Friday EFFing Memo

Oats and Beans and Barley Grow

The Memo:

To:

The Farm Committee

Re:

EFFing Commodities

Yields

Equities

Job(lessness)

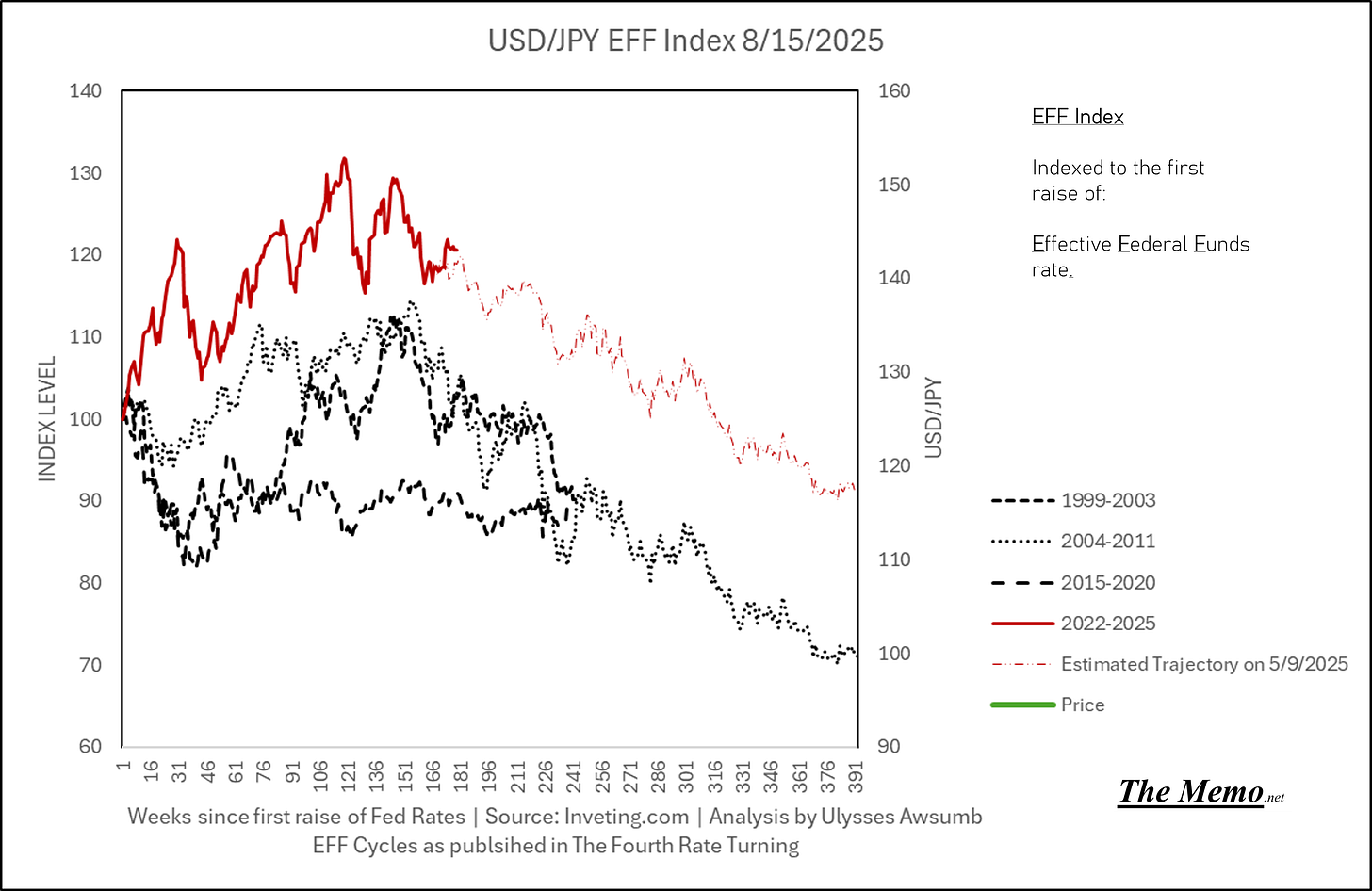

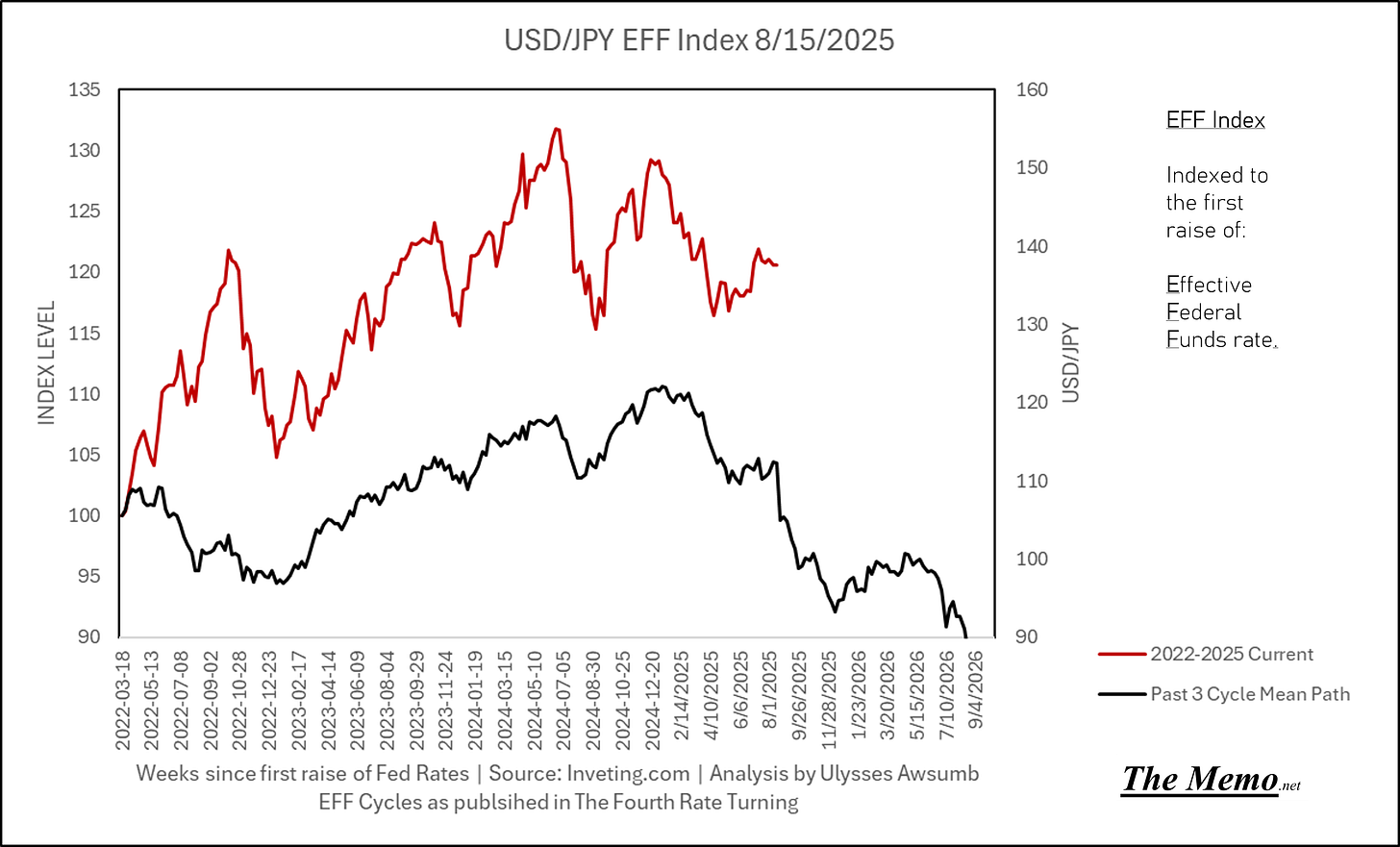

Japanese Yen

Why buy new when gently used will do?

Comments:

Oats and beans and barley grow

Oats and beans and barley grow

Do you or I or anyone know how oats and beans and barley grow?

Apparently, there’s no “wheat” in that song, despite my recollection to the contrary. Pretty sure its a conspiracy theory. Like how there was never a cornocopia in the Fruit of the Loom logo or how Sinbad wasn’t in Shazam. Whatever, you’re gonna read about wheat in a minute either way. But first I’m gonna pair unserious humor with serious charts. Enjoy!

End Memo.

There's a hole in my bucket, dear Liza, dear Liza,

There's a hole in my bucket, dear Liza, a hole.

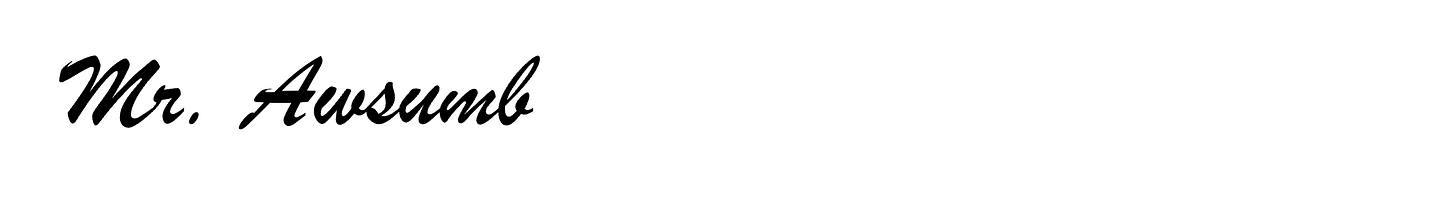

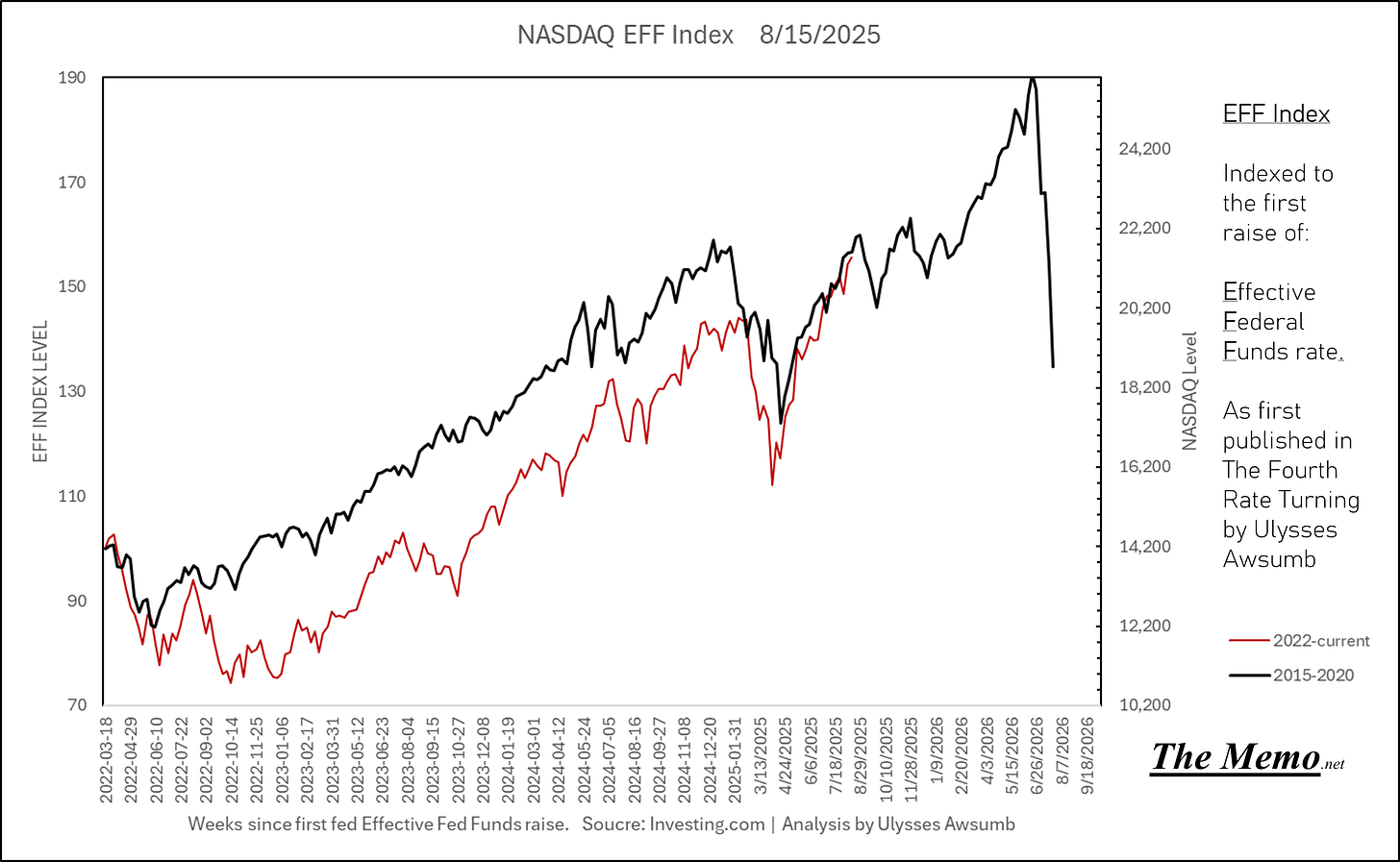

Equities

From now until September 2026, the market will be flat. Even though it’s going to go up further. If that’s a challenging proposition, the equation looks like this:

- + -

(Gabe, I promise that isn’t the other chart update you asked for)

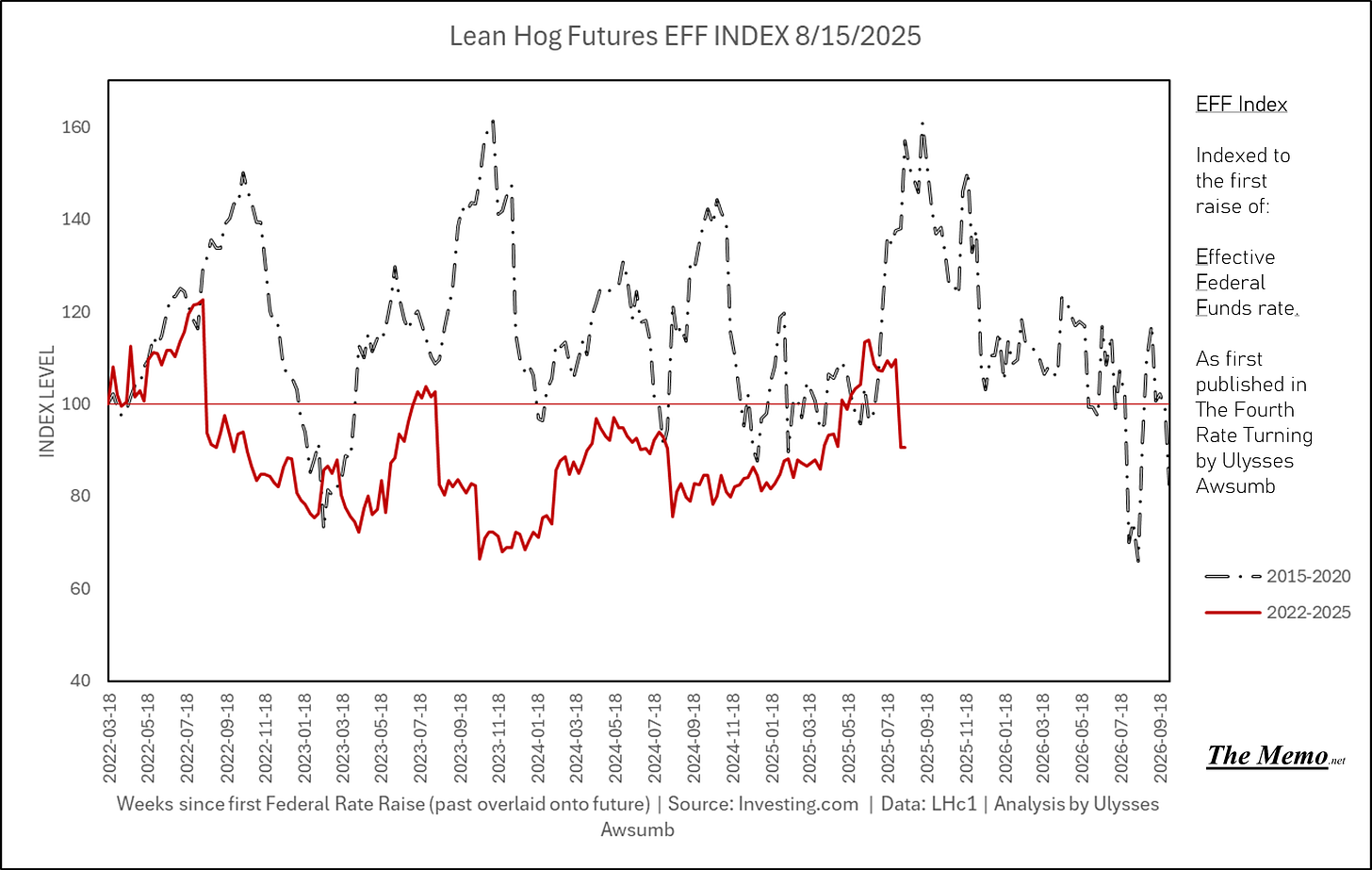

This is basically the most ridiculous, large, social control focus group experiment on earth. Past overlayed onto the future, as measured by the same week in EFFing time.

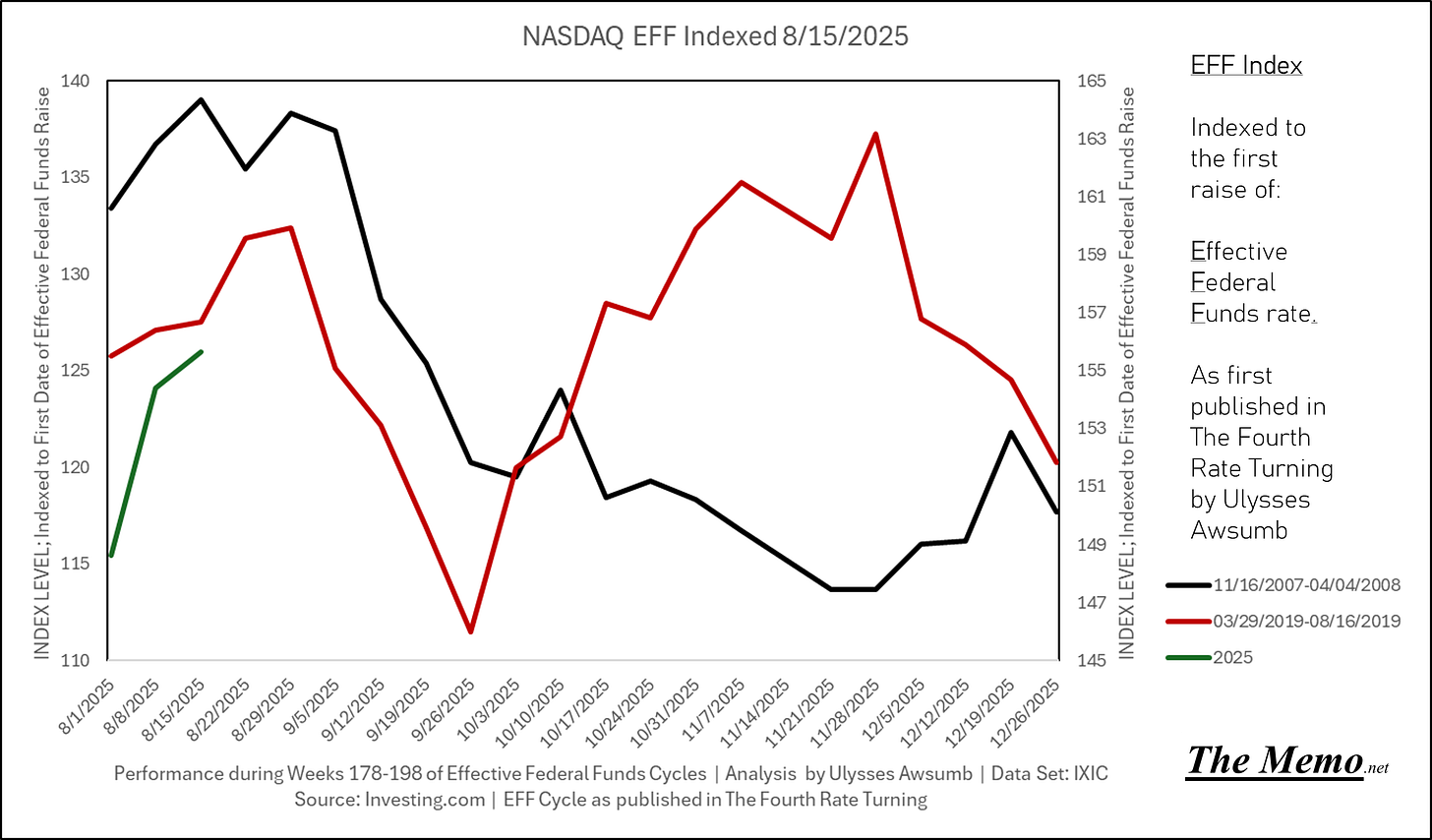

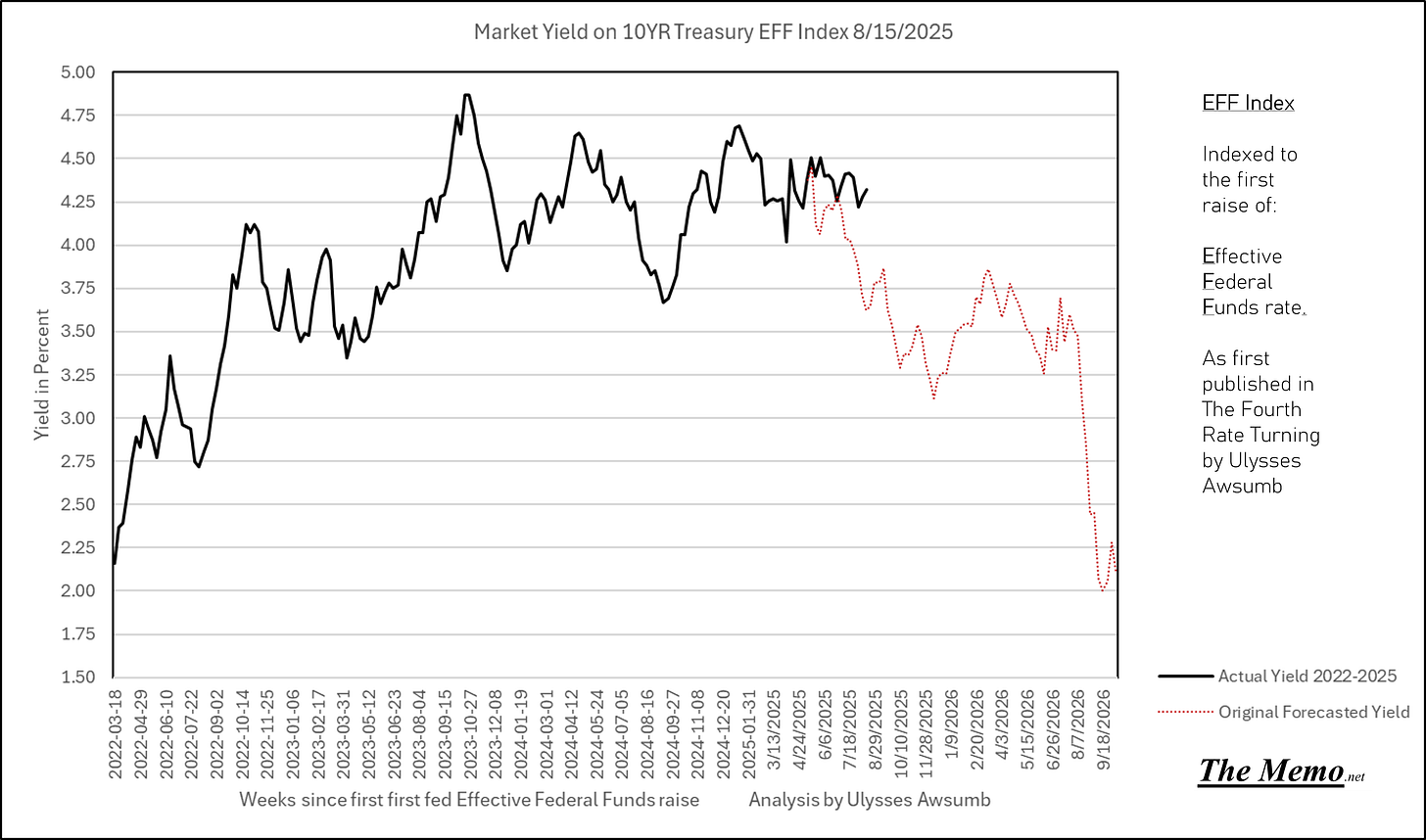

Yields

Just want to remind everyone, the Federal Reserve has no control over what yield you are willing to buy this for. That’s entirely up to you. Maybe if we take Nancy Reagan’s advice and “Just say no” to lower yields, the people jonesing to borrow more money that taxpayers have to pay for, it’ll change.

One can hope anyway.

I think more people know Honda Accords than they do the Plaza Accords.

Either way, my charts are as reliable as Honda Accords. (not financial or investment advice, pure conjecture. In fact I object to my outlandish statement. Allegedly) Also that 10 speed transmission isn’t nearly as reliable as the old models used to be. (Conjecture!)

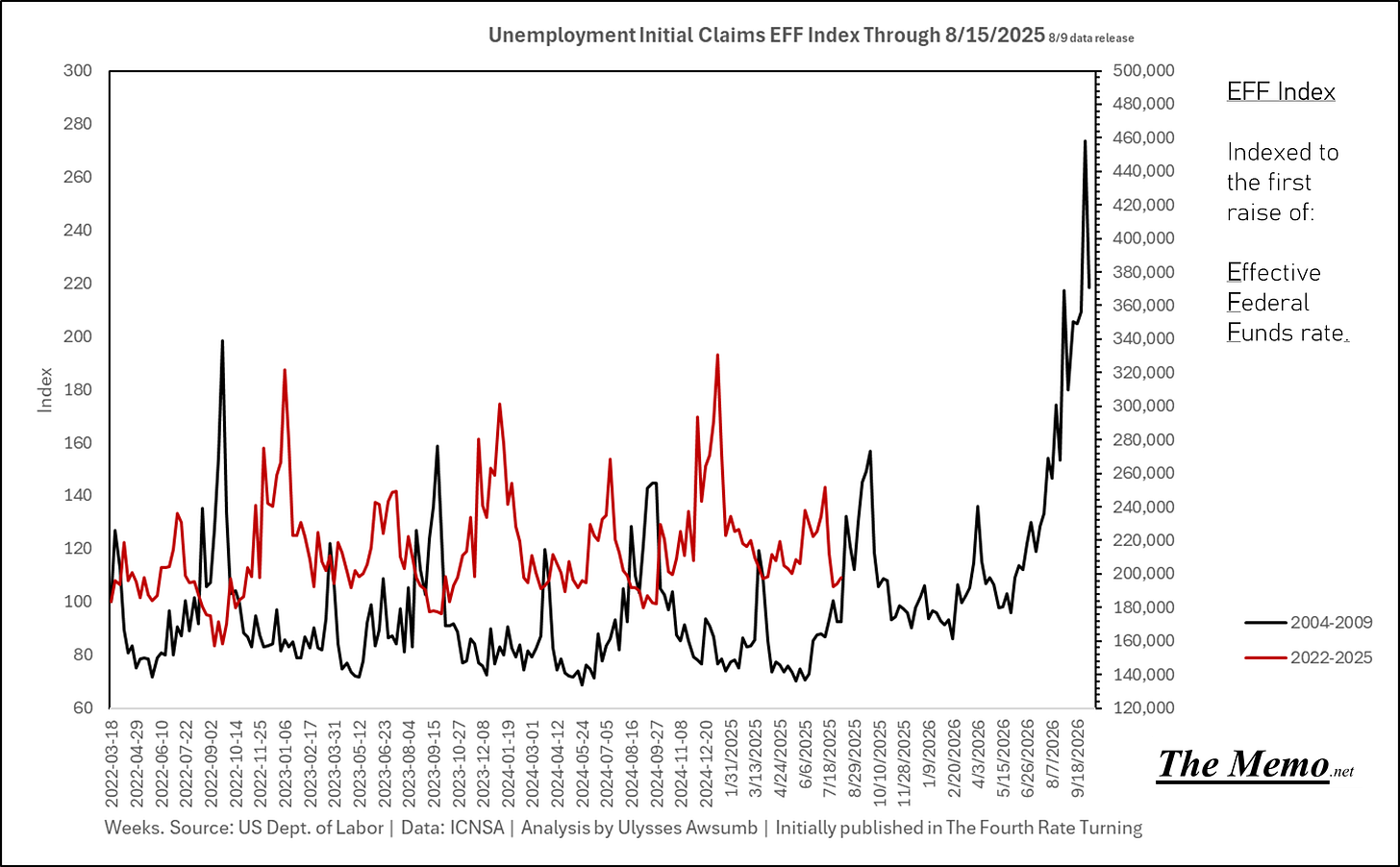

Initial Claims

Rounded the corner into another upturn. Despite it being small.

Oats, beans and barley (and lumber and hogs) So basically Land revenue sources

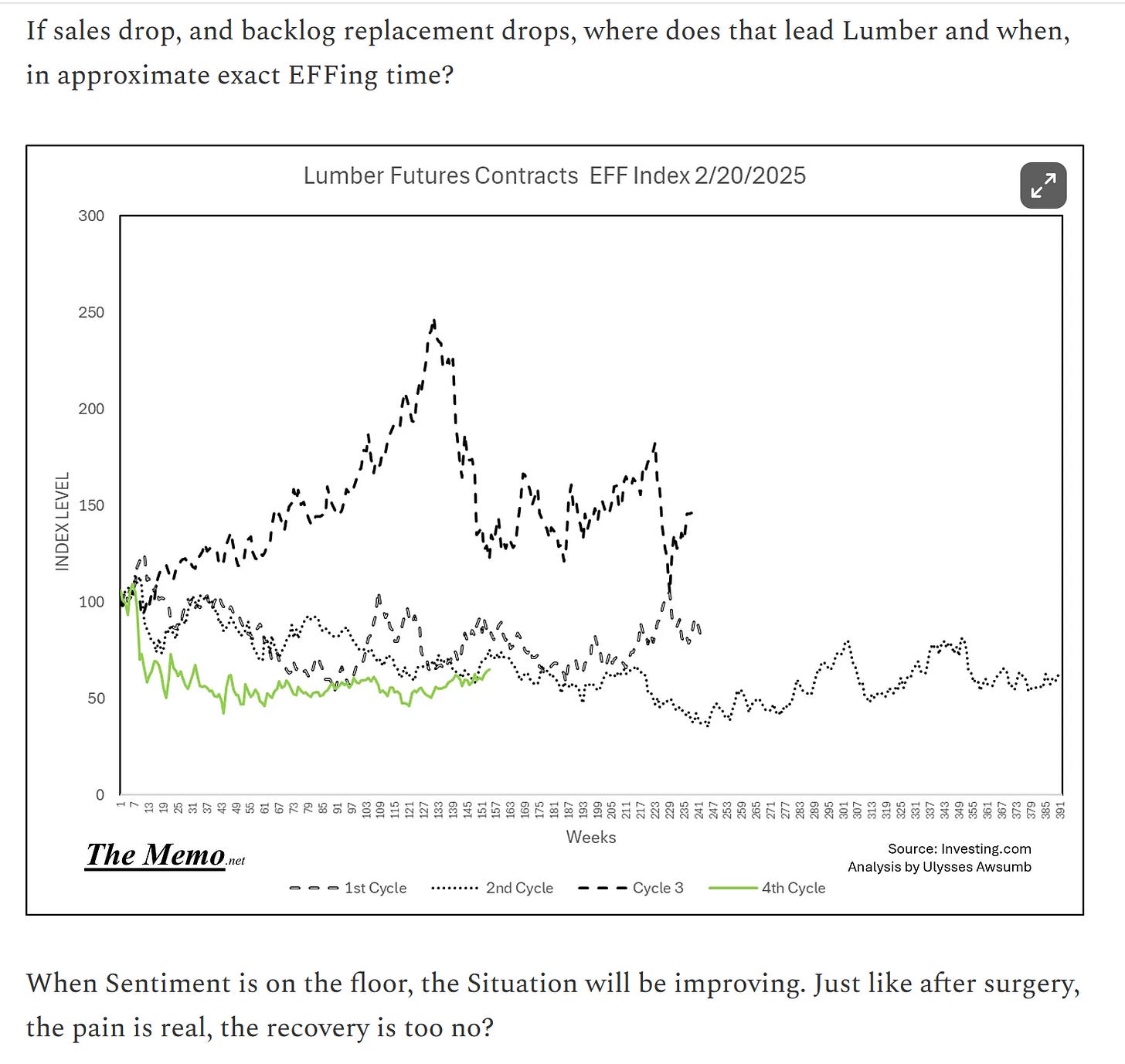

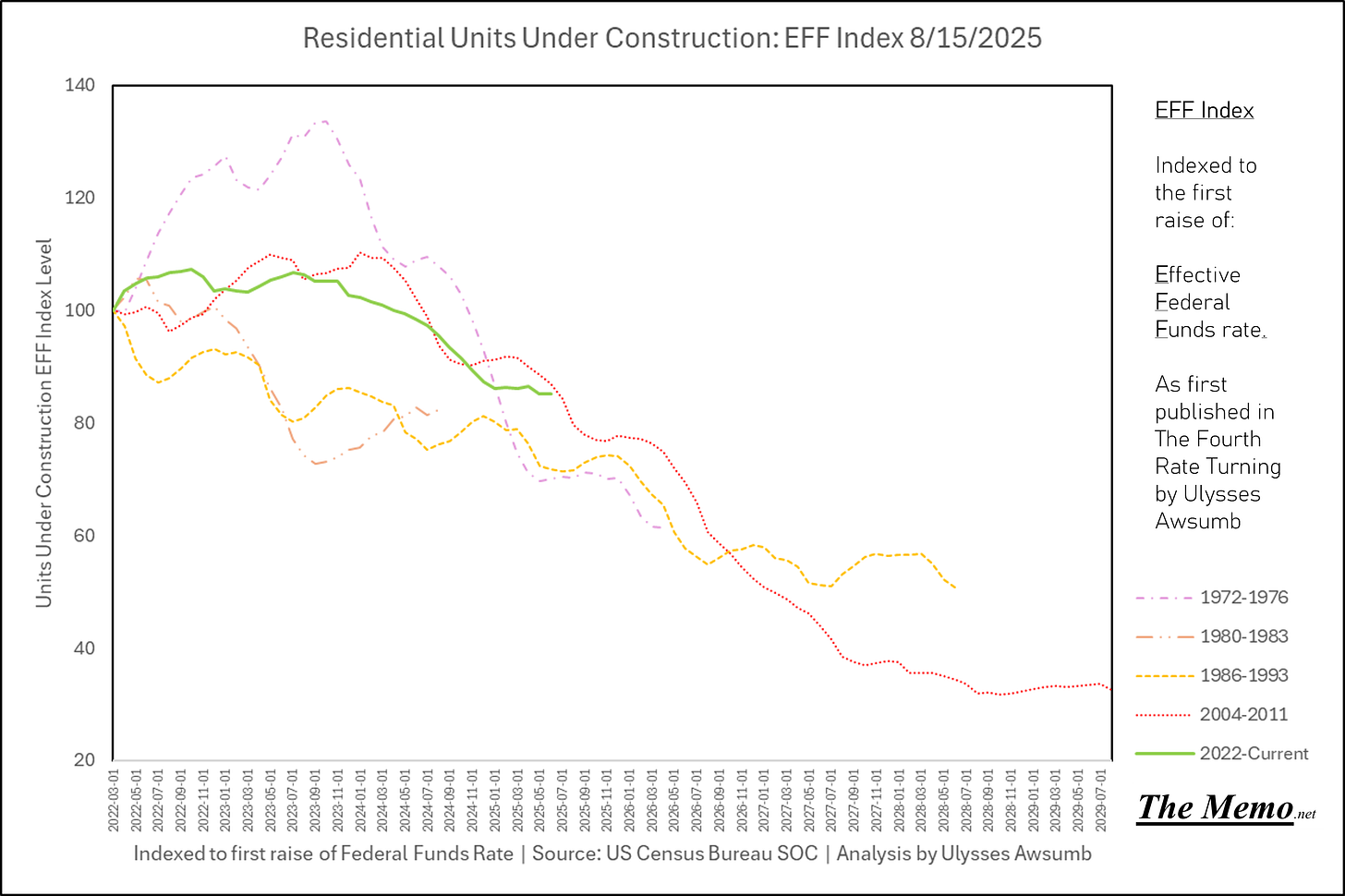

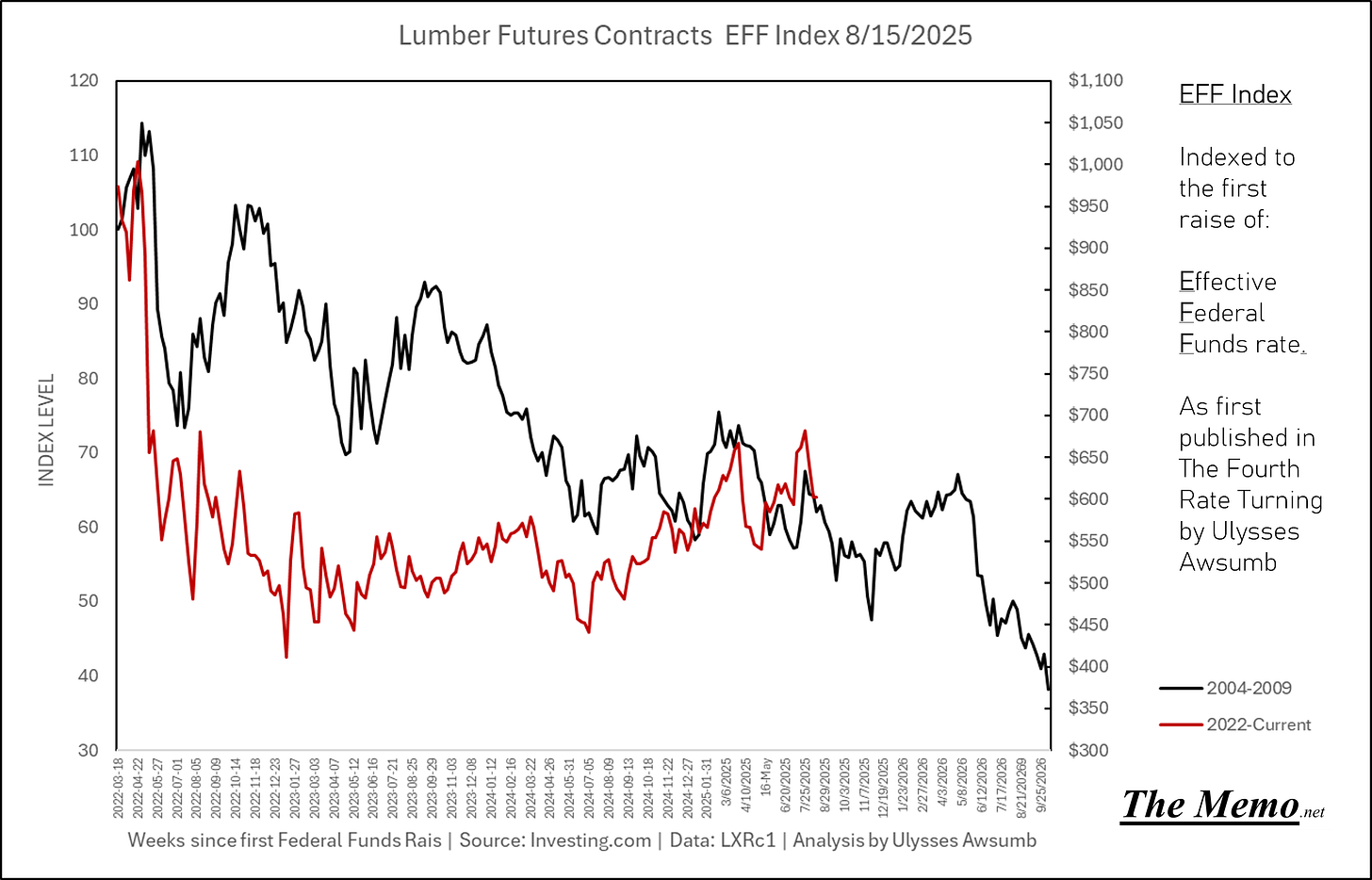

Much ado about lumber futures contracts plummeting again this week. But, as I wrote HERE in February about lumber:

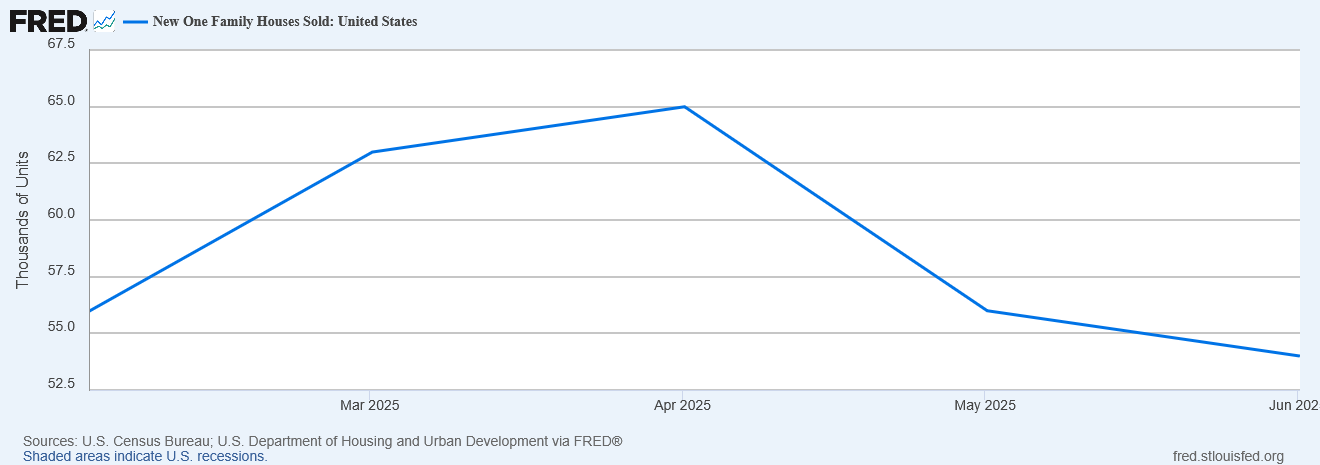

About those sales,

As for the other part, backlog replacements keep disappearing (Spelled it right Kat)

So naturally, demand for board feet of lumber is also declining. As for the timing of the drop, I present to you:

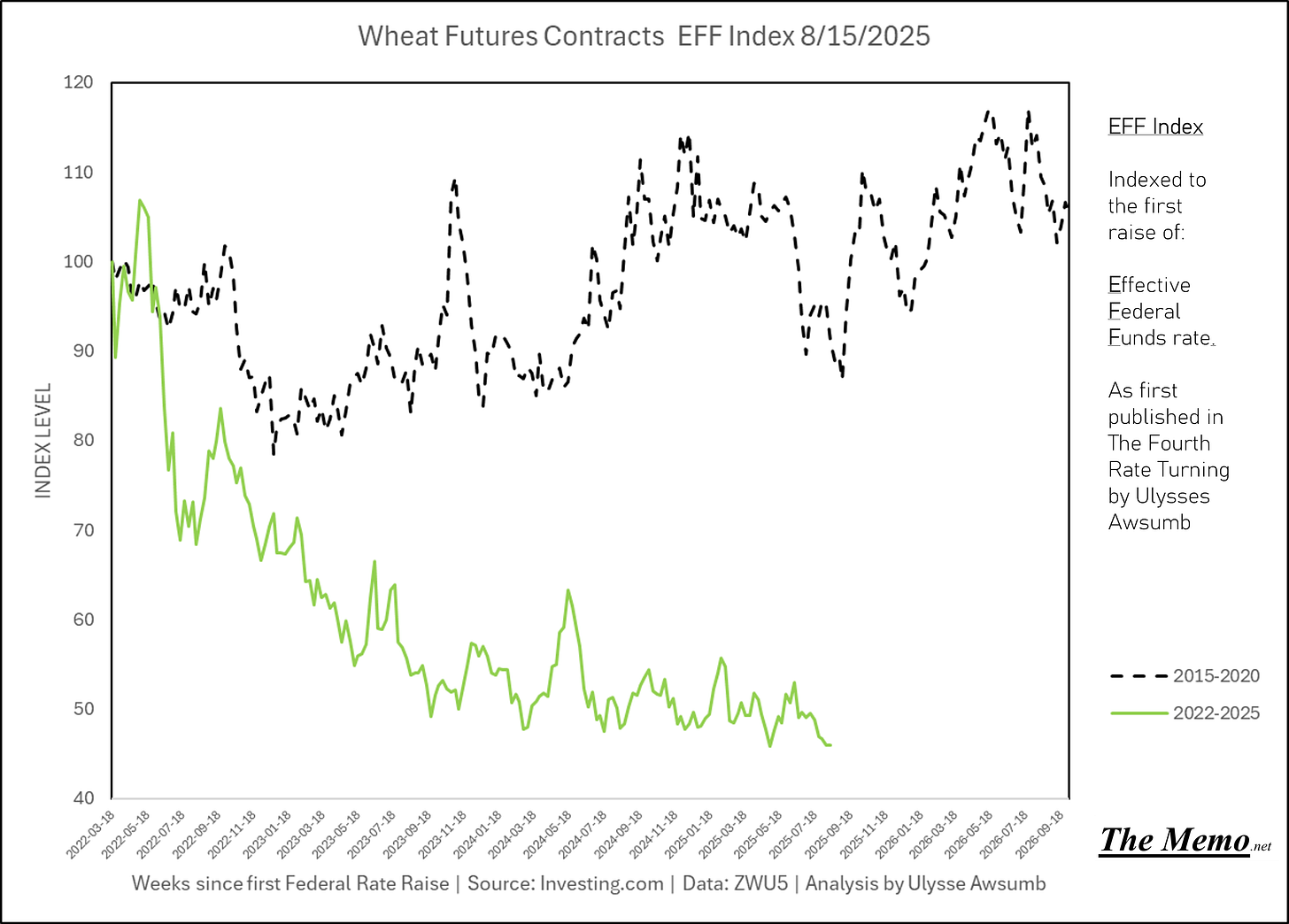

Wheat futures continue their longer term trend in decline. Which is unfortunate. Especially coupled with reports from the University of Illinois showing it might be a banner year for crop harvest. Not just wheat but for corn and soybeans. Which are 50% of US planted fields.

This wheat price is really……something.

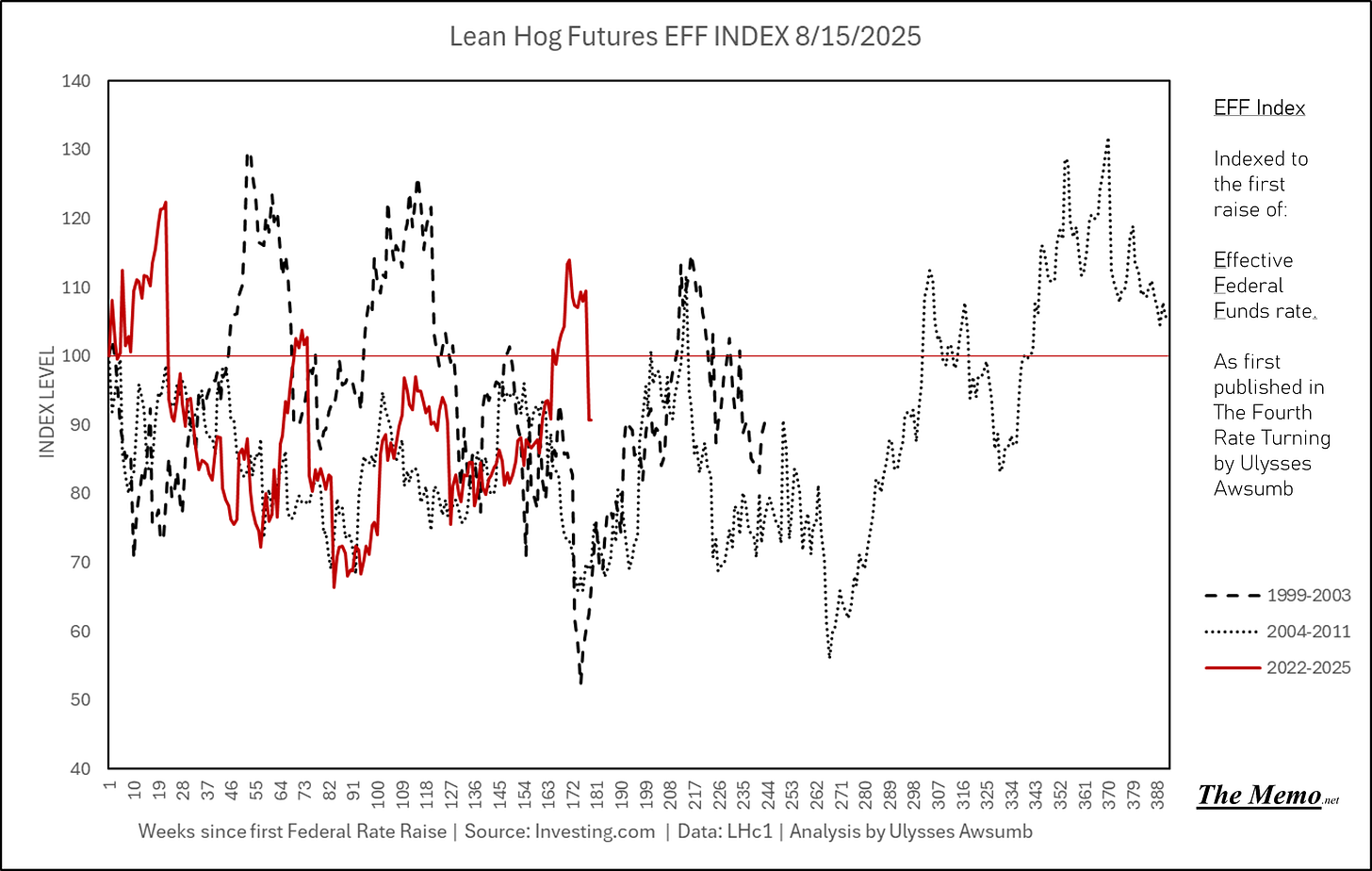

Things aren’t going much better for American Ranchers, despite the upcoming bankruptcy filing of Beyond Meat, and the increased prices at the grocery store/restaurants. As ranchers aren’t seeing the increase in prices paid for their part.

So we’ve got trends in less demand to buy farmland to replace new housing units, prices paid for crops and commodity animals decreasing, and prices for timber dropping. We may actually dent the undentable: Land.

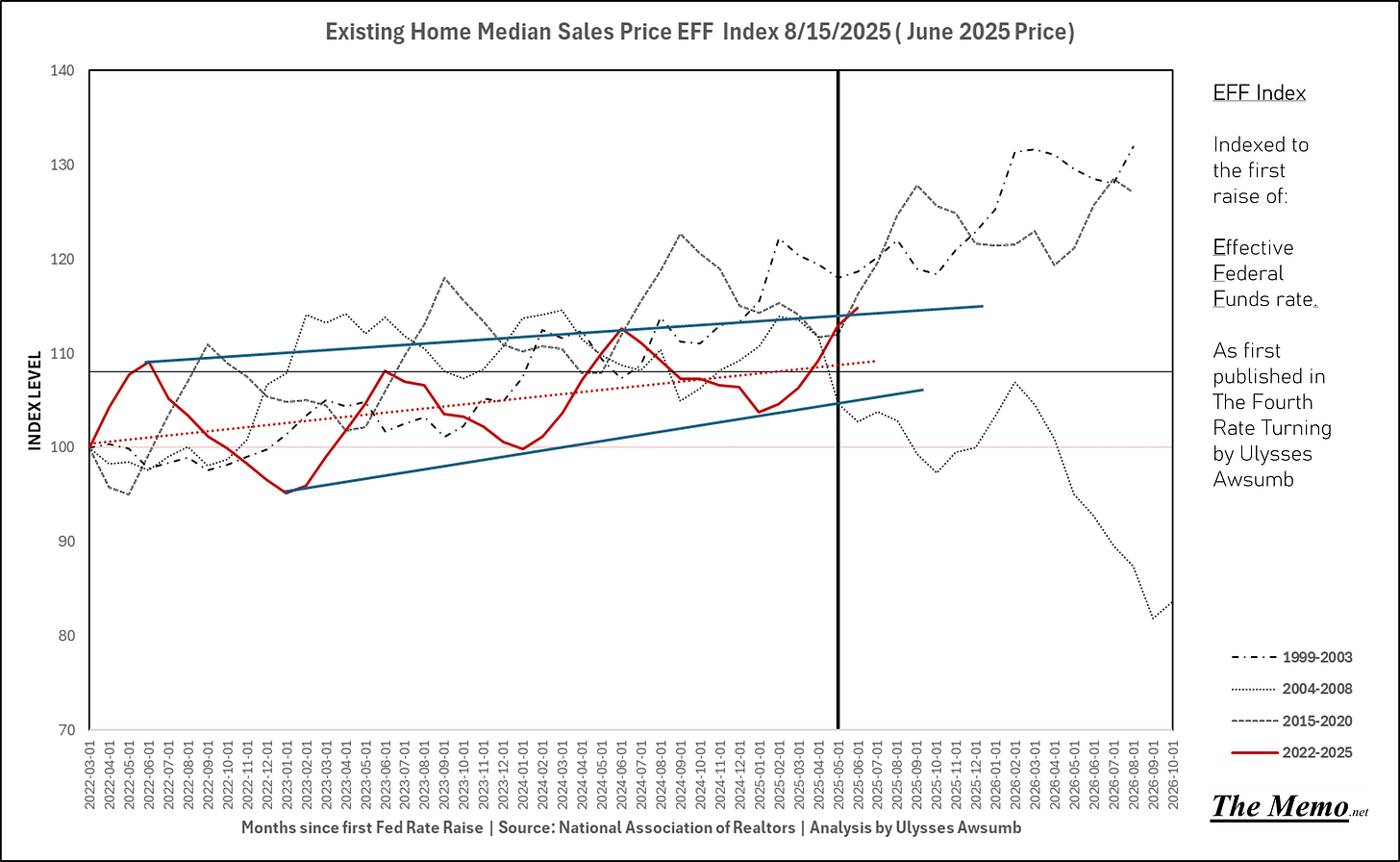

Why buy new when gently used will do?

At least this made new highs in June. It even bounced above my may trendlines.

That is until it gets revised. Why? It always gets revised. That’s the nature of the series.

Wheat from the chaff innit.

Do you or I or anyone know how oats and beans and barley grow?