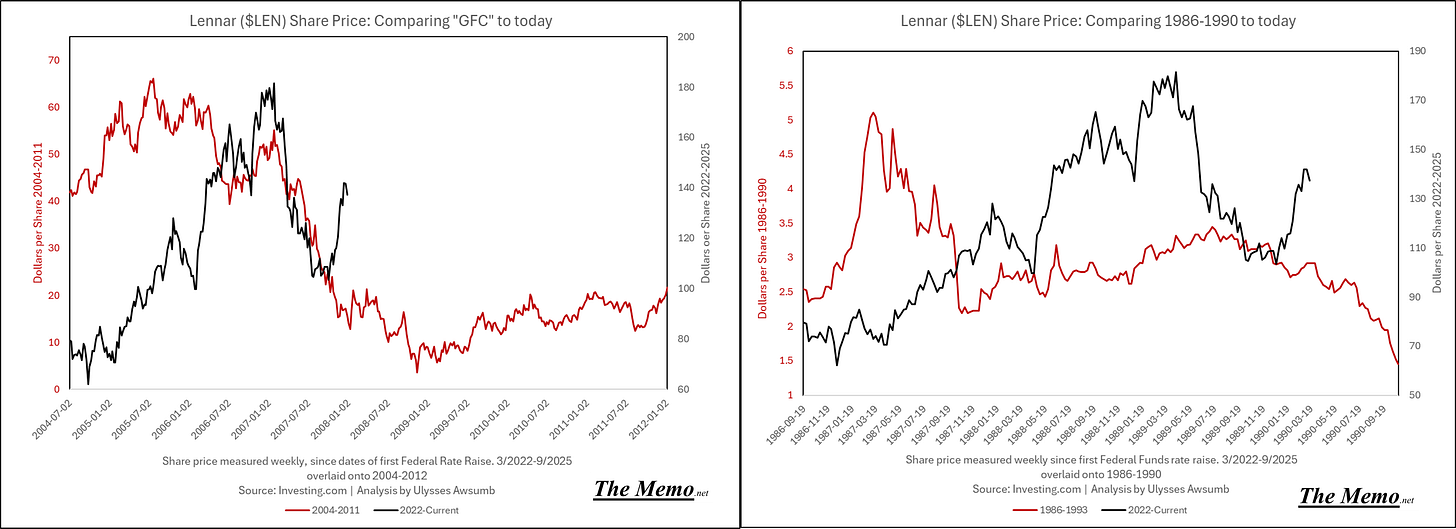

Lennar just rolled over again, and heads into the seasonal worst Quarter for sales, while BuilderOnline just published a piece on the current “Incentive Wars”.

The drop in mortgage rates has coincided with the uptick in unemployment. Which probable does as little for sales as last years Fed Rate “Cuts” that we were told by very professional people would unleash a fury of buying.

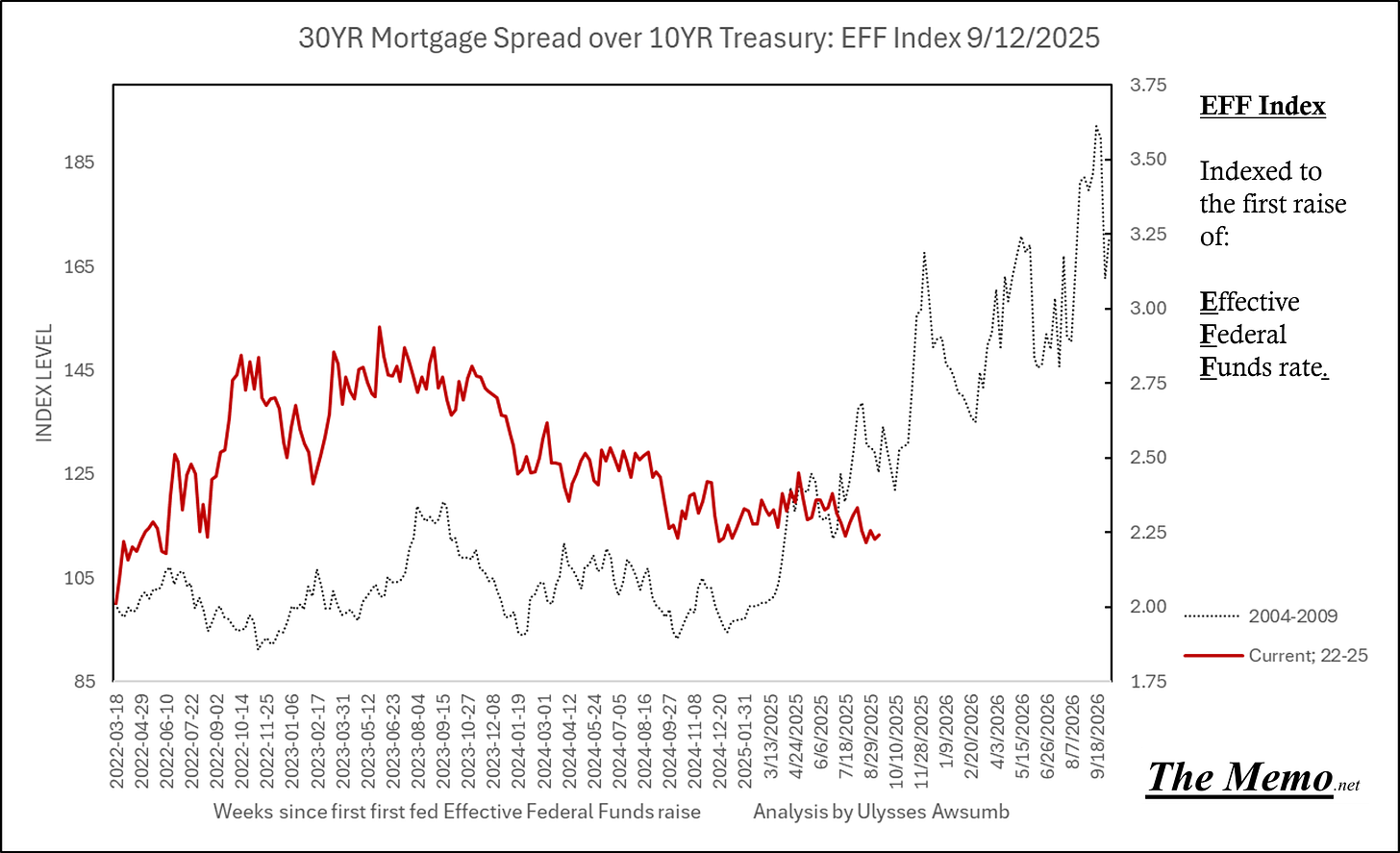

Meanwhile, we just saw the second upward bounce in mortgage spreads. Ticking away, the moments that make up a dull day.

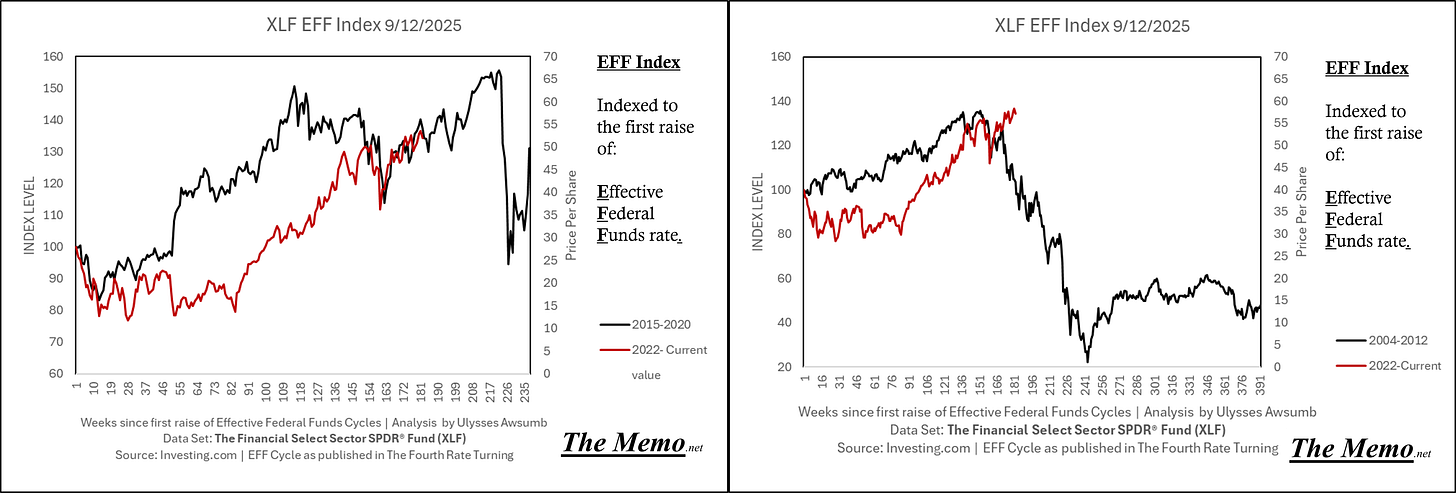

Let’s check in on this weeks bonus: XLF

What makes up XLF?

Fun.

But wait, I did say this presents opportunity. And it does.

If construction employment softens, construction commodity prices (i.e. lumber) drop, mortgage rates drop even if spreads widen, and big builders are compressing margins even futher:

The next 12 months may present some very interesting opportunities for developers in good markets to build cheaper, redevelopers looking to acquire distressed assets for less, real estate operators looking to acquire at depressed prices, and business’ expanding footprints with increasing incentives to fill space. (Just please no more chicken joints, thanks) Among other opportunities for many folks.

Even if the general public and general media says otherwise.

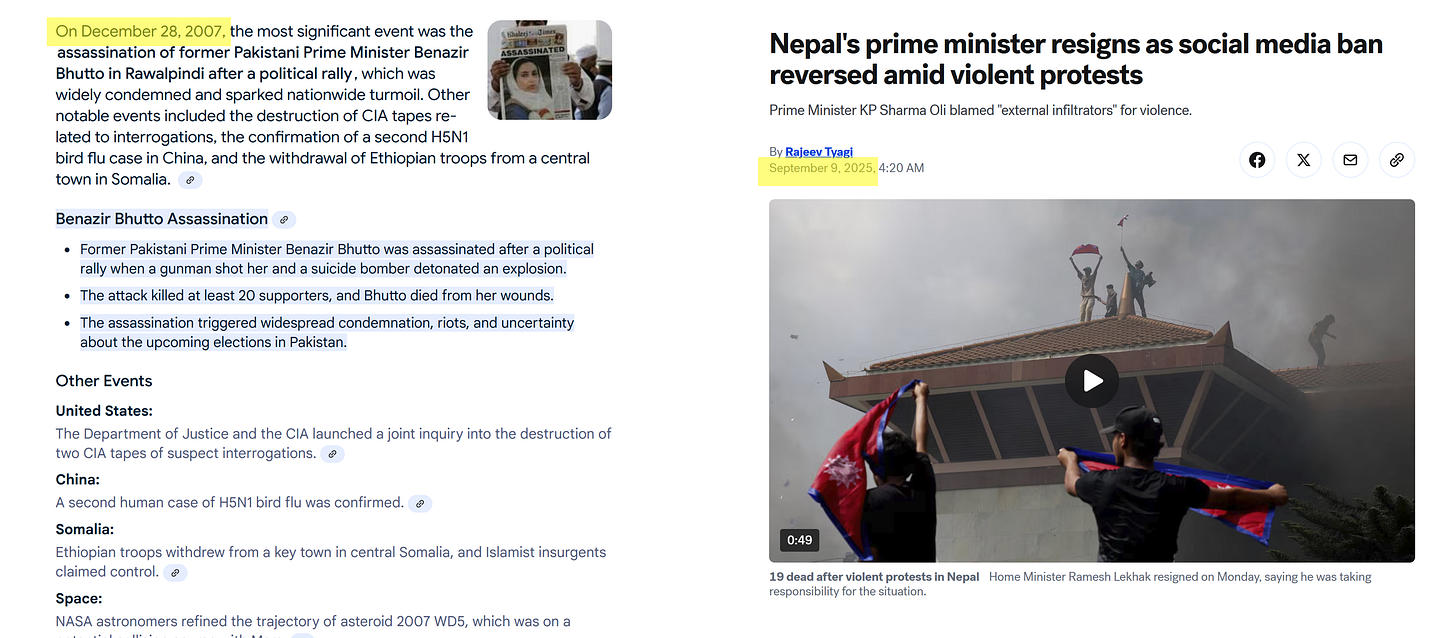

Today in EFFing Time

EFFing time is the same day/week/month in past time, that today is, since the first raise of federal funds effective rates. We’ve been here 15 times before.

It is the 183rd week ending of the EFF Cylce, or:

6/7/2019

12/28/2007

10/25/2002

7/5/1996

4/13/1990

7/25/1986

8/24/1979

8/8/1975

4/30/1971

10/2/1964

5/16/1958

7/2/1948

I don’t have anything to say about 9/11, or the events of this week. I’m not the character in those stories, and my opinion is irrelevant. But I will share a pair of songs that were released back to back in June-July 1991 that I think can offer something for those looking to make sense of the year that has been this week.

Look at your young men fighting

Look at your women crying

Look at your young men dying

The way they've always done before

Look at the hate we're breeding

Look at the fear we're feeding

Look at the lives we're leading

The way we've always done before

My hands are tied

The billions shift from side to side

And the wars go on with brainwashed pride

For the love of God and our human rights

And all these things are swept aside

By bloody hands, time can't deny

And are washed away by your genocide

And history hides the lies of our civil wars

I don't need your civil war

It feeds the rich, while it buries the poor

You're power-hungry, sellin' soldiers in a human grocery store

Ain't that fresh?

I don't need your civil war

-Darren A. Reed / Duff Rose Mckagan / Izzy Stradlin / Matt Sorum / Saul Hudson /

W. Axl Rose

Civil War released in June 1991

If this time is different, let it be the best kind of different:

Be exellent to each other